Osmosis is probably one of the most intriguing projects that I have been using and researching about.

Firstly, Osmosis is the first IBC-native Automated Market Maker(AMM). It is an advanced AMM protocol built on the Cosmos SDK, which allows developers to build, design and deploy their very own customised AMMs.

(Also Read: Why I Am Investing In Cosmos In 2022, And Why An “ATOMic” Explosion Is Incoming)

Secondly, with Osmosis, cryptocurrency holders of IBC compatible blockchains can seamlessly swap their tokens.

Vision for Osmosis

The core tenets of the Cosmos ecosystem are heterogeneity and sovereignty.

Osmosis takes these values and created a way that allows for the most efficient solution to be reached through the process of experimentation and rapid iteration.

Customizable features

Nothing about Osmosis is hard coded. This is unlike Curve Finance, a stablecoin DEX created to avoid high slippage for high volume transaction, which is a whole new AMM infrastructure built outside of Uniswap to accommodate the feature.

For example, Uniswap only allows the creation of a two-token pool of equal ratio with a swap fee of 0.3%. The simplicity of the Uniswap protocol allows quick onboarding for the average user.

On the other hand, Osmosis allows market participants to self identify opportunities and allow them to react by adjusting various parameters. This also gives Osmosis users the ability to be proactive — ability to make changes when they foresee them coming.

The parameterized inputs would enable the creation of DeFi asset types like options and dynamic fee markets to adapt to market volatility and mitigate impermanent loss.

What makes Osmosis unique?

Aligns liquidity pools, DAO members, and delegator interests

Osmosis is unique within the Cosmos Ecosystem as it aligns LPs, DAO Members and delegator interests with a variety of incentives.

Staked liquidity providers have sovereign ownership over their pools which they can adjust the parameters to fit the current market condition and pool competitiveness.

Also, LP providers would be able to vote to change any pool parameter such as swap fees, token rates and reward incentives.

Liquidity pools are self governing

This feature promotes the core value of heterogeneity which is achieved through an array of customization options.

While most DEX rely on bonding curves, Osmosis allows dynamic adjustments of swap fees, multi-token LPs and custom curve AMMs.

Theoretically, Osmosis can even enable interchain staking — you essentially stake Cosmos and earn Cosmos rewards, along with rewards from other tokens the validator is validating, for example, LUNA/CRO.

Really, the possibilities are endless. You are rewarded for everything else which are linked through ICS for securing the entire network.

From my knowledge, no other blockchain has the technology to do this.

Superfluid staking

In the traditional DeFi industry, token holders face a choice between providing liquidity or generating yield from staking.

Superfluid staking changes the entire game. $OSMO, the governing token of Osmosis, can be used for staking and liquidity simultaneously. This maximizes rewards without having to decide on committing into one option or another.

LPs on Osmosis will earn rewards from providing liquidity and staking whereas other platforms require token holders to make a tradeoff.

Watch Sunny Aggarwal, co-founder of Osmosis, explain superfluid staking below.

Tokenomics of Osmosis

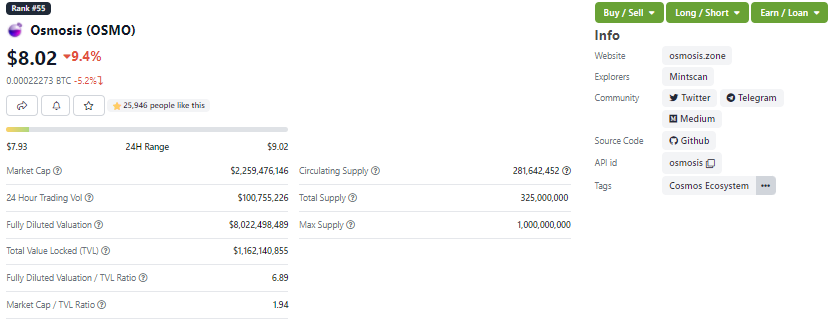

With a market capitalization of US$2.2 billion, OSMO is ranked 55 and currently trades at US$8.02. Its 24h trading volume stands at US$100.7 million with a total supply of 325 million in tokens.

The market cap to TVL ratio of 1.94 simply means the market cap being greater than its total value locked.

In the first year, there will be a total of 300 million tokens released. After 365 days, this will be cut by one third, and thus there will be a total of 200 million tokens released in Year 2.

In Year 3, there will be a total of 133 million tokens released, and so on. This thirdening process will allow OSMO to reach an asymptotic maximum supply of 1 billion.

Since its rally at the start of 2022, OSMO is also trading relatively sideways and down on the (-9.4%) 24h, (-16.2%) 7 day, and (-12.9%) 14 day charts. However, on the 90 day chart, Osmosis is trading in a bullish and upward trend.

Onboard Osmosis using the Keplr Wallet

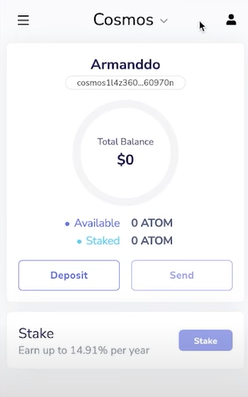

The Keplr Wallet is one amazing thing. The Keplr Wallet is a wallet for inter blockchain ecosystem, probably the most powerful wallet for the Cosmos ecosystem.

Keplr provides the most flexible and versatile account management functionalities for all Cosmos-SDK based blockchains.

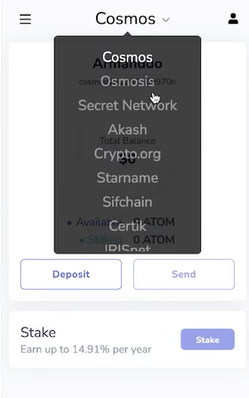

They currently support the Cosmos Hub, Osmosis, Secret Network and many more.

Creating your Keplr Wallet

- Go to Keplr’s extension download for chrome. Click on [Add to Chrome]

2. Then, in following window pop-up, select [Add extension] and it will be automatically added to your Chrome browser.

3. Once the extension is added, you may need to select the ‘puzzle icon’ on the top right of your Chrome browser and then select the ‘Keplr pin’ to have the Keplr icon link be visible in your browser bar.

Staking with your keplr wallet

Staking is simple with the Keplr Wallet. You pretty much just have to sign into your wallet and you would be able to claim your staking rewards directly from the extension tool.

Click on the drop down box your see at the top of the wallet and choose the network you would like to stake in.

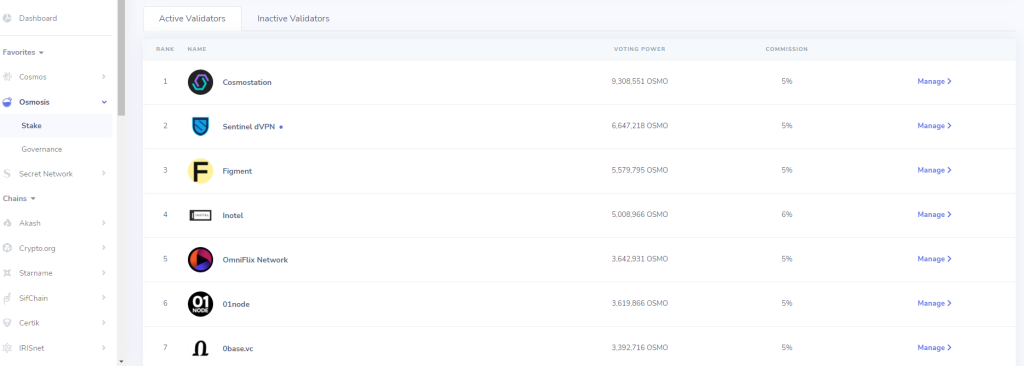

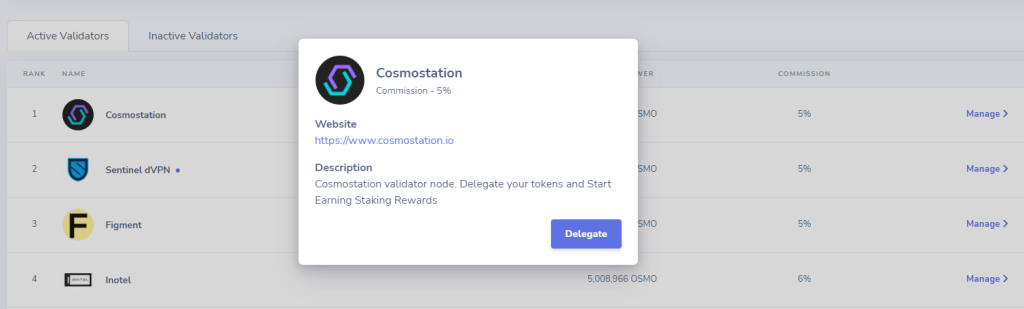

Once you click on ‘stake’, you will be brought to this page were you see a list of validators for your to delegate your tokens for staking rewards.

Personally, the validators that I choose do no exceed the commission charge of 5%, anything more would almost be daylight robbery.

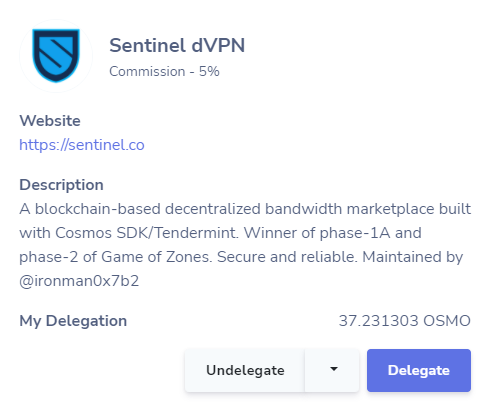

If you would like to find out more on the various delegators, click on “Manage” and you will be given the ability to delegate your tokens or visit the validator’s website.

You my delegate your funds the amount staked along with your staking rewards can be claimed on the Keplr Wallet extension.

Farming on Osmosis

I must say the Osmosis network is super user friendly with a clean and easy to understand interface.

Here, you would be able to do three main things, almost like every other DEX. — Trading/exchanging your tokens, finding pools you want to participate in, and viewing your assets

Trade

Under trade, you would be able to exchange tokens that are on the Cosmos Ecosystem. Notable tokens include $ATOM, $LUNA, $SCRT, $UST and many more. Swapping fees usually cost between 0-0.3% of the transaction.

Pools

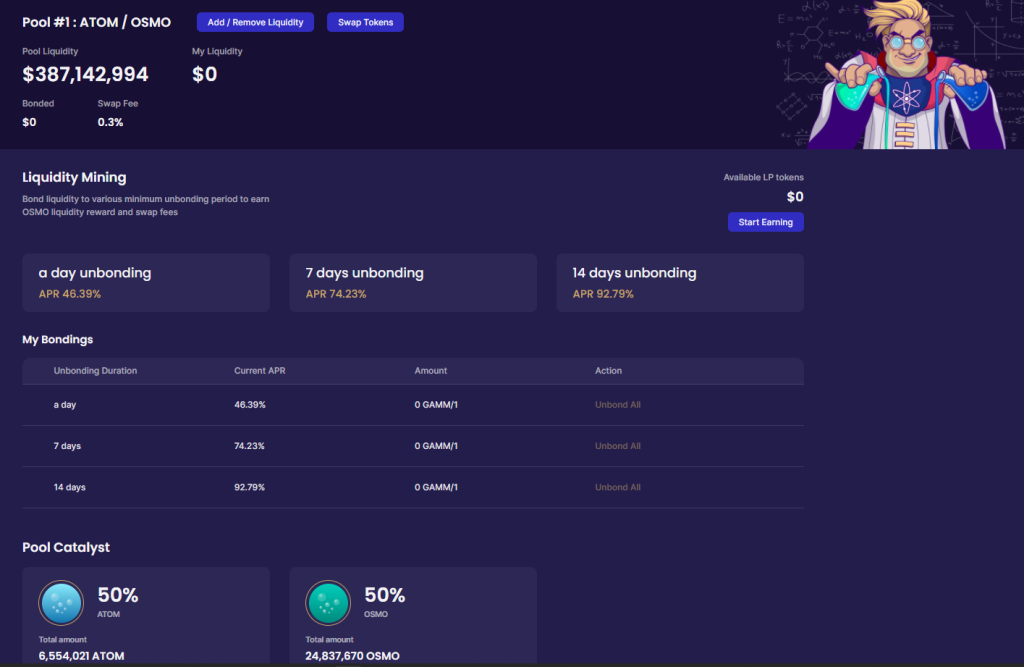

There are hundreds of pools which you may participate in. Most of these pools provide decent APYs and would also display their TVL in the pool liquidity.

Personally, when searching for a pool to participate in, I would find one which strikes a balance between decent returns as well as a good amount of TVL. It is important to note that the higher the value of pool liquidity, the more secure that LP would be.

Osmosis also provides a bonding period where you would be able to get APRs based on the duration of bonding period. The longer you decide to bond your LP tokens, the higher returns you will receive.

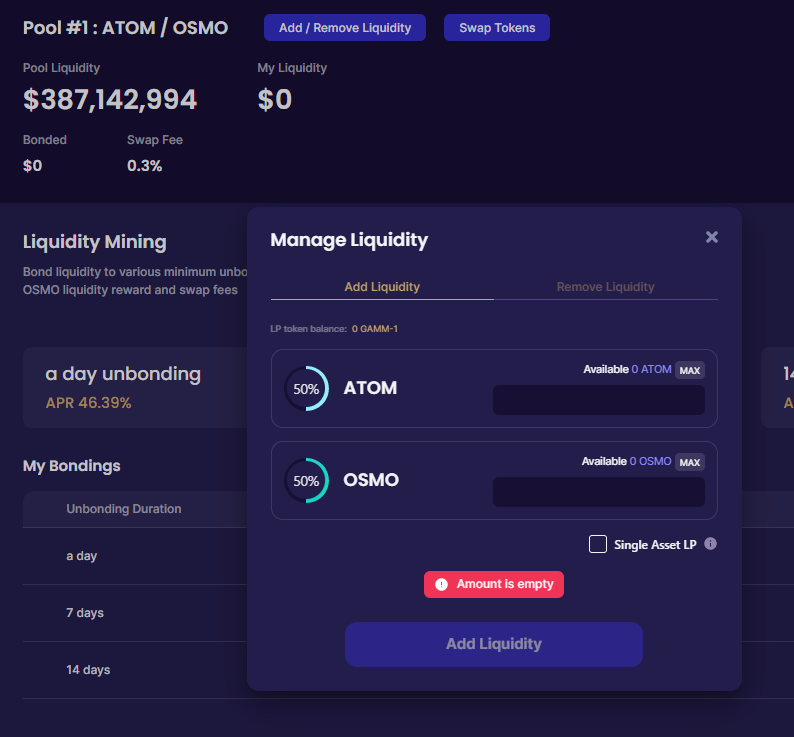

To add liquidity, click on the button at the top and add them accordingly. Take note that you would need to connect your wallet and ensure you have the correct tokens to delegate. Else, go back to the ‘trade’ tab and exchange the tokens you need!

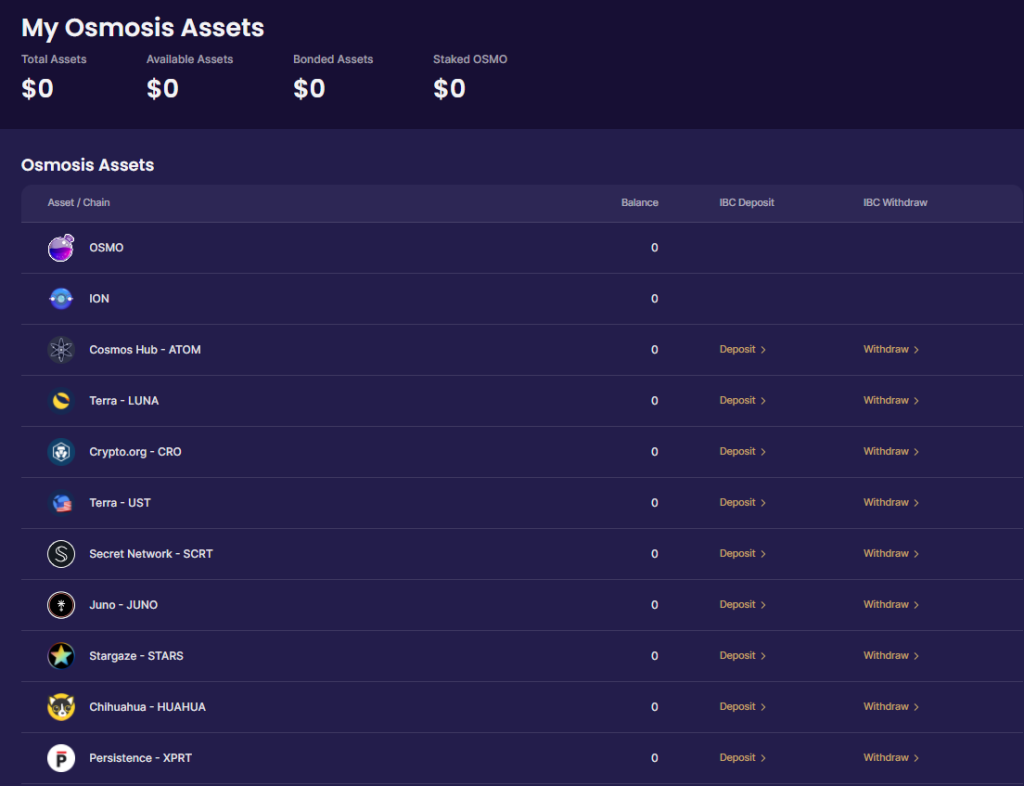

Depositing

One last thing to take note. Other than the OSMO token, every other token in you Keplr wallet has to be deposited into the Osmosis network.

To do so, head over to the “Assets” tab on the left and you will be greeted by all tokens which are on the Osmosis network.

To deposit the tokens into the Osmosis Network, click on deposit for the tokens you wish. From there you would be able to see the funds appearing on the osmosis network.

My Strategy

Here is my strategy for investing in the Cosmos Ecosystem. It has to be noted that I am bullish on the cosmos ecosystem and I would be holding them for a long period of time.

Firstly, majority of my $ATOM and $OSMO tokens are being staked on the keplr wallet. Rewards I get from staking would be funnelled into my ATOM-OSMO LP pool to maximize my returns. This way, my exposure to impermanent loss would be lesser and my tokens are very much more secure being staking in the keplr wallet.

My approach is rather a conservative one, if you happen to be a risk loving investor on the Cosmos ecosystem, I encourage you to look out for other networks like $JUNO and $SCRT and participate in their liquidity pool.

Final Thoughts

The Osmosis arm in the Cosmos ecosystem is one of, if not the most important. It provides liquidity and with its non hard coded nature, it gives flexibility for developers to full customize features they may want.

Osmosis also connects all the networks within the Cosmos ecosystem as a AMM and provides liquidity for each pairs.

However, Osmosis is still an AMM laboratory. It will become clearer over time how the token model needs to evolve to best support the needs of the project. The Osmosis Labs development team already has features in development that are expected to further impacts on the optimal token model design.

What Osmosis is offering is something no other projects can. By combining the rewards from LP and staking, it removes any trade off for users to choose either or. They have the investor’s best interest in maximizing and generating value gives me a strong reason to keep my eyes peeled for Osmosis in 2022.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief

Also Read: An Introduction To The Cosmos Ecosystem And Its ATOM Token