The MetaJam Web3 Summit is happening from the 26th to the 28th of July 2022. It is a physical summit that showcases keynote speeches, debates and sharing workshops as iconic speakers and industry leaders share their insights into current web3 topics and the future of the space.

On the topic of what’s stopping people from entering DeFi, we have three distinguished guests. They are:

- Darius Sit, Co-Founder, QCP Capital

- Edward Tan, Investor, Hashed

- Kimberley Chang, BA, Algorand Foundation

- Ben Wee, Vice President at Crypto.com Capital (Moderator)

Where Are We In The Market Cycle?

We’ve had a tough year for the market, especially for crypto. The macro environment has changed this year as compared to the previous where we see the Fed shrinking the size of their balance sheet, resulting in declining asset prices.

Darius specifically pointed out that in the crypto space, what we are currently facing is a break down in the credit market, a credit crisis triggered off by Luna and 3AC followed by the contagion effect after.

“Anyone who had exposure to loans, borrowing and lending, is getting affected by defaults as the space is experiencing a very serious deleveraging cycle. Think of it as a 2008 crisis in traditional assets without the chance of a bailout from the Fed.”

Darius Sit, Co-Founder at QCP Capital

What we are currently facing right now is a broken credit market where users are no longer able to borrow and lend efficiently which caused lesser activity to take place.

Also Read: MetaJam Asia: Navigating The Risks Associated With NFTs

What is DeFi?

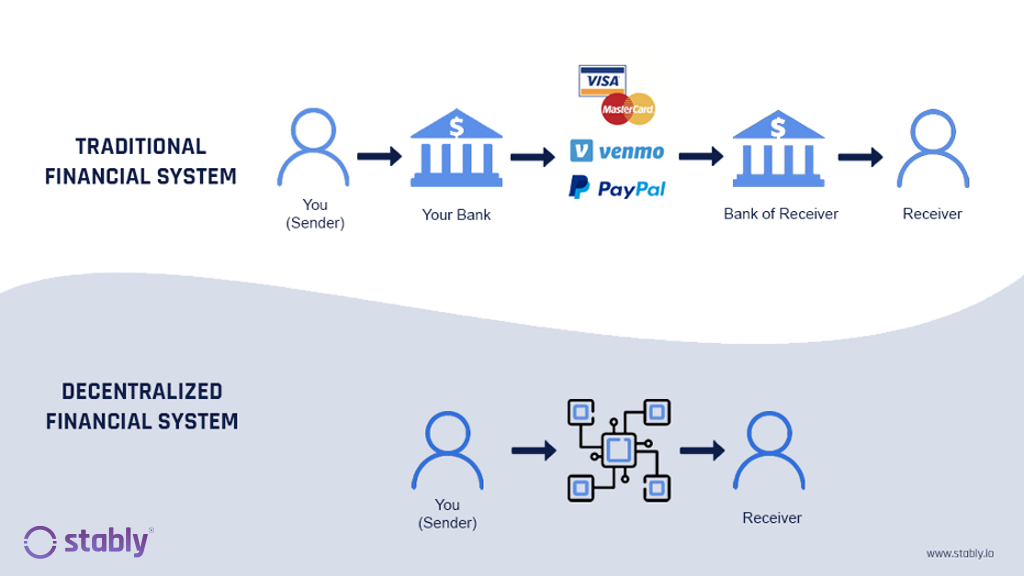

DeFi is trying to replicate your experience in traditional finance but without the need for an intermediary.

Here’s a quick run through of TradFi and DeFi transactions:

TradFi: Lender –> Bank –> Payment gateway –> Bank –> Borrower

DeFi: Lender –> Borrower

What DeFi is trying to do is to remove all the intermediaries in between during the process through a smart contract.

Also Read: MetaJam Asia: How NFTs Are Revolutionizing Every Industry

What’s Stopping Users From Entering?

Firstly, user experience in DeFi have always been an issue. The UX of some protcols are just really bad (e.g. Curve) and shuns away users who are unwilling to interact with an eyesore platform.

Secondly, newcomers are reluctant to learn the process of setting up their wallets, storing their seed phrases safely, utilising a bridge to make transactions on different chains, and the list goes on. All these requires knowledge and can be intimidating for a tech noob or a first time user.

Lastly, the ease of usage is challenging too. After learning how to set up the necessary, interacting with DeFi protocols is another concern.

In summary, DeFi hasn’t exactly replicated the user experience from TradFi which will always be a stumbling block for mass adoption. When our parents can freely transact and interact with smart contracts on a protocol is when we have the answer to this question.

Closing thoughts

While Web 2.0 do not offer decentralisation like Web 3.0 does, one thing that we all know for sure is the ease of use. When one takes out a loan, one will always be interacting with another individual in Web 2.0. Many are unwilling to try out DeFi products simply because they do not want that responsibility.

“Some people don’t want that autonomy. Some people really don’t want to have to deal with everything themselves, they are afraid.”

Edward Tan, Investor at Hashed

What if I can’t contact someone when my funds go missing? What if I’m unable to withdraw a big sum of money? What will happen?

These are always common questions when probing an inexperienced user. This is completely fine as you can never capture a 100% but what the important question is in my opinion is “How can I make the experience more seamless so that more people aren’t afraid to try out DeFi?”

And with a solution to that question, I believe more people would be willing to try out DeFi one day.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief

Read More: MetaJam Summit: Will the Next 10 Million Users Come From GameFi?