Has the “death spiral” happened?

One of the biggest volatility events on crypto have just occurred today – the depegging of UST leading to a crash in LUNA and the overall crypto market.

UST, the decentralized stablecoin of the LUNA ecosystem, which was supposed to be pegged to the value of 1 USD, had dropped its peg to as low as US$0.66 today, with its current price at time of writing at under $0.80.

Much of how Terra, UST and the system of how the peg works have been covered in our course here.

In theory, as long as 1 dollar of UST can be redeemed for 1 dollar worth of LUNA, and there is continued demand for UST, a depegging risk and ‘death spiral’ phenomenon was unlikely to happen.

Demand for UST was made popular by Anchor Protocol, which offers 20% APY on your UST. Imagine getting paid for 20% APY on a stablecoin during a bear market – sounds great right?

Warning Signs

20% APY is of course, unsustainable and with the bear market, the interest rate system changed and became ‘semi-dynamic’, where interest rates would be adjusted depending on the yield reserves in LUNA. As the yield reserves start to fall, so too does the APY for Anchor.

Eventually, money leaves the ecosystem. Warning signs were eventually spotted by some of the gigabrains in the lands of Crypto Twitter (CT), especially for Anchor reserves on LUNA, where withdrawals were starting to become massive, and UST pools on Curve were becoming unbalanced.

FACTS

— 찌 G 跻 じ Goblin King of the scam bots (@DegenSpartan) May 8, 2022

anchor deposits from 14b to 11.7b

tvl from 20.16b to 16.28b

curve pools are imbalanced

pragmatically speaking from a risk mgmt pov, i blv that the prudent move is exit any UST exposure and consider reducing LUNA exposure

i am not short either of these, so i have no agenda pic.twitter.com/GjnijNMjmt

In order to minimize a death spiral risk to LUNA, the Luna Foundation Guard (LFG) has raised about $1.5 billion USD swap of UST for BTC with Genesis and Three Arrows Capital. Furthermore, LFG has a partnership with the Avalanche Foundation, with up to $100m worth of AVAX.

Usually, when UST is below peg, there is minting of LUNA which is then sold. This causes a downward pressure on LUNA’s price. Assuming that UST does not regain its peg, more LUNA is eventually sold, causing the death spiral.

By allocating BTC and other alts such as AVAX to LFG Reserves, there is now an alternative way to defend the peg of UST instead of minting and selling off LUNA. In short, BTC and these coins can now be sold in order to ensure that UST remains at 1 dollar.

This of course introduces systemic risk into the crypto world and ties in the fate of LUNA and UST’s peg to the overall market. As the bear market set in, adding an additional layer of risk into the ecosystem led to ramifications ahead.

Also Read: Is Terra (LUNA) And UST Game Changing Or Just a Big Ponzi?

The Happening

On 9th May, LFG lent out $750m worth of BTC to OTC trading firms to protect UST’s peg.

Unfortunately, massive amounts of UST has been withdrawn and sold, causing downward pressure on UST’s price and causing a depeg.

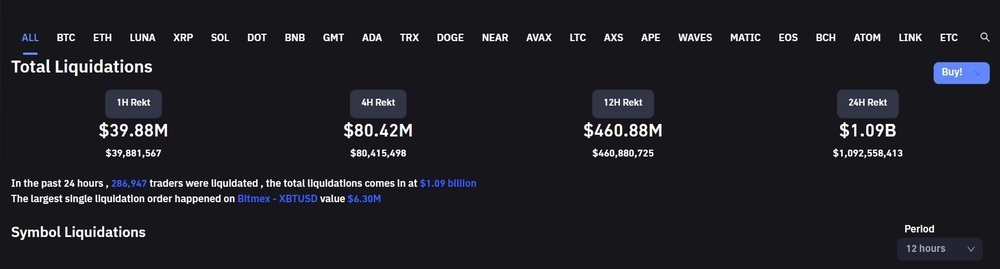

In a bid to defend the peg, massive selling on BTC occured, causing today’s market to tank. Factor in massive liquidations and we have a recipe for disaster.

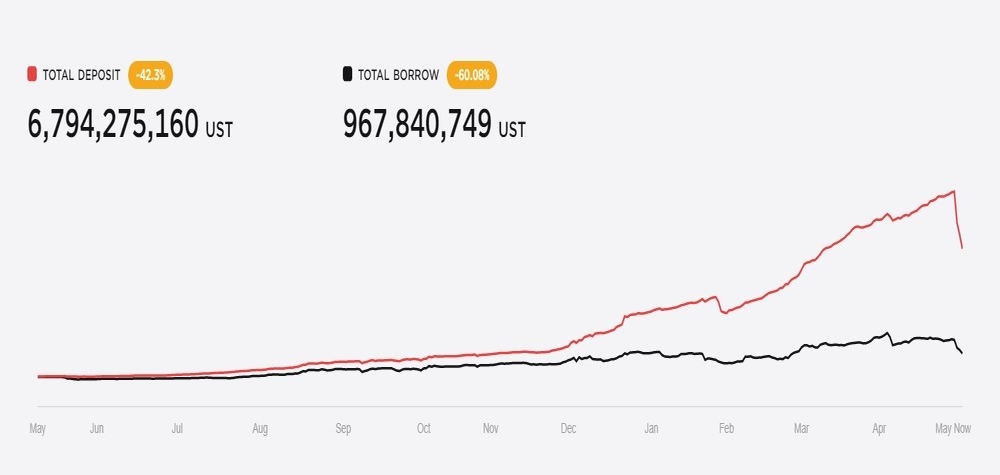

The total deposits for UST as of today has also fallen to only 6.7B due to withdrawals.

Image Credit: Anchor Protocol

LUNA was also heavily hard hit as well, falling as much as 45% in the past 24 hours.

Closing Thoughts

Is it over for UST and LUNA? Some investors may see this issue as a complete loss of trust in the Terra ecosystem and that LUNA is doomed to go the way of previous algorithmic stablecoin failures like Iron Finance. Depegging is a serious issue for stablecoins and highlights that such risks should be taken seriously.

However, there are others who remain hopeful that the peg will be restored, although the general market and especially LUNA will tank in the short or medium term. Some are also believers and builders on the Terra ecosystem, and today’s incident does not seem like one that will stop their vision or plans to continue building and creating a better decentralized future for all.

. $UST will repeg. My team builds on Terra, and majority of my personal investments and stables are on Terra. I've also used my non-USD collaterals to buy $UST.

— Edison 🌔🌊 (@edison0xyz) May 10, 2022

If Terra fails, I will be more at risk than you, anon. Buckle up.

What will happen eventually? Will LUNA and the Terra ecosystem be a failed experiment, or will this end up being a set-back that they can recover from? I will not be taking any bets personally and will be watching from the sidelines.

One thing is for sure – there never is an uninteresting day in crypto, and always remember to stay safe and not over-invest!

Editor’s Note: This article does not represent financial advice. Please do your own research before investing

Also Read: Crypto May Be a Ponzi Scheme But It Doesn’t Matter