Since the implosion of many CeDeFi entities, yields have fallen across the board in crypto. But that doesn’t mean that they’re gone. One new player in the field is Steadefi, which aims to provide competitive yields.

In fact, this crypto bear market has been a silver lining for many looking for real yield, in contrast to poor tokenomics and inflated yield that was present during the bull. With the return of on-chain activity in the last few weeks, delta-neutral strategies, such as providing liquidity, have been performing especially well.

However, sourcing for the most rewarding strategies can be taxing not only on your time, but resources such as gas fees as well – and that’s where Steadefi steps in.

Also Read: Here’s How Steadefi Will Make Yield Farming Simple, Yet Effective

Steadefi – Automating Strategies For You

If you’re looking for market-leading stable yields at the touch of a button, you’ve come to the right place.Currently available on both the Arbitrum and Avalanche networks, Steadefi offers a variety of neutral or lending strategies that earn yield without being overly exposed to crypto’s volatility.

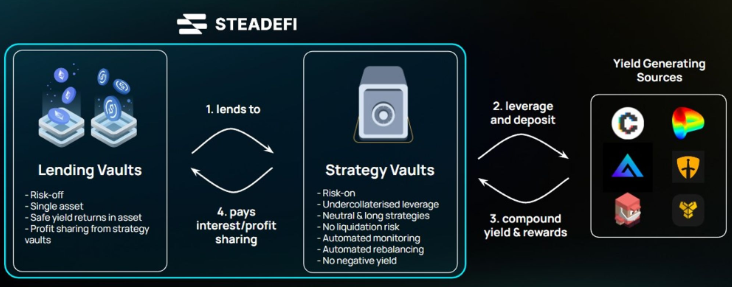

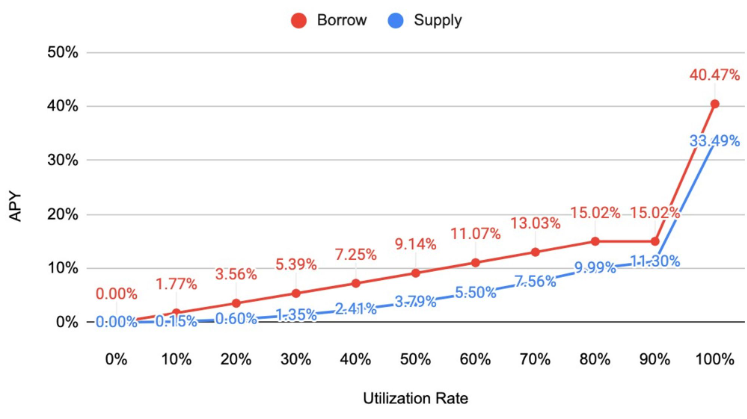

In addition to their current liquidity bootstrapping incentives, Steadefi’s profit-sharing mechanism helps to maximize returns for lenders on the protocol.

Profit-sharing allows Steadefi to reduce reliance on utilization rates of their vaults, capping their downside, while the upside is increased when more borrowers enter the ecosystem.

All the details about our innovative 3x Long $GLP Vault right here: https://t.co/D7afSaQiBD

— Steadefi 💙🔺 (@steadefi) February 10, 2023

Time to go long on #BTC, #ETH, and #AVAX while tripling the @GMX_IO #RealYield!

Furthermore, the protocol allows users to automatically leverage 3x on a delta-one (Long Strategy) position, amplifying yields for ETH and AVAX bull believers.

For example, their 3x Long GLP-GMX strategy vault uses leverage to earn boosted yields from GLP staking on the GMX derivatives protocol.

While there are currently only a limited number of strategies, the team states that their “focus is definitely on launching new vaults right now”, with “plans for Camelot DEX, Curve’s tricrypto pool, ETH liquid staking yields, and more perpetual DEXes including Level Finance and the looming GMX v2.”.

By combining some of the most sought-after yields in crypto with boosted yields and auto-compounding, Steadefi is laying a strong foundation to be at the forefront of DeFi.

Maximizing Their Liquidity Bootstrap Incentives

Alongside the launch of their strategy vaults, Steadefi has announced their liquidity bootstrapping incentive campaign, which will run until the 1st of August this year.

By depositing your vault tokens in their respective farms, users are able to earn additional rewards, boosting APRs up to 150%.

For example, their USDC Lending vault farm on GMX, which usually pays a market rate of 2.7%, is boosted to 96% here during their 3-month-long incentive campaign – a 3000% increase!

These additional rewards currently come only in the form of $esSTEADY, the escrowed counterpart to $STEADY.

This is an excellent opportunity to accumulate their native tokens prior to their official token launch in Q3 2023. Holders of $esSTEADY will be rewarded with a share of the protocol’s revenue, as well as the ability to boost the yield in their respective farms.

Hinted at our new @CamelotDEX 3x strategy vaults the other day.

— Steadefi 💙🔺 (@steadefi) May 25, 2023

Time for some more details.

👉 All 4 vaults will receive extra $esSTEADY rewards

Risk-off$ETH Lending Vault$USDC Lending Vault

Risk-on

3x Long ETH-USDC Vault

3x Neutral ETH-USDC Vault#Arbitrum

More 🧵 👇 pic.twitter.com/DpDWEzIVi0

In the future, further utility such as governance votes will become available to $esSTEADY holders.

Until the official launch of $STEADY and $esSTEADY in Q3 2023, taking advantage of Steadefi’s incentive campaign, especially on neutral vaults, is as close as risk-free as possible to accumulating as much of their native token as possible.

Remember to check our their official Twitter page for the latest updates on Steadefi and join their Discord channel, where they discuss upcoming events and new strategies being implemented!

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: ChainDebrief