As Trump returns to the White House, stablecoin issuers will likely brace for significant changes in the next 4 years. The Trump election could influence the crypto stablecoin market in various ways. In this article about Donald Trump’s return and its implications for the stablecoins market, we will explore Trump’s economic policies and their potential impact on the stablecoin market. Let’s dive in!

First thing first, will there be a crypto-friendly regulatory framework?

When Trump hit the headlines at Bitcoin Nashville in July 2024, he pledged to create a ‘crypto presidential advisory council’ and make America the world’s capital of cryptocurrency. Today, the crucial question remains: will his administration actually champion a crypto-friendly environment for stablecoins in particular?

If Trump fulfils his promise, we will hopefully see his advisory council help shape supportive crypto regulations and increase stablecoin adoption in traditional finance. As a result, there would be more off-ramp options and wider usage of stablecoins in both business and everyday scenarios, further influenced by the Trump election crypto stablecoin policies.

As of now, we have reasons to be positive on this prospect, for Trump has also declared his stance on a relevant yet competing subject: US Central Bank Digital Currency (CBDC).

A Halt on CBDC Efforts

During Biden’s presidency, he raised the possibility of releasing the government-backed CBDC. Trump, however, has taken a strong opposition, describing it as a “dangerous threat to freedom”. Their debates continue to cause repercussions around the Federal Reserve and SEC’s responsibility in policy making and regulation, especially after the failure of Silicon Valley Banks in 2023.

If Trump’s administration decides to halt CBDC efforts, this could benefit existing stablecoin providers by removing a strong competitor from the market. Stablecoin issuers would then have a unique opportunity to fill this gap, driving growth both in US domestic and international markets.

Leverage Lower Interest Rates

Another policy to watch is Trump’s approach to rate cuts. He has reiterated that he would lower interest rates to increase economic growth and improve infrastructure investment.

It’s worth noting that the rate hikes in July 2022 led to a 10% drop in stablecoin capitalisation, according to a study by the European Central Bank. Therefore, if Trump’s policies lead to sustained lower interest rates, we are likely to see potential growth in the stablecoin market.

So far, Trump’s victory seems to only send out positive signs. However, it’s also important to consider the full picture and hidden risks.

Protectionism Adds Uncertainties

Trump is known for his “America First” approach, and we are yet to find out its implications for the crypto industry.

It’s worth noting that Tether, who currently holds over 70% of the stablecoin market share, is not a US company. Additionally, Trump’s stance on immigration may affect stablecoin payments in Central America, where remittances from the US make up over 15% of the GDP in countries like El Salvador, Honduras, and Guatemala.

If Trump’s protectionist policy stretches to the crypto industry, it may cause substantial uncertainties for stablecoin issuers both in terms of changing market shares and demand volatility. On top of that, intensified geopolitical relations will also complicate regional market dynamics.

Geopolitical Conflicts as a Catalyst

As an advocate of US isolationism, Trump’s foreign policy could significantly weaken multilateral collaboration and increase global rivalries of superpowers.

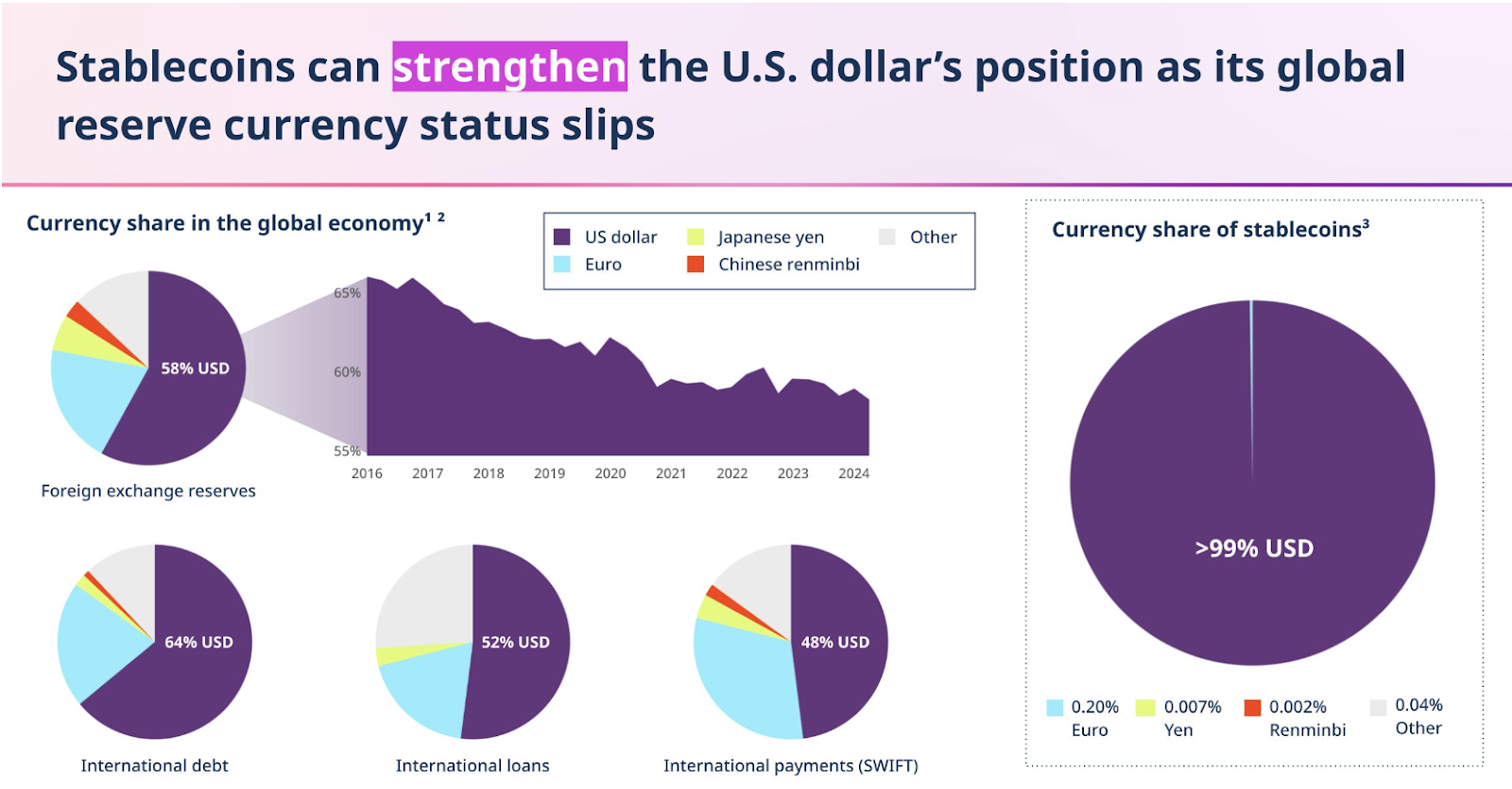

Under this circumstance, the stablecoin market could go both directions. On one hand, rising geopolitical tensions may increase demands as individuals and businesses look for alternative assets or capital preservation. On the other hand, they may cause certain countries to take specific measures against a US-dollar pegged stablecoin solution.

In October 2024 BRICS Summit, Russia proposed a new system named the BRICS PAY. It aims to provide member countries with a new settlement mechanism that solely uses their national currencies and mitigates risks associated with the US dollar. In the context of Donald Trump’s return, this new initiative could further diversify the landscape for the stablecoins market.

Although it’s hard to tell how significant geopolitical factors could become for the stablecoins market, a more volatile future for cross-border payments is likely inevitable.

In Summary

Trump’s economic policies, if implemented, could positively impact existing stablecoin issuers, especially those based in the US. At the same time, his isolationist foreign policy may escalate global tensions, potentially driving up stablecoin demand in countries facing economic or political pressures.

However, Trump’s “America First” approach will likely intensify the competition between US and non-US issuers and influence the role of stablecoins in international remittances.

As his policies unfold in the next four years, the Trump election crypto stablecoin market will likely experience a mix of exciting opportunities and complex challenges amidst geopolitical and economic uncertainties.

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]