While the crypto markets were hit hard last year with the collapse of Luna, 3AC and FTX, much of the fear and uncertainty seemed to be displaced by greed as we entered the new year. With the China and AI narratives at play, we saw many altcoins explode, with some even reaching upwards of 3-digit returns in a relatively short time span.

Despite overarching fear taking a backseat, we seem to have been hit with a wave of uncertainty – evident from the market’s stagnation, and now aggravated by sudden, sharp pullbacks.

But are we doomed for another sub-20K crash, or is this just healthy correction before another leg up?

Also Read: Blockchains With The Highest Developers Count In 2023

Federal Reserve Could Speed up Interest Rate Hikes This Year

Yesterday (7th Mar 2023), Federal Reserve Chair Gerome Powell presented the semiannual Monetary Policy Report, in which he reiterates their efforts to keep inflation levels below 2%.

“From a broader perspective, inflation has moderated somewhat since the middle of last year but remains well above the FOMC’s longer-run objective of 2 percent.“

Despite improvements in energy prices and supply chain bottlenecks, however, core inflation still remains well above the Federal Reserve’s target. In fact, core PCE inflation currently averages out at 4.7% over the past 12 months.

Powell also notes that there have been “little sign of disinflation” for core services, a worrying sign as both stock and crypto markets continue to dip.

[DB] Fed Chair Powell: Fed Is Prepared to Speed Up Rate Rises if Warranted by Data: WSJ

— db (@tier10k) March 7, 2023

To address these issues, Powell has stated that he is prepared to raise not only interest rates, but also the degree with which they are raised.

The markets have already priced in a half-point rate hike, or 0.5% increase, this month. In comparison, estimates priced rate hikes at 0.4% last month, with the actual hike coming in at 0.6%.

For a full rundown on how interest rate hikes affect crypto, check out THIS ARTICLE.

Mt. Gox Payouts Could Dump $3bn in Bitcoin on The Markets

In 2014, the now defunct Bitcoin Exchange Mt. Gox was hacked for 840,000 Bitcoin, worth an estimated $504 million at the time.

Today, that amount stands at a whopping $18.5 billion dollars, or a 37x since the hack.

While most of it remains missing, the company has managed to recover 142,000 Bitcoin, approximately worth $3bn, to repay creditors.

Despite the repayment being delayed multiple times over the last decade, the case is likely finally coming to a close, with registration for claimants set to close on the 10th of March according to Mt. Gox’s latest statement.

The claims also include 143,000 bitcoin cash , and 69 billion Japanese yen, valued at USD$17 million and USD$501 million respectively.

MtGox creditors: are you unsure choosing between Early Lump Sum Payment or waiting for Final Payment? Both are perfectly valid and rational choices, and you should think for yourself and decide what's best for you.

— WizSec Bitcoin Research (@wizsecurity) March 2, 2023

A few considerations. 🧵 https://t.co/WkwVcZysRh

Two payout options are available to creditors, namely the Early Lump Sump Payment and the Final Payment options. The former offers a lower, immediate total payout while the latter offers a slightly higher % return, spread out over an extended time frame.

According to a report from Cointelegraph, the top Mt. Gox creditor has already chosen the Early Lump Sump payment option.

Furthermore, many creditors have chosen to do the same due to the uncertainty the Final payment option offers.

Should all of Mt. Gox’s 142,000 Bitcoin be paid out at once, it would represent 0.7% of total supply that could be unloaded onto the markets all at once.

Thankfully, this only amounts to 15% of Bitcoin’s daily trading volume, and 30% of daily futures Open Interest across all major exchanges.

Another article by Coindesk also states that the top two creditors of Mt. Gox have opted to take their claims mostly in Bitcoin, which could hint at more creditors keeping their crypto instead of instantly liquidating it.

GBTC Jumps 10% as Judges appear skeptical over SEC’s arguments

Grayscale went to court against the SEC on Tuesday (7th March 2023) in their ongoing campaign to to convert their Grayscale Bitcoin Trust to an ETF.

While the Grayscale Bitcoin Trust (GBTC) is fully collateralized by Bitcoin, it’s actual share price does not currently accurately reflect Bitcoin’s. This is due to the lack of arbitrage opportunities present, as holders of GBTC cannot redeem the Bitcoin for the underlying asset.

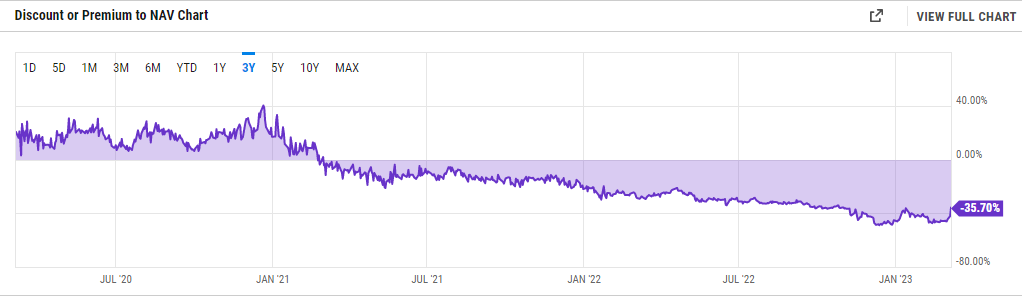

Furthermore, the discount to Net Asset Value (NAV), or the underlying asset, has only steepened with time. This effect was compounded by 3AC founder Su Zhu, who popularized the “GBTC arbitrage trade”, which would have yielded massive upside should GBTC be converted into an ETF.

Toward the start of 2023, GBTC even traded at a 48.5% discount to it’s NAV.

During the hearing on Tuesday however, the presiding judges found flaws with SEC’s arguments to not allow GBTC’s conversion to a spot ETF.

“it seems there’s quite a bit of information here on how these markets work together, and the SEC has not offered any explanation… that the petitioners here are wrong,”

–Judge Neomi Rao

As the judges continued to doubt the SEC’s arguments, shares of GBTC rose 13.3 % intra-day, with difference to NAV changing ~10.5%, the largest rise since GBTC started to trade at a discount to Bitcoin.

At the time of writing, shares of GBTC are trading at a 37.5% discount to Bitcoin.

While the court appearance was great news to GBTC holders, it may not be as exciting for those who own the underlying asset.

Grayscale currently operates more than 17 Crypto-related Trusts, with a total portfolio size of over USD$14 billion.

Just the Bitcoin they own alone accounts for more than 3% of Bitcoin’s total circulating supply. Should a Grayscale Bitcoin ETF be approved, this could potentially lead to mass redemptions from holders, and therefore major selling pressure in the markets.

Closing Thoughts

While speculation remains that there could be immediate selling pressure in the markets, previous data shows that any major offloads will likely be absorbed by whales should we go lower.

However, we must not discount that the market is currently indecisive, especially with maiden events like Ethereum’s Shanghai upgrade, Silvergate’s possible insolvency, and the U.S. government’s sudden activation of over USD$1 billion Bitcoin.

Moreover, the leading cause of worry would be inflation rate hikes, which will likely affect the market in the long-term. The Federal Reserve’s campaign to bring inflation under control could lead to demand destruction and scared consumers, something that will not favour a risk-on industry like crypto.

Also Read: Could Ethereum Shanghai Upgrade Cause A Major Market Dump? (WITH CALCULATIONS)

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief