Welcome to Market Debrief, where we summarise some of the notable events that happened throughout the week.

The crypto landscape is ever-changing with new innovations and regulations popping up every day.

It is very hard and time-consuming to keep track and filter all the latest news in this space, and so the Chain Debrief team decided to compile it into an easy-to-digest article.

Bitcoin shrugs off Fed rate hike

The US Federal Reserve hiked its benchmark interest rate by 0.25% on Wednesday, which was a move widely expected by investors and was factored into the prices leading up to the FOMC (Federal Open Market Committee) meeting.

However, Bitcoin is currently up 4.2% on the weekly to US$41,000 while Ethereum shows similar promise rising 6.4% to US$2.762.

Also Read: Interest Rate Hikes: Here’s How Interest Rates Affect The Crypto Market

The Defiant mentioned that investors have been watching the Fed with bated breath as consumer prices rose 7% to a 39-year high in 2021. The central bank also indicated that interest rates would be raised to combat inflation, a move that stock investors loathe because it makes bonds more appealing.

For the past few months, cryptocurrency has had a strong correlation with stocks. Commodity prices are also increasing, particularly as Russia’s conflict with Ukraine wrecks havoc on the oil and natural gas markets.

Investors will now be watching the Fed closely to see if it adopts a more aggressive attitude and raises the interest rates even higher.

Such a move would almost certainly be a pessimistic signal for digital assets like cryptocurrencies.

Will Fantom emerge To seek a new all-time high?

Prices of FTM have been in a downward spiral ever since the abrupt announcement of DeFi developer leaving the project. This includes the star developer Andre Cronje who was also the founder of the popular Ethereum DeFi project, Yearn Finance.

To worsen things, two Fantom-based protocols were exploited and a total of US$5.6 million was stolen. FTM has been on a downtrend and has seen a series of lower lows.

🫰Snap🫰back to reality!

— Fantom Foundation (@FantomFDN) March 16, 2022

Fantom's Snapsync upgrade can begin rolling out on mainnet 🚦

– Testnet nodes achieved 90% reduction in total storage

– Snapsync synchronization lends to further upgrades

Memory and storage reduction details 👇 : https://t.co/hOkQHWGQnt pic.twitter.com/to6TFIkLsF

This week, however, we saw a glimpse of hope as prices of FTM shot up as much as 10% following the announcement of the network upgrade.

The protocol upgrade was an important step for Fantom as it reduces memory consumption by 90% and will vastly improve the network performance.

This jump-starts investors’ confidence as the prices of FTM has been steadily increasing. The gains are considerably sizeable as it quickly shot up from a low of US$1.04 to US$1.28.

The upgrade everyone is waiting for

The long-awaited Ethereum 2.0 upgrade will be here soon. Ethereum 2.0 will see a shift from the traditional proof of work consensus to a far more energy-efficient proof of stake mechanism.

Over 10 million Ether, valued at US$25 billion, has been locked up in the Ethereum 2.0 smart contract.

And we finalized, but it seems there is a client who isn't producing blocks consistently. The network is stable, with >2/3rd of validators correctly finalizing. We're looking into the issue 👀 https://t.co/cgVwdK859r

— Tim Beiko | timbeiko.eth 🔥🧱 (@TimBeiko) March 15, 2022

While the merge on the Kiln testnet was largely a success, there were still some hiccups as a single client was not producing blocks consistently.

This is likely the final merge testnet before they roll out to the public testnet. It is a positive indicator that Ethereum 2.0 is on the right track and Ethereum will transition to 2.0 on schedule.

Staking reward on the Ethereum network would also increase as previously the gas fee paid to miners would now be paid to the stakers.

Coinbase expects the staking yield to increase from 4.3-5.4% APR to as much as 9-12% APR.

Magic Eden raised US$27 million funding

gm gm! Cat’s outta the bag.

— Magic Eden 🪄 Solana's Leading NFT Marketplace (@MagicEden) March 14, 2022

Kicking off the week with a $27M round raise led by @paradigm and a feature on Bloomberg @business 🪄

“@MagicEden will tap @sequoia and other new investors, such as @GreylockVC, to help expand into OpenSea’s waters.”https://t.co/PrvmaSleFn

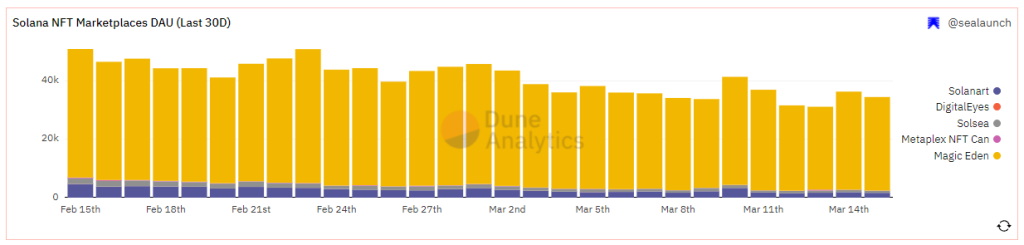

Magic Eden is the leading NFT marketplace on Solana. In just six months, it was able to accomplish the amazing feat of reaching 95% of Solana’s NFT market share.

It just announced that it managed to raise a Series A funding of US$27 million from some of the biggest VCs in the crypto space.

The funding was led by Paradigm, one of the largest and most reputable VCs who is also a major backer of OpenSea.

Magic Eden is currently leading in both the number of active daily users and also the transaction volumes.

Solanart, the first Solana NFT marketplace and was once the market leader, is lagging far behind in terms of both active users and transaction volume.

Notable tweets

HSBC joined the metaverse

The financial services provider HSBC will acquire a piece of virtual real estate in The Sandbox metaverse.@morgan_chittum reportshttps://t.co/L0AnMBa6uG

— Blockworks (@Blockworks_) March 16, 2022

BAYC announced native token $APE

For everyone else who wants to ape in: ApeCoin will be available to all and is expected to begin trading on major crypto exchanges soon.

— Bored Ape Yacht Club (@BoredApeYC) March 16, 2022

Ukraine legalizes crypto

BREAKING: 🇺🇦 Ukraine legalizes crypto after its President signs crypto bill into law

— Blockworks (@Blockworks_) March 16, 2022

– CoinDesk (@egreechee) pic.twitter.com/jjHSGf3DKA

4 million Luna burned for collateral

LFG Council has voted to burn another 4M luna to mint roughly 372M ust, which will be used to acquire exogenous collateral. Once this burn is completed, LFG’s non-luna reserves will roughly sit at a value of $2.2B, as well as 8M Luna remaining for future growth.

— LFG | Luna Foundation Guard (@LFG_org) March 15, 2022

LFG$Luna $ust

This article was written by Gabriel Sieng and Joel Zhao.

Featured Image Credit: Chain Debrief

Also Read: Is It Finally Time To Go Bananas Into $APE? Everything You Need To Know About ApeCoin