With more and more projects running on decentralized finance, decentralized oracle cryptocurrency like Chainlink plays an ever more important role in ensuring on chain data authencity.

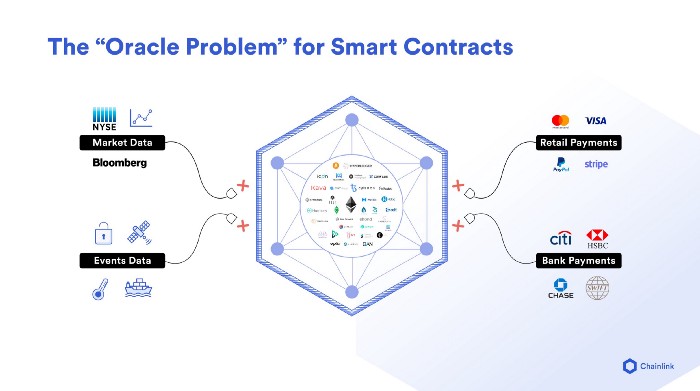

For readers who may not understand what oracles are, they basically act as intermediaries which collect and feed real world data or off chain data from third party APIs or data sources onchain onto the different blockchains.

In another term, Oracles are nodes on the blockchain network that acts as a bridge between onchain and offchain data, by enabling smart contracts to retrieve data from the outside world.

Currently, the use cases for oracles are mostly confined towards price feeds as the majority of smart contracts are currently used for tokenization. Hence most of the oracles with high usage and adoption are price feeds related oracles such as Chainlink.

As oracles are a specific type of cryptocurrency, it may be difficult to properly value it.

Here are some on chain metrics you can use to value Chainlink, one of the most used cryptocurrency oracle.

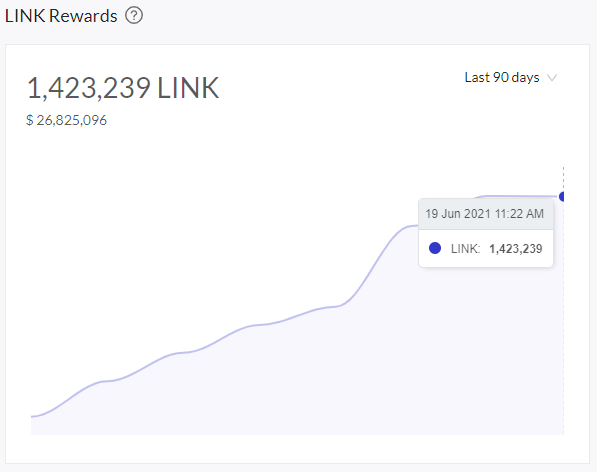

1. Number of Chainlink being rewarded

Chainlink uses a Proof of Stake (PoS) mechanism, where validator nodes stake LINK, the native token of Chainlink to obtain data contracts and be rewarded by the network.

The number of LINK rewards shows us how much these validator node operates are being compensated. You can track this metric on the Chainlink analytics website.

One interesting observation from the LINK rewards being distributed is that even though we have seen price volatility in the market since April until now, the amount of LINK being distributed still grows consistently. LINK’s network growth is not impacted by any market sentiments.

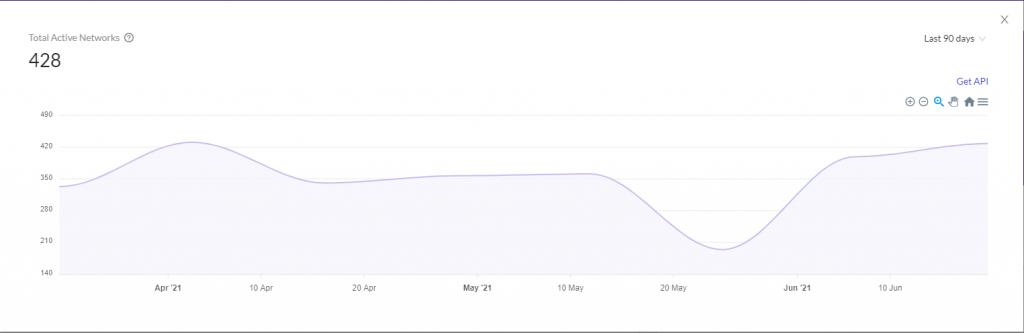

2. Total Active Networks

Total Active Networks shows us the “daily sum of feed networks having activity in the selected time period”. This is a good indicator of how many parties or applications are actively using LINK.

Similarly, the active networks using LINK over the past 3 months has been consistent despite volatile market condition.

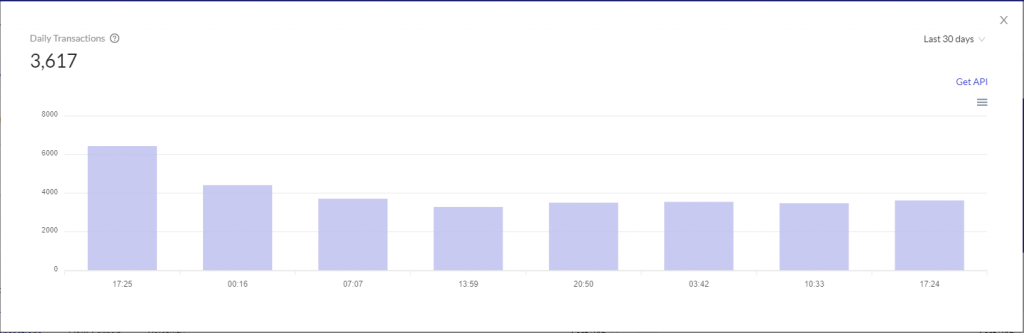

3. Daily Transactions

The third metric we can use to track the growth of LINK is the daily transactions. This metric shows us the total amount of individual oracle transactions (feed updates x participating nodes) per day across the Chainlink network.

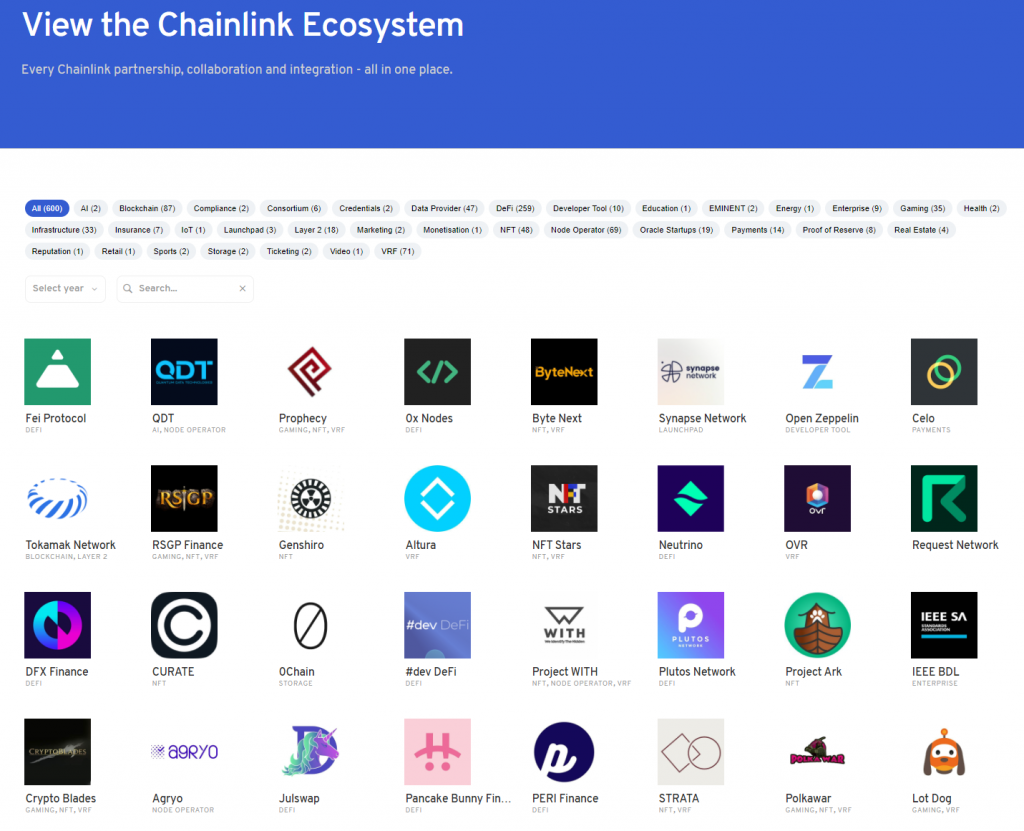

4. Number of integrations

Another key metric to track the performance and growth of Chainlink is to track the number of partners and integration that is enabled on Chainlink. More partners means higher user on the network, which is important in helping to grow the network effect of Chainlink. You can track integrations here.

Some of Chainlink’s key partners and integrations include:

| Blockchain | Polygon, OKExChain, Skale, xDAI, Tezos, Fantom, Cosmos, Solana, Polkadot, Zilliqa, Harmony, Ocean Protocol, Ethereum and more. |

| Consortium | BSN China, SWIFT, IC3 and more. |

| DeFi | Pancake Bunny, Polywhale, Venus Protocol, Pancakeswap, Sushiswap, Terra, Konomi, ICHI, Yield, Perpetual Protocol, CREAM Finance, Curve, Aavegotchi, Zapper, Binance Smart Chain, Dodo, Nexo, Kyberswap, Bancor, Celcius, 1Inch, Loopring, Aave and more |

| Enterprise | Google, Intel, Oracle and more |

| Infrastructure | Near Protocol, Baseline Protocol, Loopring, Offchain Labs, Linkpool, Celer Network and more |

| L2 | Arbitrum, Starkware, Polygon, RSK, xDai, Celer Network and more |

Chainlink works as a decentralized Oracle powering the on chain data authencity for these partners. As long as demand and usage on these partners grow, the LINK feed usage will also grow along with the whole blockchain ecosystem.

It is interesting to note that enterprises like Google, Intel and SWIFT is already integrated with Chainlink and we expect to see more enterprises providing data or setting up oracles on Chainlink over the next few years as adoption grows.

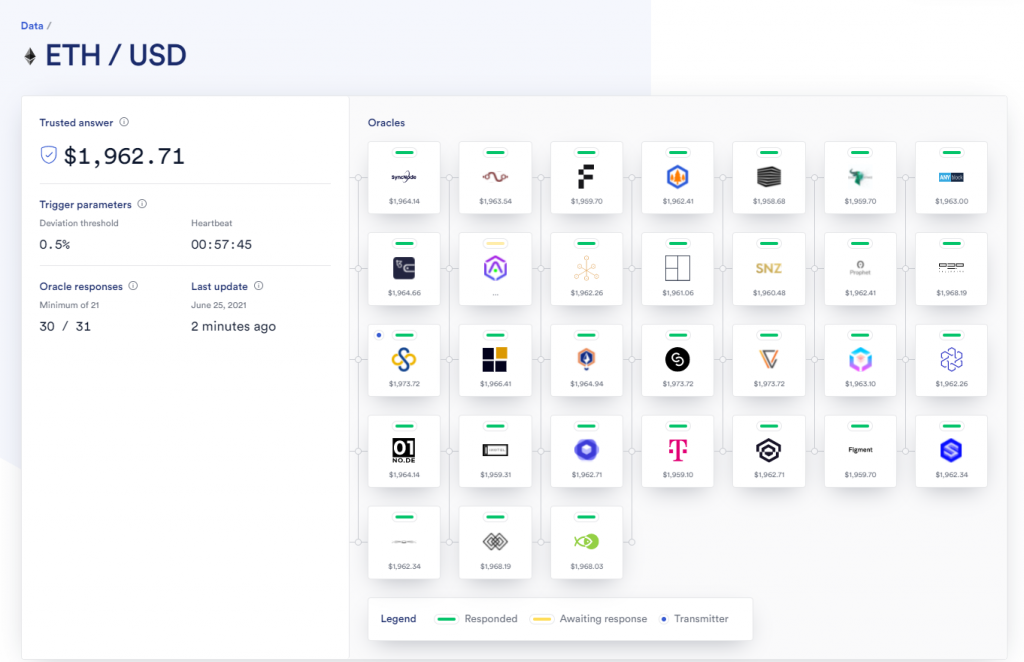

5) Number of price feeds

Another metric that can track the health and growth of Chainlink is the number of active price feeds on Chainlink. The number of oracles providing price feed data is important to track. You can track the various price feeds here at data.chain.link

Looking at the different metrics mentioned above, one can see that the network growth of Chainlink is continuing despite the volatile market.

LINK rewards are growing at a healthy clip and as more users join the cryptocurrency industry and explore the usage of different blockchains, Chainlink will also see continued usage growth.

Also Read: An Introduction To Blockchain Oracles And Chainlink