Everyone has heard of leveraged trading, and how it has caused the downfall of many large scale institutions. Behind the rugs are skilled traders who silently make TONS of capital in the leveraged market?

This article aims to introduce a new type of derivative – the power perpetual.

Power perpetuals grow exponentially compared to their underlying asset, with the rate of growth denoted by their power. For example, if ETH grows by 100%,

- ETH^2 (ETH to the power of 2) increases by 400%

- ETH^3 (ETH to the power of 3) increases by 800%

- ETH^5 (ETH to the power of 5) increases by 3200%

However, those who invest in a power perpetual must pay a regular fee to those who sell it. Power perpetuals offer similar opportunities as options without expiration or predetermined prices, making them a potential consolidator of options market liquidity into one instrument.

Let’s take a dive into how you can use this in your trading strategy.

Also Read: Crypto Futures For Beginners; What Is Funding Rate And How To Profit From It

An Introduction To Power Perpetuals

Power Perpetuals are a novel financial derivative that offers a unique payout structure for traders. Imagine a regular perpetual future but raised to a power.

For example, Squared Solana (²) would be worth 10,000$ (if Solana is at 100$), square root Solana (¹/2) would be 10$, and so forth. This property is enforced by changing the typical perpetual futures funding rate to mark — index^power.

The main benefit of using power perpetuals is leverage. If you buy squared Solana (²) and its price increases by 2x, your investment increases by 4x.

The difference between leverage and power perpetuals is that with leverage, you risk getting liquidated, whereas with power perpetuals, you can’t. This is because power perpetuals with powers greater than one offer positive convexity, while power perpetuals with powers lesser than one offer negative convexity.

This is key for larger institutions to trade in size, or liquidity providers as a better option of trading.

However, using power perpetuals also comes with a cost, just like regular perpetuals, as there is funding involved. In the example given, squared perps traders who are long will be paying funding to those who are short.

01Exchange – One of the rare products offering power trading.

This exchange is a secure trustless and powerful crypto exchange that is backed by Multicoin Capital, Alameda Research (now gone) and Solana. However, trading is temporarily halted due to market conditions until further notice.

Out of an abundance of caution, we will be temporarily halting trading tomorrow at 12:00 pm EST due to current market conditions.

— 01.xyz (@01_exchange) November 11, 2022

Rest assured, all funds are safe and withdrawals are open

For more info and any question, please join our Discord (https://t.co/gib4YKzVFV)

One of the key selling points of their product is it allows you to hedge impermanent loss from LP pools. Power payout allows you to avoid IL while staking into market maker pools on the Solana network, which can be simplified through automated vaults.

How is it possible that you don’t get liquidated from Power Perpetuals?

Just to clear the air, not getting liquidated doesn’t mean that you cannot lose a hefty sum of money. One of the most significant things traders consider with power perpetuals are the funding rate. But why is that so?

As mentioned earlier, power perpetuals have an exponential greater than one displaying positive convexity, resulting in holders earning money more quickly when prices move in their favor and losing less money when prices move against them.

In traditional Finance, this would be categorized by a positive gamma.

But where’s the catch? Let’s paint a scenario with one Ethereum. Ethereum is currently trading at about 1300 USD.

For those unfamiliar, a long contract typically pays a funding rate of Funding = Mark – I(S) which is for perpetual futures. For this case, lets just assume the funding rate is 0.01, the standard rate for many centralized exchanges.

Now as ETH is a power perpetual, these means that it is now traded at 1300^2 = 1,690,000 USD. Assuming the position is just one ETH^2, that would mean that the funding rate for a long would be:

(0.01% x 1,690,000) x 21 (funding fee per 8 hours) = 3,549 USD per week.

This might seem quite cheap, but this is because this is using Binance as a reference.

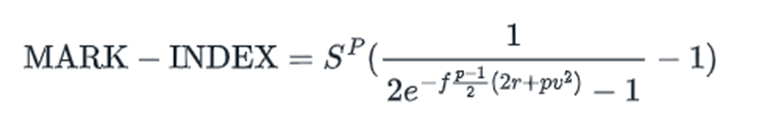

In reality, the premium yield (new term for funding rate) is calculated as

In simple terms, the cost of borrowing is approximately 0.019%, about 2x higher.

That would mean that the cost of capital would be close to $7000, a 151% APY. In addition, should your trade go wrong, your losses are amplified by a square, meaning if for example it goes down by 50 dollars, it would go down by 2,500 when using a power perpetual, which is a 50x multiplier.

Closing Thoughts

For those keen to check this out, you can utilize Deri Protocol, which is a DeFi way to trade derivatives.

Deri Protocol also allows trading of NFTs, something you can explore. Deri protocol has also created a method for executing trades on the blockchain in a precise and capital-efficient manner, which has been integral for DeFi infrastructure.

As a leading platform for trading derivatives, @DeriProtocol offers Perpetual #Futures, Everlasting #Options, and Power Perpetuals for $BTC, $ETH and other top cryptocurrencies#Arbitrum #BNBChain #DEX #Derivatives #Trader #degens pic.twitter.com/O1CS74GFOM

— Deri Protocol (@DeriProtocol) December 15, 2022

However, it is important to take note that trading futures carries inherent risk, and it is highly recommend you do not touch this if you are unfamiliar with leverage and options in general. Cheers 😊

Also Read: Pendle Finance Is Breaking DeFi By Unlocking Future Yield

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Edited by: Yusoff Kim

Featured Image Credit: Chain Debrief