We all know how strong a single Binance announcement is, but when coupled with strong fundamentals, threaddooors shills and a really nice ring to its name, it almost brought me back to the bull market days in 2021.

The announcement of Pendle’s listing on Binance’s innovation zone brought all bears to their knees and made every bull on the edge of euphoria. The massive green candle alone was enough to bring more eyeballs, liquidity, fomo and bring the act of aping, back to life.

I won’t bore you with how Pendle works (it is actually pretty interesting how they did it though) but if you’re curious you can find out more about how Pendle Finance Is Breaking DeFi By Unlocking Future Yield.

The Stats Don’t Lie

The price of Pendle skyrocketed by more than 50% and its market cap more than doubled from a sub $100M to upwards of $200M.

What contributed to an even stronger Pendle bull case, is the rollout of boosted yields, exciting new features in V2, and ecosystem development news fitting the liquid staking narrative.

Pendle was a clear buy, clear as day.

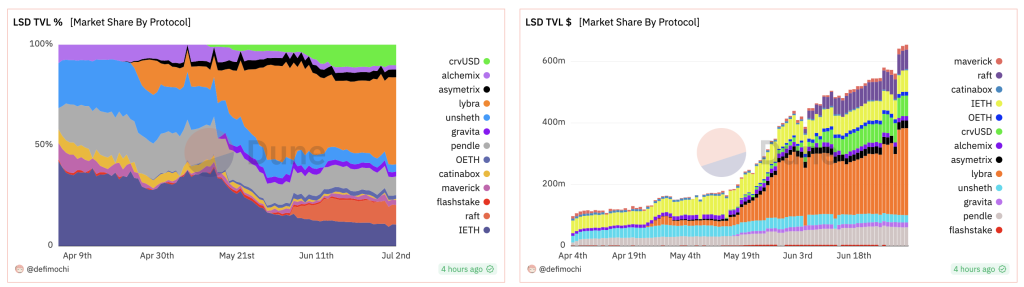

Interestingly enough, taking a look at the LSD TVL stats, the Binance news did not move the needle much for its LSD Total Value Locked (TVL). It seemed more like a game for traders, not so much so in terms of interest in the product itself.

A Wave of Sell Pressure

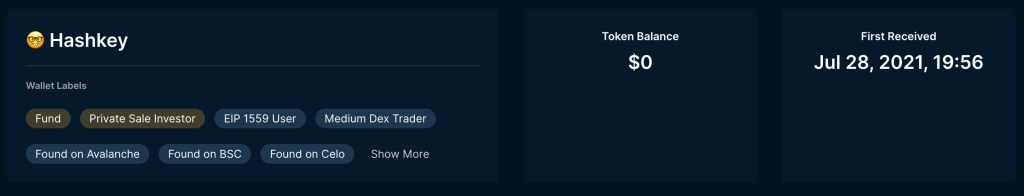

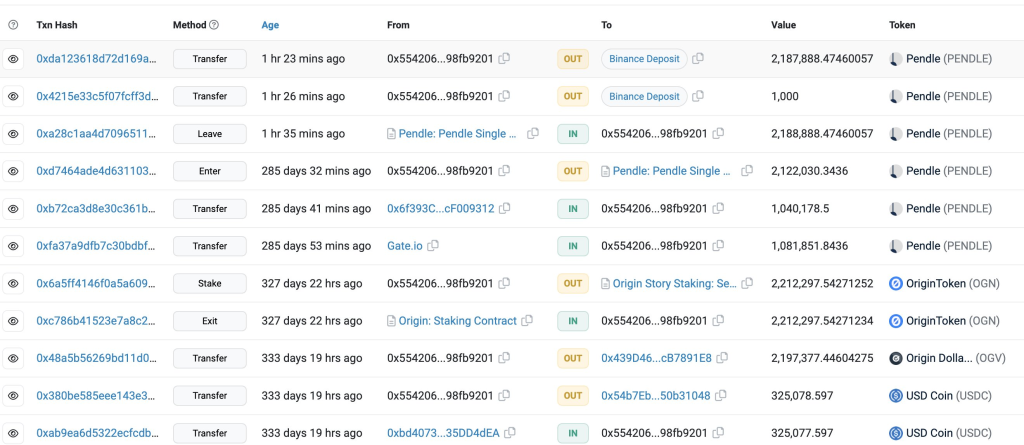

By looking on-chain, there were certain transactions which particularly stood out. Hashkey group sent 2.4M of Pendle tokens into Binance in the afternoon right after the Binance announcement.

When the movement of assets by large entities/whales moves their assets into an exchange, often signals an incoming selling off in tokens. I mean, Binance is really the only place you can sell assets in large quantities.

Some context, Hashkey has been a long-time investor of the Pendle and has vested tokens for about 2 years now.

Furthermore, Lookonchain reports 3 whales depositing a total of 5.6M Pendle to Binance.

Notably, whale “0x5542″ deposited 2.19M Pendle amounting to $2.54M to Binance with an average buying cost of ~$0.06 and whale”0xa9E9” deposited 1M Pendle valued at $1.16M that was received from Vesting Distributor Wallet to Binance.

This selling pressure was immense and could be the reason why Pendle’s price dropped from its highs of $1.2 to approximately $0.8. As of the time of writing (7th July), the price of Pendle has cooled off and currently trades in the $0.9 region.

Here are some other large on-chain entities/whales holding Pendle dated back to April 19th, a little outdated, but could be useful information.

Some large on-chain entities holding $PENDLE 🐳

— Thor⚡️Hartvigsen (@ThorHartvigsen) April 19, 2023

• Jump Capital: 22.65m PENDLE

• Hashkey: 2.4m PENDLE

• Spartan Group: 1.4m PENDLE

• Arthur Hayes: 40k PENDLE (bought Apr 2021 at ~$1.4)

Both Hashkey and Spartan Group received PENDLE in 2021/2022 from a private round.

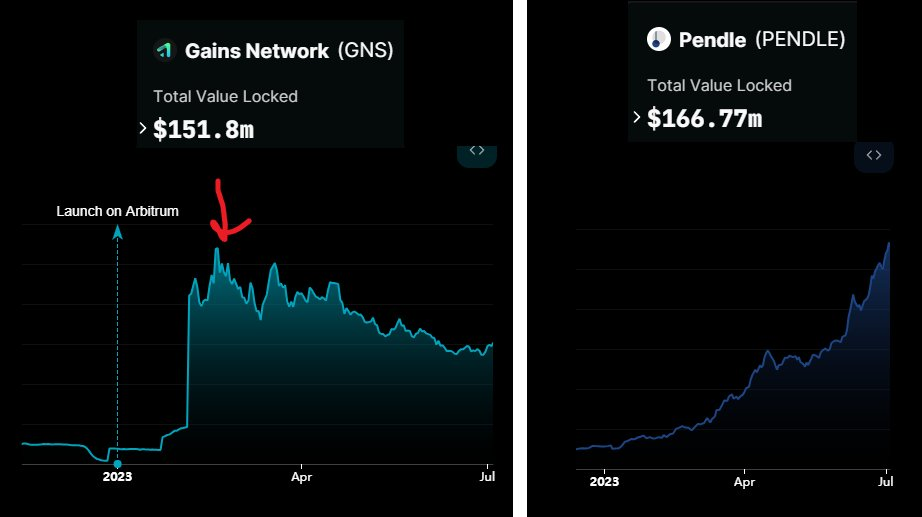

Another case of $GNS?

Pendle’s price action reminds me of Gains Network’s price action when it marked its local top after its listing of Binance. Its price never recovered since.

Pendle might do something similar, even with a good team, and a good product, but it is still an inflationary token with not many fees captured. Of course, farming Pendle is still lucrative and decent, this is just another way to look into things.

While the pricing chart looks similar, the TVL situation between GNS and Pendle amidst the listing announcement shows different stats.

Overcollateralized Jonny on Twitter talked about how GNS had its TVL topped during its Binance listing and went down ever since, which goes to say the impact of Binance listing should not be considered as a factor affecting its TVL.

Pendle on the other hand looks up only.

I still believe there’s still plenty of legroom for Pendle to grow, especially when it expands into other chains, we can expect a larger dominance, TVL and volumes. It would be interesting to see how this plays out.

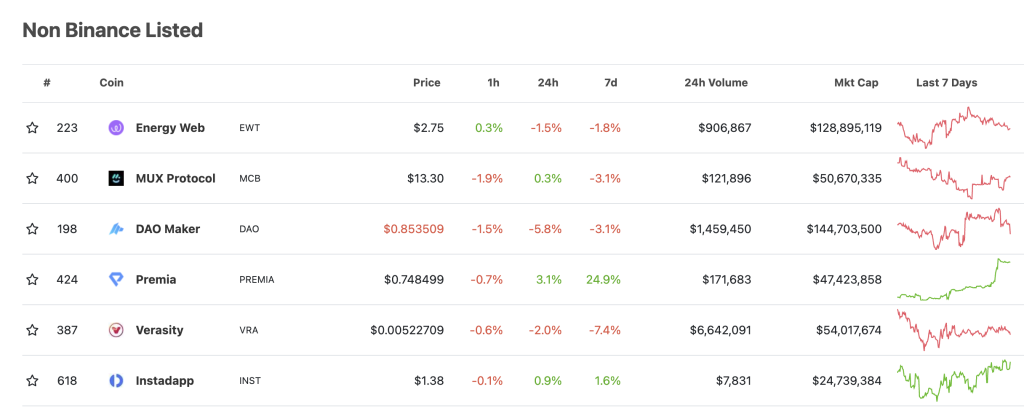

Playing the tokens “not listed on Binance narrative”

Now playing this narrative may seem at first sight, a quick way to earn that juicy 10, 20x, but in actual fact to be successful in this narrative will require time and understanding of the market along with a tinge of luck. That still, does not guarantee success but catching any wave could be worth it.

Not all tokens will demand great returns like GNS and Pendle, that is where intersecting narratives play a huge part, bascially relevancy. GNS pumping was attributed to Arbitrum’s growth and Pendle, the LSD hype.

I guess we would never know if huge entities have made an insider play ahead of the Binance listing, but taught me learning points which I can act on ahead of the next big announcement.

Cross-referencing non-Binance listed tokens and mapping them with big purchases from entities is something I look to do in the coming months. Alternatively you can track the biggest whales who bought Pendle before it’s run up and find out recent coins they bought.

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Also Read: Shorting Azuki? Here’s How nftperp Lets you short NFTs With Up To 5x Leverage

Featured Image Credit: Chain Debrief