Crypto investing is often a hot topic of conversation and has gradually become the go-to conversation starter with friends and family.

But investing in crypto is not as easy as it seems. With thousands of coins to choose from, which coin will go to the moon and which will crash and burn?

While there are many of the so-called crypto “gurus” out there preaching about the next big thing, it is generally unwise to base your crypto portfolio on their shill.

With that in mind, we came out with three different sample portfolios that cater to different groups of investors based on their risk appetite.

We also advocate diversifying into different cryptocurrencies. While diversification doesn’t guarantee profits or prevent losses, it helps to balance the risk to reward ratio.

Here are the sample portfolios that you can follow based on your risk appetite:

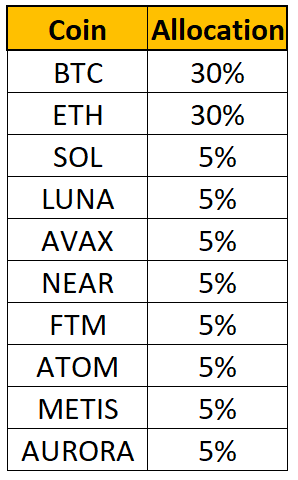

1. Conservative crypto portfolio – 80/20

Before we jump into the different sample portfolios, it is important to categorise the cryptocurrencies base on their risk level. Cryptocurrencies can be classified into three main categories: large-cap, mid-cap and low-cap.

Large-cap cryptocurrencies generally refer to crypto tokens with more than US$10 billion in market cap. Large-cap are considered safer crypto investments compared to mid and small-cap crypto tokens because it is less volatile

Mid-cap cryptocurrencies have market caps of between US$1 Billion and US$10 Billion. Mid-cap cryptos are more volatile than large-cap but also have a lot more growth potential.

Small-cap cryptocurrencies have a market cap of less than US$1 billion and can be extremely volatile. It is usually classified as a highly risky investment because it is most susceptible to dramatic swings.

A conservative portfolio should follow the 80/20 rule. It would see a blend of 80% large-cap and 20% mid to low cap crypto tokens.

Following the 80/20 rule, my sample portfolio would look like this:

The majority of the holding is allocated to Bitcoin and Ethereum because they are the largest and most established cryptocurrencies in the market.

As much as I don’t believe in investing in Bitcoin because of the low reward-to-risk return, I can’t deny that Bitcoin is the market mover and all the major altcoins are highly correlated to Bitcoin which makes it a safe bet.

The rest of the portfolio is diversified among the other big layer 1s and promising layer 2s like Near Protocol and Metis network.

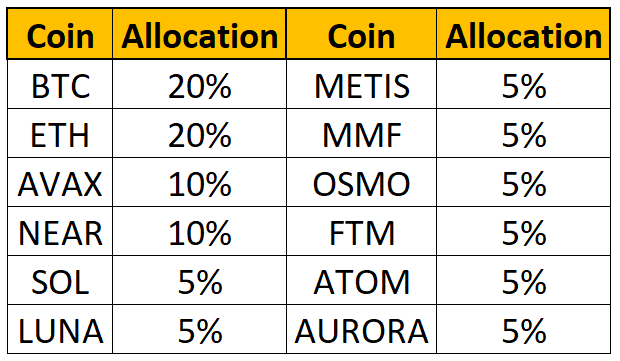

2. Balanced crypto portfolio – 40/30/30

A balanced portfolio is one that is weighed slightly skewed towards the large-cap cryptocurrencies but also balanced with a mix of mid and small-cap tokens.

The balanced portfolio looks almost identical to the conservative portfolio but the weighting of Bitcoin and Ethereum is reduced to fit two other tokens from promising protocols, Osmosis and MM.Finance.

Both projects are the leading DeFi protocol in their own ecosystem with strong support from the community. Both projects are well-positioned in the ecosystem and will no doubt grow as the ecosystem expand.

You can read more about Osmosis here: The Case For Osmosis: Why I’m Bullish On The Top DEX In The Cosmos Ecosystem

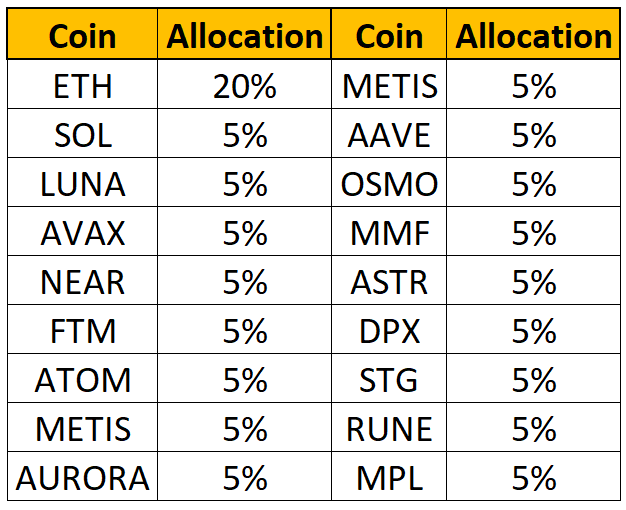

3. Aggressive crypto portfolio – 20/40/40

A full-on aggressive portfolio for those adrenaline junkies would see more portfolio allocation to mid and low cap cryptocurrencies.

Low-cap crypto gems are highly speculative investments so it is recommended to hold some mid and large-cap cryptocurrencies to reduce volatility.

The aggressive portfolio will be more volatile compared to the other two portfolios but at the same time, it has the highest possibility for huge gains with many mid and low-cap tokens.

This portfolio includes some risker assets like STG, the native token for Stargate Finance. Stargate Finance is a fully composable liquidity transport protocol that lives at the heart of Omnichain DeFi. The ICO token sale was on 18 March 2022 so it is still a relatively new token.

Also Read: Solving The Bridging Trilemma: Here’s Everything You Need To Know About Stargate Finance

Conclusion

This is just a general sample portfolio guide for beginners to follow. The tokens chosen for the portfolio are all individually handpicked based on the current narrative and potential to grow.

It is highly recommended to rebalance your portfolio based on the market condition. A bull market portfolio should see more capital allocated to assets with the potential to grow and a bear market portfolio would pivot to more stable blue-chip assets or stablecoins.

To end off, the golden rule is to always diversify your portfolio. Putting all your eggs in one basket is never a good idea and diversification would help to safeguard your portfolio.

Buying and holding crypto are just the basics of crypto investing. There are other ways to invest like staking and yield farming. Do check out staking here & yield farming here.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief

Also Read: Want To Be A Crypto Investor? Here Are 10 Resources To Get Yourself Up To Speed In Web3

Was this article helpful for you? We also post bite-sized content related to crypto — from tips and tricks, to price updates, news and opinions on Instagram, and you can follow us here!