The decentralized finance (DeFi) market has continued to gain momentum and is growing at a fast pace. At the end of August 2021, the total value locked (TVL) in various DeFi protocols across all blockchain networks reached an all-time high of over $165 million.

It is clear that the expansion of various applications and protocols would continue growing at a fast rate, given that there is still a vast number of sectors and functions of the traditional financial markets that can be enriched on the blockchain.

One of the critical components of a fully functioning financial marketplace, as can be seen in the traditional financial sector, is the insurance industry. The function of risk mitigation has always been a bedrock for financial services, and especially so for the DeFi industry, where the culmination of new financial and technological risks brings about a greater need to manage risks.

According to data from Defi Llama, the TVL in insurance DeFi protocols amounted to $1.5 billion, which covers just 0.8% of all total value locked (TVL) in DeFi.

The nascency of the DeFi space and the frequency of hacking incidents due to smart contract bugs and vulnerabilities will necessitate a robust insurance infrastructure for the decentralized world.

Given the currently low insurance coverage rate in DeFi, there is a tremendous opportunity for projects to innovate. One of the leaders in the decentralized insurance space is Nexus Mutual.

Nexus Mutual: leading the decentralized insurance race

Nexus Mutual is a blockchain project that is focused on providing a decentralized alternative to insurance that utilizes a co-insurance model. As a mutual, it is driven primarily by the decentralized community.

It leverages on the Ethereum blockchain to share risks in a distributed manner without the need for centralized intermediaries.

This new paradigm shift is disrupting the traditional insurance model by reimagining and realigning stakeholder incentives to continually assess risk effectively whilst achieving financial collectivization.

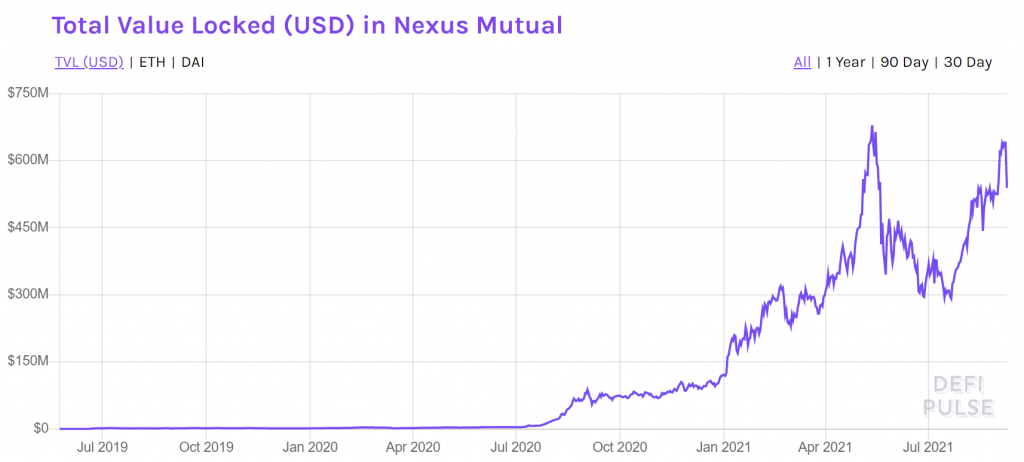

Nexus Mutual insurance sales gone parabolic. Even if this armor-farm boost is not sustainable, this was already the fastest growing insurance company in the world when it went from $1M in cover to $100M in cover in a year. Now it has gone from $100M to $650m in 2 weeks! pic.twitter.com/qBGT1tOB4h

— ⒿⒹⒽ (@jdh) February 3, 2021

Although Nexus is registered as a non-profit in the United Kingdom, it employs a decentralized autonomous organization (DAO) structure and is governed and owned by its members.

Participants that join Nexus will automatically become members and will be granted the ability to acquire protection of covers against the wide variety of risks in the DeFi space.

Nexus is the pioneer of decentralized insurance, and therefore it is no surprise that it holds one of the largest TVL in DeFi of close to half a billion dollars.

How does Nexus Mutual work?

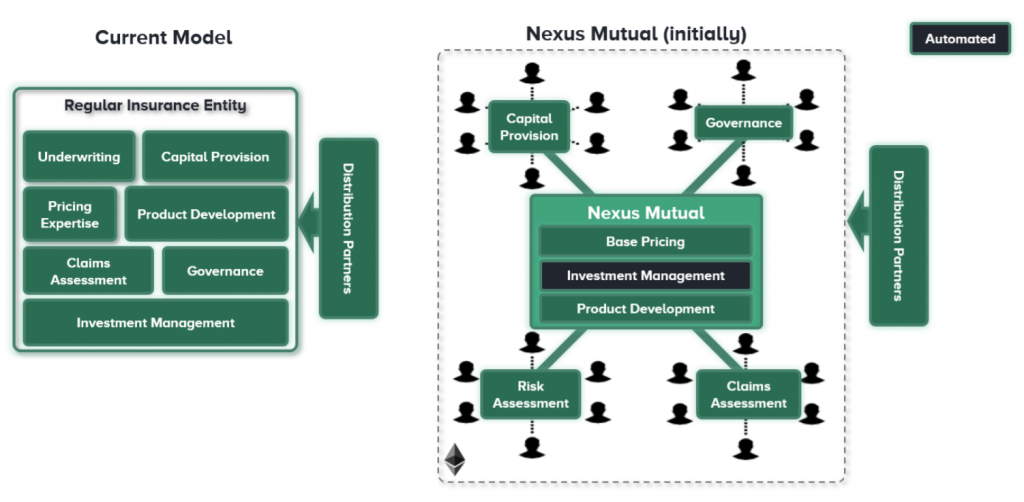

The traditional insurance industry is made up of large and complex incumbents with highly ingrained business models driven by profit maximization, premiums and reinvestment.

Nexus undercuts the conventional insurance structure by democratizing key functions that include governance, capital provision, risk assessment and claims assessment.

Nexus’ native token, NXM, is the medium for Nexus Mutual’s ecosystem that allows anyone to be a member and enables their contribution across a wide range of functions including purchasing covers, governing the protocol, providing capital and assist in assessing claims.

NXM can only be purchased directly from Nexus’ application, and only individuals that have passed the Know-Your-Customer (KYC) process can hold NMX. Once onboarding is successful, the individual would be a legal member of a mutual under UK’s law.

Nexus Mutual’s products

Nexus’ flagship product is the Smart Contract Cover, which provides insurance coverage for smart contract-related vulnerabilities such as bugs and hacks.

Smart contract risks are a huge concern since they are the backbone of the DeFi infrastructure. All DeFi protocols are developed using smart contracts, and the vulnerabilities surrounding smart contracts is perhaps the most important risks for decentralized applications (dApps).

The fact that smart contracts are developed using new programming language, such as Solidity, makes it even more imperative to establish a feasible risk management solution to protect billions of dollars of funds locked in these smart contracts.

Nexus democratizes the risk assesment process and leverages on a pooled claim staking process to protect members from financial loss. The Nexus DAO pools and manages members’ funds into a risk-sharing pool that represents the source of funds for future claims.

Members are encouraged to analyze and accept coverage proposals, and are incentivized to provide capital into the various coverage pools on Nexus.

Nexus also offers Custody Covers, which represents insurance coverage for centralized exchanges. This coverage mitigates the risk of user funds on centralized exchanges getting hacked or compromised, as well as when withdrawals is halted.

Steps to buy covers on Nexus Mutual

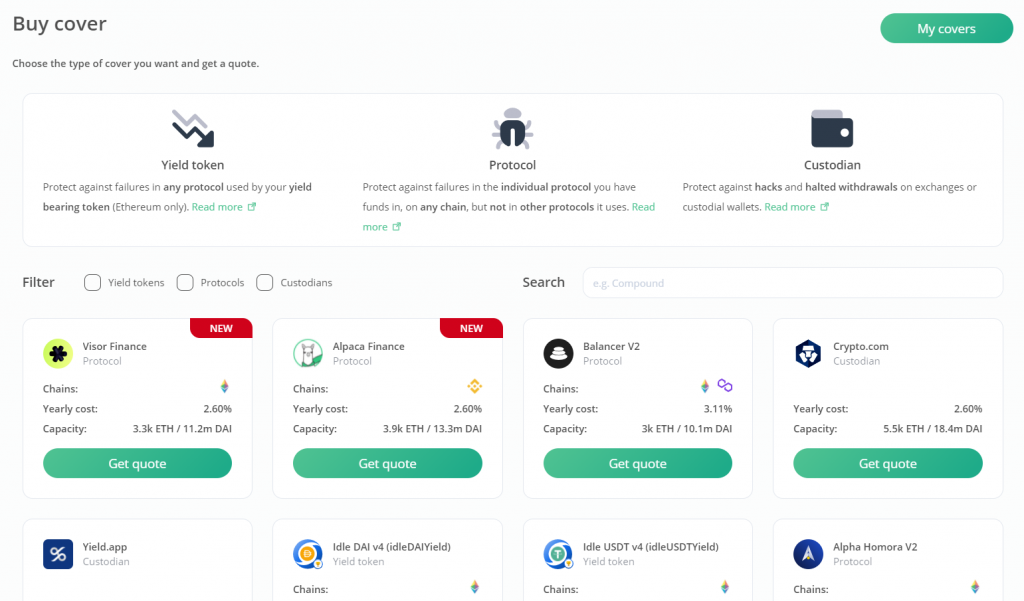

Nexus allows members to purchase insurance covers to protect themselves against protocol risks. Members can simply head to their application and access the range of covers that are available on Nexus.

Here are the steps involved to buy covers on Nexus:

- Head to the application page and browse through thte range of protocols that are covered and listed on Nexus

- Select the protocol that you want coverage for

- Specify the amount you want covered, the time duration of the coverage and the payment currency (which is either ETH or NXM)

- Generate a quotation based on your inputs

- Purchase the coverage by authorizing your digital wallet and pay with ETH or NXM

- Finish the process by paying an initial fee for being a new member and undergo the KYC process

Nexus will cover any token or combination of tokens that you will have in the selected protocol, and you will receive the equivalent of lost funds, if materialized, up to the covered amount finalized.

Featured Image Credit: The Block Crypto

Also Read: A New Class Of Loans: How Self-Paying Loans On The Blockchain is Redefining Finance