What is Qredo?

Qredo, the company behind the Qredo protocol and the $QRDO ERC-20 token, aims to solve the current problems faced by traditional finance institutions who want to participate in DeFi.

In a world with low bond yields and negative interest rates, large capital markets are looking for returns, but are prevented from engaging in DeFi protocols because of regulatory and counterparty risks

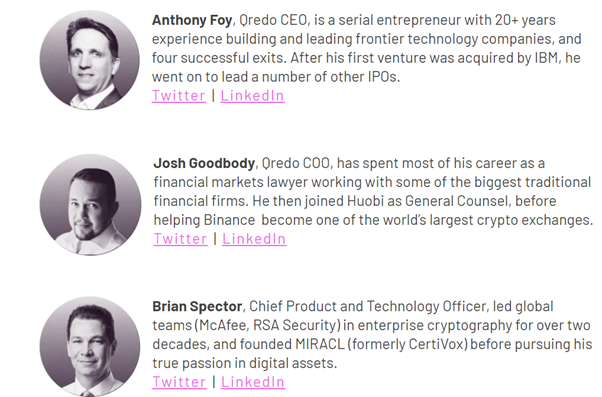

Meet the Team

The London-based company was founded by Anthony Foy and Brian Spector, who have a respectable combined track record of investing in successful start-ups and working in technology and blockchain-based companies.

Josh Goodbody also joined the team later as COO, bringing along his expertise in working with some of the world’s biggest crypto exchanges.

What Qredo aims to do

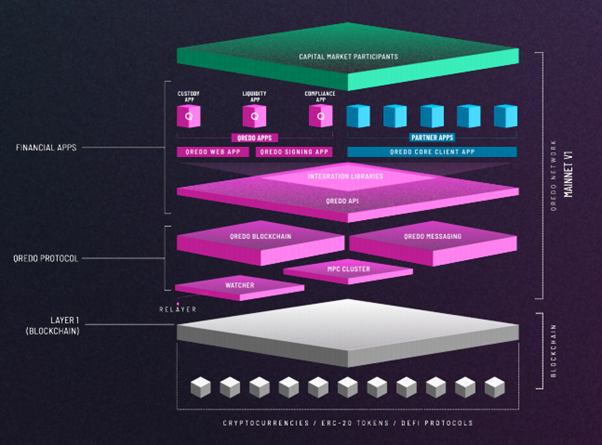

Currently strong barriers exist for capital markets to engage in DeFi protocols, and Qredo is aiming to combine their Layer 2 blockchain with a Consensus-Driven Multi-party Computation (CD-MPC) Network and also a Layer 3, end-to-end encrypted decentralized conversation replication network to bring down these barriers through its “Network as a Vault” vision.

What this means is that large capital firms moving millions, or even billions of dollars a day can be assured that their wallets have a reduced risk of being hacked, and do not have to go through a middleman such as BitGo or Fireblocks for custody of their keys and their transactions are prevented from being front-run by bots hoping to copy their algorithms.

Gas fees are also streamlined, with a 0.5 maker and taker fee instead of traditional “gas” which requires a platform’s native token to be used.

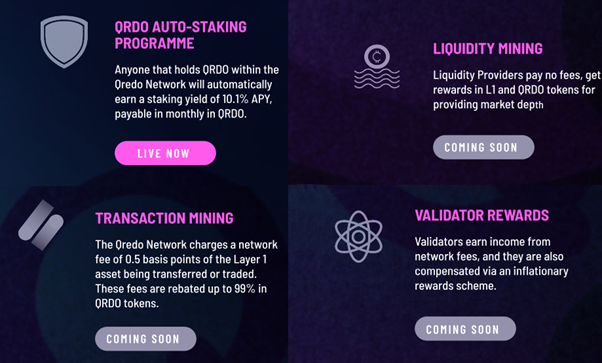

These fees will be rebated up to 99% in $QRDO tokens, which validators and market makers can also currently earn through staking and liquidity provision.

Qredo network’s Version 2 will enable single-sided loan pools easy access to credit, which acts as a money market to provide credit for up to 8-10x leverage, which can then be used for yield farming or short term arbitrage trades.

Furthermore, the collateral deposited can still earn yield and does not have to be transferred out of Qredo wallets, further decreasing counterparty risk.

Institutions can also create their own organizational accounts on Qredo and assign roles to participants. This means that institutions can bring their own governance models into the network and assign power to accounts based on who controls them.

It also helps institutions comply with governments via a detailed, immutable audit trail of all transactions available on its blockchain in line with SEC custody rules and the EU’s Regulation on Markets in Crypto Assets (MiCA)

The project also backs up their security protocols with a few more layers, and are audited, verified, and insured by reputable parties.

Partnerships and upcoming goals

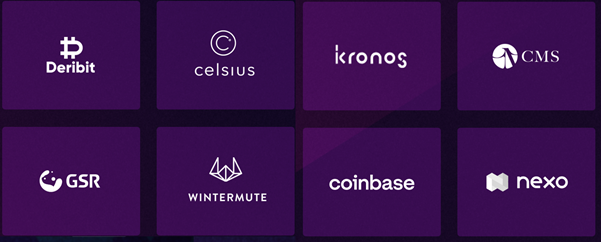

$QRDO’s recent price pump can be attributed to its growing list of big-name partners and investors despite its relatively stealthy launch.

These include big names in the crypto space such as Deribit, the world’s biggest Bitcoin and Ethereum options exchange and coinbase, a popular cryptocurrency exchange.

Thrilled to announce strategic integrations with @QredoNetwork, @CactusCustody, and @BitGo!

— MetaMask Institutional (@MMInstitutional) October 5, 2021

These partnerships will allow funds to access DeFi with institution-required security, operational efficiency, and compliance features.https://t.co/s7AeSrfmFX

Its biggest partnership though, may just be MetaMask, the world’s leading non-custodial crypto wallet. Metamask’s Instituion-compliant version, MetaMask institutional, helped the Qredo network gain larger exposure and shows confidence in the protocol.

$QRDO @coinbase Investor does around $6bn daily volume.@DeribitExchange Investor does around $3bn daily volume. @MMInstitutional Partner has over 10m users. @wintermute_t Investor has over $800bn cumulative volume. @Quantstamp Investor with over $100bn assets secured

— SWCapital (@Sherwoodcapita1) October 17, 2021

The potential for transaction volume is huge on the Qredo network, thanks to its partnerships and investors and its strategic positioning means that it has already secured a high amount of capital to be deployed eventually.

Furthermore, unlike retail traders, every single institution that joins the network will bring in millions, if not billions of dollars worth of daily transactions which will reward validators heavily.

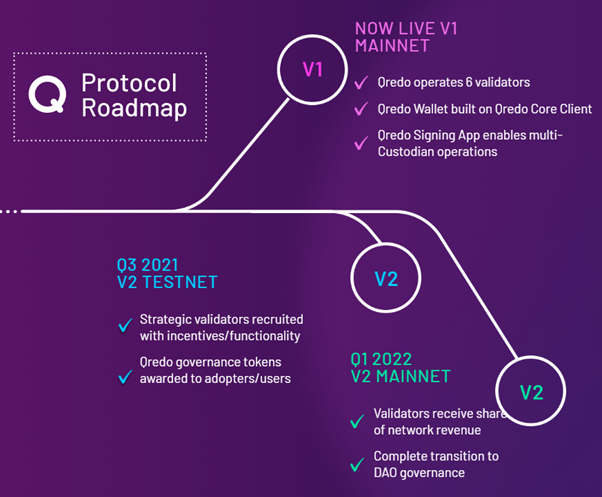

The network is set to transition smoothly into its V2 Mainnet, where node validators will be able to receive rewards from the network in the form of $QRDO tokens.

It is also currently transitioning into a DAO, or decentralized Autonomous Organization governance system. While the network is currently centralized through the main Qredo project, it aims to become fully decentralized with $QRDO as a governance token, so that the network is completely owned and operated by users.

💥⚡️Announcing the launch of QREDO LABS⚡️🔥

— Qredo (@QredoNetwork) November 10, 2021

New team will supercharge the Qredo roadmap 🛣️ by exploring new crypto technologies and their application to #digitalassets 🧪🧠🚀

To be headed by cryptography innovator and Qredo Co-founder @bspector 🥼💪

ℹ️ https://t.co/6o3AFriWYK pic.twitter.com/ylsN7igeFv

The project recently announced the launch of QREDO LABS, a new innovation unit which will be in charge of delivering its Version 2 fully and adding new functionality such as transaction ordering optimization and distributed consensus mechanisms.

QRDO Tokenomics

Qredo’s user-centric tokenomic model is built on

- Incentives existing to drive custody user, trader user and market maker participation

- The above participation driving economic activity on the network, generating income for market makers and validators

- Greater trader user, Custody user and market participation results in greater network security as it allows more validators to participate and more expensive to mount attacks on the networks.

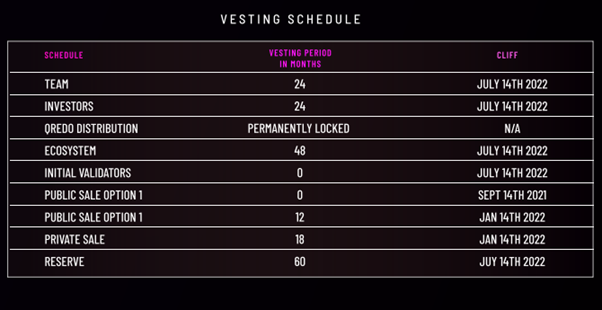

To achieve this, they will be incentivizing network usage through liquidity protocols and rebates, which have a stable vesting period to prevent dumping of tokens on the open market.

$QRDO also pays a respectable 10.1% APY yield by simply holding the token in the network, which makes it attractive to hold the token on the network instead of an exchange, further encouraging participation.

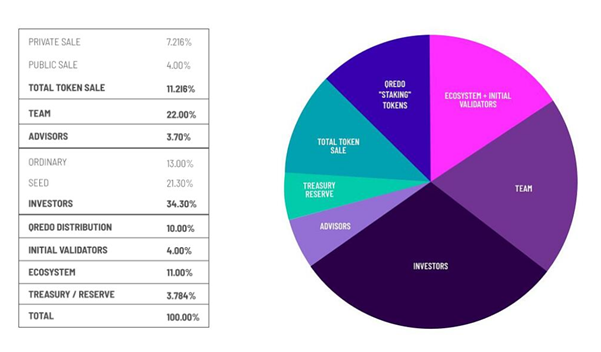

While only 33 million $QRDO tokens are in circulating supply, there is actually a hard cap of 2 billion tokens which will be slowly released until 2050 into the open market.

Half of the 1 billion has already been allocated and only 10% of that was distributed to a combined private and public sale.

Most of the initial 1 billion tokens have been allocated to the team and earlier investors, which may be worrying initially but are common for newer projects and are most only fully vested in mid-2022, reflecting their confidence in their network.

$QRDO recently hit blew up to an All-Time-High of $8.91 after a steady price uptrend following the announcement of their Metamask partnership, resulting in a 1443% ROI since it started being tracked by coinmarketcap.

With a market capitalization of $255Million, it ranks barely within the top 300 and may be a project to look at if Institutional money really starts pouring into the DeFi space.

A hard cap on supply and attractive rewards also helps to combat supply side price pressures, which would help to prevent the token simply being dumped on the open market despite early investors holding a sizeable chunk of $QRDO. However, having a small market cap also means that price swings will be extremely volatile in the medium term.

Featured Image Credit:

Also Read: Introduction to Oolong Swap: Boba Network’s First Native Automated Money Maker