MicroStrategy recently made another bold move in the crypto world. On November 18, 2024, they announced a massive purchase of 51,780 BTC at an average price of $88,627 per BTC, totaling approximately $4.6 billion.

MicroStrategy Announces Proposed Private Offering of $1.75B of Convertible Senior Notes. $MSTR https://t.co/dBJMUvfjj1

— Michael Saylor⚡️ (@saylor) November 18, 2024

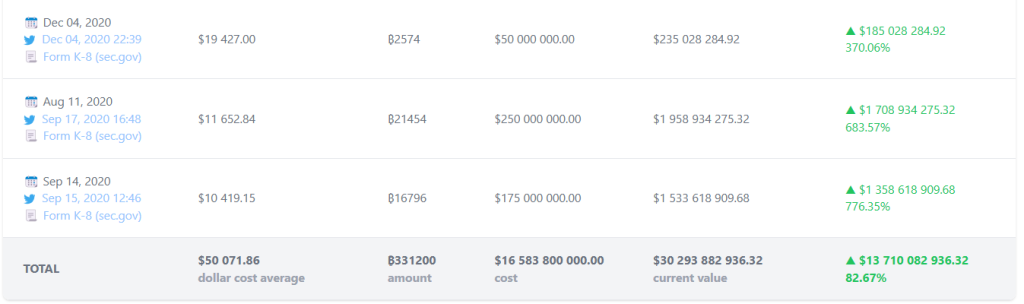

This purchase solidifies their position as the largest BTC-holding company, with a total of 331,200 BTC. Their portfolio’s current value stands at about $30.29 billion, with an unrealized gain of around 82.67% from their total investment of $16.58 billion.

MicroStrategy Announces Its Largest Purchase Yet: $4.6 Billion for 51,780 $BTC!

— CryptoQuant.com (@cryptoquant_com) November 18, 2024

“This mega-deal brings significant updates to the stats:

– BTC Holdings: from 279,420 #BTC to 331,200 BTC

– MSTR Realized Price: from $42,692 to $49,874

– MSTR MVRV: from 2.12 to 1.80

– Percentage… pic.twitter.com/gNT4IY1fX9

MicroStrategy’s commitment to Bitcoin is evident from this massive investment. Michael Saylor believes Bitcoin is a long-term asset that will protect the company’s value against inflation and global economic uncertainty.

Unique Convertible Notes Offering

To fund this Bitcoin purchase, MicroStrategy raised $1.75 billion through convertible notes set to mature in 2029. These notes have a 0% interest rate, meaning there are no interest payments to investors. However, they can be converted into shares or cash, giving flexibility to investors.

For investors, this is a unique opportunity to gain exposure to Bitcoin through MicroStrategy’s stock. MicroStrategy’s stock price (MSTR) often moves in tandem with Bitcoin prices, making it an appealing alternative for those who want to benefit from BTC’s price increases without directly buying Bitcoin.

This approach demonstrates how MicroStrategy employs innovative strategies to raise capital. By avoiding interest payments, they can manage cash flow more flexibly while still supporting their Bitcoin-first mission.

Michael Saylor’s Conviction in Bitcoin

Michael Saylor has unwavering confidence in Bitcoin’s long-term potential. He believes Bitcoin is the “digital gold” of the future, one that will continue appreciating in value.

Saylor views Bitcoin as the best store of value, especially amid global economic uncertainty and market volatility. In various interviews, Saylor has emphasized that gold or fiat currencies don’t match Bitcoin’s potential as a corporate reserve.

He believes Bitcoin can shield the company from value erosion due to rising inflation, which is one of the main reasons MicroStrategy consistently accumulates BTC.

A Long-Term Bitcoin Portfolio Strategy

MicroStrategy has accumulated 331,200 BTC at a total cost of approximately $16.58 billion. With Bitcoin’s price rising, their portfolio’s value has now reached $30.29 billion, providing substantial unrealized gains. This is not just about profit but also reflects the company’s long-term strategy towards Bitcoin.

The average purchase cost per BTC stands at $50,071, giving them a significant gain over their initial investment. With such a large position, MicroStrategy has become a leader in Bitcoin accumulation among public companies, showing their readiness to hold BTC despite market fluctuations.

Data on Dollar Cost Average, total Bitcoin holdings, Bitcoin purchases, and Bitcoin gains of MicroStrategy | Source : Saylotracker

This move illustrates that MicroStrategy does not view Bitcoin merely as a speculative tool. Instead, they see it as a core asset to preserve the company’s value. This confidence has made them one of the largest “whales” in the Bitcoin world, influencing the market with every major acquisition.

Consistent and Significant Bitcoin Purchases

MicroStrategy has acquired 51,780 BTC for ~$4.6 billion at ~$88,627 per #bitcoin and has achieved BTC Yield of 20.4% QTD and 41.8% YTD. As of 11/17/2024, we hodl 331,200 $BTC acquired for ~$16.5 billion at ~$49,874 per bitcoin. $MSTR https://t.co/SRRtRrB2jO

— Michael Saylor⚡️ (@saylor) November 18, 2024

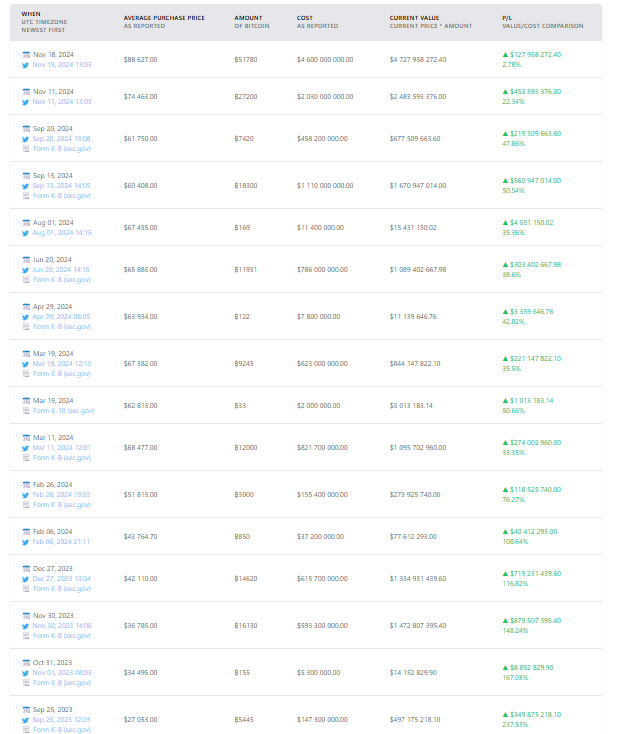

This year’s acquisitions have been monumental for MicroStrategy. On November 18, 2024, the company bought 51,780 BTC for $4.6 billion, averaging $88,627 per BTC. Just a week earlier, on November 11, 2024, they acquired 27,200 BTC for $2 billion at an average price of $74,463.

The acquisition streak also includes 8,742 BTC bought on September 20, 2024, at an average price of $61,750, totaling $458.2 million. On September 13, 2024, MicroStrategy made another significant purchase of 18,300 BTC at $60,408 per BTC, worth $1.1 billion. These large-scale purchases demonstrate the company’s strategy to leverage Bitcoin’s appreciation, even amid market volatility.

For MicroStrategy, these acquisitions go beyond immediate profits. With over $16.58 billion invested in Bitcoin, Michael Saylor and his team are strategically positioning the company for sustained relevance in the digital age.

Related MicroStrategy to raise $1.75B with 0% interest notes to buy Bitcoin

Impact of Bitcoin on MicroStrategy’s Stock

MicroStrategy’s stock (MSTR) continues to show significant gains in line with the company’s growing investment in Bitcoin. On November 19, 2024, MSTR traded around $385.17, up 1.74% in a single day. This increase coincides with the recent large-scale BTC purchase announced by MicroStrategy, which added 51,780 BTC to its holdings.

Traditional investors seeking Bitcoin exposure through conventional means are increasingly drawn to MSTR, as its stock price closely correlates with Bitcoin’s performance. When BTC appreciates, MicroStrategy’s stock tends to follow suit, making it an appealing alternative for investors who want to benefit from Bitcoin’s price appreciation without directly purchasing BTC.

You can also read this Polymarket Whale Loses “zxgngl” $3.6 Million on Mike Tyson Bet

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]