Blockchain technology has advanced significantly ever since the inception of the concept of blockchain in 2008 with Bitcoin.

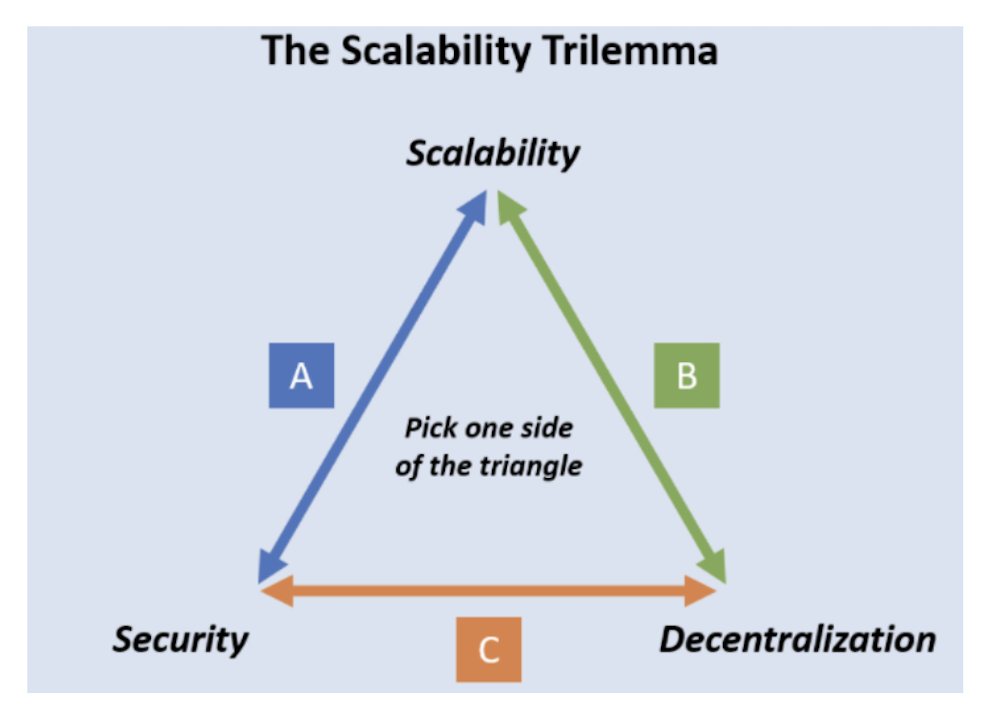

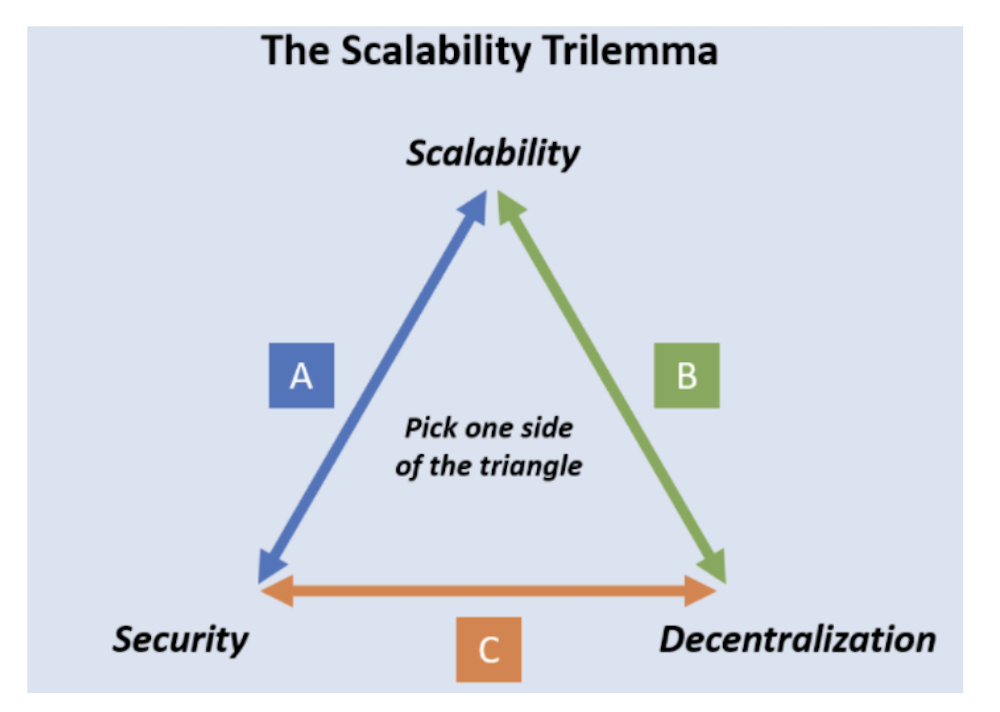

Blockchain technology is proving to be essential in the new digital economy. However, ever since Bitcoin’s inception, users have realised that blockchains face the blockchain trilemma, resulting in scaling solution being developed to improve upon existing infrastructure.

But is it effective? Let’s look at why Layer 2 blockchain solutions are better than Layer 1s.

What are Layer 1s and Layer 2s?

Layer 1 is a term used to describe the underlying main blockchain architecture. Layer 2s are an overlaying network build on top of a Layer 1 blockchains. It is meant to improve problems they are or scaling issues that are found with Layer 1 blockchains.

Layer 1 scaling solutions

Layer 1 Scaling solutions augment the base layer of the protocol, improving scalability found in the blockchain trilemma. They do this by changing the rules of the protocol directly to increase the transaction capacity and speed, which allows more users and data.

For example, by increasing the data in each block, more transactions can be processed through the network at once. There are currently two ways Layer 1 scaling solutions can improve Layer 1 blockchains.

Consensus Network Improvements: Many protocols such as Ethereum are moving from older versions of consensus mechanisms to newer ones like Proof-of-Stake. Although L1 using Proof-of-work is secure, it is slow.

Instead of requiring miners to solve cryptographic algorithms which is energy inefficient and uses a lot of computing power, Proof-of-stake processes and validates new blocks of transactional data based on participants staking collateral in the system.

For context, Bitcoin can only manage seven transactions a second, while Ethereum can only manage around 15-20 transactions a second.

This is also why you have heard of Ethereum 2.0, which allows Ethereum to transition into a PoS algorithm, which is expected to dramatically and fundamentally improve the network.

Sharding: Sharding is another technology that is a mechanism that is adapted from distributed databases that have become a popular scaling solution.

Sharding entails breaking the state of the network into distinct datasets known as shards, which is a more manageable task than requiring all nodes to maintain the network.

These network shards are simultaneously parallel processed by the network. Each network node (validator) is assigned to a shard instead of maintaining a copy of the blockchain in its entirety.

Layer 2 scaling solutions

Layer 2 scaling solutions are built to ‘stack’ on top of a Layer 1, improving Layer 1’s previous flaws of scalability and efficiency.

It aims to solve problems of the blockchain trilemma by shifting a portion of the blockchain protocol’s transactional burden to another system architecture which handles the brunt of network processing and sends it back to the main blockchain to finalise its results.

This is generally done in three methods of state channels, nested blockchains, and sidechains.

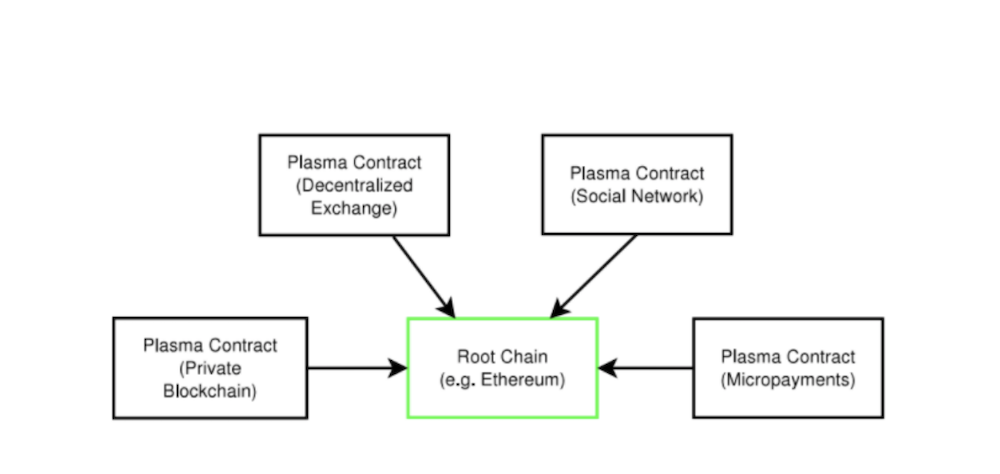

Nested Blockchains: Nestled blockchains are a blockchain on top of another blockchain. Usually, its architecture involves a main blockchain that sets parameters for a broader network, while executions are taken on the nestled blockchain before being sent back. T

hey are known as the parent and child chain respectively.

The distribution of work using this model helps to reduce the processing burden on the parent chain by distributing work, and if executed properly, also increases scalability exponentially.

State channels: State channels facilitate two-way communication channels between participants which enable improved overall transactional capacity and speed. This cuts down the waiting time as you are no longer dependent on a third-party like a miner. The Liquid Network, Celer, Bitcoin Lightning are all known as state channels.

A portion of the blockchain is sealed off via multisig or smart contracts which are pre-agreed by the participants. In some cases, proxy smart contracts may be used.

This enables participants to directly interact with each other without needing to talk to miners. When a transaction or batch of transactions is completed on the state channel, the final state and all its inherent transitions are recorded on the underlying blockchain. One of the main issues with this state channels sacrifice some sort of decentralization in the blockchain trilemma.

Sidechains: Sidechains are quite similar to nested chains but are slightly different. A sidechain is a blockchain-adjacent transactional chain that is used for large batch transactions.

Sidechains use an independent consensus mechanism separate from the main chain which can be optimized to solve the blockchain trilemma of speed and scalability.

Sidechains are different from the mainchain as transactions are publicly recorded to the ledger, and furthermore, security breaches on sidechains do not impact the mainchain. One of the main issues with this is that its infrastructure must be built from scratch unlike nested blockchains.

So which is better? L1 or L2?

The biggest pro of Layer 2 is that it doesn’t mess with the main blockchain. Layer 2 state channels can also conduct multiple microtransactions without wasting time for miner verification and paying fees.

As for Layer 1, the biggest pro is that there is no need to build vulnerably infrastructure from scratch. Hard-coded and battle-tested infrastructure such as Ethereum is much more secure and proven.

However, there are significant issues in both L1 and L2. Millions of dollars are traded everyday on Ethereum and Bitcoin, which is why it doesn’t make sense to add unnecessary code and complications with this high capital output at risk.

Another issue is that both L1’s and L2’s fail to solve the scalability trilemma. All of them will fail at least one component.

This is one of the main issues, as for example, Ethereum scalability suffers as a result of decentralization and security, while Solana’s scalability and higher security comes at the cost of decentralization.

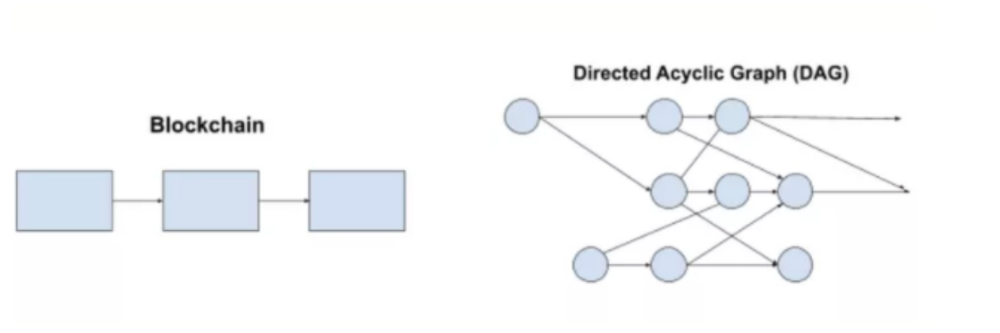

This is when technology such as Pure Proof of Stake (PPoS) or DAG comes in. Focusing on DAG technology, DAG technology has a theoretical ability to break these constraits and achieve all 3 factors of the blockchain trilemma.

A DAG can have multiple chain transactions being processed at once. Fantom is able to break the constraints of the trilemma because it is technically not a blockchain but a subset. To explain it simply, imagine a blockchain like Bitcoin and a y and x graph. It can only plot 2D graphs of “smart contracts” where as a DAG has a 3D graph of x y z, which allows more complex smart contracts.

In conclusion, scalability is one of the largest issues of mainstream adoption of cryptocurrency. This is why new technology is constantly coming up with new projects racing to solve these pertinent issues, and of course with new mechanisms, comes another set of problems.

Featured Image Credit: AAX Academy

Also Read: Crypto Will Shake Up TradeFi: 5 Reasons Why Blockchain Tech Will Disrupt The Finance Industry