Avalanche has been on an explosive growth trajectory in the last month, with significant interest and traction from the greater cryptocurrency market.

This is apparent in the exponential rise of its native cryptocurrency, AVAX, which jumped in value more than 4x from $13 at the start of August 2021 to a high of $57 three weeks later.

Founded as a Blockchain protocol to compete directly with Ethereum, Avalanche offers a novel approach to scalability and interoperability through its unique technology.

What is Avalanche?

Avalanche was founded in 2018 by a team of notable developers led by Emin Gün Sirer, an associate professor of computer science at Cornell University, as well as the co-director of The Initiative For Cryptocurrencies & Contracts (IC3).

Emin is a prominent individual that has contributed to the advancement of peer-to-peer systems and computer networking, which are essentially building blocks of the cryptocurrency revolution.

Avalanche is focused on building a flexible smart contract platform that facilitates the creation of custom blockchains that supports a much higher throughput as compared to Ethereum’s smart contract platform.

Ethereum can currently process 15 to 25 transactions per second (TPS) while Avalanche claims that it can support a much higher throughout of 4,500 TPS.

Avalanche is backed by Chinese mining giant Bitmain and Mike Novogratz Galaxy Digital, with other prominent backers including Dragonfly Capital and NGC Ventures. The public sale of their native tokens, AVAX, raised a staggering $42 million in just 4.5 hours back in July 2020.

Core differentiator of Avalanche: Avalanche consensus protocol

The biggest value proposition of Avalanche is the creation of its own consensus protocol, which is often referred to as the “the next big breakthrough in consensus protocols”.

Called the Avalanche consensus protocol, it integrated the benefits of Bitcoin’s consensus mechanism called Nakamoto Consensus and the classical consensus protocols such as Practical Byzantine Fault Tolerance (PBFT) and Tendermint/Cosmos, which have been used in the last 40 years in distributed systems.

The Avalanche blockchain is lightweight and energy-efficient, requiring very little energy. More importantly, it can scale to millions of validators without compromising its high throughput capabilities. Avalanche’s platform is made up of three core blockchains:

- Exchange Chain (X-Chain): Platform for the creation and trading of crypto assets

- Platform Chain (P-Chain): Coordinates validators, facilitates the creation of subnets and custom blockchains

- Contract Chain (C-Chain): Facilitates smart contract creation, execution and management

Avalanche’s modular architecture as a “platform of platforms” is directly attributed to its focus of interoperability, as it enables support for any kind of blockchain to be built on its platform.

This flexibility in exploring various structures of custom blockchains fuels the innovation that can be harvested in this nascent industry.

Focusing on DeFi for mass adoption

On August 18, Avalanche Foundation launched a $180 million liquidity mining incentive program called Avalanche Rush to spur development within its DeFi ecosystem.

Liquidity mining is an investment strategy in DeFi where users earn rewards by contributing their cryptocurrencies to liquidity pools within decentralized exchanges (DEXs). Rewards are manifested in two fronts; native token rewards and a share of the underlying trading fees for every transaction that happens on the DEX.

Top DeFi protocols like Aave, the biggest money market platform, and Curve, the largest stablecoin automated market maker (AMM) in the space, were unveiled as the latest applications that will build on top of Avalanche’s blockchain.

The integration of two prominent DeFi protocols into Avalanche’s ecosystem carries tremendous credibility for the project. Sushiswap, one of the top three DEX on Ethereum blockchain, has also joined the list of notable projects that will build on Avalanche.

Avalanche’s ecosystem is growing at a fast pace, with more than 100 applications and protocol that has been onboarded.

Avalanche's ecosystem is surging with growth.

— Avalanche ? (@avalancheavax) June 1, 2021

Check out the newest additions here: https://t.co/62O4RaCZLu pic.twitter.com/JmZI9F3AFP

In addition to the list of strategic applications that will integrate with Avalanche, it has also worked on several ground-breaking projects that aims to foster interoperability between blockchain networks.

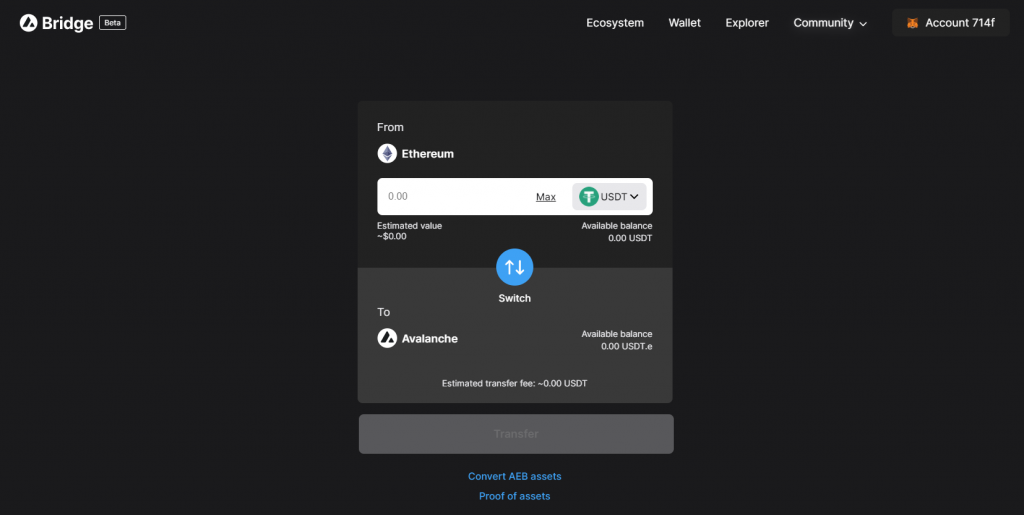

They recently launched the Avalanche Bridge, which is a cross-chain bridge that facilitates the transfer of cryptocurrency assets between different blockchain networks.

Avalanche’s bridge is 5x cheaper and is more secure than previous iterations of their cross-chain bridge. It is widely known that transferring assets from one blockchain network to another — for example sending Ether (ETH) originating from Ethereum blockchain to the Binance Smart Chain (BSC) network — is time-consuming, expensive and complex.

Avalanche’s bridge is cost-effective, fast and intuitive, with plans to support more blockchain networks in the future. Avalanche hopes that its cross-chain bridging technology will be the defacto standard for secure and efficient cross-chain interoperability.

The surge in viable competitors in the smart contract space aiming to unseat Ethereum is a reflection of the pace of innovation in the cryptocurrency space. Avalanche seeks to distinguish itself by conceiving a proprietary and ground-breaking technology that focuses on scalability and interoperability. The traction that it has received in the last few months is testament to their efforts and expertise in being one of they key infrastructural blockchain protocols to look out for in the future.

Read also: An Introduction To Solana – Why It Is The Hottest Blockchain Right Now