Yield farming was the hottest trend of DeFi Summer in 2020; there were endless farming opportunities with insane APY everywhere. Today, DeFi has evolved so much that there are multiple platforms and ways to farm yield.

The traditional way to farm yield is through providing liquidity into a protocol. It is essentially committing a cryptocurrency pair into a liquidity pool in exchange for yield. Liquidity providers are then able to earn a percentage of the pool reward based on the amount they contributed to the pool.

Liquidity providers have to provide cryptocurrency pair in equal value to the pool. For instance, if the liquidity provider wants to participate in the USDT-ETH pair, US$100 worth of ETH and US$100 worth of USDT must be deposited into the pool.

In return for providing liquidity to the protocol, liquidity providers earn trading fees and crypto rewards from the platform. Rewards are distributed based on the proportion of liquidity they contributed to the pool.

This can definitely be a rewarding venture, but be sure to do some proper research beforehand. Here is a starter’s checklist to ensure that your investment is on track, but is by no means exhaustive.

Let’s dive into the pools.

Project Fundamentals

First, before considering the liquidity pool’s APYs or token prices, we should explore the value of its project within the ecosystem.

What value does the project bring to the ecosystem? How widely accepted is it by the members of the community? Read up about its goals, visions and future plans in its whitepapers, blogs or any other relevant documents they provide.

For example, DeFi Kingdoms is one of the premier decentralised exchanges and play-to-earn projects in the Harmony ecosystem. It can be safe to say that their native token Jewel and main liquidity pools look rather promising in the long run.

Another aspect of the project to look at is its team, and its funding and backers (if any).

Naturally, projects with strong teams would have a better potential to do well. Receiving funding or some form of backing from investors or the main ecosystem itself is also a positive sign.

Finally, take a look at the project’s community, and their marketing efforts. The best projects cannot succeed without either.

From the project’s Telegram and Discord channels, you can get a sense of how supportive the members are. You can also discern if they are there for the long haul, or just for a quick flip.

You can also get a good sense of the project’s marketing success on their Twitter or other social channels. Bonus points if reputable figures in the space are following and tweeting about them!

Technical aspects

In most liquidity pools, you would be earning rewards in the form of its native project tokens. Hence it is crucial to understand where the value of the native token comes from.

Ideally, the native token has multiple use cases in the project (e.g. governance, new liquidity pool pairing, new project staking). This way, there will be higher incentives for users to hold the token and maintain its price.

Conversely, if it has little value, most users will simply accumulate the tokens and dump them for other more valuable assets.

Another key aspect to look at is the price history of the native token. Unless you have extreme conviction, it is generally not advised to buy the native token and enter the liquidity pool at its peak price.

Finally, some key metrics I will look at are its TVL, APY and potential Impermanent Loss.

TVL, or Total Value Locked, refers to the total value of assets that are being staked in the specific protocol. Generally, when the TVL is consistently high, it suggests a healthy protocol, with the trust of many users.

You can find the TVL of various protocols on websites such as Defilama.

Of course, I will also look at its APY (Annual Percentage Yield) to assess the potential risk rewards of joining its liquidity pool. APY is simply the annual rate of return of providing liquidity, while taking into account compounding.

You can calculate the difference between APY and APR on this handy website.

Impermanent loss

Finally, a term that many are familiar with, but might still be confused by, is Impermanent Loss (IL). In essence, we can see IL as opportunity cost.

Simply put, it is the difference between holding 2 assets separately without adding them into the liquidity pool, versus the total value you would have received (including rewards) if you contributed them into the liquidity pool.

Sounds complicated? Here’s a simple scenario to illustrate IL:

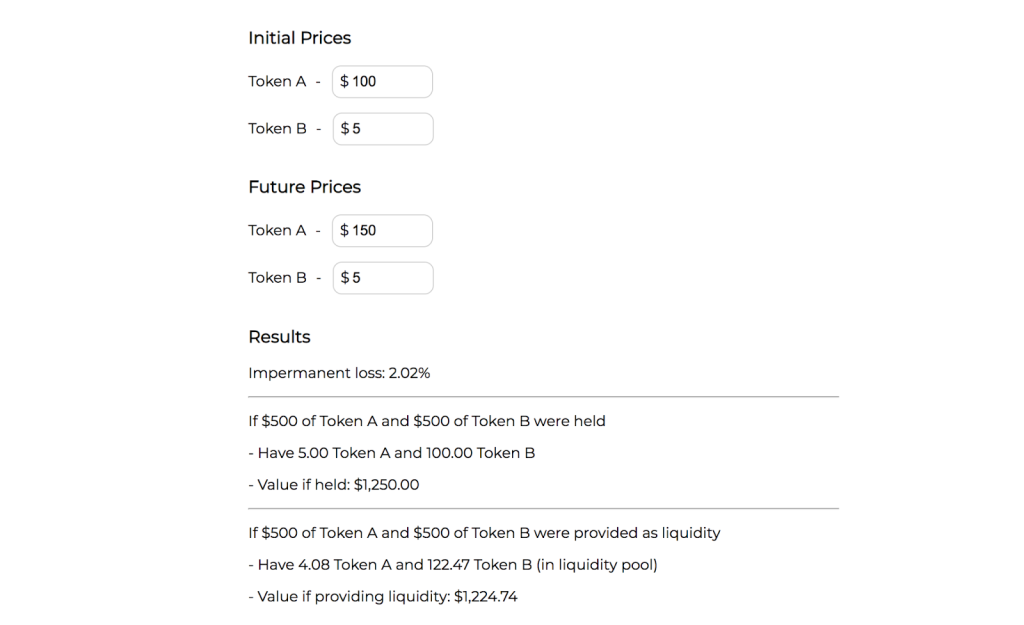

- You provided liquidity of 2 tokens, Token A and Token B in a liquidity pool.

- Token A was initially $100, while Token B was $5. You provided 5 units of Token A, and 100 units of Token B.

- Token A’s price rose 50% in value, to $150. Token B’s price remained the same.

- To maintain a 50/50 value balance between the 2 assets in the liquidity pool, the units of Token A falls, and the units of Token B increases.

- You now own 4.08 units of Token A, and 122.47 units of Token B. This adds up to a total value of $1,224.74.

- However, you would have earned 2.02% more if you held tokens A and B separately, compared to if you entered them into the liquidity pools. This is IL.

If you want to calculate potential IL from liquidity pools for yourself, you can try out this calculator.

Best case scenario: both tokens’ prices go up equally in percentage, resulting in minimal IL.

Worse case scenario: both tokens prices head in drastically different directions, causing you to have a lot more of the token with a lower price, and a lot less of the token with a higher price.

There are ways to mitigate potential IL though.

You can enter pools where both tokens typically move in the same direction in parallel, or pools with a stablecoin as one of the 2 tokens.

Impermanent Loss is highly common in liquidity pools. If you have strong conviction of the tokens and do not wish to lose them, you might want to reconsider your liquidity pool positions.