How crypto lending came about

When cryptocurrency first came out, the main way of profiting from it for the everyday person was through price appreciation.

A market for lending and borrowing was created when crypto subsequently became more mainstream and hedge funds came into the picture. But what do they do with the crypto they borrow?

According to my understanding, they use it for arbitrage and other practices such as spot and futures trading. Back in March, such a trade would yield 40% per annum. If you ever wondered how lending rates in a centralized setting can be so high, you now know why.

If you are still unconvinced, Celsius, a staking platform, wrote a blog post on how they are able to pay such high rates apart from the reason mentioned above.

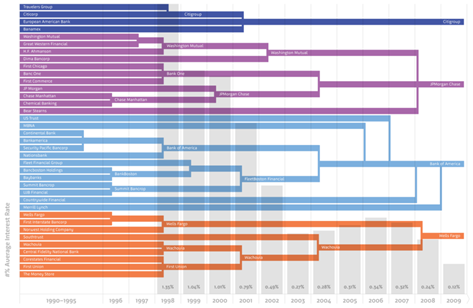

They claimed that banks, which have a similar business model, could actually pay such rates as well, just that they do not want to, nor have to, with reduced competition over the years.

Where and how to start earning?

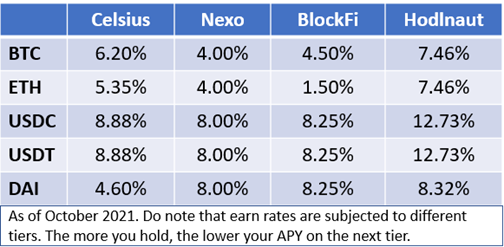

If you are wondering where you can put your crypto to work, there are tons of platforms out there. Some of the more widely used platforms in Singapore include Celsius, Nexo, BlockFi, and Hodlnaut.

If you are looking for referral rates, here are some referral codes for you which entitles you with discounts when you sign up:

- Gemini https://www.gemini.com/share/pqepnn8s9

- Hodlnaut https://www.hodlnaut.com/join/hpgtm3bXH

US$20 sign-up bonus after making a deposit equivalent of US$1,000 - FTX https://ftx.com/#a=36327662 5% off trading fee

- Kucoin https://www.kucoin.com/ucenter/signup?rcode=r3385MC

- Huobi https://www.huobi.com/en-us/topic/double-reward/?invite_code=hid43223

This is based on my analysis when going through various forums and my own personal research. While there are many more platforms around, these few would be a good start for you to do further research.

The platforms mentioned above all have their own mobile app which boast of clean and simple user interfaces — great for the confusing world of crypto. This allows you to check the interest that you are earning, sometimes paid out on a daily basis, on the go.

To begin, all you have to do is download the app, go through the usual KYC process and you are good to go (Don’t forget to set up 2FA for extra security!).

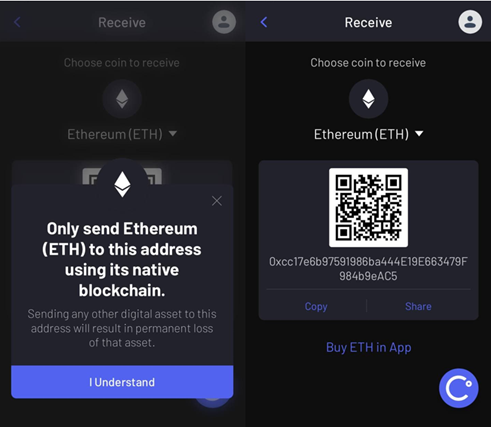

Next, just scroll through the app to find the address of the coin you want to deposit to start earning and transfer the coins from your current centralized exchange (CEX) to that address.

I have included an example below based on the Celsius mobile app, but do take note to transfer your coins on the appropriate network! There have been cases where crypto ends up missing because people transferred their crypto over a different network by mistake.

While these platforms have customer support, it is very difficult for them to retrieve the crypto for you. You really don’t want to put yourself through that turmoil, so please double-check before sending all the time!

Pros

Easy to use and low fees

For most of us who are testing waters, fees can really eat into our profits. However, you can sit easy knowing that deposits and withdrawals for most of these platforms are free, subject to some caps.

For example, Nexo has a limit of 1 withdrawal a month for stablecoins and cryptocurrency at their base loyalty each. Lending your crypto on centralized platforms is also cheaper as compared to using DeFi protocols.

On a centralised platform, you will occur little to no fees for depositing your crypto. For decentralised platforms, you will incur fees when transferring from a CEX to a DEX or when depositing it into protocols.

Low volatility

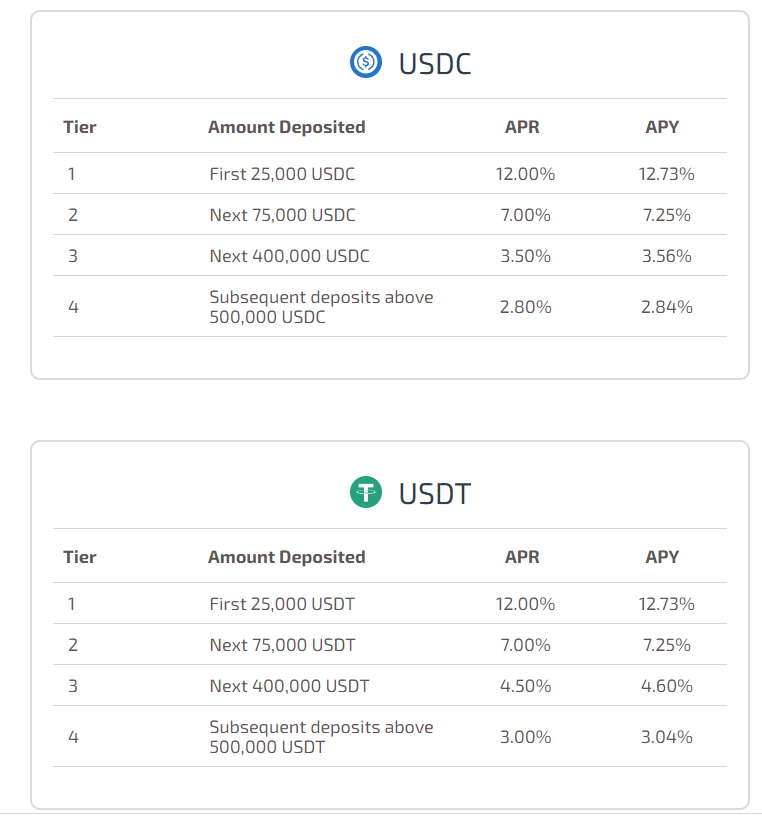

For those that are looking for an alternative to putting your money in a traditional bank, stablecoins are the answer. Stablecoins are cryptocurrencies where the price is designed to be pegged to a cryptocurrency, fiat currency, or to exchange-traded commodities.

In our case, it is pegged to the USD. For example, 1 USD Coin (a type of stablecoin) today is worth 1 USD and should be worth 1 USD in 10 years’ time as long as the peg holds.

Hence, the only “volatility” on earning yield on stablecoins is if the platforms change their interest rates. However, most big platforms normally strive to maintain a constant rate for as long as they can.

Personally, this is the strategy I use myself and I’m able to earn upwards of 8% on stablecoins on most of these platforms. It is nothing to shout about in the world of cryptocurrency but a huge leap from what traditional financial institutes offer.

Of course, this should not substitute your current savings account with DBS as the degree of risks is far greater.

Ability to earn yield on your favorite coin while waiting for it to moon

As mentioned at the start, the only way to profit in crypto as a lay person in the past was to wait for the price of your favorite coin to appreciate and then selling it aka ‘buy low, sell high’.

Sure, you could stake your crypto, but that involves some level of technical knowledge and isn’t as straightforward. But now, with such platforms, you can earn a yield on it conveniently while waiting for the price to increase!

If you are a more advanced investor who is into technical analysis, you can also alternate between stablecoins and normal crypto based on the current market cycle to maximize your earnings. In short, to earn on stables during a bear or sideway market and on normal crypto during a bull market.

Cons

Potential risk of hacking

Firstly, we have all heard of the saying “not your keys, not your coins”. This is very true when earning yield on such platforms.

Although these platforms generally have great security, their AUM is high enough to entice hackers to make a quick buck. There have been past cases of hacking attempts although no funds were lost. So do keep this in mind.

Insurance

Next, you need to be aware that even though some companies offer insurance on your deposits, the insurance does not cover your coins when it is being loaned out, which is most of the time as that is their main business model.

However, you can take heart in the fact that most of these platforms require borrowers to over collateralized their loan. This means that they have to put up more than what they are borrowing.

This mitigates the risk of you losing all your coins even in a severe black swan event. In addition, since this is not a traditional bank, your deposits are neither SDIC nor FDIC insured.

Regulation issues

Regulation on the crypto space has been intensifying of late. The latest victim as we know is Binance.com which is one of the main CEXs that Singaporeans use.

While crypto lending platforms haven’t been targeted around this region yet, there might be a possibility that the earn feature becomes a target for regulation in the future.

Some states in the US have crackdown on such crypto lending platforms. As a result, their residents are no longer able to earn these juicy interest rates. To this I say, earn while we can!

APY is not as high as DeFi protocols

Of course, while the APY that you can earn on the platforms mentioned above are great, it will not be as high as those that you can earn on DeFi platforms (eg. Anchor protocol which yields around 19.5% APY) or on other protocols which allow you to leverage to boost earnings.

However, this comes with its own tradeoffs as well as decentralized platforms do not have customer support for you to turn to when things go wrong. If someone reaches out to you saying they are. It is also not as convenient as earning on centralized platforms as you have to on-ramp your fiat and do more research in general.

Conclusion

In conclusion, lending your crypto to earn extra yield is an avenue worth exploring. This is especially so if you are doing it with the big names as it is in their interest to protect your deposits as best as they can since this is becoming quite a competitive space and they would want to keep their market share.

However, as with all things, please do further research before plunging in head first.

If you are looking to sign up for, here are some referral codes for you.

Featured Image Credit: Chain Debrief

Also Read: Guide To Using Discord For Crypto And NFT Servers