Introduction to the Mirror Protocol (Mirror)

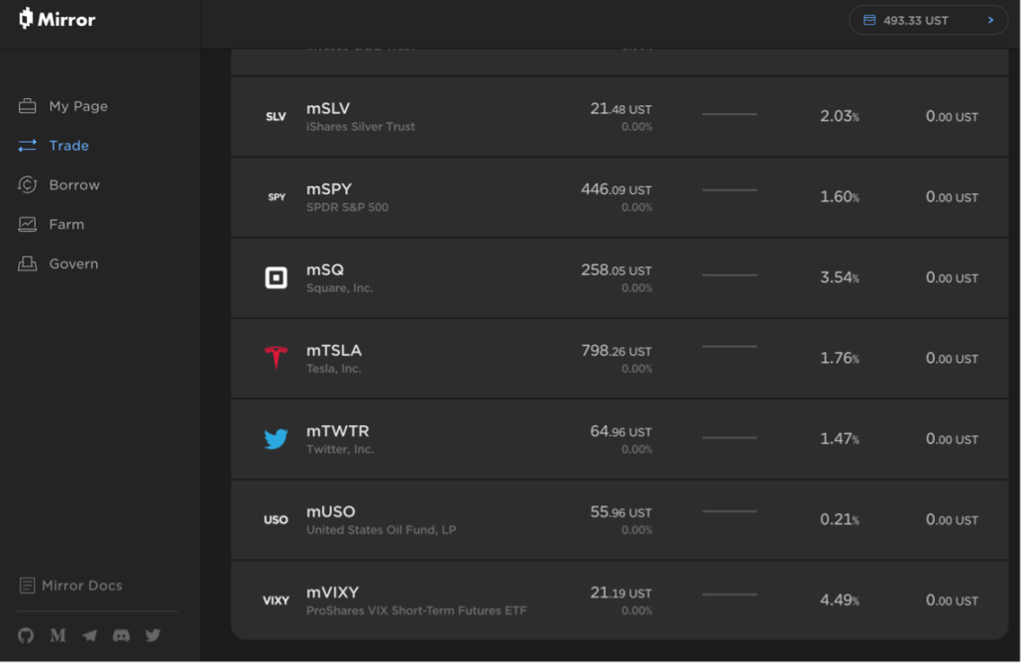

Mirror is a DeFi protocol created on the Terra network. Like its name suggests, Mirror enables the creation of synthetic assets called Mirrored Assets (mAssets) that ‘mirror’ their corresponding real-world assets.

Cryptocurrency-based synthetic assets are derivatives of real-world assets, and may be compared to traditional financial derivatives which derive their value from other underlying assets (such as stocks, bonds and precious metals).

The difference is that these synthetic assets are created on the blockchain and catalogued through tokenization; the process of issuing a digital token representing the real-world asset on the blockchain. Unlike traditional derivatives, mAssets are also purely synthetic and is meant only to track the price of real-world assets.

These mAssets allow traders to be exposed to the price movements of these assets without having to own them. Each mAsset is backed by collateral, where the minter must lock up at least 150% of the asset’s current value in UST.

The mAsset’s price is set via a decentralized price oracle such as Chainlink and is updated about every 30 seconds to track real-world prices.

When the price of the mAsset deviates significantly from the oracle price, arbitrage traders are then incentivized to take advantage of this price difference by purchasing or selling the mAsset. This process brings prices back to equilibrium and ensures that the on-chain price is always pegged to the oracle price.

Since its launch, Mirror has seen strong growth. Currently, the Total Value Locked (TVL) in smart contracts on Mirror is around 1.6 billion UST and the total value of all mAssets is around 425 million UST.

What are the advantages of synthetic assets?

As a decentralized stock exchange, Mirror represents one of the core use cases of DeFi. There are numerous advantages to synthetic assets.

First, there will be enhanced accessibility because individuals from anywhere in the world who may not be able to own traditional assets due to geographical barriers can now own and transact these mAssets on the blockchain.

Second, tokenization means that assets can be divided into as many units as desired and this allows for fractional ownership of the mAssets. While fractional ownership is being offered in traditional stock exchanges, the blockchain is able to offer fractionalization in a far more efficient manner.

Lastly, DeFi eliminates the need to rely on a middleman to settle transactions and this allows for 24/7 permission-less trading.

Yield farming on Mirror

i. What is yield farming

Yield farming, also referred to as liquidity mining, is a way to generate rewards by contributing to a liquidity pool. In return for providing liquidity to the pool, liquidity providers are rewarded by the Defi platform.

These rewards come from fees generated by the platform when users lend, borrow or exchange tokens. A simple way to think of it is as a money exchange.

In return for providing liquidity to the USD-SGD pool, the money exchanger collects fees from the customer when he exchanges USD for SGD. In Defi, anyone can be the ‘money exchanger’ and earn rewards by contributing to the liquidity pool. Depending on the mAsset chosen, Mirror currently offers yields of 20-40% APR for liquidity providers.

ii. Step-by-step guide to yield farming on Mirror

To start yield farming on Mirror, you would first need to have UST in a Terra Station wallet.

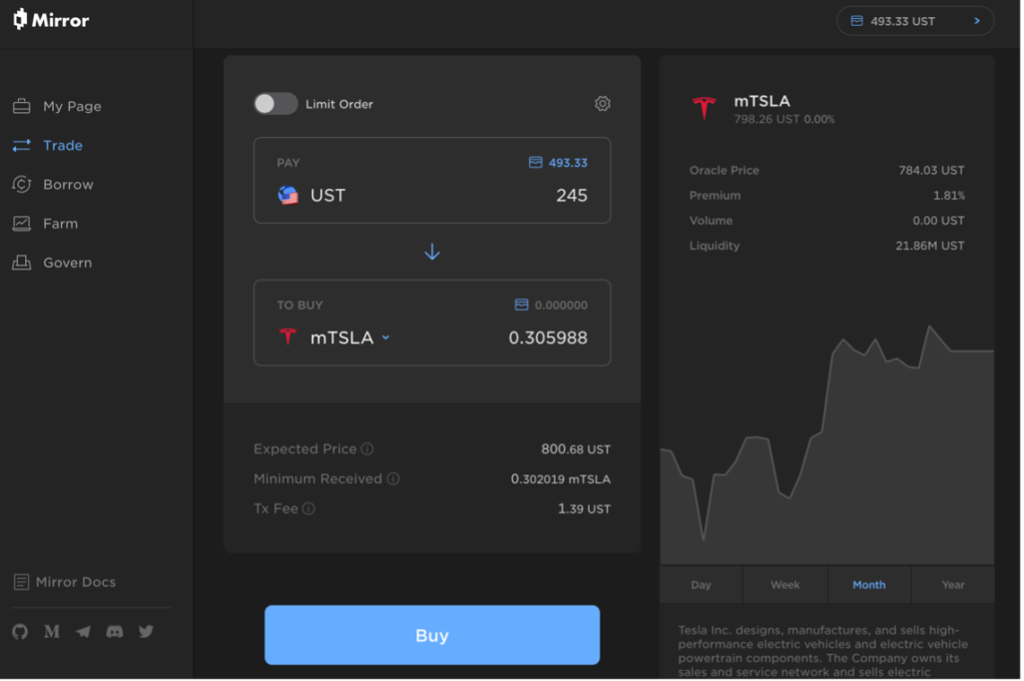

Step 1: Go to Trade and buy your selected mAsset with UST. Ensure that you have sufficient UST left after buying your mAsset as you will have to stake the mAsset and UST in a 1:1 ratio. In this example, I purchased around 0.3 mTSLA with 245 UST.

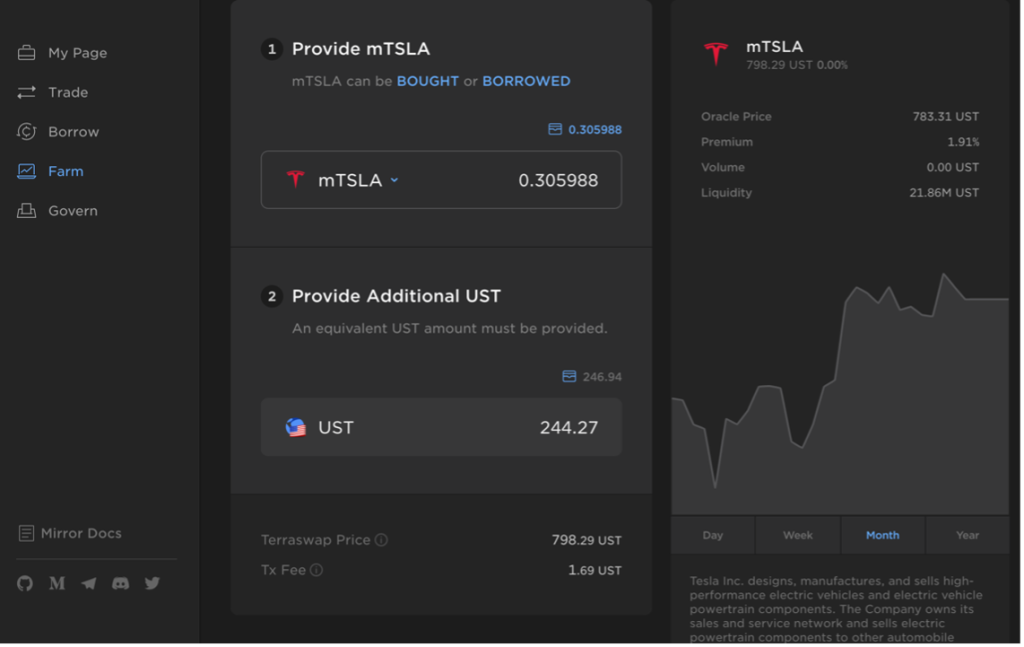

Step 2: Go to Farm and select the mAsset you wish to provide liquidity for. You will be required to provide, in UST, the equivalent value of the mAsset. Your rewards will be paid out in the form of Mirror tokens (MIR).

BONUS: Borrow UST on Anchor to farm on Mirror

You can also borrow UST on Anchor and yield farm on Mirror. To do so, go to Anchor and put your bonded Luna (bLUNA) down as collateral to borrow UST. You may get bLUNA by bonding your LUNA to bLUNA on Anchor, or by swapping your LUNA for bLUNA on terraswap. The borrow amount can be specified by selecting the loan’s target LTV (loan-to-value) ratio. Thereafter, head over to Mirror to yield farm.

NOTE: While this allows you to leverage your LUNA tokens and farm on Mirror to generate additional yield, you should bear in mind the risk of liquidation should the price of LUNA drop below your liquidation price. Do pay close attention to your LTV ratio to ensure that it does not exceed the max LTV ratio of 50%.

That said, with the current net APR (Distribution APR – Borrowing APR) at around 10%, you are essentially being paid (in Anchor tokens) to borrow UST on Anchor. If liquidation risk is properly managed, borrowing UST on Anchor is a good way to put your LUNA tokens to work while also earning additional rewards on Anchor.

Risks of Liquidity Mining: Impermanent Loss

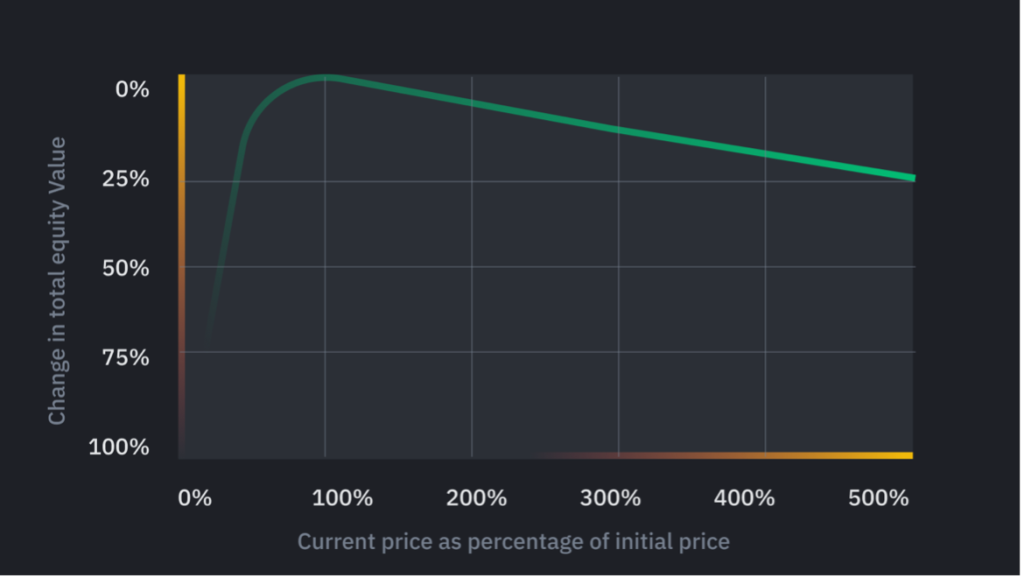

Anyone who takes part in liquidity mining should familiarize themselves with the concept of impermanent loss. In short, impermanent loss measures how much you would have been better off by simply HODLing the asset rather than participating in the liquidity pool.

This occurs when the price of your mAsset changes compared to when you deposited them. The bigger the change, the more the impermanent loss. However, this can be counteracted by the rewards you earn by participating in the liquidity pool.

Conclusion: should you farm on Mirror?

Yield farming as a liquidity provider for mAssets on Mirror is merely one of the many ways to generate income on the Terra ecosystem. Aside from providing liquidity for mAssets, Mirror also allows you to provide liquidity for MIR tokens or stake the MIR tokens.

Mirror’s main value proposition is to enable you to generate passive income from assets that you would otherwise be holding on a centralized exchange without any yield.

If you believe that the asset you are HODLING will be trading sideways or will not increase in price significantly for a foreseeable period, your impermanent loss is unlikely to be significant and you may be better off HODLING your assets in a liquidity pool on Mirror instead to earn yields of around 30% APR.

Featured Image Credit: Mirror Protocol via Medium

Also Read: Terra (LUNA): How To Earn Upwards Of 19% Annual Percentage Yield With DeFi