To address the perspectives on risk management, five distinguished guests — Baily Reutzel, a Freelance Crypto Journalist and Moderator, – Chen Arad, Co-Founder and Chief Operating Officer at Solidus Labs, Jon Knipper, Senior Director of Crypto Treasury Management at Republic Crypto, Omer Goldberg, Chief Executive Officer at Chaos Labs and Matt Dobel, Business Development at Gauntlet Network were invited to speak at the Avalanche Summit.

Panelists’ personal stories

Majority of us have lost money in the crypto market, and this applies to the panelists as well.

Jon mentioned that he bought ETH at US$60 and sold it at US$30 which is horrifying, given today’s price. If he had held, it would have been more than 52x today!

On the other hand, there is Matt whom like some of us, have degen moments. He made known that he had been rugpulled and liquidated before.

This also proves that it’s not just the average Joe who gets it wrong, but also some of the big names in the industry.

What are the risks in crypto?

There are plenty of risks in crypto not just limited to the extreme volatility in price fluctuations. The other notable risks are:

1) Smart contract risk

2) Regulatory risk (government)

3) Theft

4) Rugpulls

1) Smart contract risks

Omer mentioned that audits alone are not sufficient. He was quoted saying “some big protocols have been audited 5 or 6 times and still got wrecked”.

The same tools are required in Web3 as in Web2 — continuous integration and continuous testing.

The developers need to be more responsible and it shouldn’t be the case where they have to hire outsiders to find bugs in their code.

2) Regulatory risks

The regulation of cryptocurrencies remains in an unsettled state.

While profits in cryptocurrency trading are not yet taxable in most countries, we know for certain that USA do tax on capital gains.

Just recently, Singapore’s Finance Minister, Mr Lawrence Wong, announced that the “prevailing income tax rules” will apply to income derived from NFT transactions.

Also Read: Taxes Imposed On NFTs: Is This The Downfall Of NFTs In Singapore?

3) Theft

Crypto theft has been on the rise and scammers are getting smarter in their phishing approaches.

A week ago, Arthur Cheong, founder of DeFiance Capital, said on Twitter that a hacker has stolen his NFTs. He mentioned that the hacker compromised his device using a technique known as spear phishing.

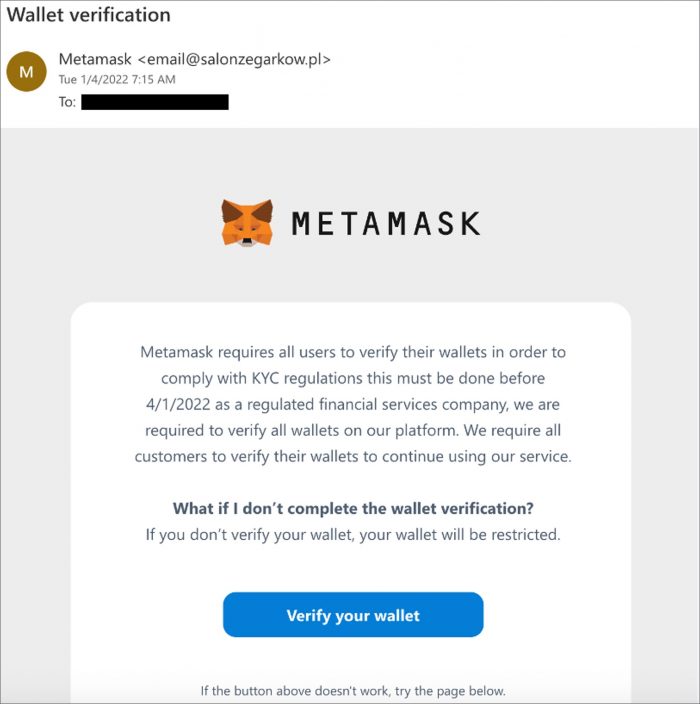

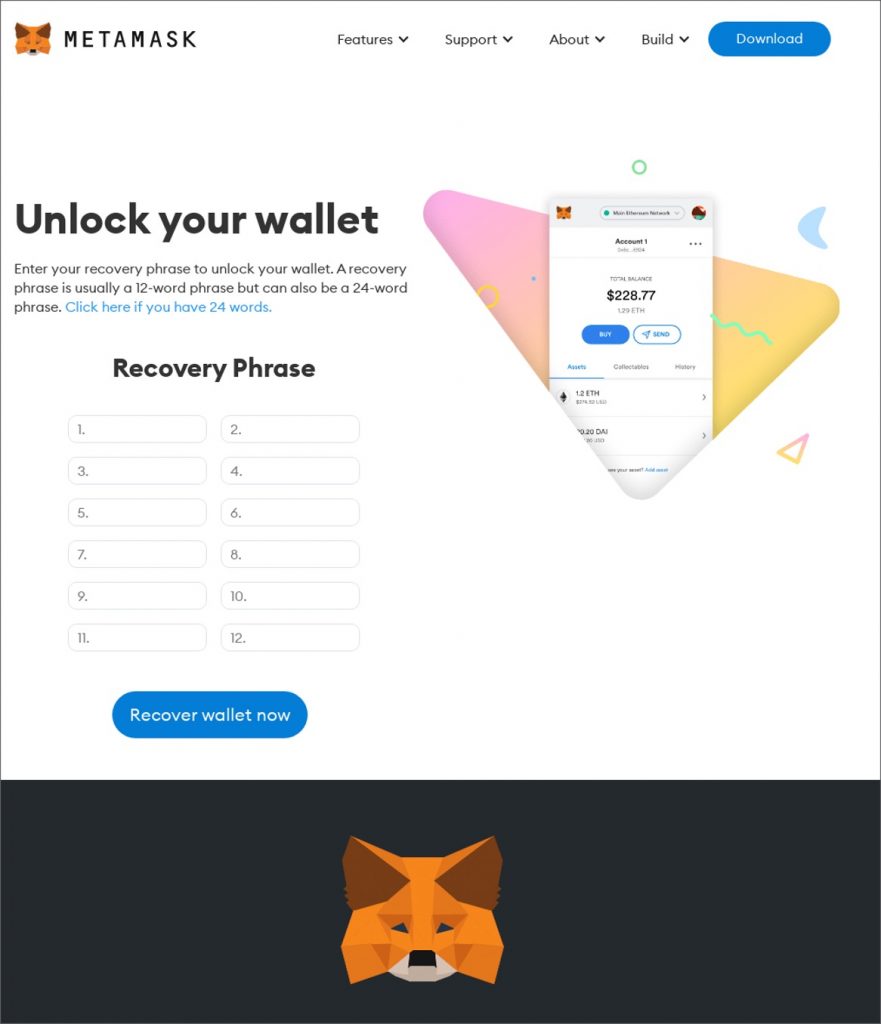

The most common theft these days are fake MetaMask security emails prompting you to verify your wallet.

After clicking on the embedded link in the email, you will be redirected to a fake MetaMask website which is almost identical to the real one.

Scammers will then ask you to provide your seed phrase for “verification” purposes and that is when all your crypto will be drained immediately after.

4) Rug pulls

This is the worst way to lose your money in crypto because there is definitely no way of getting back a single cent.

A rug pull happens when the developers of the token draws in buyers before stopping any trading activity and leave with the money raised.

One notable rug pull was the Squid Game token which is not affiliated in any way with the show on Netflix but capitalised on the global branding.

The price of SQUID token started trading for less than 1 cent. In less than a week, price jumped to a high of US$2,856 before plummeting to almost zero just five minutes later on 1 November 2021. At that point in time, that was when over 43,000 investors realised that they have been rug pulled.

Is it possible to be risk-free?

It is never possible to be entirely free of risks. Even in TradFi, there are risks. There is credit risk, liquidity risk, and currency risk to name a few. Likewise for crypto, there will be risks.

The panelists suggested that it is more of how to mitigate risks rather than to be risk-free which is impossible. No one likes to be a victim of scams and to lose money.

Hence, it is always important to do your own research before investing and to never buy into any investment products just because someone told you to.

Featured Image Credit: Thomson Reuters

Also Read: Is The User Experience In DeFi Bad? Opportunities, Challenges And How To See Growth In DeFi