Key Takeaways:

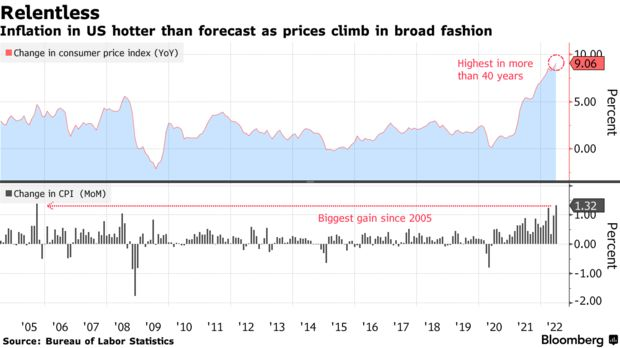

- Inflation at 9.1%, Rising interest rates is used as a tool to curb the high inflation rate

- High-interest rates would create a higher selling pressure for Crypto assets

- Bitcoin and Ethereum bounced back to US$20,200 and US$1108 levels after a 5.68% and 8.28% drop respectively

_____________________________________________________________________________________________________

Inflation reaches 9.1%, the highest the United States has seen in 40 years, so why is this important and how does it affect crypto? We need to go all the way back in disecting the basic economics before unveiling the effects it has on the broader crypto market.

What is inflation?

Inflation is the general rise in prices across goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money.

Why is inflation so high right now?

So there are several factors leading up to the 9.1% inflation. Two main factors include pandemic relief packages where government bodies inject money to supplement their economy and the war between Russia and Ukraine, leading to supply issues and rising commodity prices like gas and oil.

How to combat inflation?

The main tool used by the FEDs in combating the rising inflation is to rise the interest rates.

In a nutshell, the interest rate is the amount a lender charges for borrowing money. High-interest rates would mean people would need to pay more for the money they borrow, discouraging spending in the economy.

Inversely, lower interest rates will encourage spending as people borrow more and pay back a lesser principal amount of capital they borrow.

In a high-interest rate economy, people resort to saving their money instead of spending since they receive more from the savings rate as the opportunity cost of holding also increases. As more and more people would rather save their money than spend, the demand for goods and services will fall leading to falling in prices, and bringing down inflation.

So that is why the Feds are facing immense pressure to increase interest rates, but to which levels? The answer to that will affect various markets inclusive of equities and the broader crypto market.

Also Read: Interest Rate Hikes: Here’s How Interest Rates Affect The Crypto Market

How does interest rates affect the crypto market?

The fears that rate increases from central banks could affect Bitcoin’s attractiveness, which is already floundering in the midst of a crypto winter.

Bitcoin was born from the ashes of the 2007/08 financial crisis, and its network launched in January 2009. This means that, for most of its existence, the world’s biggest cryptocurrency has benefited from an era of ultra-low interest rates.

However, the exact effect on crypto is difficult to quantify, it’s possible that demand for BTC could take a plunge as rates rise. One thing is for sure though, high-interest rates lead to larger selling pressure for crypto.

Crypto is still classified by many as a high-risk asset class and now, it would be more enticing for them to sell off their assets and move them to old-fashioned savings accounts which are offering higher returns at lower levels of risk.

Just the news of the 9.1% can see cascading and immediate effects not only on Bitcoin and Ethereum but throughout the entire crypto market with a large volume of sell offs.

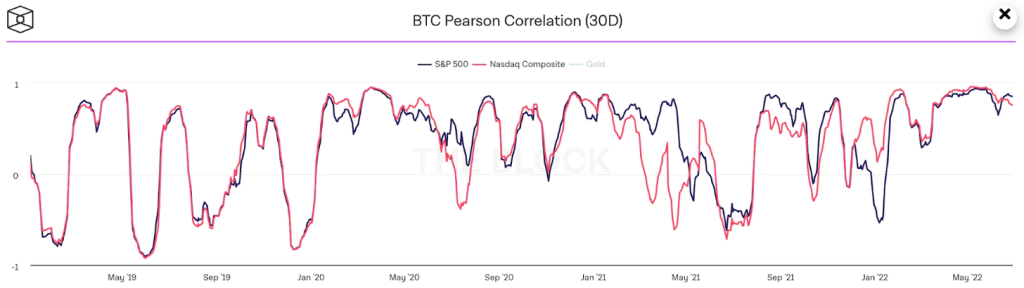

There is also a growing correlation between Bitcoin and the S&P500 reinforcing the notion that crypto no longer operates in isolation. As the equities market reacts to the high inflation and increased interest rates, crypto will mimic similar price activities to the equities market.

Though the selling pressure in crypto assets was a substantial one, the market quickly recovered bringing Bitcoin and Ethereum back up, hovering around the US$20K and US$1.1k levels.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chaindebrief

Also Read: 4 Crypto Narratives For 2022 To Look Out For And How To Play Them