Selling NFTs is not as simple as you think, there are many factors one must consider before selling NFTs that they purchased.

In this guide, we take you through a few of the common factors investors should take note of before selling.

I think it would be funny if all NFTs randomly lost all value overnight so all those people were left with nothing but a badly drawn jpg they thought they could sell for millions

— Big Orange Shake McGee (@AboutNintendo) November 8, 2021

Royalties and fees

The first thing you need to take note of when selling NFTs are the fees. If you are using a brand new Metamask wallet and have never listed an NFT for sale before, you will have to pay an “Initialise Wallet” Fee. This fee is rather expensive, but you will only need to pay it once.

The second fee is known as the “Initialise Token” Fee. This fee is paid once for each NFT collection when you sell. If you have 2 NFTs from the same collection, you will only need to pay this fee once.

The last fee is also known as royalties. Opensea and the NFT projects take a cut of the sale as commissions of the sale price, this is how Opensea earns revenue and how NFT projects fund their future plans long after the project has been minted.

Opensea charges a flat 2.5% fee while project royalties are decided by the project team, some projects announce their royalties before the mint and others do not, you will be able to see the royalties charged when you are making a listing.

It is recommended that you list your NFT when Gas prices are low, for people reading who live in Singapore like me, Gas prices are cheapest from 3 pm-6 pm SGT.

Listing your NFT

It is recommended to list your NFT when gas is low, this is to ensure that you have already paid both fees ahead of time and when the time comes and you want to sell your NFT, you can avoid situations where you have to pay super-high gas to sell. To list your NFT but not have it get sold, you can just list your NFT at a high price.

This is because the mechanics of sales on Opensea only allows you to lower prices. If you want to raise the price, you will have to pay gas to cancel your listing. You will not be required to pay any gas to lower your sale price.

What price to list?

Now that you know how sales work on Opensea, you have to pick a price that your NFT will likely sell at. This depends on your NFT Rarity. There are a few ways to do this.

The first method is to check based on rarity rank, you can do this through rarity checkers like Rarity.tools or Rarity Sniper. Find out your NFT’s rarity rank (higher the better) and what are the prices that NFTs in the same range are listed for.

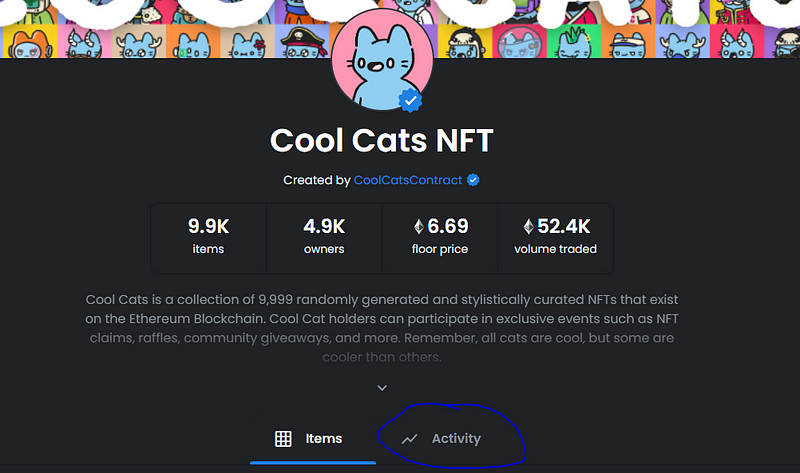

If your NFT is common and not rare at all, you can just decide to sell the NFT at the floor price. The floor price is the minimum price that buyers need to pay to own an NFT from the collection. For this section, I will be using an example of an NFT from my own collection, Cool Cat #4655.

As of writing this article, the floor for Coot Cats is 7 ETH.

The first price I could list is the floor price of 7 ETH, I could also undercut the floor by listing at 6.9 ETH. Undercutting is selling your NFT at a price that is lower than the current floor, in situations where sellers want to cut their losses and exit a project, heavy undercutting by multiple sellers often occurs causing a big price drop.

Under-cutting also makes your NFT stand out compared to other NFTs, as buyers always look at the floor pieces, and being listed on the floor often means that you are competing with other NFTs to be sold.

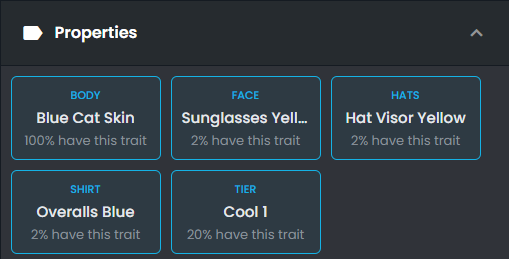

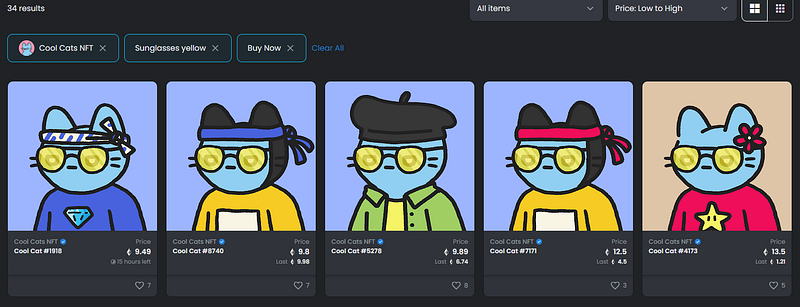

When looking at the traits for my cool cat, we can see that there are 3 traits with a rarity of 2%, by clicking on any of the traits you can see all the NFTs with that specific trait and how much they are selling for. In this example, I will be looking at the price of the Face Property “Sunglasses Yellow”.

As you can see, the floor price for Cool Cats with the Sunglasses Yellow is 9.49 ETH, approximately 2.5 ETH above the normal floor price. If you do not know how to properly list your NFT, you could potentially lose out on a lot of money. Remember to always check your rarity traits.

Pro Tip: Liquidity is the highest on the floor and decreases as price increases.

When to sell

For people who are looking to flip their NFTs, knowing when to sell is the hardest thing to do. No matter what you do, 99% of the time you will end up in a situation where you sold too soon or held too long, but there are still a few indicators you can use to know when to sell. You should always sell in a seller’s market (Advantageous to sellers, high demand for NFT).

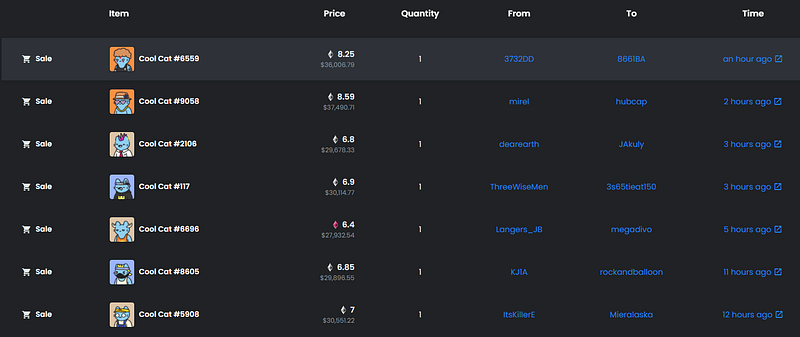

Sales per minute

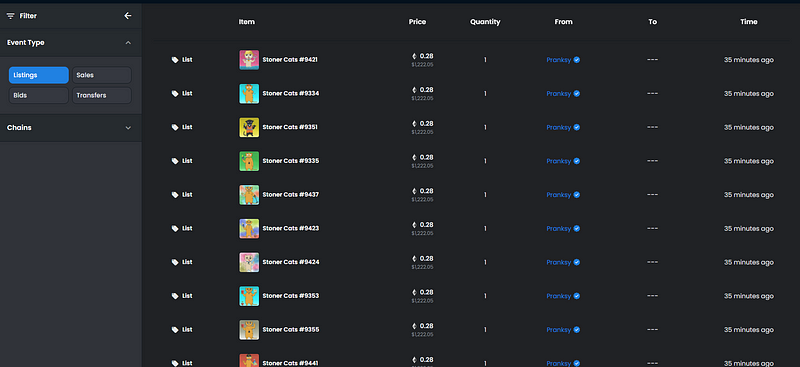

You can find what are the recent sales for the collection under the activity tab on Opensea.

The floor is lava

A term used when floor pieces are getting bought up quickly compared to pieces being listed on the floor. (1 Sale a minute)

If you are looking to flip your NFT, this is the time where you should be selling it, the high number of sales will cause NFT tracking websites to alert their members and more people will start FOMO-ing in.

When the sales start dying down, flippers who got in late will start panicking because they did not get the 10x that they wanted in 1 hour and start undercutting.

Follow the whales

In the image above, a verified Opensea account dubbed “Pranksy” has listed more than 10 pieces of the collection at once, Pranksy is one of the most influential NFT influencers in the space right now, he is currently ranked number 2 in profits from trading/investing in NFTs based on Nansen’s leaderboard.

When whales like Pranksy sell, they have likely lost confidence in the project and cut their losses or taken profits to move on.

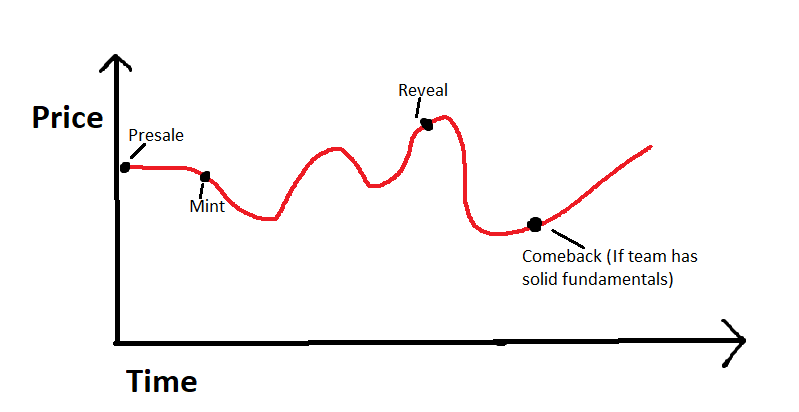

Price cycles

NFT markets move similarly to any other markets, stay long enough and you will start noticing similar patterns.

Presale: Presale is the safest time to sell if you are just looking to flip, there is a limited supply on Opensea, and buyers who want to avoid a gas war will buy here.

Mint: After the public mint, the majority of the supply will be on the market as people look to sell for a quick profit.

Reveal: Leading up to the reveal, excitement builds up and people start buying unrevealed NFTs for the chance to win a 1/1 or rare NFT. Imagine a scenario where there are 10 NFTs in a Collection and within the collection, there is one 1/1 and two rare NFTs, since they are all unrevealed there is an “equal” chance of each NFT being a rare piece, hence buyers speculate and price all of them at the same price. However, when the art and rarity are revealed, people start selling off common NFTs and keeping the rares, causing the floor to dip.

Comeback: This is the period where the NFT project starts recovering if the team has a good roadmap, art, and support from the community.

Featured Image Credit: Chain Debrief

Also Read: Here’s How You Can Win A Gas War On An NFT Drop