Decentralized Finance, or DeFi for short, is one of the biggest buzzwords in crypto. The current financial system is referred to as TradFi (Traditional Finance), which includes traditional banks offering lending and borrowing services, insurance, mortgage, wealth planning, investments like Mutual Funds, Unit Trusts and derivatives.

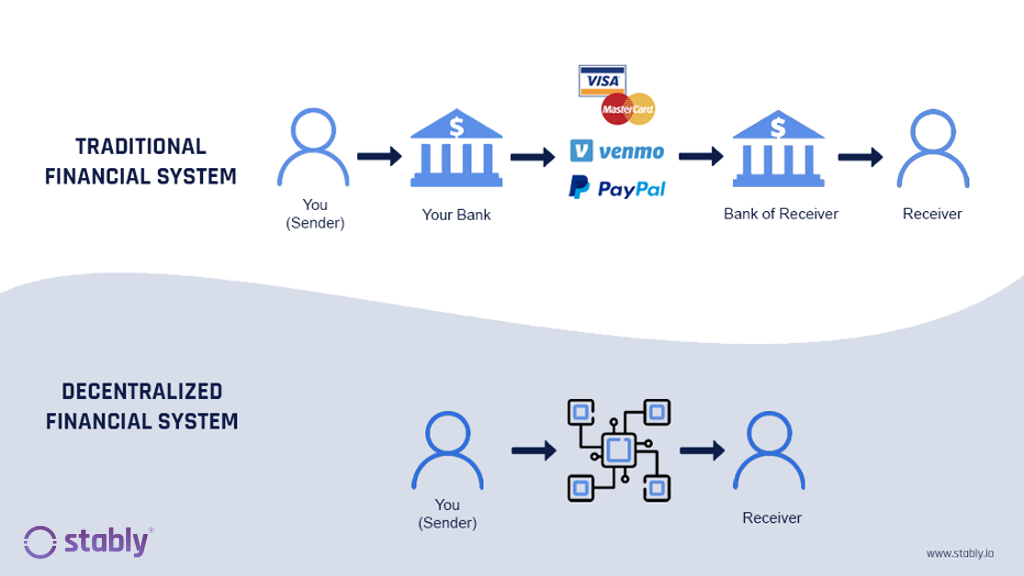

The key difference between TradFi and DeFi is the involvement of an intermediary. For every transaction in TradFi, the intermediary is there to act as a trusted third party, who verifies or executes certain financial decisions, and receives a commission from the transaction.

Ever wondered how it is possible for crypto protocols to offer mind-boggling yields of up to 1000% APY (annual percentage yield)? The reason for such sky-high yields is simply this: in DeFi, each and every user acts as their own bank and there is no central bank to take the profits from borrowing and lending. Hence, the profits go directly to the users themselves.

What are Smart Contracts?

In DeFi, there is no intermediary and transactions are executed via smart contracts. It needs no external party to enforce the contract; once the pre-programmed conditions have been met, the smart contract completes the protocols automatically.

Much like a traditional contract, a smart contract needs three qualities in order to be valid: signatories, a subject agreement, and terms. Once these are in place, the smart contract will deploy its preset protocols accordingly.

Smart contracts are executed based on the “if/then” principle, and rules deployed under a smart contract cannot be changed. The best way to understand how a smart contract works is to think of it as a vending machine: if A puts in 10 Ethereum (ETH) into the blockchain, then the 10 ETH will be transferred to B. If A is unwilling to comply and does not put in 10 ETH into the blockchain, then the smart contract will not be executed.

Every transaction deployed under a smart contract is verified by hundreds of nodes running the blockchain, and will also be recorded in the blockchain ledger which is completely transparent and immutable (i.e. cannot be changed).

What is a DEX?

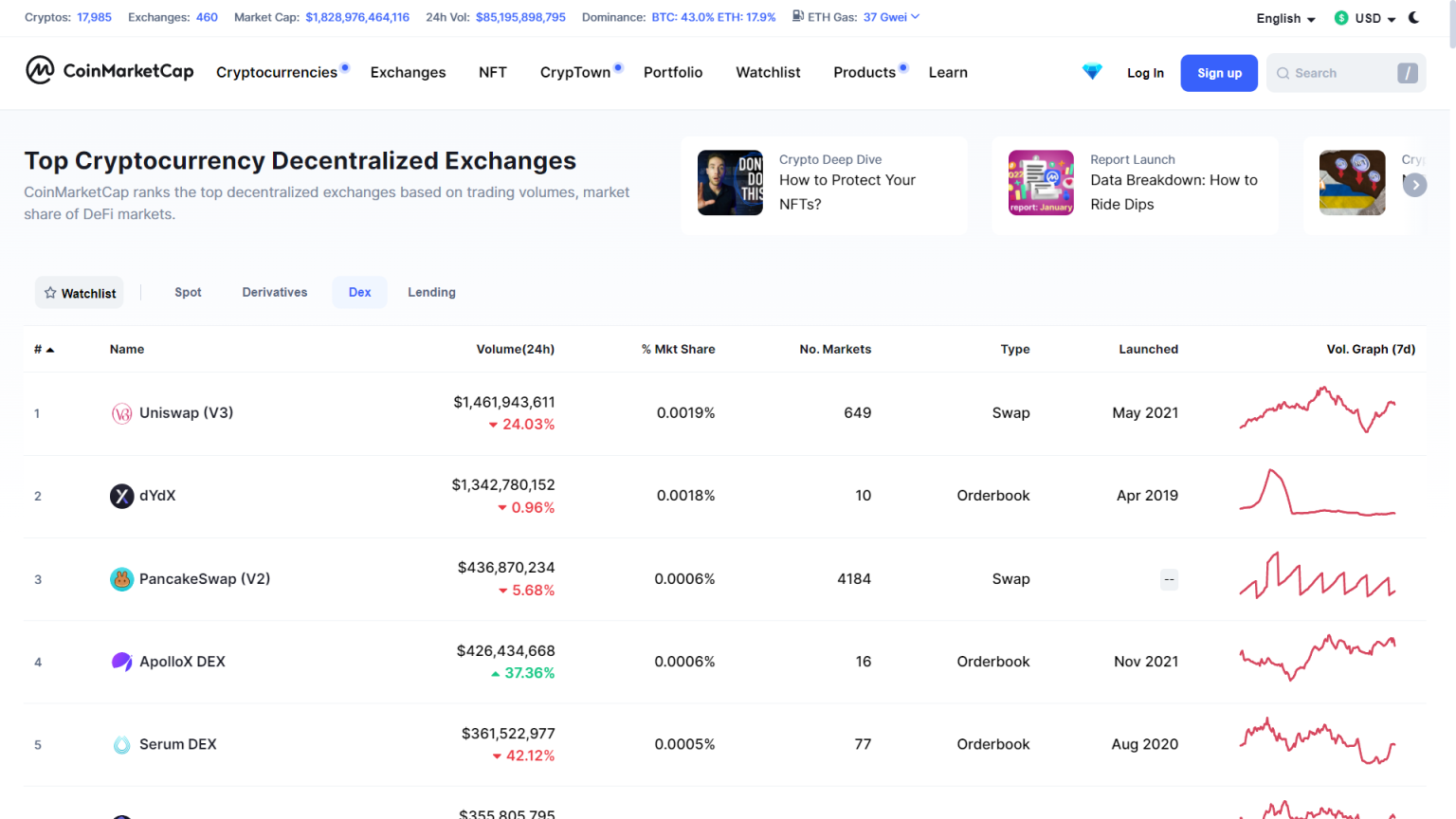

Smart contracts form the basis of how a decentralized exchange (DEX) functions. Trading is done online securely via direct peer-to-peer transactions or between pools of liquidity without the need for an intermediary.

DEXs allow users to access the DeFi world of smart contracts and DApps that provide financial services; including lending, borrowing and savings products with attractive rates as there is no intermediary involved.

Trading on a DEX is usually significantly slower than on a CEX. While this varies from DEX to DEX, each transaction must be validated by miners which will take time before being confirmed. This can lead to unfavourable trading conditions. The functionality of DEXs are also rather limited. Unlike CEX, limit orders, margin trades, or stop losses are widely unavailable.

Another reason why DEXs attract users is because of the concealment of identity. DEXs only require you to connect your crypto wallet and there is no identity verification process needed before being able to use them. DEXs are generally more secure than centralized exchanges (CEX) because there is no identity checks and they are non-custodial.