Many people think of NFTs as synonymous with JPEG image files, but NFTs can be anything from a JPEG, GIF, video or audio file.

It is the “non-fungibility” aspect that defines these tokens as a scarce digital collectible, not its file type per se. Lately, music NFTs have gained some attention in crypto.

i made more income from one NFT drop than my 15 year career as a musician.

— rac.eth (@RAC) February 6, 2022

can I be exploited some more? plz https://t.co/NAAuGkx3o5

Some might ask: Why would I want to pay for “ownership” of a song when I can listen to the song freely online?

The same reason you would want to own a rare baseball card, a limited edition sneaker, or profile picture NFT, even if you don’t care about baseball, sneakers or art.

You’re not paying for the right to view/listen (i.e., patronage) — you’re paying for property ownership.

Reasons to be an NFT owner:

- You’re a fan and you want to support an artist you believe in. Singaporeans who like to #supportlocal will relate.

- You’re a collector and it’s your pet hobby.

- The scarcity and immutable ownership of a music NFT gives you an investment opportunity. Owning a limited NFT copy of the song may be worth much more down the road when the artist blows up. There may also be utility reasons. The artist may use the NFT as a token for access to his exclusive events or future content, like many PFP NFTs are doing for social clubs and events.

The music NFT market is nascent right now, but its early activity is showing some promise. Here are a few avenues by which artists are marketing their music in this niche NFT submarket.

NFT music marketplaces

After minting their music into NFTs (popular options are OpenSea or Rarible), artists can list them for sale through NFT music marketplaces.

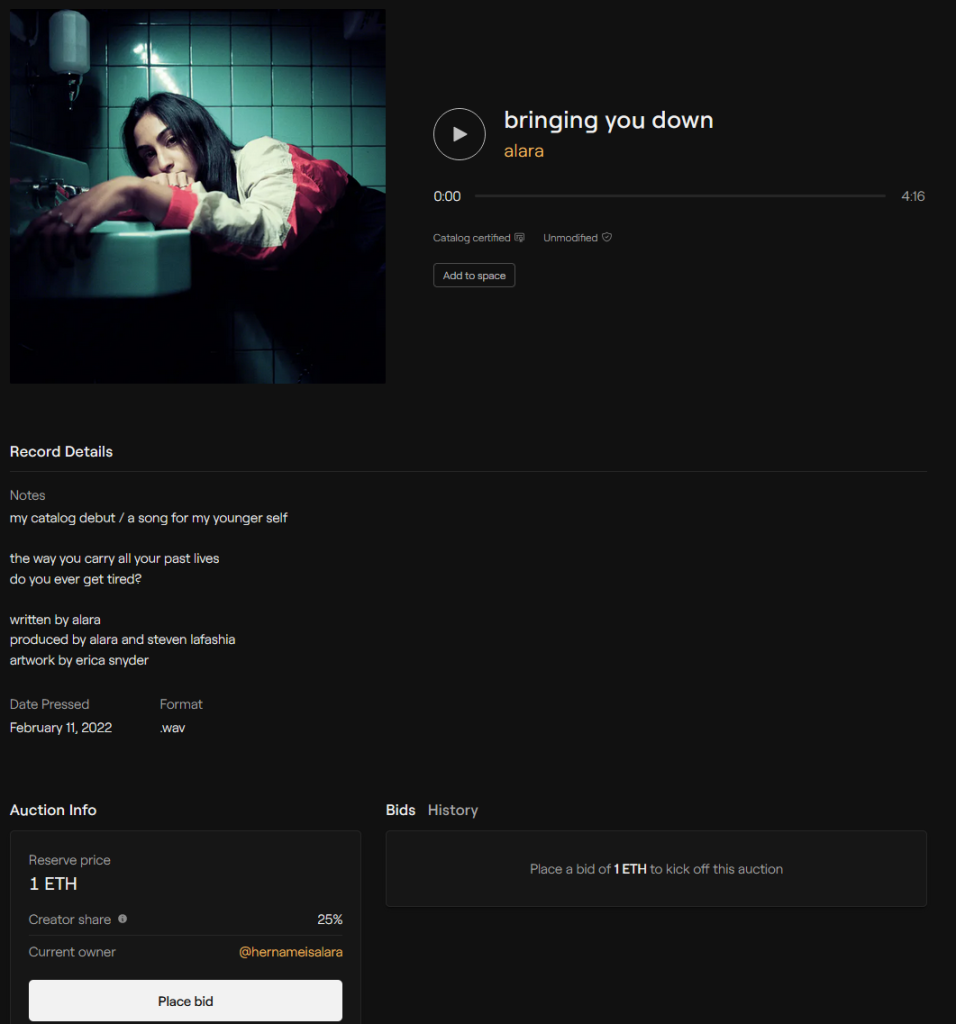

The top example right now is Catalog, built on the Zora protocol. If you go onto Catalog, you can bid on any NFT like you would on OpenSea. There is also a “creator share” percentage that goes to the artist when the NFTs are resold, the equivalent of a “creator fee” on Opensea.

It’s worth repeating that you’re buying the music NFT as a digital collectible, not the song itself. In fact, all the listings on Catalog lets you listen to the song for free. Yes, the entire song, not a 15-second teaser snippet like on Apple Music.

Catalog lets artists sell only NFTs that come in a 1 of 1 edition, which means that these NFTs are extremely scarce and likely more expensive.

As of February 2022, Catalog has sold more than US$2 million worth of music NFTs.

┻┳|

— Catalog 💽 (@catalogworks) February 1, 2022

┳┻|

┳┻|

┻┳|

┻┳|

┳┻|

┳┻|

┻┳|

┳┻|

┻┳|

┳┻| _ artists have sold $2M worth

┻┳|•.•) of Catalog records 💽

┳┻|⊂ノ

┻┳|

Other marketplaces like Sound lets artists sell NFTs in collections instead. Sound also lets artists curate a personal listening experience with their fans called “listening parties”.

Fans who purchase the NFTs are able to have little benefits like an audience spotlight and commenting privileges during these virtual parties.

NFT-skeptics will likely dismiss this as trivial, but its design is aligned with the whole ethos of music NFTs, which is to allow artists to monetize their trade through a small community of dedicated fans, rather than having to cater to as many casual fans as possible.

Other aspects of interest:

- As these platforms are still in its early beta stages, artists typically to undergo KYC verification before being onboarded. So the 1/1 NFT to my rendition of my favourite Backstreet Boys song in the shower is probably not going to get listed (yet).

- Similar to image NFTs, the actual media file is stored on IPFS due to the cost-prohibitive reasons to store on the blockchain, making it more centralized at present.

Royalties marketplaces

Blockchains also allow artists to tokenize the royalty rights of their songs and sell them to fans. Royal is one marketplace doing just that. Fans who purchase the NFTs of an artist’s song in effect entitles them to future cash flows (think of it as stock dividends).

Depending on the legal contractual arrangements of the artist and their record label, the better the song sells, the more royalties will be generated that will accrue to owners of these royalty NFTs.

If owners don’t wish to receive a passive dividend, they can sell it on OpenSea. To date, data from a Dune dashboard shows that a small submarket has emerged from Royal, with total sales volume of all Royal NFTs amounting to US$1.1 million.

To take one example, legendary rapper Nas tokenized 50% of the royalty rights to his song Rare into 1,100 tokens. These tokens are also broken down into different tiers that comes with additional benefits.

Just from one song, he raised US$369,000.

A world of possibilities

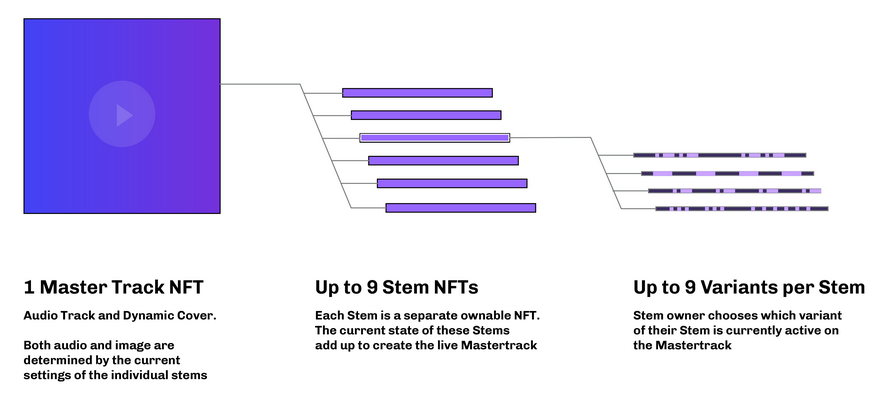

That’s not all in the music NFT department. Another protocol Async, has gone a step further and allows artists to split up their digital media and tokenize individual layers of their music (Async can be used for more than just music).

Here’s how it works — An artist mints an NFT out of his music: This is the master track. The music can be split into five different layers (called stems).

Each stem is an NFT in itself that can be owned by a different holder. Within each stem is another different set of variants. The owner of each stem can tweak to any variant as they like. The result is a piece of music that has a living, changing composition.

If all that is too confusing for you, I recommend listening to this particular Mozart classic for yourself, which will sound slightly different from what you’ll probably recall because of how the stem owners have tweaked it.

I can already hear the criticisms. But why would anyone want to split up their favorite songs? Especially an age-old classic?

Putting aside the fact that most of our favorite songs today are probably sampled from songs decades ago we’ve never heard before, the amazing thing about Async is in how it opens up a new world of engagement between artist and fans.

Instead of the artist remixing it for us, the fans themselves can own parts of the song and remix it now.

Why care about music NFTs?

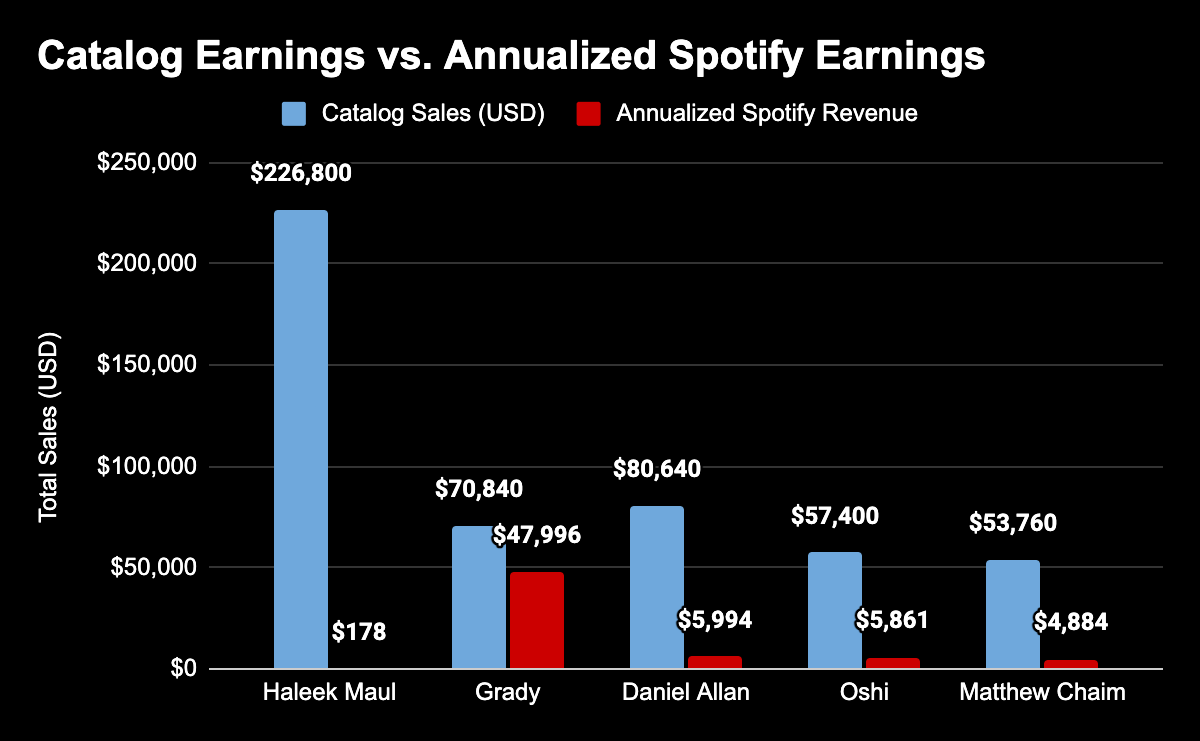

Innovators in this space are addressing a key problem in the current music streaming industry, which effectively pays far too little to artists ($0.003 per stream).

Music NFTs are creating a monetization model that shifts the power away from big record labels and streaming platforms. It enables artists to directly engage their most dedicated fans and monetize their work.

One estimate shows that even indie artists on Catalog make more than 200 times more than they do from revenue on Spotify.

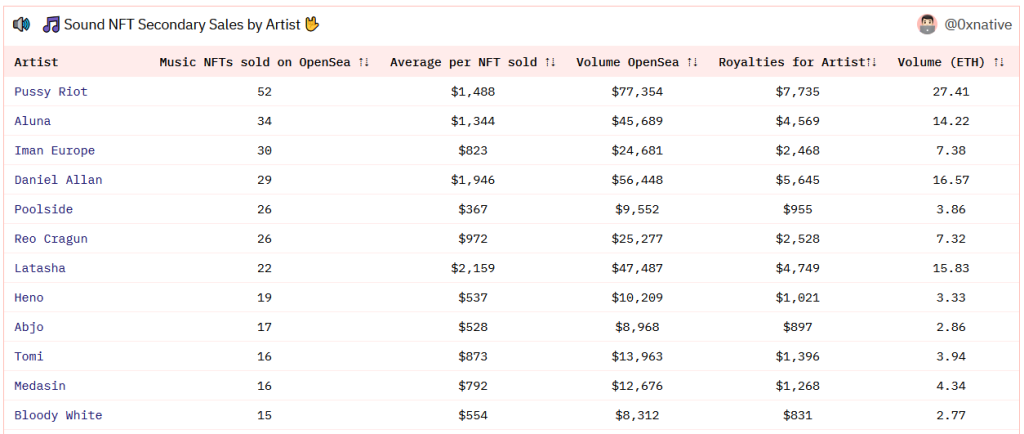

Based on Dune analytics data, the top Sound artists have made up to US$7,700 from royalties from secondary sales alone.

Platforms allow artists to receive the full proceeds from the original sale and a % of resales on the secondary market, empowering them to make a better living through music, taking another step towards the Web3 “ownership era“.

Featured Image Credit: Chain Debrief

Also Read: Introduction To Genie: All You Need To Know About This NFT Marketplace Aggregator