Ethereum is notorious for its high gas fees. As users flooded into DeFi during the 2021 boom, network congestion reached a breaking point that spurred developers to innovate two main new ways to address these pain points.

The first is by launching an adjacent transactional chain using the same Ethereum Virtual Machine (EVM).

Known as sidechains, these chains process large batches of transactions on a public ledger. Popular examples include Polygon, xDai, Binance Smart Chain, Liquid Network and SKALE.

The second way to achieve scaling are through “Layer-2” solutions such as rollups, which is what many developers in the Ethereum ecosystem have chosen to focus on.

Popular examples of rollups include Arbitrum, Metis and Optimism. Attention on rollups are significant due to Vitalik’s inclusion of rollups as a key plank in Ethereum’s roadmap towards better scalability since 2020.

Also Read: Optimistic VS. Zero-Knowledge (ZK) Rollups Explained: What Are They And How Do They Work?

This article focuses on the state of the Layer-2 rollup market.

How do rollups work?

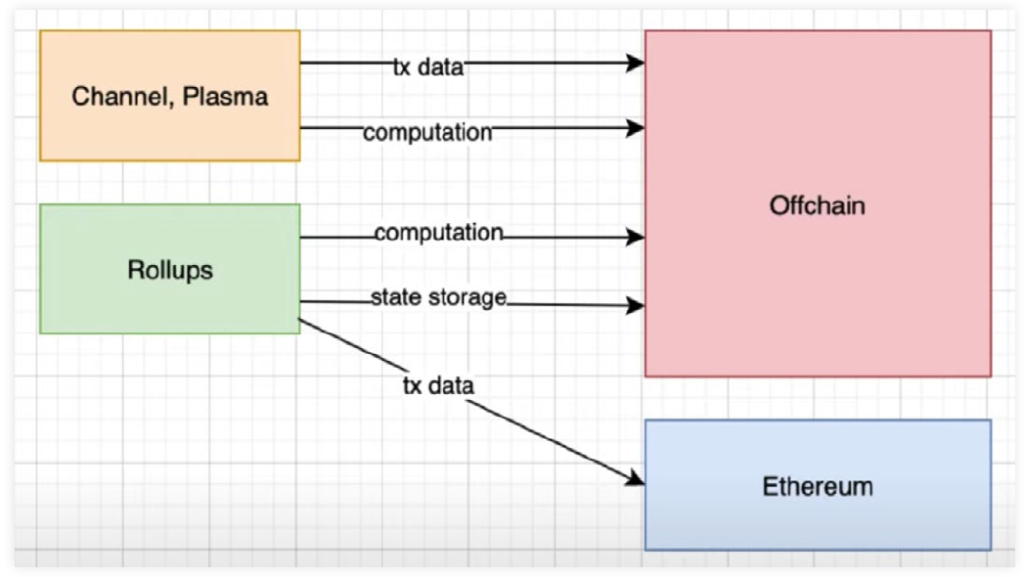

Rollups are designed to reduce gas fees by compressing the data footprint on Layer-1 blockchains. The basic idea of how rollups work is that it pushes the bulk of a transaction — computation (and state storage) — off the base chain onto a second layer, while submitting transaction data back onto the underlying Layer-1 chain for storage.

The latter is key as it allows blockchain operators to check and detect fraud of the transactions that are being computed off-chain if they wish to.

In terms of security, rollups still depend on the Ethereum base chain, so users do not have to trust a separate set of validators if they already trust in Ethereum’s security validation.

This is in contrast to sidechains like Polygon who employ their own security and consensus mechanisms.

Types of rollups

Two types of rollups exist: Optimistic and ZK (zero knowledge) rollups.

Also Read: Optimistic VS. Zero-Knowledge (ZK) Rollups Explained: What Are They And How Do They Work?

ZK-rollups (Loopring, DeversiFi, ZK-sync) validate bundles of transactions by through a validity proof security model. When blocks are submitted, “relayers” generate instantly a form of cryptographic proof called a zk-SNARK (zero-knowledge Succinct Non-interactive ARgument of Knowledge) that shows a before and after snapshot of the block’s resulting hash.

The “zero knowledge” name is derived from the fact that validation is only performed on the zk-SNARK proof without actually verifying the details of the embedded transactions.

Optimistic rollups (Arbitrum, Metis, Optimism) on the other hand runs an optimistic virtual machine (OVM) system on the base chain and sends transaction data as calldata.

It makes use of fraud proofs, which “optimistically” assumes that all transactions are valid, but allows “sequencers” to challenge them if they suspect fraud. In the event that fraudulent transactions are confirmed, the on-chain record is reverted back to the state before that particular transaction took place.

In order to afford sufficient time for sequencers to publish fraud proofs, optimistic rollups typically have a seven-day delay before users can withdraw funds, giving it the drawback of speed relative to the much faster ZK-rollups.

However, it comes at the cost of higher gas fees per batch of transactions and lower generalizability than optimistic rollups, making it harder for existing smart contracts on Ethereum’s Layer-1 to migrate to a Layer-2.

| Optimistic rollups | ZK-rollups | |

| Gas fees per batch | ~40,000 (a lightweight transaction that mainly just changes the value of the state root) | ~500,000 (verification of a ZK-SNARK is quite computationally intensive) |

| Withdrawal period | ~1 week | Very fast (just wait for the next batch) |

| Complexity of technology | Low | High (ZK-SNARKs are very new and mathematically complex technology) |

| Generalizability | Easier (general-purpose EVM rollups are already close to mainnet) | Harder (ZK-SNARK proving general-purpose EVM execution is much harder than proving simple computations, though there are efforts (eg. Cairo) working to improve on this) |

| Per-transaction on-chain gas costs | Higher | Lower (if data in a transaction is only used to verify, and not to cause state changes, then this data can be left out, whereas in an optimistic rollup it would need to be published in case it needs to be checked in a fraud proof) |

| Off-chain computation costs | Lower (though there is more need for many full nodes to redo the computation) | Higher (ZK-SNARK proving especially for general-purpose computation can be expensive, potentially many thousands of times more expensive than running the computation directly) |

The Layer-2 market

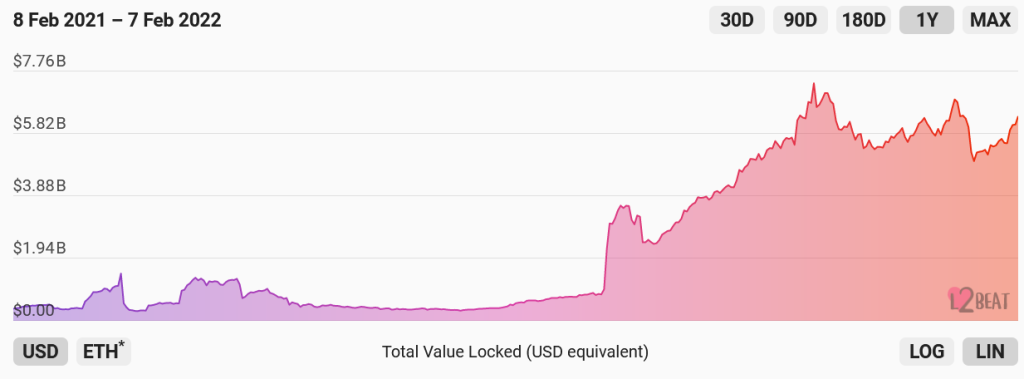

What does the Layer-2 market look like? As of February 2022, there are a total of $6.3 billion (2 million ETH) locked into Layer-2 protocols.

The use of Layer-2 solutions saw an exponential rise in mid-September 2021.

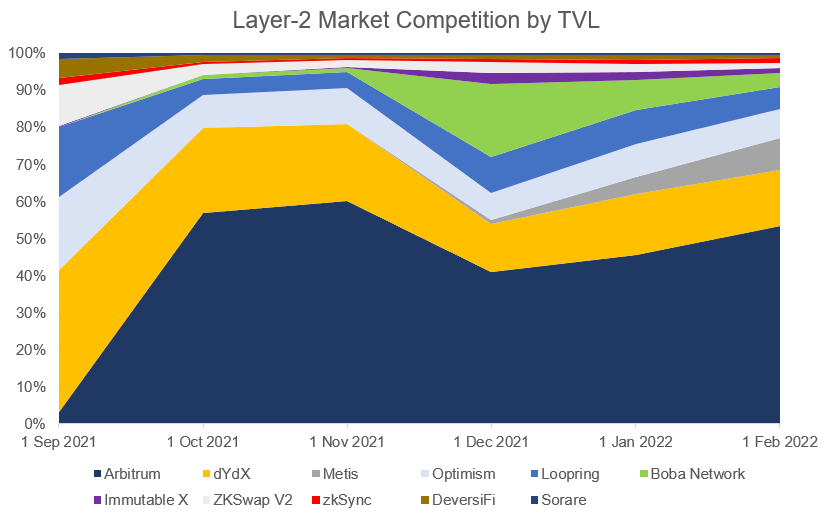

Split by technology type, optimistic rollups make up a 3/4 majority (73%) of the Layer-2 market, while ZK-rollups take 1/4 (24%) with Validium and Plasma in the remaining 3%.

When we break down optimistic and ZK-rollups, Arbitrum and dYdX lead in their respective categories.

Looking at the top 11 Layer-2 protocols, Arbitrum leads at 53% (US$3.38 billion), followed by dYdX at 15% (US$966 million), Metis at 8.5% (US$546 million), Optimism at 7.9% (US$504 million) and Loopring at 5.9% (US$380 million).

Optimistic rollups as a whole have grown aggressively in Q3 2021 due to Arbitrum and Optimism’s growth, and in more recent months Metis, an Optimism fork which launched its Andromeda mainnet in November.

Finally, another way to measure the strength of Layer-2 solutions is to look at the number of live applications deployed on the platform.

Unsurprisingly, Arbitrum leads with 59 live dapps including popular DeFi protocols like Curve, 1inch, Balancer, and Frax Finance. At present, Optimism has 21 while Boba network has 12 live dapps up and running.