CRV Tokenomics

Released in August 2020, the CRV token is the utility and governance ERC-20 token of CurveDAO which is a Decentralized Autonomous Organization (DAO) running the Curve protocol.

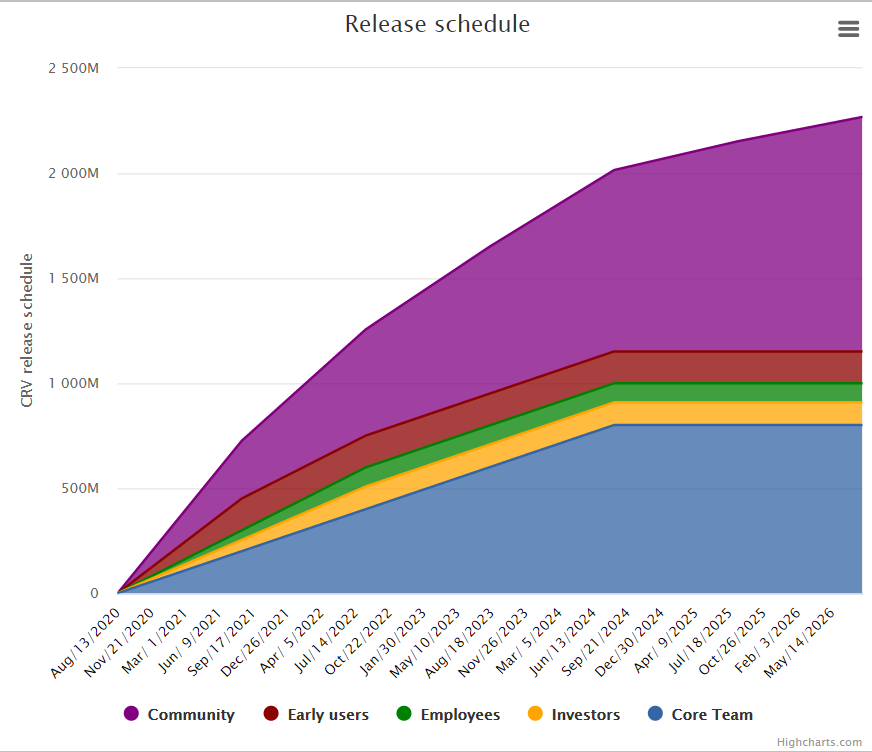

CRV-bearing users have the right to vote in the governance of the protocol regarding the voting weight proportional to lock time. When providing tokens in Liquidity Pools, Liquidity Providers can earn CRV tokens with the distributing rate decreasing by years.

CRV Key Metrics

- Token Name: Curve Finance.

- Ticker: CRV.

- Blockchain: Ethereum.

- Token Standard: ERC-20.

- Contract: 0xD533a949740bb3306d119CC777fa900bA034cd52.

- Token Type: Utility & Governance.

- Max Supply: 3,303,030,299 CRV.

- Circulating Supply: 434,489,745 CRV.

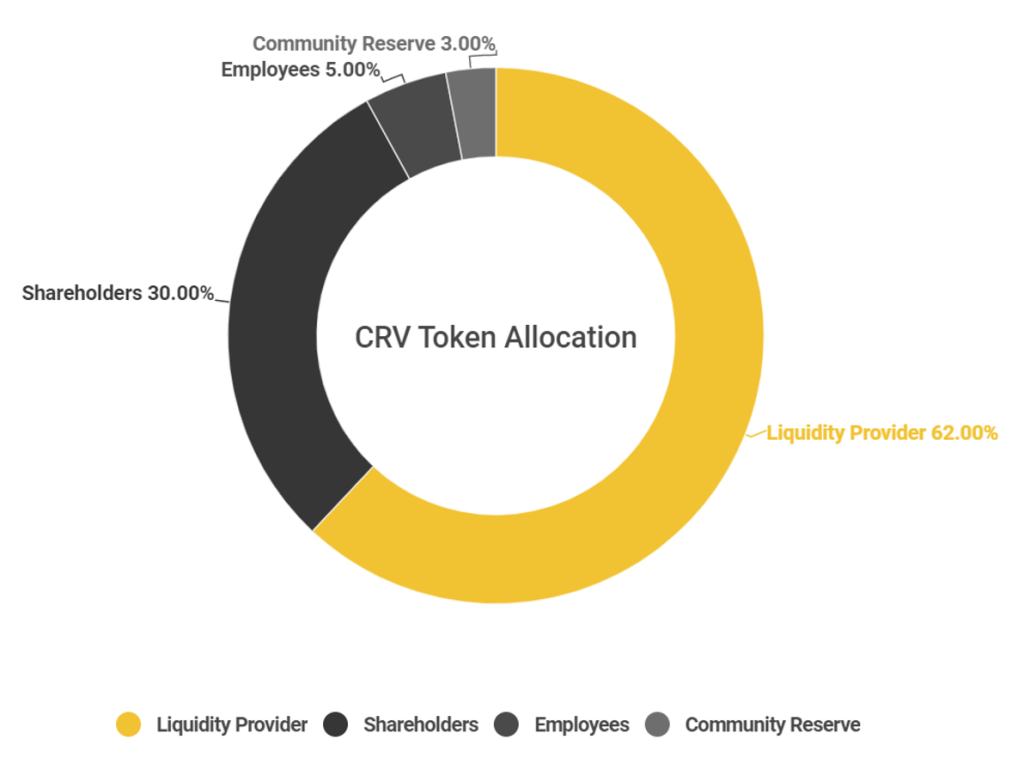

CRV Token Allocation

The total supply of 3.03B CRV tokens is distributed as follows:

- Liquidity Provider: 62% – 2,047,878,785 CRV.

- Shareholders: 30% – 990,909,090 CRV.

- Employees: 5% – 165,151,515 CRV.

- Community Reserve: 3% – 99,090,909 CRV

CRV Token Use Case

CRV is being used mostly in four main ways: Liquidity Providing, Voting, Staking, and Boosting.

Apart from Liquidity Providing, the requirement of the other three is that users have to use veCRV tokens acquired by locking CRV on the Curve platform.

In simple terms, Vote-escrowed CRV (veCRV) is the token you receive when locking CRV. And the longer you lock CRV, the more veCRV you get.