With new projects popping up seemingly every hour, I was looking around for more alpha in hopes of the elusive early adopter 10x. So, when I saw the SnowDog ($SDOG) token trending on social media, I had to take a closer look.

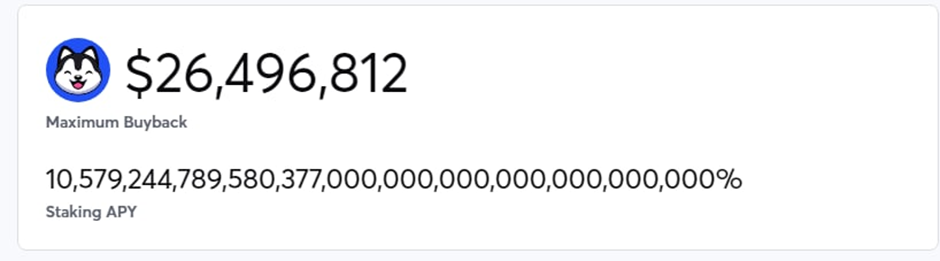

The reason was the ridiculous APY of the project, with more zeros than I even knew how to comprehend. To put this in context, if the APYs actually paid out with no token price change, for every $1 I put in, it would return more than $20,000,000 in 90 days.

So, I put a few minutes into (barely) researching the project and, as every person chasing a pump does, aped in.

What is SnowDogDAO?

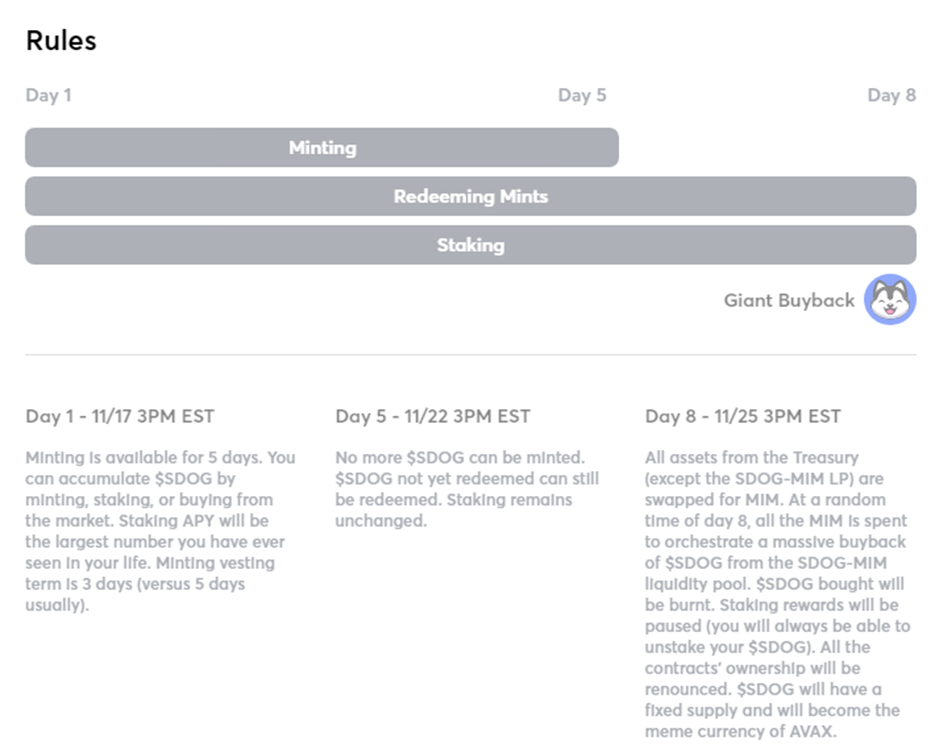

SnowDogDAO ($SDOG) was an Avalanche-based fork of Olympus DAO, a project which aims to become the reserve currency of the crypto space.

However, SnowDog’s mission, unlike other Olympus forks, claimed to be different from the start, as it was gearing towards become the first meme token on the Avalanche Network, instead of a reserve currency.

The project also framed its roadmap uniquely compared to other forks, where it would only be live for eight days. After the runway was up, it claimed that it would orchestrate a massive buyback of the token using its treasury reserves, pumping the value of $SDOG and ceasing supply.

Thanks to this major buyback, those who participated would then be able to sell their $SDOG for a high price, and those who wanted to keep their $SDOG to speculate on its future would also be rewarded as they would own a part of the very, very limited supply in circulation.

Did the project rug?

For those lucky enough to not know what a rug is, it basically means that the developers make away with most, or all the money deposited, usually through a backdoor of some sorts.

While $SDOG’s insane APY was, in hindsight, too good to be true, where it becomes hazy is that the project was affiliated with Snowbank ($SB), which was a successful Olympus DAO fork on the avalanche chain.

With Snowbank performing well, most participants in SnowDog believed that it was a good project, especially since the Snowbank developers had potentially more to gain if the project succeeded than if it failed.

The website is password protected for now. We just want to make sure you'll be there when it happens and everything is revealed.

— Snowdog🔺 (@SnowdogDAO) November 25, 2021

However, on the day of the buyback, confusion ensued as it was announced that the buyback would only be done on a custom SnowDog AMM (Automated Market Maker), instead of Trader Joe, the decentralized exchange that most were using to purchase $SDOG previously.

Smoking gun is that this address never even approved $SDOG for trading on @traderjoe_xyz… only on their own DEX once announced.

— 𝔻𝕒𝕟 🔺(.\, .\) (@DastardlyDaniel) November 25, 2021

Shame on you @SnowbankDAO @SnowdogDAO pic.twitter.com/khG4ceO1YX

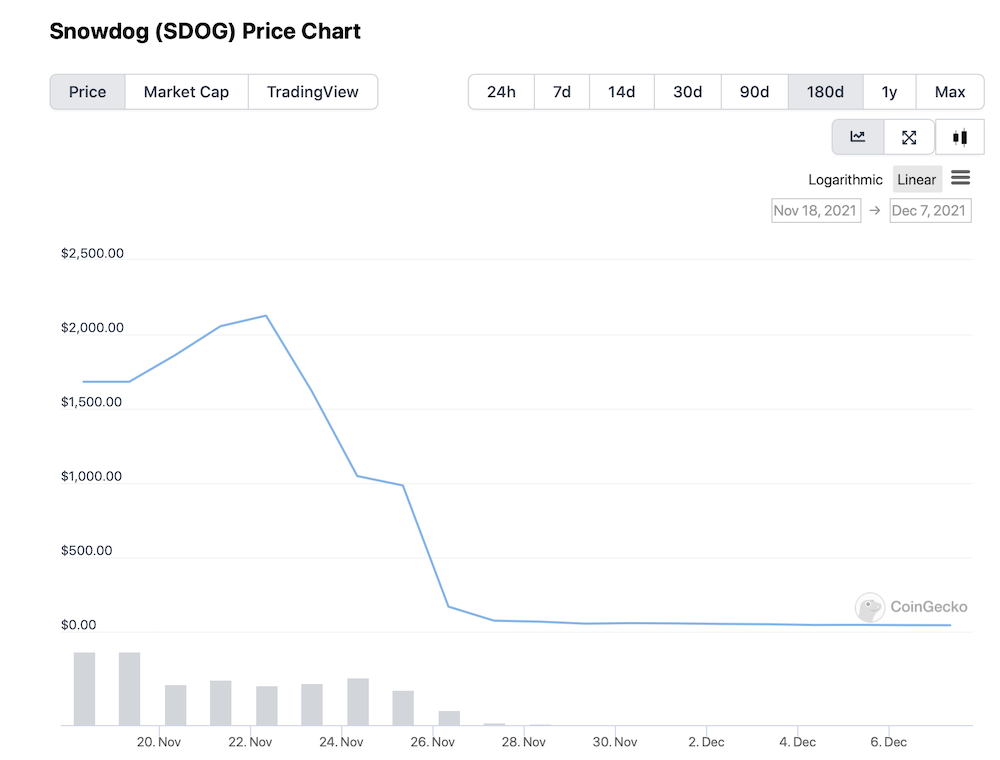

When $SDOG holders eventually were finally able to log into the password protected AMM, they were met with a sharp dump. Two whale wallets had already surpassed everyone, with one selling 187 $SDOG for $10 million dollars, or $54,000 a token.

While most $SDOG holders expected that they were not going to be the first to sell their $SDOG tokens, true frustration came later, when the community realised that the wallets that dumped their tokens were able to do so before the AMM’s password protection was lifted.

Furthermore, these wallet addresses had never before approved the $SDOG contract on Trader Joe, which one would expect them to do if they had no prior insider information. All these pointed to the likely scenario that the SnowDog team had rugged the project.

Since then, $SDOG has been trading at $50, my first ever negative 10x – with $SB’s graph looking quite similar as community trust around both these projects plummeted.

Lessons from SnowDog

- Always DYOR

SnowDog was a strong, albeit expensive reminder to always, always Do Your Own Research. While you can make insane gains in crypto relatively quickly, the same can be said about losing money.

Till now, I had always taken the time to do my own research on projects — whether the developers were doxed, tokenomics, timeframe of the project and so on. But one moment of greed can indeed ruin a lifetime of work and getting rugged helped me refocus my goals and rules when it came to crypto.

- Never Invest more than you can afford to lose

While I did get rugged for quite a bit, I was lucky that I was still level-headed enough to only ape in less than 1% of my portfolio.

While there cannot be any reward without risk, the amount put in should always be relative to the potential pay out. With the insane APYs and short time frame of SnowDog, I knew that if the project succeeded, even a small amount invested would be in immense profit and as such I had somehow managed to allocate accordingly.

- Remember to enjoy the ride

It's not about the money, it's about the rugs along the way.

— DeFiGod (@DeFiGod1) November 25, 2021

Don't be sad it happened, be happy you were apart of it.

With the Crypto markets being 24/7 and my feed being full of daily 2-5x’s, I was beginning to suffer from burnout and major FOMO. While the rug definitely did not help my portfolio, it helped me take a step back, appreciate how far the crypto space has come and re-evaluate my priorities.

While being used as exit liquidity for the first time was not the best experience, I feel that viewing it as a “tuition fee” for the crypto space was worth it. Though stories of being rugged are common, I was always sure that it would never happen to me – and being able to experience one first hand will definitely serve me well in the future.

Featured Image Credit: utoday

Also Read: I Got Rug Pulled and Scammed By A NFT Project, Here’s What I Learnt