In recent times, Russia and China have been slowly reducing their dependence on the US dollar but are rather dealing in their local currencies. These two global powerhouses are also calling on other nations, mostly BRICS nations, to join this move to remove the dollar as the global reserve currency.

This potential shift from the world’s current reserve currency has raised questions about the future of global trade and finance. As the cryptocurrency industry continues to expand, many people are wondering how these changes will impact the digital asset market.

In this article, we will take a closer look at the potential impact of Russia and China’s move away from the US dollar and what it could mean for the future of crypto.

Also Read: Polygon’s zk IDs: The Solution To a Web3 Identity?

The Rise of BRICS

The chances are that you have heard about the G7 countries and how huge their influence was on the global order. However, since the turn of this decade, there has been barely any notable mention of this group of countries. Instead, we are seeing a new set of countries stake a claim to their “throne”.

This new – or not so new – group of countries are commonly known as the BRICS nations. This acronym represents five prominent countries, including Brazil, Russia, India, China, and South Africa. This group, which initially consisted of Brazil, Russia, India, and China (BRIC), was used to describe the world’s fastest-growing economies.

Contribution to global GDP (PPP) growth

— The Spectator Index (@spectatorindex) April 30, 2023

2002

G7 (🇨🇦 🇫🇷 🇩🇪 🇮🇹 🇯🇵 🇬🇧 🇺🇸): 42%

BRICS (🇧🇷 🇷🇺 🇮🇳 🇨🇳 🇿🇦): 19%

2022

G7 (🇨🇦 🇫🇷 🇩🇪 🇮🇹 🇯🇵 🇬🇧 🇺🇸): 30%

BRICS (🇧🇷 🇷🇺 🇮🇳 🇨🇳 🇿🇦): 31%

The BRIC label was initially formulated by Goldman Sachs chief economist Jim O’Neill in 2001. These four nations are believed to be key drivers of the global economic growth at the start of the 21st century – and even till date. In 2010, the BRIC group invited South Africa to join them, providing them with African representation and adding the “S” to BRICS.

However, it is clear that the “founding myth of the emerging economies” is no longer the only truth. The BRICS nations have somewhat evolved into an intergovernmental political movement, steadily challenging the status quo and the preexisting world order.

For instance, China and Russia have been pushing for the creation of a new global currency, challenging the US dollar’s dominance as the world’s reserve currency

China and Russia Advocates For New Global Currency

As inferred earlier, the BRICS nations have somewhat become an organization of countries with common political ambitions and goals. This is displayed in the group’s bid to dethrone the United States Dollars as the global currency. China and Russia, in particular, are at the frontline of this “war”, leading the charge for the global currency change.

As part of the Western sanctions imposed on them for invading Ukraine, Russia has been pretty much shut out of the global financial system. As a result, the Eastern European country has had to look elsewhere to ease the impacts of these seemingly political sanctions. Interestingly – and perhaps expectedly, China has primarily been the economic savior of Russia in the past few months.

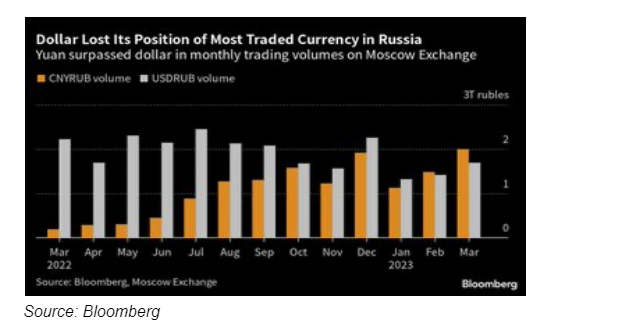

Since the Western sanctions kicked in, Russia has improved its cooperation with China, while embracing the Chinese Yuan for the majority of their trades. In fact, China’s Yuan became the most traded currency in Russia ahead of the US dollar in February and March, according to a Bloomberg data report.

Meanwhile, a Global Times report revealed that the trade volume between the two BRICS nations reached a record high of $190.27 billion in 2022. Notably, 70% of trade between the two countries have been settled in their own currencies.

China and Russia’s call for the elimination of dollar relevance is beginning to gain international traction, as other countries are expected to join the push. Specifically, Brazil, another member of BRICS, has urged other BRICS nations to embrace the global currency shift.

JUST IN: 🇧🇷 Brazil President says he supports creating a new currency for BRICS nations to trade with.

— Watcher.Guru (@WatcherGuru) April 26, 2023

Even with all the changes taking place, the US dollar still remains the most widely-used currency in the world. However, one can only wonder how long it can hold on to this crown. If it doesn’t hold on for long, what effect would this have on the cryptocurrency space?

What Does This Mean For Cryptocurrency?

The fact is that it is difficult to say what the displacement of the US dollar – as a global currency – would do to the cryptocurrency industry. However, there is a popular belief that a weak greenback would result in more valuable crypto assets – and vice versa. After all, we’ve seen it occur a couple of times.

Relationship Between The Dollar And Crypto

For instance, the Federal Reserve – in response to the rising inflation rates – had to increase the interest rates a couple of times last year. By raising these interest rates, the demand for and value of the dollar jumped by quite some percentage last year. Meanwhile, Bitcoin – the largest cryptocurrency by market cap – bled by a staggering 58%.

When the greenback becomes more robust, there is often a negative effect on the value of other assets, including cryptocurrencies and precious metals. This might explain why Bitcoin lost a considerable percentage of its value last year. Moreover, history shows Bitcoin – and most crypto assets – to be inversely correlated with the dollar.

Bitcoin and US Dollar Index YoY change pic.twitter.com/n09EaCCwMp

— Will Clemente (@WClementeIII) April 28, 2023

The Effect Of “De-dollarization” On Crypto

If the dollar loses its place as the global reserve currency, its value is expected to plummet. Going by the relationship between the dollar and crypto, a less valuable greenback could mean a boost in cryptocurrency value.

Moreover, a weak greenback might convince several investors to store their value in crypto assets. With increased adoption of cryptocurrency, there will be a surge in demand for and value of crypto assets.

It is, however, important to mention that none of this might go as anticipated. Considering that cryptocurrency is still relatively new, we can’t be certain of its response to huge upheavals, like the dollar losing strength. After all, crypto has its own quirks and unusual deviations that can be triggered by factors other than dollar strength.

An example of these unusual deviations is Bitcoin reaching an all-time high of $69,000 in 2021; meanwhile the dollar index (a measurement of the dollar against a pool of six foreign currencies) jumped from 92.7% to 95%.

Final Thoughts

As two global superpowers gradually cut ties with the United States and its currency, it indicates an impending shift in the world economy. It remains to be seen how this change would impact the cryptocurrency industry. However, a weakened US dollar will most likely trigger a bullish run in the crypto market.

At the same time, it is worth noting a drastic decline in the value of the greenback could result in negative consequences in the crypto space. Cryptocurrencies are still highly volatile and reliant on market sentiment, meaning that an extensive economic crisis can lead to a loss of faith in digital assets.

Also Read: 10 Huge Upcoming Crypto Unlocks and How To Trade Them

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Swissinfo

This article was written by Opeyemi Sule and edited by Yusoff Kim