Crypto investing is risky. When scouting for new tokens to allocate toward, investors often surf through countless metrics and publications in order to offset some of the volatility.

One metric that often draws parallels with traditional is the “Fees-to-Market Capitalization” ratio. Arguably, a token should perform well when it generates strong revenue whilst being undervalued.

Fees are operational metrics, protocols generate fees as a result of usage and adoption, some protocols might share their fees generated with liquidity providers others with stakers or just token holders this is why some may use fees and revenue interchangeably.

Another factor to consider is that when a protocol starts seeing an increase in adoption and usage fees generated might increase this means higher fees to stakers and liquidity providers, which in turn creates a positive flywheel, leading to more stakers and LPs committing their funds to the protocol.

As more funds are locked in the protocol the total value locked (TVL) will increase and this is an indicator that the protocol is in good health.

Market Capitalization is a valuation metric that tells us the value of all the circulating supply of a token.

Therefore, the “fees to market capitalization ratio” give us an idea of a protocol’s operational profitability, as well as possible payouts, in this case yield, to stakers and liquidity providers.

This means the higher the figure of the ratio the more valuable a token is using this metric because a higher ratio would mean higher fees and this means that the project is a potentially good investment going by this indicator.

Also Read: Be Early To The Next 100x With These 5 Crypto Launchpads

1. Lido Finance ($LDO)

Lido Finance (LDO) is a crypto-staking solution available on Ethereum, Solana, Polkadot and Kusama.

The liquid staking solution lets users stake their ETH with no minimum deposits or maintaining of infrastructure whilst participating in on-chain activities, e.g. lending, to compound returns.

Lido Finance issues stETH tokens for ETH staked on its platform on a 1:1 basis. Stakers can use their stETH tokens like regular ETH for trading on crypto exchanges and for various activities across decentralized finance platforms.

The Lido DAO manages the entire staking fund and charges a 10% fee on the earnings which is split between node operators and the Lido DAO.

Lido also supported the staking of SOL, DOT and KSM on their native blockchains.

LDO is the native utility token is used for:

- Granting governance rights in the Lido DAO.

- Managing fee parameters and distribution.

- Governing the addition and removal of Lido node operators.

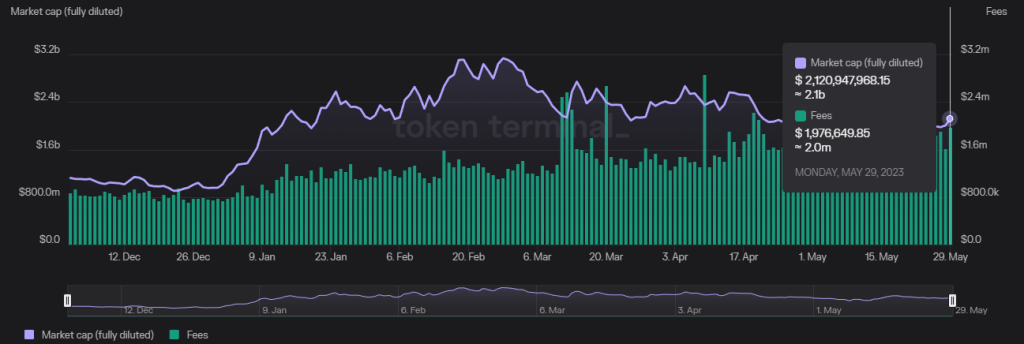

LDO currently has a market cap of $1,805,394,541 and it’s currently trading at $2.06.

LDO made $48m in fees in March and $49m in fees in April, so far in May LDO has generated $59.7m from fees. The protocol has seen a 63% increase in fees in the past 90 days.

Also Read: Ethereum 2.0 Staking Solution: What Is Lido Protocol ($LDO) And How To Stake Your ETH On It

2. PancakeSwap ($CAKE)

PancakeSwap is the leading decentralized exchange native to BNB Chain. Users can swap their coins for other coins without the input of middleman services although PancakeSwap focuses on BEP20 tokens (a specific token standard developed by Binance).

To those who have been in DeFi for a while, PancakeSwap actually needs no introduction, the DEX is useful not just because of swapping but also because you can:

- Stake CAKE in Syrup Pools.

- Lend and provide liquidity on the automated market maker (AMM).

- Participate in IFOs (Initial Farm Offerings).

- Engage in perpetual trading.

- Buy or sell NFTs via the NFT Marketplace.

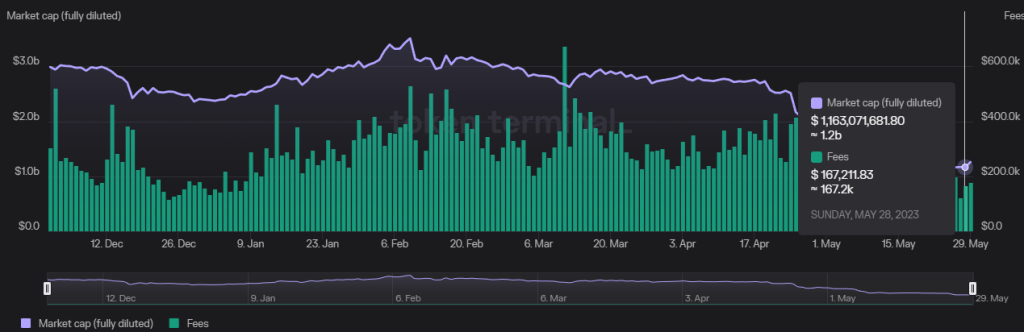

CAKE has a market cap of $309m and a TVL of $1.66B with a market cap to TVL ratio of 0.186, CAKE is trading at $1.53 at the time of writing.

In the last 90 days, PankcakeSwap is among the top 10 protocols that have generated the most fees. Sitting at number 9, PancakeSwap has generated $28.2m in fees in the past 90 days.

YTD, PancakeSwap has generated $45,880,829.5, therefore, the fees/MC ratio is 0.148.

Also Read: Pancakeswap – How To Withdraw and Swap BNB

3. Convex Finance ($CVX)

Convex Finance is a DeFi protocol that allows Curve (CRV) liquidity providers to earn a share of trading fees on Curve without staking liquidity there.

Instead, Liquidity Providers can stake with Convex and receive boosted CRV and liquidity mining rewards.

This provides CRV stakers with better capital efficiency and positions.

See how it works in 4 simple steps:

- Deposit any amount of CRV tokens into Convex

- Receive cvxCRV tokens in exchange for providing CRV

- Receive a share of the total CRV rewards

- Earn Curve platform trading fees

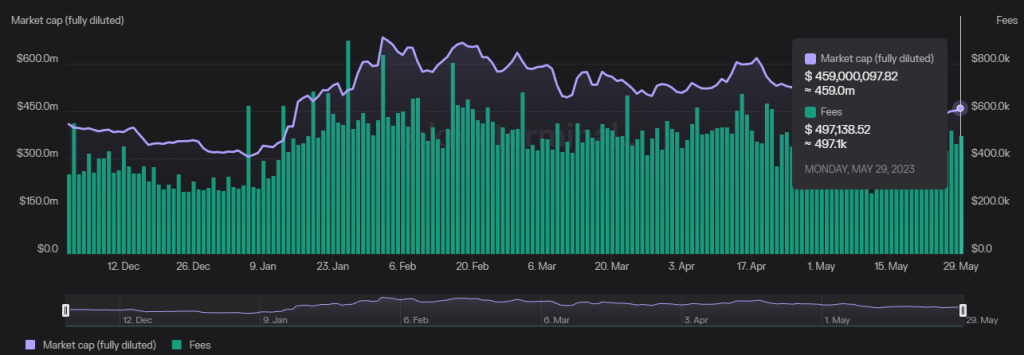

CVX has a market cap of $339m and a Total Value Locked of $3.25B with a market cap to TVL ratio of 0.104, CVX is currently trading at $4.38

Convex is number 7 among the top 10 protocols that have generated the most fees in the past 90 days. The protocol generated $45.1m in this time frame.

Convex Finance has generated $75,776,192.3 in fees YTD its fees/mc ratio is 0.22.

Also Read: Understanding The Curve ($CRV) Wars and What It Means For The Curve Ecosystem

4. SushiSwap ($Sushi)

Sushi is a community-driven decentralized exchange (DEX) built on the Ethereum blockchain. The automated market maker (AMM) DEX, uses a liquidity pool to facilitate trades, users can also partake in yield farming and staking.

Its native token, SUSHI, is used to govern the protocol and incentivize liquidity providers.

With a market cap of $164m, SUSHI is currently trading at $0.852. SushiSwap has generated $14m in fees in the past 90 days

SushiSwap has generated $24,766,726.4 with a fees/mc ratio of 0.15.

Also Read: Sushiswap’s Low Price To Sales Ratio Suggests It May Be Undervalued

5. GMX ($GMX)

GMX is a decentralized exchange (DEX) for trading perpetual cryptocurrency futures with up to 50X leverage on popular cryptocurrencies like Bitcoin, Etheruem and more,the exchange supports low swap fees and zero-price impact trades.

Trading is supported by a unique multi-asset pool that earns liquidity providers fees from market making, swap fees and leverage trading.

The platform launched in September 2021, GMX has a total trading volume of over $130B and 285K total users, making it the leading derivatives DEX on Arbitrum and Avalanche.

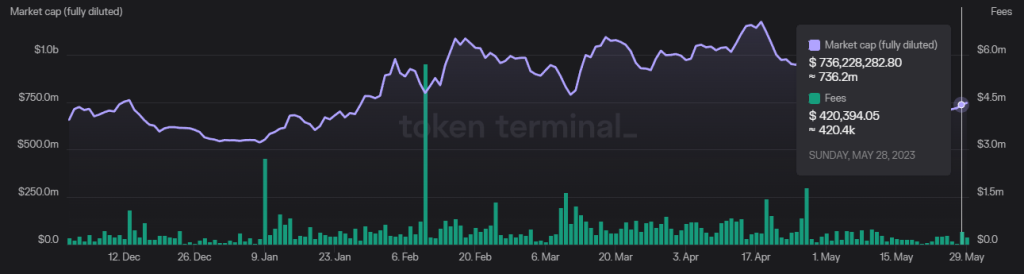

GMX has a market cap of $495,618,871 and is currently trading at $56.46

GMX has generated $75,293,824 in fees YTD therefore having a fees/mc ratio of 0.151.

This ratio can be employed when comparing protocols, especially in the same industry e.g DEXs then it can aid in making informed decision when choosing the project to investing.

Also Read: All You Need To Know About GMX – A Deep Dive Into The Next Crypto Derivatives Leader

One caveat however is that some project might be overvalued this will inflate the market cap that’s why its also important to use other ratios like market cap/TVL to see which ones are over or undervalued.

Most importantly use other metrics like total supply, circulating supply, FDV etc and always do your research before investing.

Also Read: Want To Hop On The Crypto Bandwagon? Five Things To Ask Yourself Before Investing In Crypto

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chain Debrief

This article was written by Godwin Okhaifo and edited by Yusoff Kim