As the crypto space continues to grow, the demand for sophisticated trading products was also on the rise. Options trading is a popular product in the cryptocurrency markets.

Options, like futures, are derivatives which track the price of an underlying asset.

An options contract offers the buyer the opportunity to buy or sell depending on the type of contract they hold. Unlike futures, the holder is not required to buy or sell the asset if they decide against it. Each contract will have a specific expiration date by which the holder must exercise their option.

The stated price on an option is known as the strike price.

Call options

Call options are financial contracts that give the option buyer the right but not the obligation to buy the underlying asset at a specified price within a specific time period. Specifically, when the investor predicts the

A call buyer profits when the underlying asset increases in price. A call option

How a call option works

A call option becomes more valuable as the price of the underlying asset increases. Conversely, a call option loses its value as the price of the underlying asset decreases.

Put options

Put options are financial contracts that give the option buyer the right but not the obligation to sell the underlying asset at a specified price within a specific time period.

A put buyer profits when the underlying asset decreases in price.

How a put option works

A put option becomes more valuable as the price of the underlying asset decreases. Conversely, a put option loses its value as the price of the underlying asset increases.

Crypto vs Stock options

The premiums in crypto options can be costly due to the implied volatility in pricing options. Volatility is a double-edged sword. The higher the volatility, the higher the potential profit. However, this also increases the loss potential.

Options vs Futures

The major difference between options trading and futures trading is that the former are optional while the latter are obligatory.

For example, when you purchase a BTC options contract, you pay a premium to be able to buy or sell BTC at a certain price on a certain date. If the price on that date is not favourable for you, you can choose not to take any actions and the option will simply expire.

In the case of a futures contract, you will have to complete the transaction and buy or sell the underlying asset at the settlement date.

Options trading is also relatively low risk as compared to futures trading since the maximum risk for an options contract buyer is the premium that they pay. Whereas the risk in a futures contract has no limit.

Reason to use options

Speculation

Speculation is a wager on future price direction. A speculator might think that the price of a crypto will go up and buy a call option. Speculating with a call option instead of buying the crypto outright is attractive to some traders as options provide the ability to leverage on their funds.

Hedging

Hedging is protect oneself against loss on (a bet or investment) by making balancing or compensating transactions.

Hedging with options is meant to reduce risk at a reasonable cost. By using put options, you could limit your downside risk and enjoy all the upside in a cost-effective way. For short sellers, call options can be used to limit losses if the underlying price moves against their trade especially during a short squeeze.

Options trading in crypto markets

Derbit and Delta exchange are the two leading crypto options exchanges. They both offer a wide range of trading products in the derivatives segment attracting both institutional and retail investors.

The most popular option pairs are BTC and ETH.

Step by step guide to trading Simple Options on OKX

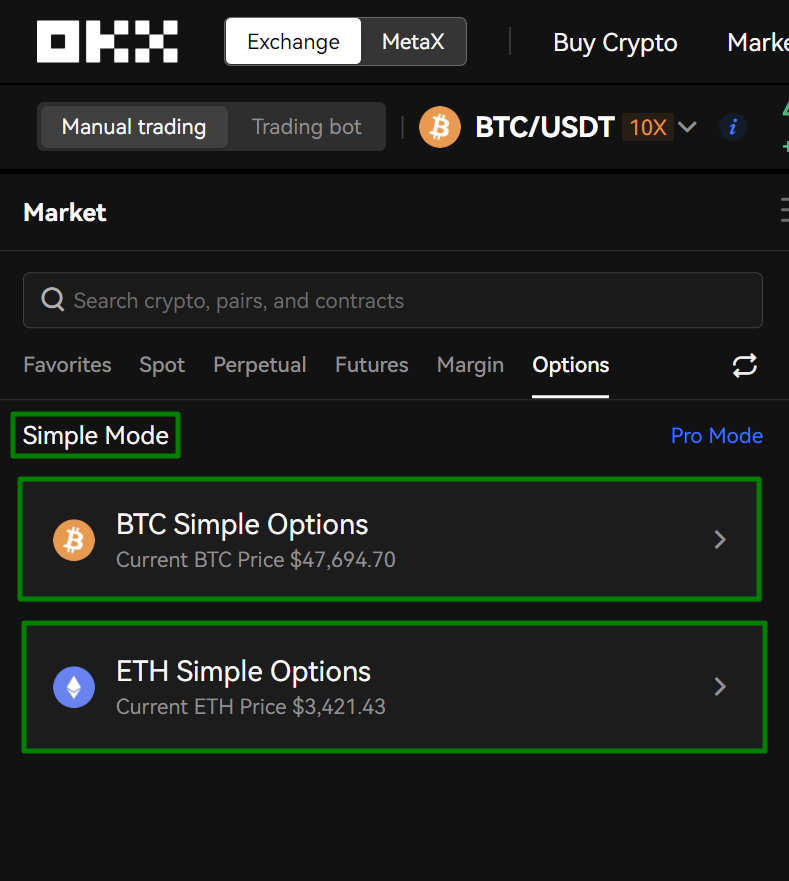

Step 1: Choose BTC or ETH Simple Options

When accessing the Options section, simple mode should be selected by default. If not, click Simple Mode.

Next, click choose either BTC Simple Options or ETH Simple Options.

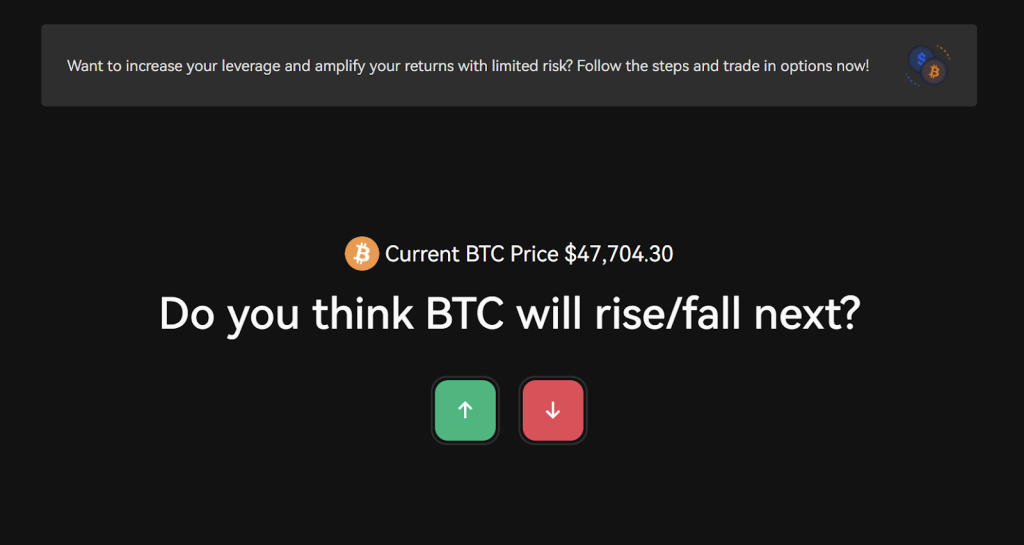

Step 2: Choose a direction

Next, select the direction in which you believe your chosen asset will move by clicking the up or down arrow. If you choose up, you’ll be buying a call, and if you choose down, you’ll be buying a put option.

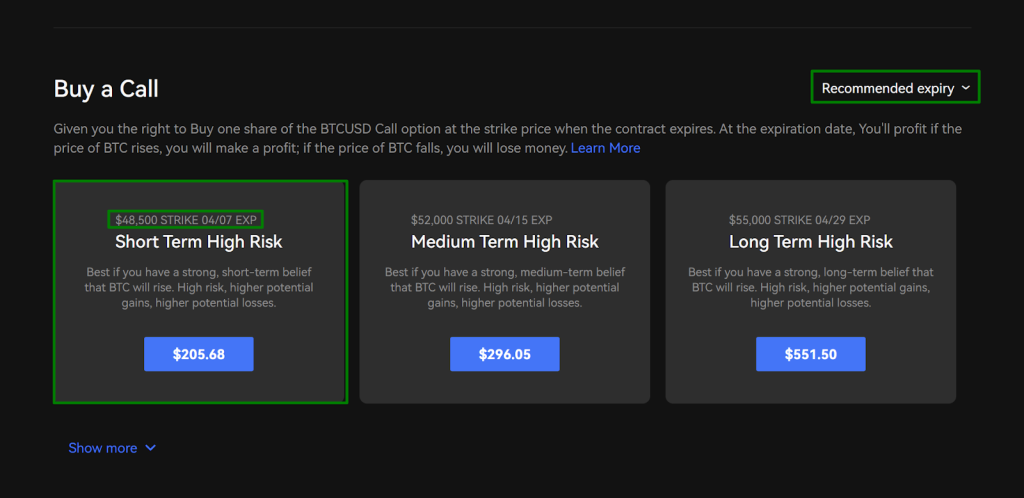

Step 3: Choose an Options contract

On each contract, you’ll see the price at which you agree to buy or sell the underlying asset — or strike price — and the date on which the contract will expire.

For example, BTC’s price is at $47,548, and the first recommended call option will expire in just over 48 hours, giving its holder the right to buy BTC at $49,000. The suggested price indicates that entering into that contract will cost around $174.

Suppose you bought 10 contracts enabling you to buy 1 BTC at expiry, and the market price of BTC increased to $53,000. Exercising it would enable you to buy 1 BTC cheaper than the current market rate. If you were to sell the BTC bought immediately, you would profit around $3,826 (minus platform fees) — the difference between the price at expiry and the strike price added to the premium.

If at expiry, the price had fallen to $47,000, the contract would expire worthless because it makes no sense to exercise your option to buy BTC for $49,000 when the spot price is lower. Since you do not have an obligation to buy, your loss is limited to the option premium.

Option Premium is the money you need to spend to “buy” the contract and not the token itself.

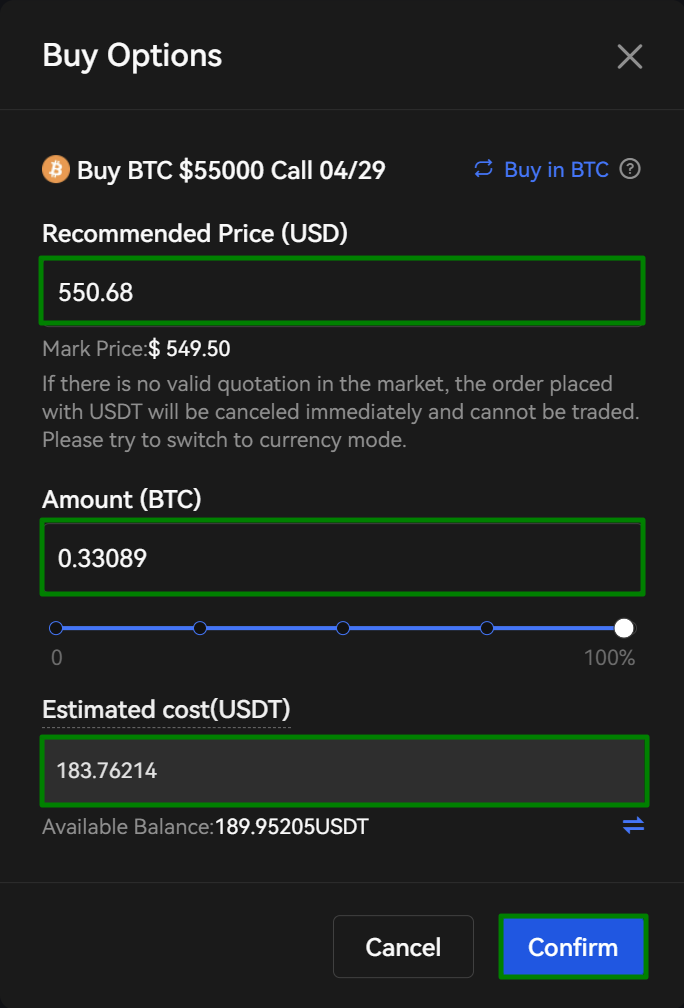

Step 4: Buying the contract

On the following pop-up, select whether to buy your option in the underlying asset or USDT. The “Recommended Price” field refers contract’s price assuming you are attempting to buy a full unit of the asset — i.e., 1 BTC or 1 ETH.

The “Amount” field is where you enter the amount of the asset you actually want the option to buy at the expiry.

The “Estimated cost” field will fill automatically based on the price, and the amount entered.

When you’ve entered your order details, click Confirm to submit.

Closing thoughts

Crypto options trading can be risky on top of an already volatile crypto market.

If you have never done any form of trading before, it is best to educate yourself first before risking your hard earnt money in leverage trading.

Options can be a great way to profit in any market conditions or be used as a hedge. However, not many actually comes out profitable so do not jump in thinking the odds are in your favour because they are not.

The introduction of financial tools from traditional finance systems into the crypto space may come as a double edge sword. We will see a larger inflow of capital into the space, essential for adoption and potentially opening the doors for larger investments from firms.

However, as the crypto space continues to mature, retail investors would see these institutions/whales as a thread as they have great “influence” in the price action with their large funds.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief

Read More: Decentralized Options Exchange: All You Need To Know About DopeX, All You Need To Know About DeFi Options Vaults (DOVs) And How To Get Started