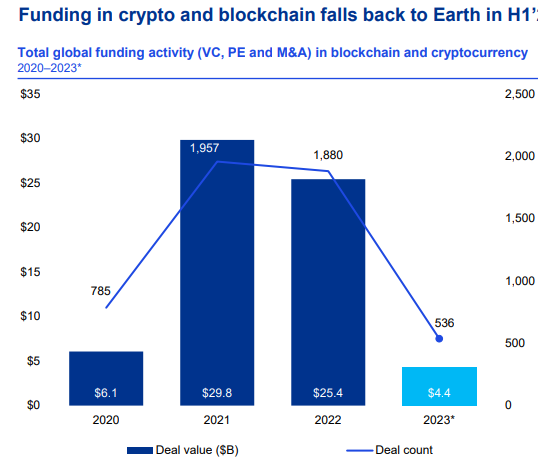

While funding in the cryptocurrency sector fell to a multi-year low in 2023, there continues to be strong interest in blockchain-based solutions around the world, KPMG highlighted in their H1 2023 Pulse of Fintech report.

In tandem with the wider tech sector, crypto and blockchain saw investors taking a softer approach toward it, especially given the high-profile collapse of multiple companies including Do kwon’s Terra Luna, Three Arrows Capital, and most notably, cryptocurrency exchange FTX.

With investor confidence in the space shaken, the report also notes that more intense due diligence and governance were key factors affecting the speed of deal flow.

However, that does not mean that investments have come to a halt.

Ripple’s recent $250 million acquisition of Switzerland-based crypto custody firm Metaco, Ledger’s eye-watering $493 million Series C, and Sam Altman’s $115 million raise were just some of the major moved made in the first half of the year.

Funneling Adoption in 2023 with Real World Assets

As Web3 enters the second half of the year, KPMG’s Debarshi Bandyopadhyay, Director of Financial Services, Blockchain, & Crypto notes that the industry will likely see more non-USD stablecoins, particularly in Asia, being leveraged for real world use cases.

Projects such as the Monetary Authority of Singapore’s digital money pilot scheme, which has tapped into Web3 native firms like FAZZ (StraitsX) have added to the reputability of the industry, while bringing about the next frontier of adoption.

Also Read: A Peak Into New MAS Chairman Lawrence Wong’s Stance on Crypto

Other industries such as carbon credits, ESG, and logistics are also prime for disruption, adding to the long list of possible real world use cases for blockchain technology and cryptocurrency.

Blockchain is such a new area of development. The more you study it, the more you can understand the full implications of it and the considerations related to it.” – Debarshi Bandyopadhyay, Director, Financial Services, Blockchain & Crypto, KPMG

Strengthening interest from banks to leverage asset tokenization and fractionalization services via blockchain technology also introduces higher upside for various asset classes, possibly introducing a new wave of interest in Web3.

Could Non Fungible Tokens Make a Comeback in 2023?

While volume across the NFT (Non-Fungible Token) space has taken a drastic fall this year, the report reminds us that the fundamental use case of NFTs remains one that is heavily underexplored, especially when it comes to non-financial institutions.

The second half of 2023 could see an increasing focus in the NFT space, with the emergence of marketplaces such as Blur and LooksRare reigniting a spark in the scene recently.

Also Read: Kaiko Research: Bitcoin Volume Dominance Plummets amid Altcoin Rally

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief