SEI is a new player that has entered the L1 scene, and they are beginning to gain popularity in DeFi, particularly in terms of speed.

AMMs have long dominated the DeFi space, becoming a norm in the market making but are inherently less efficient than CLOBs (we will get into this a little more) which offer lower slippage, tighter spreads, and more.

SEI is here to solve all that.

What is SEI?

SEI will be the first order book-specific L1 blockchain. This features a built-in CLOB module which is optimized for speed, stability, and cost-efficiency.

With the goal of being the layer1 for DeFi applications, the team behind SEI is building an order matching engine where every app building on the network can leverage on top of its IBC capabilities by building on Cosmos.

Most L1s present themselves as either general purpose, like Ethereum, Avalanche, Solana, OR app-specific L1s in the cosmos like Osmosis and DYDX. Sei isn't general purpose or app specific. It's "DeFi-specific", and here is why that is BIG (bigger than Vitalik) 👀

— Warren Feldman ⚛️ (@WarrenFeldman3) September 2, 2022

Something different about SEI is it is a permissioned blockchain. What this means is that proposals will need to get approved and see it get passed through its governance before it could be deployed as a smart contract.

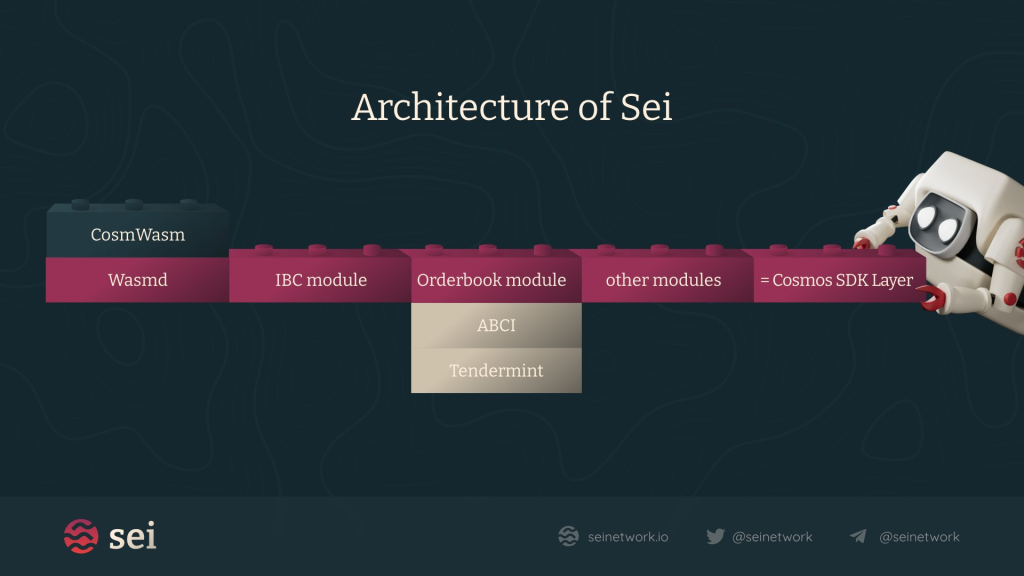

Its architecture is different from projects we already know, especially being built on Cosmos, the introduction of CosmWasm and the IBC module is present with the orderbook module being built on.

MEV Proof

SEI is also MEV proof. This is of particular importance because of the evident disruption of frontrunning and MEV within DeFi. SEI does a frequent batch auctioning which will prevent this and make the layer1 uniquely MEV proof, a feature that strengthens applications built on SEI

(Maximal extractable value (MEV) refers to the maximum value that can be extracted from block production in excess of the standard block reward and gas fees)

Orderbook engine

So what is a CLOB?

CLOB is the acronym for Central limit order book. CLOB is basically an exchange-style execution method which is commonly used in the equities world where all bids and offers are matched according to price and time priority.

It allows all users to trade with each other, instead of being intermediated by a dealer. There are hints of decentralization right there.

SEI aims to utilize this engine system as the bedrock of its tech. CLOB has largely existed on centralized exchanges (CEX) but they are aiming for another verticle within Crypto, DeFi.

Why hasn’t this been popularized?

Well apparently bringing an order book on-chain turns out to be difficult. The probable reason why CEXs find much success in this mainly contributed to the utilization of existing web2 infrastructure, which is tested and proven.

But currently, no team has been able to successfully scale and build it on-chain. “The problem stems from the scalability of the underlying L1, but with Sei, dApps get off-chain speed with on-chain security.”

That is why current DeFi employ the use of AMMs (Automated Market Makers) because they are easier to implement. Here’s a breakdown of DEX volumes.

There are others who tried this before SEI, Serum (built on Solana) for example attempted to introduce on-chain CLOBs but AMMs continue to dominate DeFi while CEXs continue to dominate CLOB trading.

But SEI believes the two should coexist, DeFi and CLOBs.

Unlike dYdX and Injective, Sei’s order book matching engine is completely on-chain. This ensures security and decentralization while being able to achieve both the speed and efficiency that off-chain order books provide.

They do all that by also providing deep liquidity and price-time-priority matching for traders and applications.

1/ @Seinetwork is currently working on optimistic block processing to improve block speed and throughput: pic.twitter.com/H813Tgdqiw

— Jay (@jayendra_jog) August 23, 2022

Built on Cosmos and Tendermint

Sei’s decision to build their own blockchain on Cosmos allows them to customize the network for their specific needs, which is to include the built-in CLOB module. A permissioned blockchain built on a flexible layer.

The permissioned nature allows for careful curation of application launching on their network. This allows for maximum compatibility and avoids those which are detrimental to the performance of the core protocol.

Oh, on top of that, Cosmos SDK allows for communication between blockchains on the Cosmos ecosystem via Inter-blockchain communication (IBC).

Potential Use cases

1. Derivatives

One use case that comes to mind is derivatives.

This space itself in the TradFi markets accumulated over $12.4T at the end of 2021 but why hasn’t such a pot of gold founds its breakout in narratives in crypto? Derivatives at their core demand high efficiency, which was something that has been hindering blockchains for a long time coming.

You might be thinking of competing for derivative platforms such as dYdX, but the way they handle transactions, trades, liquidations and transfers are done all off-chain. The decentralized nature of SEI does all of that, on-chain.

Should SEI provide an orderbook experience that matches all that of dYdX or any CEXs, they would likely change the game for how current on-chain trading and liquidity functions.

2. DeFi

As mentioned in what SEI can do above, it provides the optimum environment for DeFi. The built-in order book, fast transaction finality (600ms) and frontrunning protection almost seem to solve existing issues of DeFi.

The team behind SEI

Founded by Jeffrey Feng and Jayendra Jog, the founding team of SEI comprises team members with vast experience in the tech and TradFi industry like Airbnb and Goldman Sachs, among others.

Sei is thrilled to announce a $5 million funding round led by @MulticoinCap.

— Sei ♒️ (@SeiNetwork) August 31, 2022

We've partnered with some of the most respected founders and institutions in the world to drive forward the same mission: build the best layer 1 for financial applications https://t.co/p0Yjd629Yt

♒️👇

In an attempt to build the best player 1 for financial applications, Jayendra Jog said “we partnered with some of the most revered financial institutions in the world to drive forward the same mission”, and recently announced a $5 million funding round led by Multicoin Capital along with other “very known VCs” in the space.

Thrilled to support the team behind @SeiNetwork for @tangent_xyz's first investment as they crystalize a new vision for DeFi using first principles.

— Wangarian (@0xWangarian) August 31, 2022

Sei aims to offer the composability of a full-fledged L1, with built-in orderbook infra for the next generation of DeFi apps. https://t.co/MRIbevW5Fi

SEI’s Ecosystem

Despite being in testnet, SEI has already onboarded three protocols onto the network.

1. Vortex

Formerly known as Retrograde, Vortex is a DEX focusing on derivatives on Cosmos. It mainly features borrowing and lending, cross-collateral and cross-margining capabilities.

Vortex is permissionless which means it allows anyone to list an asset for trading. Users will be able to post any IBC asset as collateral and trade with up to 10x. As of the time of writing, Vortex offers trading for BTC, ETH, SOL, ATOM and OSMO on testnet.

.@SeiNetwork Incentivized Testnet Act-2 is still ongoing. If you still want to complete the missions, then you need to hurry up to @VortexProtocol.

— BoJack 🇺🇦 (@0xbezzub) August 21, 2022

Especially for you, I've prepared a step-by-step guide.

📍0/7#Seilor #SEI #Seinami #Vortex #Cosmos #DeFi pic.twitter.com/1oljDYDVBu

2. Axelar Network

Sei has Axelar onboard to enable cross-chain messaging DeFi on Cosmos and EVM chains. This partnership will open up possibilities for bridging, messaging and execution across chains and virtual machines.

1/5

— ♒QW♒ (@I_love_to_lick_) August 25, 2022

Sei is partnering with Axelar to provide interchain messaging between DeFi chains on Cosmos and EVMs. This partnership will open up new possibilities for bridging, messaging, and execution between chains, programming languages, and virtual machines. pic.twitter.com/Htb7PRQGS8

3. Pharaoh Protocol

Pharoah protocol is a synthetics primer, basically providing access to synthetic assets with the advent of DeFi applications.

A synthetic asset is a digital asset with its price pegged to another real-world asset. Individuals trading synthetic assets benefit from price exposure to various assets without the need to access the actual underlying real-world asset.

TLDR:

— FarmerTuHao (♒,♒) (@FarmerTuHao) July 19, 2022

One of the first @cosmos protocols to offer synthetic versions of:

1. Crypto

2. FOREX

3. Commodities

As well as vaults for Delta-Neutral strategies for hedging with a strong focus on making it easy for everyone to use, only on @SeiNetwork, the L1 Orderbook chain. https://t.co/zOOt4VnjRa

Closing thoughts

Although I don’t see CLOBs killing AMMs entirely, I think they can certainly capture a good chunk of AMM’s market share within DeFi.

While certain applications dependent on the orderbook mechanism did not see much success existing on-chain, those applications might see success building on SEI and are likely to bring new builders, and users and bolster the TVL.

Oh did I forget to mention its speed? Its parallelized transactions make it the fastest blockchain out there, with a 600ms finality. With this, SEI can sustain 18k of orders per second, making it ideal for spot trading, derivatives or even options.

Should SEI become successful in rolling out the on-chain orderbook design, it would clinch the title of being the first mover in the space. Just like the AMM boom, which saw forks of various AMMs concepts across various layer1s, there might be similar chains doing the same with built-in CLOB modules, but SEI would have the opportunity to capitalize on having the first mover advantage.

Also Read: Ethereum Ranks #27 By Developer Activity – Who’s Number 1?

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief