If cryptocurrencies are to become the next big thing, we are looking at a total market cap of hundreds of trillions worth of US dollars as it is the current case for the global equity market cap. How would the top 10 coins in crypto look like?

There are thousands of crypto out there with plenty more springing out every day. Of course, many of them do not actually succeed and are pump and dump schemes capitalising on hype and misinformation.

With such a big dollar value potentially in future, which coins actually deserve or rather, do not deserve to be in the top 10 by market cap?

Today, I’ll be sharing on why I think these coins do not justify enough to command a top 10 spot in the crypto market.

These are purely my opinion and others may disagree, so take it with a pinch of salt and always do your own research.

Current state of the crypto market

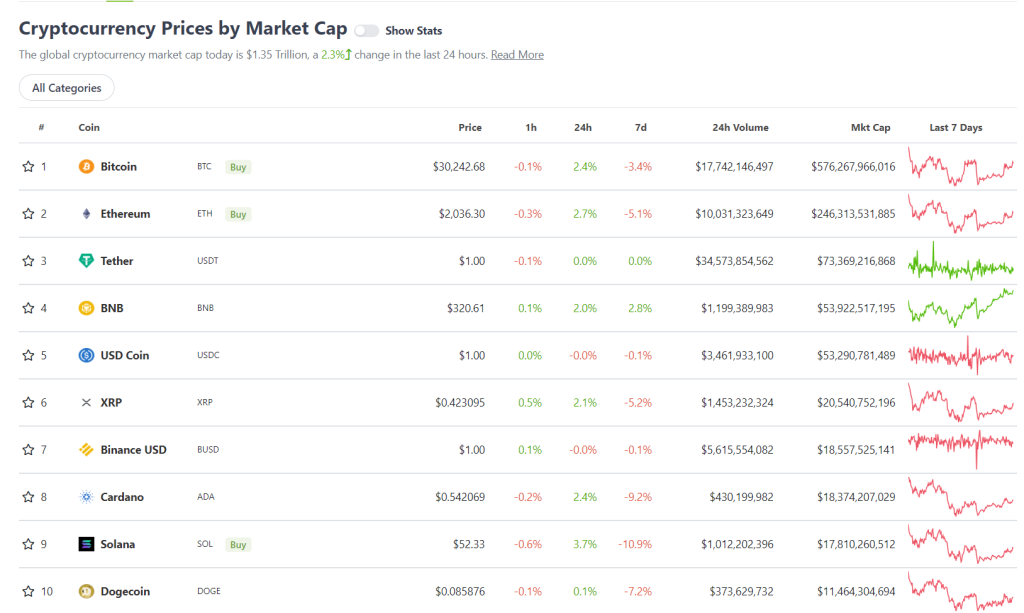

As things stand, the current crypto market cap is still standing strong above USD $1T. However, just a mere 7 months ago, the market cap surpassed USD $3T with leaders Bitcoin and Ethereum hitting new all time highs (ATH).

Things have not been the same as the markets have been on a steady decline since. The crypto total market cap is down almost 60% from its all time high. This has caused many to believe we are currently in a bear market and I mirror the same outlook.

It is also a shame to hear people who got “burnt” in the crypto market started to lose faith in the space, in fact these are the coins which may have burnt you very badly. Over two months ago, I wrote about how interest rates can affect the financial markets; more specifically, the crypto market.

Also Read: Interest Rate Hikes: Here’s How Interest Rates Affect The Crypto Market

It is crucial to know what affects the financial markets to determine the next move in the crypto market as risk-on assets move in tandem. What hit the equities market will most likely affect the crypto market in the same way but of a bigger magnitude due to the smaller market cap by nature.

With that said, many eyes will be on the top 10 crypto coins and how they will survive the drop to come. So, do the current coins deserve their spot? In my humble opinion, these three do not.

1) Dogecoin

The first of three is DOGE. A fan’s favourite and clearly well supported by the richest guy in the world, Elon Musk, DOGE has no shortage of haters and suitors alike.

But what sets DOGE apart from other coins? To me, nothing.

DOGE is highly speculative and purely driven by hype with no real use cases. It started gaining attention when it was doing a few Xs in a short amount of time with the help of celebrity influencers (Elon Musk, Mark Cuban) mentioning it.

However, it has been down almost 90% from its ATH. Those who bought DOGE in the past 12 months would have seen the value of their holdings decreased significantly. And they are most likely wondering why did they choose to buy in.

One reason why was because these “investors” believe it was a good quick cash grab opportunity. In 2021, many were fooled into the crypto market believing they could profit from it easily and as though it was a guaranteed. Those that were early did manage to profit from it if they sold. Unfortunately, for most, they are still holding

Also Read: Elon Musk Now Owns Twitter: What Does This Mean For Crypto Twitter And Dogecoin?

2) Cardano

Next on my list is ADA. There was a brief period where I actually believed in ADA and that was before smart contracts were implemented. “If ADA is this strong before smart contracts go live, imagine how much potential it has when it goes live” were my exact thoughts. Sadly, it did not go as well as we all expected it to be.

After the first DEX, SundaeSwap, went live on Cardano, many users complained of failed and lagging transactions among many other issues.

In my opinion, smart contracts on Cardano was way overhyped and the dApps developers did not properly stress tests their products before releasing it which lead tor a huge disappointment.

There are not many active developers on the Cardano chain and its TVL sits at USD $137M today, 58% away from its ATH.

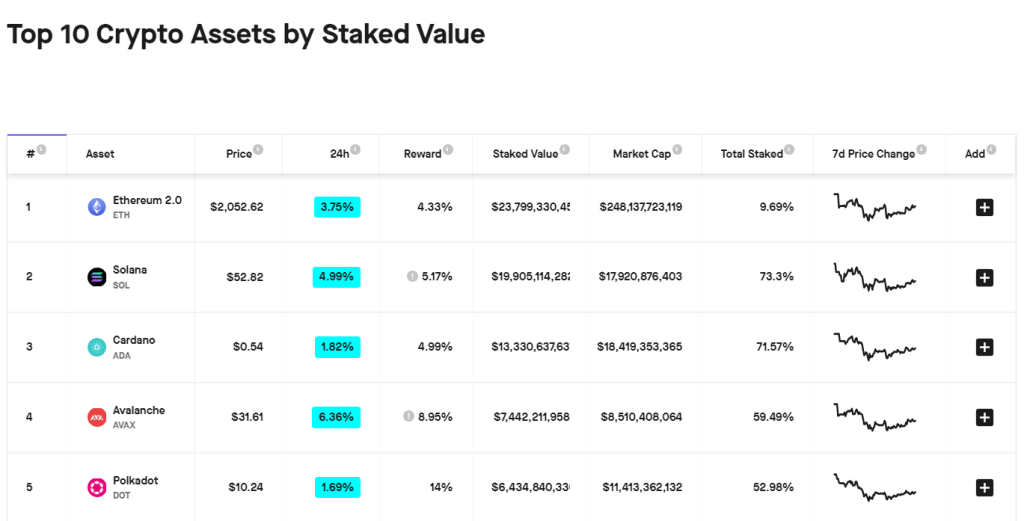

This proves that there really isn’t much activities happening on Cardano, and the reduced selling pressure (as compared to the rest of the market) is purely because ADA is ranked 3rd in terms of total supply staked.

3) Ripple

It has been 1.5 years since the SEC stunned the crypto industry by suing Ripple, kicking off what has become the most closely watched legal battle in this space.

Ripple claimed that XRP is a utility token for payments, not a speculative asset. The only time when XRP was sold is when it is required to provide “on-demand liquidity” for customers.

However, SEC argued that Ripple “took people’s fiat currency, handed people something called XRP and said the value of your XRP will go up or down depending on whether we’re successful at building out the use case for XRP”. This is equivalent to a security unlike what Ripple said XRP is.

If Ripple loses, most crypto that are available to trade on US exchanges would be deemed securities, which means exchanges would have to register with the SEC as broker dealers. That’s additional cost and friction incurred.

If XRP wins the case, it would prove pivotal for the entire crypto market and be a step in the right direction.

With the current uncertainty surrounding XRP, I believe there are better projects out there that have proved themselves worthy of Top 10.

Closing thoughts

Personally, I feel there are more deserving coins that should belong in the Top 10 crypto list with real world use cases.

Prominent Layer-1 (Avalanche) and perhaps the leading Metaverse (Decentraland) and Privacy (Monero) token because they have a strong potential use case. Sadly, I don’t think any privacy token will enter top 10 because in the near future as it’s just not as appreciated and in demand as other coins.

These are my own thoughts and in no way financial advice. Please do your own research before you decide to buy/sell any asset.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief

Also Read: Profiting During A Crypto Crash; A Beginner’s Guide To Short Bitcoin On FTX Pro (Mobile)