Welcome to Market Debrief, where we summarise some of the notable events that happened throughout the week.

The crypto landscape is ever-changing with new innovations and regulations popping up every day.

It is very hard and time-consuming to keep track and filter all the latest news in this space, and so the Chain Debrief team decided to compile it into an easy-to-digest article.

Luna breaking all-time high

30% in three days — This insane pump surpassed any other cryptocurrency in the space, leaving no regard to inflation, rising interest rates, or any geo-political FUD.

Luna is the first coin, with a large market cap, to break its all-time high since the bull summer at the crypto market peak in 2021. Terra’s LUNA token climbed to US$104, breaking the previous all-time high of US$103.34 set in December.

Luna’s massive surge also saw it’s total value locked (TVL) rise from US$18 billion at the beginning of the year to US$26.22 billion, as of 10 March 2022.

Since late January, when Luna hit a 2022 low of about US$44, the token has more than quadrupled in price. It now has a market capitalization of slightly under US$38 billion, making it the sixth-largest cryptocurrency by market cap.

Luna’s gains came likely from the increasing growth in its stablecoin, TerraUSD (UST).

Due to such a high demand for $ust , the curve pool is unbalanced again…

— LFG | Luna Foundation Guard (@LFG_org) March 9, 2022

LFG council members just voted on burning the 4.2m $luna left in LFG treasury.#LUNAtics

UST keeps its currency peg by burning or issuing LUNA tokens. Holders of UST can convert UST to US$1 worth of LUNA when the value of UST falls below US$1 (for example, to US$0.98).

Terra’s Anchor Protocol, a decentralized finance (DeFi) network that advertises an annualized percentage yield (APY) of roughly 20% on Terra stablecoins, is also driving tremendous demand.

Also Read: Here’s The Best Way To Buy UST Using Fiat And Stake It On Anchor Protocol

The influx of demand saw the platform reaching US$12.72 billion in TVL, making it the largest DeFi Protocol in the Terra ecosystem.

Terra co-founder Do Kwon tweeted that LFG has added US$418 million in reserves to its treasury, bolstering its total to US$1.5 billion.

These reserve helps supplement Anchor’s reserves in delivering to pay those sky high stablecoin yields, which contributed to the upward pressure on the price of Luna.

. @LFG_org has just added $418M to its reserves – current balance around 1.5B

— Do Kwon 🌕 (@stablekwon) March 9, 2022

Biden’s executive order on cryptocurrencies

On Wednesday (9 March), US President Joe Biden issued an executive order (directive by the president that manages operations of the federal government) directing the federal government to investigate the dangers and advantages of cryptocurrencies.

His order urged federal agencies to take an uniform approach to digital asset regulation and monitoring. US President Joe Biden also emphasized on these key points below:

Protecting consumers

The measures announced on Wednesday focused on six key areas:

- Consumer and investor protection (crypto scams/cyber attacks)

- Financial stability

- Illicit activities (laundered crypto)

- U.S. competitiveness on a global stage (significant as China has banned cryptocurrency)

- Financial inclusion

- Responsible innovation (climate change etc)

Exploring a digital version of the US Dollar

Biden called on the government to place “urgency” on research and development of a potential CBDC (central bank digital currency).

Last year, the Federal Reserve began looking into the possibility of issuing a digital dollar. The central bank issued a long-awaited research outlining the benefits and drawbacks of such virtual money, but it has yet to say whether the US should create one.

White House Exec Order and U.S. Government Strategy for Digital Assets — a thread with thoughts; TLDR = this is a watershed moment for crypto, digital assets, and Web 3, akin to the 1996/1997 whole of government wakeup to the commercial internet. (1/7)

— Jeremy Allaire (@jerallaire) March 9, 2022

There was a surge in crypto prices after the announcement of the executive order came to pass. Prices of Bitcoin and Ethereum grew 9.23% and 7.19% respectively.

I think there are two takeaways. Firstly, from the executive order, there is a clear indication of a positive outlook on the crypto market and the broader crypto ecosystem. With the president of the United states mentioning that it is important to stay competitive and maintain it’s leadership in digital assets.

Secondly, the executive order does not lay out policy directives but instead, asking thoughtful questions which would lead to policy goals in the future.

The long awaited executive order was mentioned to “spark new bull market” by Bitwise’s Matt Hougan.

Winter is coming for NFTs?

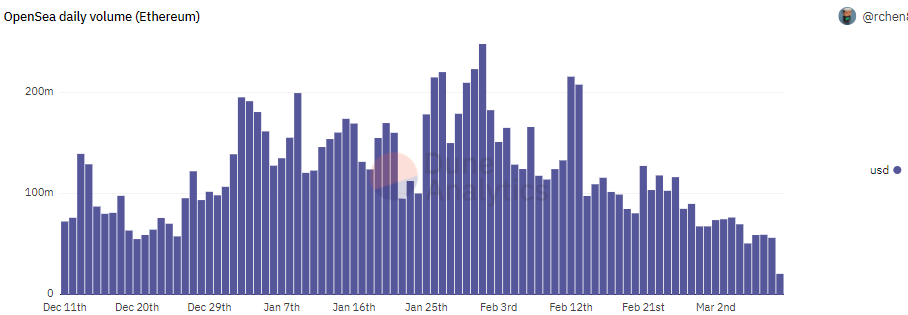

NFTs had an amazing start this year with an astounding bull run that lasted through the whole of January all the way to mid-February.

The OpenSea volume peaked at a whopping US$247.8 million on 1st February alone.

Since then, NFT volume on OpenSea has been slowing down and there is no sign of recovering. This is not an isolated event as NFT volume on the other NFTs marketplace have seen a drop in volume too.

The drop in volume is not a surprise as the macro market have been struggling due to the ongoing geopolitical crisis.

Notable tweets

Avalanche “Multiverse” incentive program to invest up to US$290 million

NEW: @avalancheavax is putting 4 million $AVAX ($290 million) behind a new effort to court application-specific "subnets," starting with one for @DefiKingdoms.@zackseward reportshttps://t.co/Z4vatMb9sn

— CoinDesk (@CoinDesk) March 8, 2022

Immutable X raised US$200 million in funding, includes Temasek Holdings Singapore

1/ Major news: we’re thrilled to announce @Immutable has raised $200M in Series C funding @ $2.5B val.🎉

— Immutable | $IMX (@Immutable) March 7, 2022

We’re supercharging our mission to make NFTs mainstream through high-quality blockchain games (and more).https://t.co/mZkrK2PnEj pic.twitter.com/69zbECxlIw

FTX allows users to buy Terra’s UST on its exchange

FTX now supports native Terra UST!@terra_money #Terra $UST pic.twitter.com/RPzCXVL6dt

— FTX (@FTX_Official) March 6, 2022

Microsoft’s job posting

Microsoft job posting

— Blockworks (@Blockworks_) March 4, 2022

Big crypto ambitions ⚡️🔥 pic.twitter.com/COIWBAUaa4

This article was written by Gabriel Sieng and Joel Zhao.

Featured Image Credit: Chain Debrief

Also Read: LUNA Is Now The 7th Largest Cryptocurrency By Market Cap: Why This Is Just The Beginning