Welcome to Market Debrief, where we summarise some of the notable events that happened throughout the week.

The crypto landscape is ever-changing with new innovations and regulations popping up every day.

It is very hard and time-consuming to keep track and filter all the latest news in this space, and so the Chain Debrief team decided to compile it into an easy-to-digest article.

The bull is back?

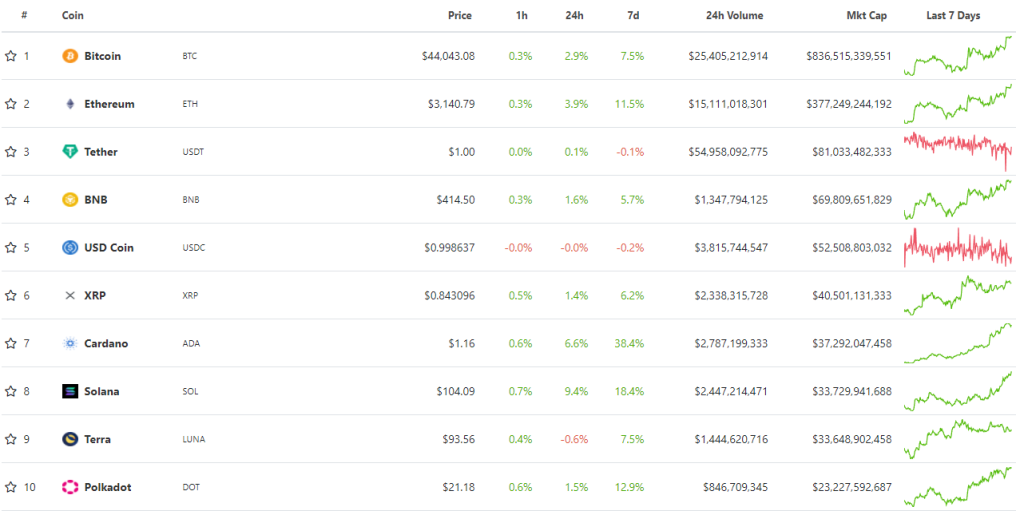

Bitcoin and the broader crypto market rallied back to US$2 trillion market cap amidst the announcement of institutional inflow.

At press time, Bitcoin is currently up 7.8% on the weekly to US$44,182 while Ethereum shows similar promise rising 11% to US$3,124.

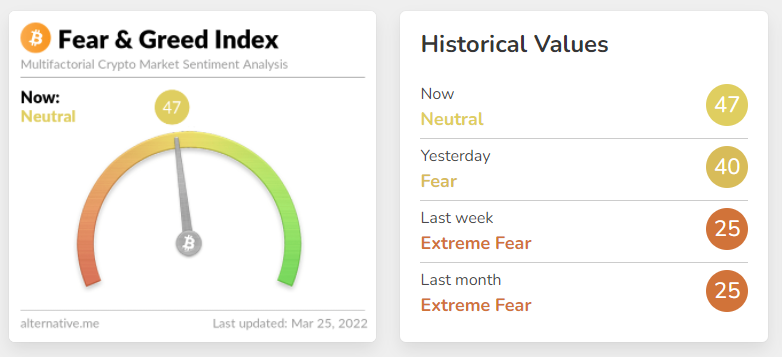

The Fear and Greed Index used to measure the wide crypto market sentiment saw a shift from fear to a neutral stage with a reading of 47. This shift of market sentiment led some investors to speculate about the impending bull market.

The shift in sentiment is largely due to the Wall Street crypto FOMO as large Wall Street banks start to add crypto into their offering.

Grayscale investments announced that it is offering a new investment fund called the Grayscale smart contract fund. The fund will consist of non-ETH tokens from blue-chip Solana to layer 2 Polygon.

Furthermore, Goldman Sachs which did not recommend bitcoin to its client back in 2020 had a change of heart as it started to offer OTC crypto option trade and other digital asset derivatives.

Lido is king

Lido is a staking solution protocol that helps to unlock liquidity for staked tokens. It is currently the market leader for liquid staking with over 2.7 million ETH staked on the protocol.

Lido ETH holdings continued to see higher highs as more investors rushed to stake ETH ahead of the ETH 2.0 upgrade.

The Three Arrows Capital address (0x4862733B5FdDFd35f35ea8CCf08F5045e57388B3) has inflowed 7,500 ETH in the past seven hours, with a total value of about $22.43m; of which 5,500 ETH was withdrawn from FTX and 2,000 ETH was withdrawn from Deribit. https://t.co/27A1u6o4su

— Wu Blockchain (@WuBlockchain) March 22, 2022

Singapore-based hedge fund Three Arrows Capital (3AC) staked about US$22.5 million worth of ETH into Lido protocol.

This move allowed 3AC to earn yield for staking ETH and also get liquidity through the synthetic asset stETH.

Also Read: Ethereum 2.0 Staking Solution: What Is Lido Protocol ($LDO) And How To Stake Your ETH On It

Goodbye fixed 19.5% APY

1/ With the passing of Prop 20, Anchor will now implement a more sustainable semi-dynamic Earn rate!

— Anchor Protocol (@anchor_protocol) March 24, 2022

Let’s cover what this will look like 🧵

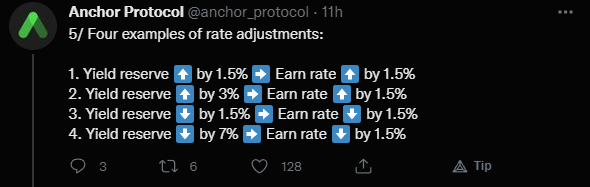

If you missed the announcement, Anchor protocol just passed proposal 20. It will shift from the fixed 19.5% APY to a more sustainable dynamic interest rate.

The dynamic rate would readjust every month based on the yield reserve performance for that month.

There is a hard cap on rate adjustment of 1.5% per month. The above example would show the earn rate would change based on the yield reserve.

Hopefully, this long-awaited change will help turn Anchor protocol into a self-sustainable protocol that will continue to provide attractive yields to the Terra community.

Avalanche Summit

Avalanche Summit is a conference for developers, researchers, and makers building on Avalanche in Barcelona, Spain from 22 to 25 March 2022.

The Avalanche Summit hosted huge names in the crypto space including Ava Labs, Chainlink, VC firms and even the trade and investment Secretariat from the El Salvador government.

If you missed the live stream, fret not as we have covered some of the hottest topics from the summit.

From the upcoming game-changing trends to prophecies for the web3.0 age by leading industry experts. We also covered some beginner-friendly topics like how to not get rekt in the world of decentralized finance.

Notable tweets

Arthur Founder of Defiance Capital lost US$1.7 million worth of NFTs

ATTENTION ALL @AzukiZen it seems sadly @Arthur_0x wallet has been hacked please do not bid or buy any of these NFTs from this address!!! pic.twitter.com/SsdKt8otis

— StockEd NFT's (@robbyhammz) March 22, 2022

Is Singapore really crypto friendly?

Singapore:

— Alex Svanevik (@ASvanevik) March 20, 2022

– clamped down on crypto ads

– banned binance .com

– taxing NFTs

– put a top DeFi fund on MAS “Investor Alert List”

Not as crypto-friendly as I thought when I moved here a year ago.

South Korean gaming giant partner with Solana Labs

Krafton, the South Korean gaming giant founded by billionaire Chang Byung-gyu, is expanding its crypto empire by partnering with Solana Labs to develop play-to-earn crypto games: by @zinnialee23 https://t.co/y642dKW1VK

— Forbes Crypto (@ForbesCrypto) March 24, 2022

World largest hedge fund is entering crypto

BREAKING: World's largest hedge fund, Bridgewater, is preparing to invest in its first crypto fund – Sources

— Blockworks (@Blockworks_) March 21, 2022

– CoinDesk (@realDannyNelson & @IanAllison123) pic.twitter.com/CzLTte30On

This article was written by Gabriel Sieng and Joel Zhao.

Featured Image Credit: Chain Debrief