In 2014, the now defunct Bitcoin Exchange Mt. Gox was hacked for 840,000 $BTC, worth an estimated $504 million at the time.

Today, that amount stands at a whopping $16.8 billion dollars, or a 33x since the hack.

Shortly after, the exchange reported that they had found 200,000 Bitcoins in old company wallets that they promised to distribute to victims, which they never did.

After 8 years, however, it may finally be happening.

September 15th

According to the latest official documents from Mt. Gox, they will start repaying victims on September 15th.

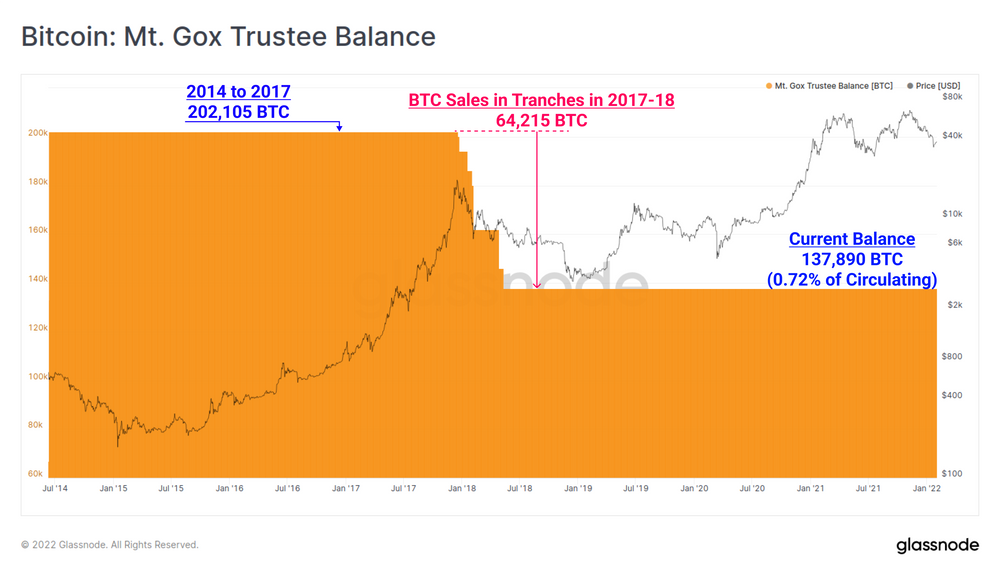

This would involve up to 137,890 $BTC, or 0.72% of the circulating supply.

However, this announcement is the latest in a series of delays by the platform, and speculators are warning that it may drag out further.

As mentioned before, the trustee is not yet ready to pay out. There will be a KYC process, he has to explain how payouts will happen etc, he has to collect bank account data and so on. This will drag for months if not years. Nothing the trustee does is quick.

— Django Bits (django.tez) (@djangobits) August 31, 2022

Sell The Rumor, Sell The News?

Bitcoin price has failed to hold major levels of support recently, and seems to be heading under $20k again.

With thinning liquidity and the red button looking increasingly attractive everyday, some are worrying that Mt. Gox may indeed crash the market.

However, the FUD is most likely overblown.

MT GOX release probably creating more fear than needed

— Rager 📈 (@Rager) August 27, 2022

140k BTC = $2.8B

BTC daily trade volume $20B to $30B

These BTC aren't going to be all sold at once https://t.co/ZLBh0HVIgs

Firstly, the repayment process will not happen all at once, but over the span of a few months.

Secondly, Mt. Gox has multiple payment options – early lump sum payments or in a later payment. Those who choose the former will only receive a portion of their original funds.

Lastly, the total amount unlocked will be equivalent to approximately 11% of Bitcoin daily traded volume. Even if all of it is sold at once, it would likely not cause any major price dislocations.

The strength of the rumors are therefore more likely associated with the negative sentiments within the market, and Bitcoin’s already weak price action.

Also Read: S’pore Institutions Are Still Looking Towards Crypto Investments – Bitstamp Survey Shows

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: The Verge