Metaplanet, a Tokyo-listed investment firm, purchased 135 BTC for $12.9 million, boosting its total Bitcoin holdings to 2,235 BTC. This acquisition happened just before Bitcoin’s price dipped below $91,000. Despite the drop, Metaplanet’s strategy has proven successful, with a 12% unrealized gain since it began accumulating Bitcoin last year.

Metaplanet has acquired 135 BTC for ~$13 million at ~$96,185 per bitcoin and has achieved BTC Yield of 23.2% YTD 2025. As of 2/25/2025, we hold 2235 $BTC acquired for ~$182.9 million at ~81,834 per bitcoin. pic.twitter.com/IxCCvR0zWC

— Simon Gerovich (@gerovich) February 25, 2025

By acquiring Bitcoin at $95,961 per coin, Metaplanet stays focused on its long-term vision. The firm’s aggressive strategy aims to reach 10,000 BTC by 2025 and 21,000 BTC by 2026.

Metaplanet’s quick response to market changes continues to set it apart in the growing world of institutional crypto investment. Their strategy is a clear sign of confidence in Bitcoin’s future value.

You can also read this Metaplanet Targets $62 Million to Expand Bitcoin Accumulation

El Salvador Joins the Bitcoin Buying Frenzy

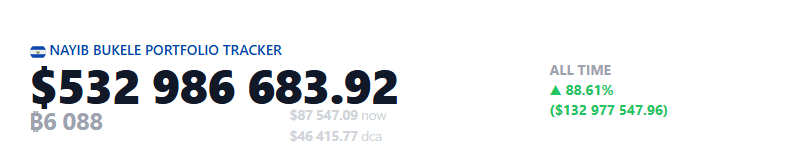

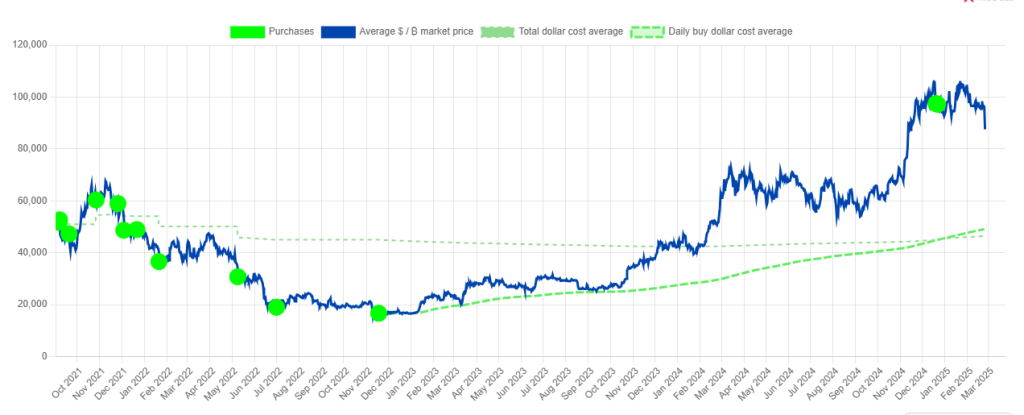

El Salvador also took advantage of Bitcoin’s dip. On February 24, President Nayib Bukele announced the purchase of 7 BTC, bringing the country’s total holdings to 6,088 BTC. This purchase reassures critics that El Salvador remains committed to its Bitcoin strategy, despite IMF pressures to slow down Bitcoin acquisitions.

Since November 2022, El Salvador has consistently purchased one Bitcoin per day. This latest purchase, though a break in routine, strengthens the country’s position as a Bitcoin-driven economy.

El Salvador’s ongoing commitment to Bitcoin reflects a strategic approach that sees cryptocurrency as a valuable tool for future economic stability. Buying Bitcoin during dips aligns with their long-term financial goals.

Metaplanet’s Bitcoin Strategy Pays Off

Metaplanet’s Bitcoin strategy continues to deliver solid results. The firm reported a BTC yield of 23.2% for Q1 2025, putting it on track to meet its 35% yield goal. CEO Simon Gerovich has emphasized that maximizing Bitcoin yield is central to their strategy, which also includes a goal to reach 10,000 BTC by 2025 and 21,000 BTC by 2026.

By acquiring Bitcoin at a low average cost, Metaplanet has built a robust portfolio. The firm’s growth mirrors that of MicroStrategy, another leader in Bitcoin adoption.

Metaplanet’s strategy is focused on long-term growth, using Bitcoin as a treasury asset. Its performance highlights the potential for corporate investors in cryptocurrency to thrive during market fluctuations.

You can also read this Polymarket, Where You Can Bet on Anything

Will Bitcoin’s Price Rebound?

Bitcoin’s price recently fell by 5%, but it has since rebounded to $86,895.12. Despite these fluctuations, Metaplanet and El Salvador are still confident in Bitcoin’s long-term potential. Both continue to accumulate more Bitcoin, betting on its future appreciation.

Metaplanet now holds 0.01% of Bitcoin’s total supply, securing its spot as one of the top Bitcoin holders globally. Similarly, El Salvador’s increasing Bitcoin reserves demonstrate its belief in Bitcoin’s future value, even amid market dips.

For both Metaplanet and El Salvador, Bitcoin remains a core part of their financial strategies. Their continued investments reflect their unwavering confidence in Bitcoin’s long-term potential.

You can also read this Bybit Fully Replaces Stolen $ETH After $1.4B Hack

Looking Ahead: The Future of Bitcoin Accumulation

Metaplanet and El Salvador remain committed to their Bitcoin accumulation strategies. Metaplanet’s goal of reaching 21,000 BTC by 2026, along with El Salvador’s ongoing daily purchases, shows their dedication to Bitcoin as a long-term asset. Despite market fluctuations, both entities continue to position themselves for future growth.

These strategies align with the broader trend of institutional and governmental adoption of Bitcoin. As more entities follow their lead, Bitcoin’s role as a global financial asset continues to strengthen.

For both Metaplanet and El Salvador, Bitcoin represents more than just a market play. It’s a strategic investment that will provide long-term financial stability and growth.

Editor’s Note: This article does not represent financial advice. Please do your own research before investing.