Japanese investment firm, Metaplanet plans to raise ¥9.5 billion ($62 million) to expand its Bitcoin holdings. The company will use Moving Strike Stock Acquisition Rights to raise the funds. These rights will be allocated to EVO FUND.

*Metaplanet Announces Issuance of Moving Strike Stock Acquisition Rights to Raise Up to ¥9.5 billion ($62 million) for Accelerated Bitcoin Accumulation* pic.twitter.com/bL7rs6Qkk4

— Metaplanet Inc. (@Metaplanet_JP) November 28, 2024

This strategy follows the approach of MicroStrategy, the leading corporate Bitcoin holder. Metaplanet’s CEO, Simon Gerovich explained the benefits of this method. It helps the company grow its Bitcoin holdings without heavily diluting shareholder value.

当社の行使価額修正条項付新株予約権の発行に関するご質問やご懸念を拝見しました。これらに対する明確な回答を提供するため、この取引の概要、その構造、および当社のビットコイン蓄積戦略をどのように支えるかについて、主なポイントをまとめました。 pic.twitter.com/tuEEJGLJzK

— Simon Gerovich (@gerovich) November 28, 2024

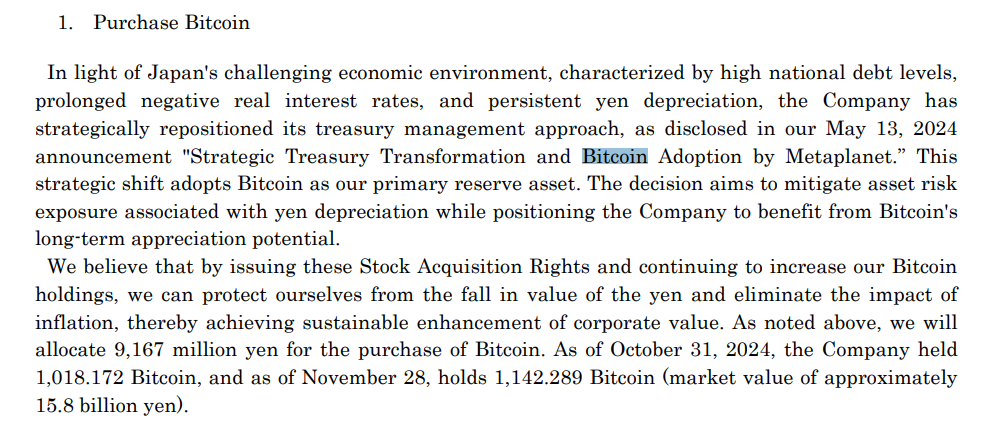

Metaplanet is setting its sights on becoming Asia’s first Bitcoin Treasury Company. This move shows how much faith they have in the future of digital assets.

Metaplanet aims to protect its purchasing power as the yen weakens by adopting this strategy. It also seeks to capitalize on Bitcoin’s growth potential. This move secures the company’s financial stability. It further supports their vision of leading the Bitcoin economy.

Related Metaplanet Stock Soars 6.5% After Raising $62 Million for Bitcoin Acquisition

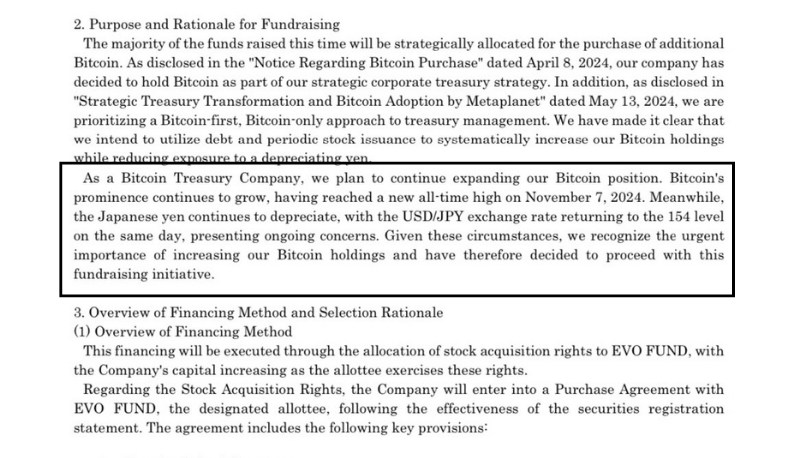

Metaplanet’s Focus Shifts to $BTC

Metaplanet is turning its attention to Bitcoin after it reached a record price of $99,645 on November 22, 2024. With the yen continuing to weaken against the US dollar, they see Bitcoin as a strategic way to safeguard their finances and hedge against inflation.

Since May 2024, Metaplanet has invested $75.3 million to purchase 1,142 BTC. The weakening of the yen against the dollar has been a key factor in this decision, as Bitcoin offers a way to hedge against inflation and secure their financial position.

For Metaplanet, Bitcoin is more than just a financial asset. It is a tool to protect against inflation and tackle the challenges of a weakening yen. Additionally, Metaplanet uses Bitcoin as preparation for the future.

This move highlights Metaplanet’s confidence in Bitcoin. They are fully committed, making it a central part of their long-term plans.

You can also read this Vancouver Mayor Eyes Bitcoin Reserve, the Next El Salvador

Metaplanet’s Growing Bitcoin Reserves and Fund Allocation

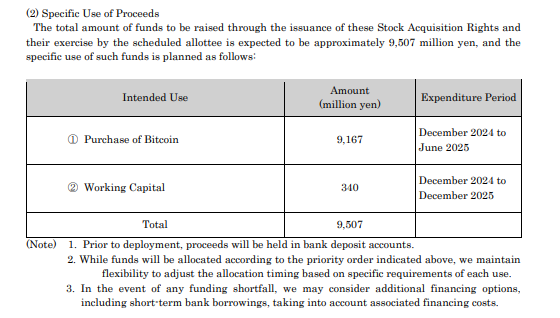

Metaplanet is focused on increasing its Bitcoin reserves, planning to raise ¥9,167 million ($62 million) to buy more Bitcoin. The purchases are set to take place between December 2024 and June 2025.

Metaplanet will raise these funds through the issuance of Stock Acquisition Rights, with a total expected amount of ¥9,507 million. The breakdown of the funds is as follows:

- Purchase of $BTC ¥9,167 million (December 2024 – June 2025)

- Working Capital: ¥340 million (December 2024 – December 2025)

Metaplanet will allocate ¥340 million for working capital to be used from December 2024 to December 2025. By balancing operations with a focus on growth, they are building a stronger and more innovative future.

Metaplanet Strengthens Its Presence in Asia

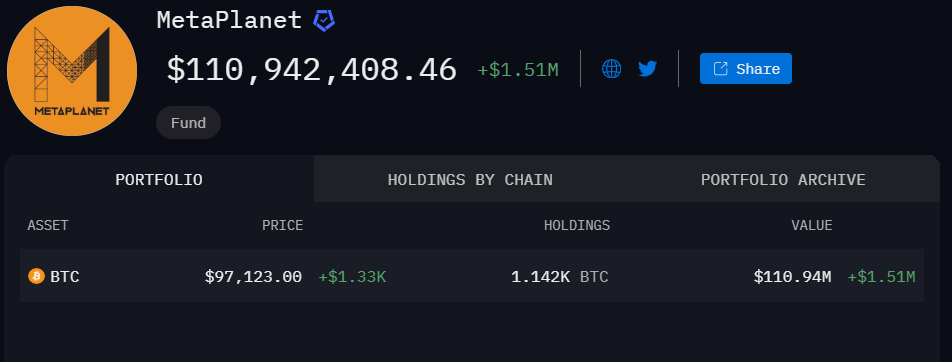

Metaplanet has grown its $BTC holdings to 1,142 BTC as of November 20, 2024. This achievement highlights their dedication to digital assets and strengthens their position as one of Asia’s leading corporate Bitcoin holders.

Right now, their $BTC is worth $111.29 million, with an average purchase price of $65,972 per BTC. Thanks to this smart approach, they have made a 47.68 percent profit.

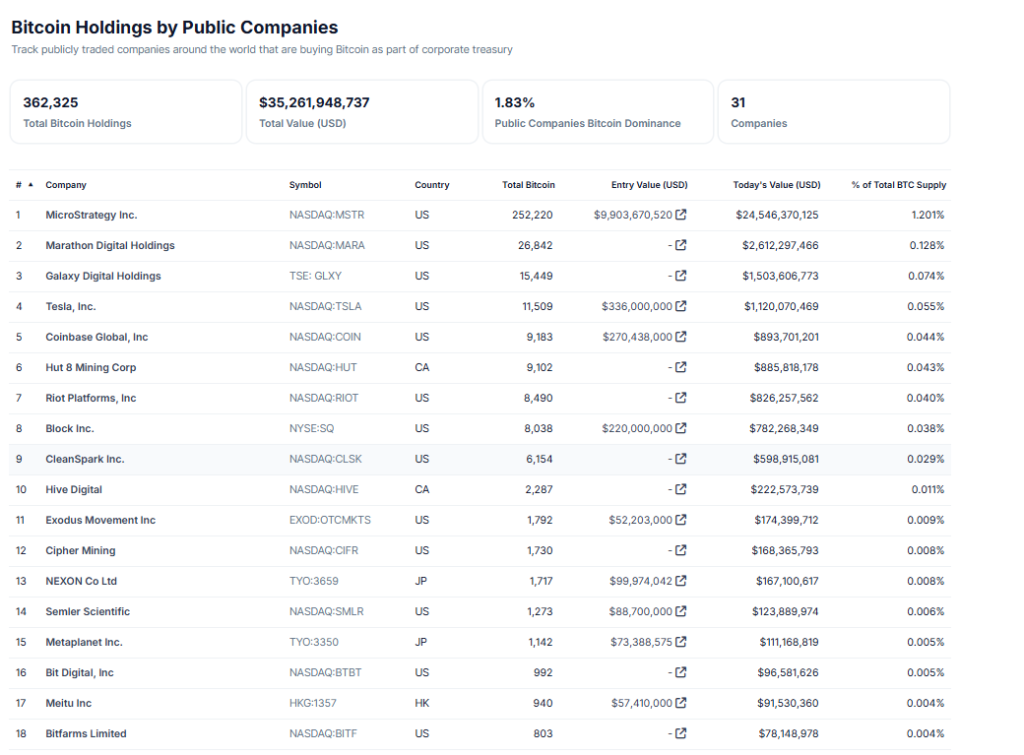

Globally, Metaplanet ranks 15th among public companies with the largest $BTC holdings. Building on this success, they have outpaced several major corporations, showing other companies in Asia how digital assets can become a valuable part of their strategies.

You can also read this Ethereum Co-Founder Moves 20,000 ETH to Kraken, What’s Next?

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]