Welcome to Market Debrief, where we summarise some of the notable events that happened throughout the week.

The crypto landscape is ever-changing with new innovations and regulations popping up every day.

It is very hard and time-consuming to keep track and filter all the latest news in this space, and so the Chain Debrief team decided to compile it into an easy-to-digest article.

Bullish sign or just another fakeout?

Just one week ago, the news about Russia’s military operation in Ukraine shook the world and down came the crypto market. The market however, quickly saw a recovery in most coins being in the green on the 7-day price change. This brings the total crypto market cap back to the US$2 trillion mark.

As an inflow of money continues to move into the crypto market, the most important question is, are we back in the bull run or is this just another fakeout?

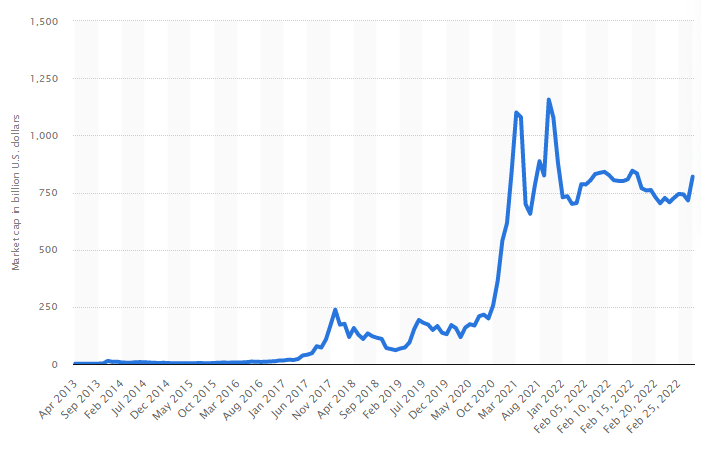

Bitcoin’s market value saw a 17% rise from the end of February of US$37,000 to US$44,964 with a 17% gain. Currently, Bitcoin sits at a total market capitalization of US$829 billion, shy of its all-time market capitalization high of over US$1 trillion.

We also see Bitcoin dominance (the ratio between the total crypto market cap and BTC market cap) hovering around 43-45%. In my opinion, with other cryptocurrencies like Ethereum breaking the psychological price barrier of US$3,000, we may be seeing a bullish sentiment in the space.

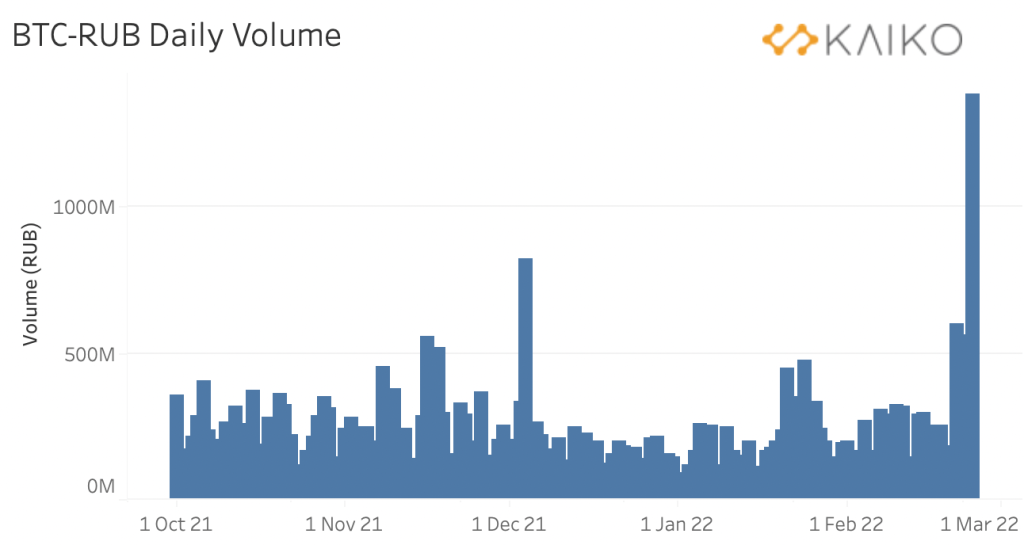

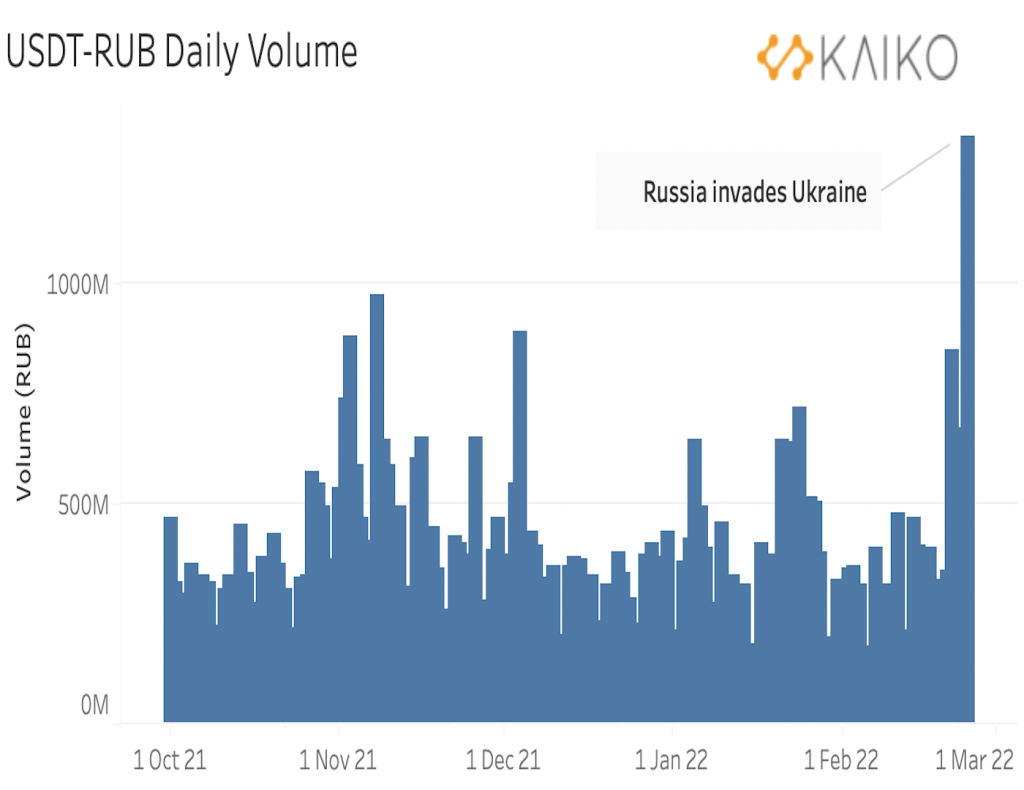

We saw how cryptocurrency acted like a type of “refuge” currency as the Russian ruble hit a record low after sanctions were imposed against Russia. This suggests that Russians are potentially moving money from their native currency to crypto.

The increased demand for Bitcoin resulted in BTC trading at a 6% premium versus the Ukrainian currency, Hryvnia, as the Russian and Ukrainian markets spiral out of control and investors seek financial assurance in crypto.

Many believe that Bitcoin or cryptocurrency as a whole can be a useful asset during geopolitical turmoil. The performance amid the volatility has some bulls pointing to a break from the narrative that crypto is just another riskier asset.

Pixelmon NFT a soft rug?

Welp, @Pixelmon just made over $70 million dollars and when reveal happened, this is what everyone got. pic.twitter.com/3v6euOIdkT

— Hustler (@0xHustler) February 26, 2022

One of the biggest events this week was the Pixelmon NFT reveal. The highly anticipated NFT reveal turns out to be nothing but a laughingstock. Collectors were furious as the art was shockingly bad with many disfigured illustrations.

The Pokemon-inspired Pixelmon was one of the biggest NFT launch sales ever as it raised a staggering US$70 million. The project had a promising roadmap with many perks of owning the first generation Pixelmon.

How Osmosis’s Superfluid staking will make your farming game look weak

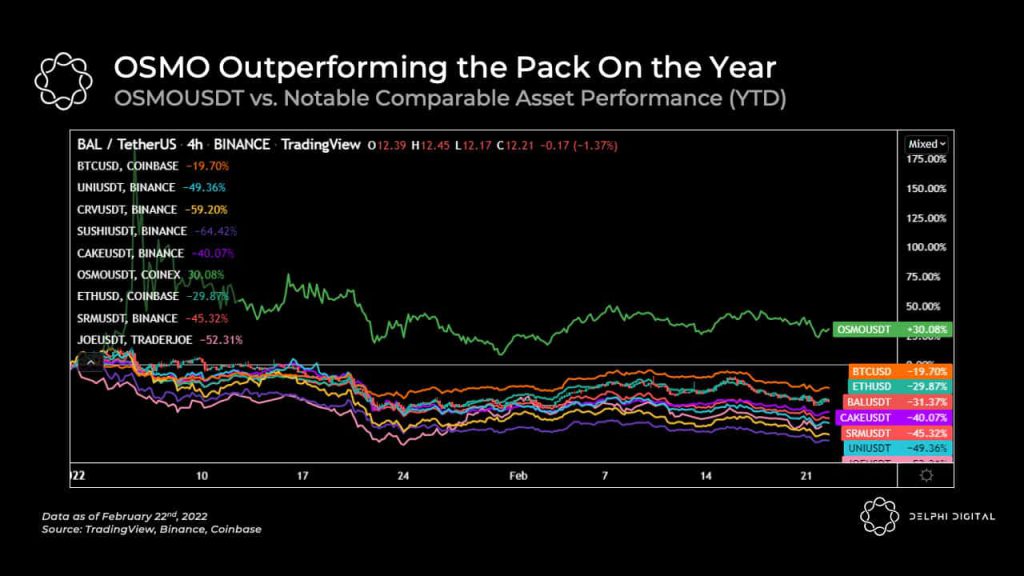

Osmosis, the AMM and biggest DEX in the Cosmos ecosystem, outperformed amid the market dip, seeing a 200% increase in TVL.

Since its time of release, Osmosis saw its TVL rise from US$49.7M to US$1.83B in less than a year.

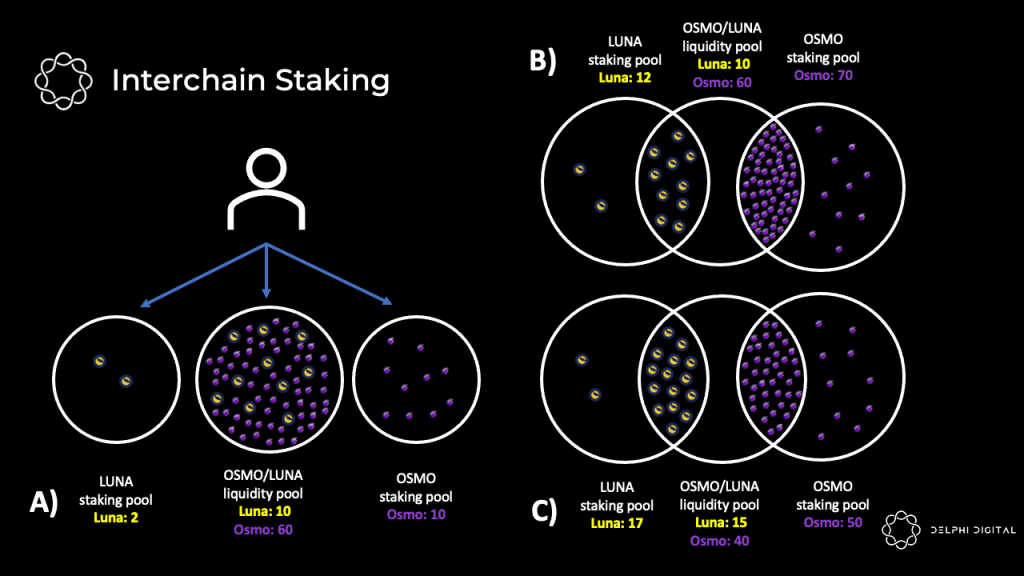

It soared in TVL lead from the unique feature it proposes known as superfluid staking which allows tokens from different chains to be deposited in AMM pools and at the same time, being staked/delegated in their respective chains. This can only be made possible through Cosmos’s IBC (Inter-blockchain communication).

As the cosmos ecosystem continues to gain traction in the crypto space, utilities such as superfluid staking and interchain staking put Osmosis in a unique position with Cosmos. Osmosis will scale along its parent ecosystem and will pride itself on being one of the most prominent applications in this space.

Read more here.

Treasure Marketplace exploited

DELIST ALL YOUR SHIT OFF TREASURE MARKETPLACE, THIS ISNT A JOKE. THIS WAS JUST STOLEN IN A MARKETPLACE EXPLOIT FOR 0 MAGIC, I JUST HAD A PINK SMOL STOLEN. THESE ARE NOT REAL SALES, DELIST NOW. @Treasure_DAO KILL THE SITE https://t.co/8TySOce5kW

— Keyboard Monkey (@KeyboardMonkey3) March 3, 2022

The largest NFT marketplace on the Arbitrum network was hit by an exploit. A bug in the exchange has allowed exploiters to purchase expensive NFTs for free.

Treasure marketplace is being exploited. Please delist your items. We will cover the costs of the exploit—I will personally give up all of my Smols to repair this. I cannot fathom what subhuman targets a fair launch marketplace for robbery, but they will not defeat the community.

John Patten, Co-founder of Treasure DAO

John Patten, the co-founder of Treasure DAO, confirmed the exploit and urged users to delist their NFTs. Unfortunately, it was too late as many dishonest users who exploited the marketplace started to spread the know-how to other groups.

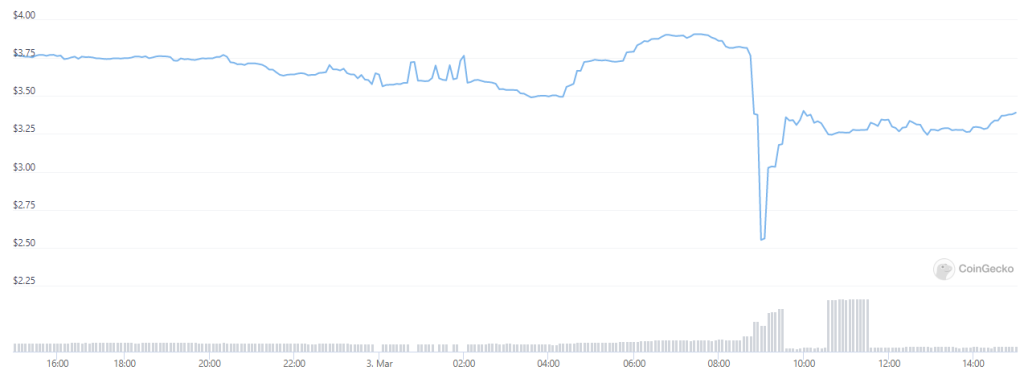

The price of Treasure native token, $MAGIC, took a dive after news of the exploit surfaced. It dropped from US$3.82 to as low as US$2.55. The price quickly bounced back and is now trading at roughly US$3.39.

US$8 million loan backed by NFT

we like the punks. very creditworthy. thanks @nftfi for facilitating https://t.co/uF8tE4odry

— MetaStreet (@metastreetxyz) March 1, 2022

Claimed to be the largest NFT collateralized loan, an anonymous borrower just took out a $US8 million loan backed by a collection of 101 CryptoPunks. The 30 days loan has an Annual Percentage Rate (APR) of 10% and was facilitated by Meta Street.

This is revolutionary in the crypto space because it promotes capital efficiency and NFT utility as idling NFTs can be used as collateral to take out loans for liquidity. The NFT borrowing market will only get bigger as more NFT collectors look into ways to get liquidity.

Twitter Digest

Barcelona FC joining the Crypto world

JUST IN: World's most valuable football club, FC Barcelona to develop its own crypto and metaverse

— Blockworks (@Blockworks_) March 1, 2022

South Korea poured US$187 million into metaverse

JUST IN: 🇰🇷 South Korea will provide $186 million to build the country’s #metaverse ecosystem.

— Watcher.Guru (@WatcherGuru) February 28, 2022

Puma bought a Cool Cat NFT

New PFP… what do you think @coolcatsnft? pic.twitter.com/KkfYitj9WX

— PUMA.eth (@PUMA) March 2, 2022

CryptoPunk #5364 donated to Ukraine

JUST IN: CryptoPunk #5364 #NFT has been donated to Ukraine’s #Ethereum wallet. pic.twitter.com/UyyNOZNANL

— Watcher.Guru (@WatcherGuru) March 2, 2022

Insight on Fantom’s gas fees from Delphi Digital

0/ What’s causing increased gas fees on Fantom?

— Delphi Digital (@Delphi_Digital) March 3, 2022

In today’s Delphi Daily, @fantomFDN’s increased congestion, @solidexfantom’s new yields, and a deep-dive on @osmosiszone.

For more 🧵👇 pic.twitter.com/34HOiX1RFK

This article was written by Gabriel Sieng and Joel Zhao.

Featured Image Credit: Chain Debrief

Also Read: All You Need To Know About Wrapped Ethereum (wETH) And How To Get It On MetaMask