Over the last few days, users of the now-defunct cryptocurrency exchange FTX have been receiving emails addressing their locked account balances.

These emails are sent by the address [ftx@noticing.ra.kroll.com], and titled “FTX – Your Scheduled Claim Information and Unique Customer Code”. However, many are unsure of what it actually means or whether their funds will finally be returned to them.

Unsure of your next steps? Here’s what you should do.

Also Read: Mt. Gox Repayments

Is This a Scam To Fish Your Hot Wallets?

If you navigate to the official FTX site, you will notice that their front-end has been replace by a notice redirecting you to their restructuring information.

This redirects to the same link given in the email, in order to view all debtors’ schedules and statements and global notes.

If you believe you have a net positive account balance on FTX’s exchanges and have not yet received your unique Customer Code from FTX’s claims agent, Kroll, please email FTXInfo@ra.kroll.com.

— Official Committee of Unsecured Creditors of FTX (@FTX_Committee) March 30, 2023

Official accounts on Twitter linked to the retrieval of funds for FTX creditors have also cited that users are supposed to receive an email regarding the issue. Furthermore, Kroll has previously been named as FTX’s official claims agent, through which users can view all of FTX’s official documents regarding bankruptcy.

While the email seems legitimate, Kroll has yet to respond at the time of writing.

What Should I Do With the Email?

The short answer is – nothing.

While the email has been sent out to most unsecured creditors of FTX (those who had funds deposited on FTX) at the time of 11th Nov 2022, there have been little to no updates regarding the case.

However, there are two important things within the email that you should note down.

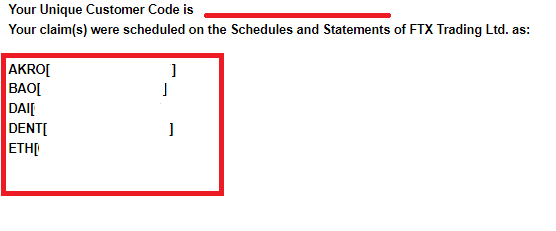

Near the bottom of the email, you are given a unique customer code regarding your deposits as well as the remaining balance on your FTX account when the snapshot was taken (11th Nov 2022).

While this information will likely be fully available on the Kroll site eventually, it could be helpful to note this information down for future reference.

When Will I Get My Money Back?

The collapse of FTX will likely go down as one of the biggest institutional failures in crypto. Not only were retail investors affected, but equity holders, institutional players, and almost anyone in the crypto space felt the aftershocks of SBF’s actions.

The FTX balance sheet is really something

— db (@tier10k) March 7, 2023

$1.6 billion worth of Bitcoin owed to customers, with only $1m there in reality

Rough NFA breakdown of what liquidators have found so far across all silos

-$3.5b in 'liquid' coins

-$1.7b cash

-$800m 'illiquid' https://t.co/dDthjFWDvF… pic.twitter.com/qckkb2yc02

While SBF previously stated that the exchange has sufficient assets on hand to cover all their liabilities, reports from liquidators shows that there may be a significant black hole within their balance sheet.

At the time of writing, it is still unclear whether FTX creditors will have their assets returned at a 1:1 ratio.

We can also take Mt. Gox, a cryptocurrency exchange that went under in 2014, as a case study for unsecured creditors.

Creditors have only stared being paid out in 2023, almost a decade after the incident, due to not only regulatory proceedings, but also the sheer amount of creditors involved, and the hack that occurred prior to it’s collapse.

Even if FTX creditors were ever to be returned their funds, it would likely involve a multi-year process, with users receiving less than their actual deposits.

Also Read:U.S. President Clamps Down on Crypto, Capital Gains – A Complete Breakdown

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chaindebrief