Over the past few weeks, the crypto world was shaken by the sudden collapse of the Terra ecosystem.

Terra’s algorithmic stablecoin, UST, depegged and lost its dollar parity, while LUNA’s value dipped close to zero.

Terra’s founder Do Kwon argued that “Terra is more than UST”, and came up with a Terra Revival Plan.

The vote for the final proposition ended on 25 May 2022, with 65.5% of those who voted approving the proposition. 20.98% abstained from voting, and 13.20% rejected it.

This thus kickstarted the creation of the new Terra blockchain.

Recap on Luna 2.0

- The new Terra 2.0 will not share any history with Luna Classic (The Old Luna )

- Luna 2.0 will be a genesis blockchain starting from block 0

- New Terra will be without any algorithmic stablecoin

- DApps or assets from the old chain (Terra Classic) will not pre-exist on Terra (as they would in a fork), & will therefore need to migrate.

- New $LUNA is planned to be airdropped to various stakeholders

1/ Recently, a few community members (including some from TFL) have referred to the proposed new blockchain in Prop 1623 as a “fork” as opposed to a genesis chain.

— Terra 🌍 Powered by LUNA 🌕 (@terra_money) May 23, 2022

Note: The revival plan is not proposing a “fork” of the existing chain, but rather the creation of a new one 🧵.

From this day on, the current LUNA token will be renamed LUNC, while the new LUNA 2.0 token will assume the ticker LUNA.

Holders of LUNC (Luna Classic), USTC (UST Classic), and aUST (staked UST on anchor) will be airdropped LUNA tokens from the new chain.

Who can get the LUNA 2.0?

While the test-net has been live for LUNA 2.0, and the main-net will be activated on 27 May 2022. Airdrops to stakeholders will begin when the main-net goes live.

The amount of tokens you will receive will be dependent on two requirements. Firstly, the types of token you hold on the old Terra chain (Terra classic) and secondly the time period you hold the tokens in the pre and post-attack snapshots.

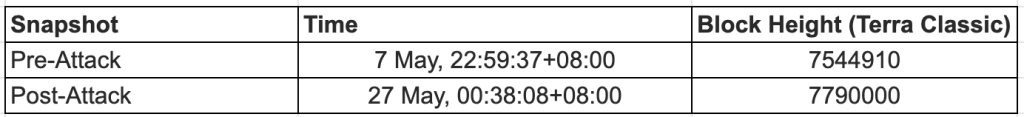

The time for each snapshot can be seen below.

At the Pre-Attack snapshot, hold:

- LUNA (including staking derivatives)

- Less than 500k aUST (UST deposited in Anchor)

And/or at the Post-Attack snapshot, hold:

- LUNA (including staking derivatives)

- UST

The distribution and vesting of airdropped LUNA depends on the wallet’s token/asset type & quantity, as well as the snapshot it exists in.

When will the LUNA airdrop occur?

The first airdrop date will occur on May 27, 2022. “At Genesis, 30% of the LUNA airdrop will be immediately available to Pre-Attack users with wallets that had less than 10k LUNA (including staking derivatives) or deposited UST in Anchor, and Post-Attack users with any quantity of LUNA (including staking derivatives), UST, or both.”

The remaining 70% is to be issued over a 2 year 6 months cycle. Users will start to receive the rest of their airdrop after 6-months at around 3.9% per month.

Vested LUNA

All airdropped tokens will be automatically staked to Terra validators to “preserve network security.”

Users also have the option to un-delegate, redelegate, and delegate their LUNA while it’s vesting and being staked. This ensures users have final call over which validators their vested LUNA is staked with.

“Users will earn staking rewards on their vesting LUNA starting from the point at which it is staked, and can claim these rewards at any point.”

Non-vested LUNA can be removed at any point. However, vested LUNA will be staked according to the above schedule of a 6 month cliff cycle at a 3.9% per month. However, it does appear that investors will still be able to claim their rewards at any point.

Cliff- Users will start to receive the rest of their airdrop after XXX amount of months at around XX% per month.

Regarding vested LUNA, “if a user would like liquid LUNA as soon as their cliff hits, they’ll need to undelegate their staked, vested LUNA at least 21 days before the first day of their cliff.” Alternatively, they can keep their vested LUNA staked to continue to earn staking rewards.

Bridged LUNA will be expected to be distributed at a later date.

LUNA tokens that will not be included in LUNA 2.0

Any LUNA currently held in the bridge contract will be set aside “as part of the community pool for distribution after the chain launches.”

For investors who hold LUNA bridged off of Terra, such as Wormhole, may wish to convert into LUNA tokens before the snapshot.

Medium outlined assets where airdrops will not be available for below

UST or LUNA bridged off of Terra

- Users with bridged UST or LUNA who would like to be included in the Post-Attack snapshot need to bridge back to Terra before the snapshot is taken.

UST or LUNA on Terra protocols that cannot be easily identified

- All protocols listed on DeFi Llama here will be covered, in addition to a few others that are known.

UST or LUNA on CW3 multi-sig contracts

- Most UST and LUNA in CW3 multi-sig contracts will be accounted for, but there could be edge cases that may not be included.

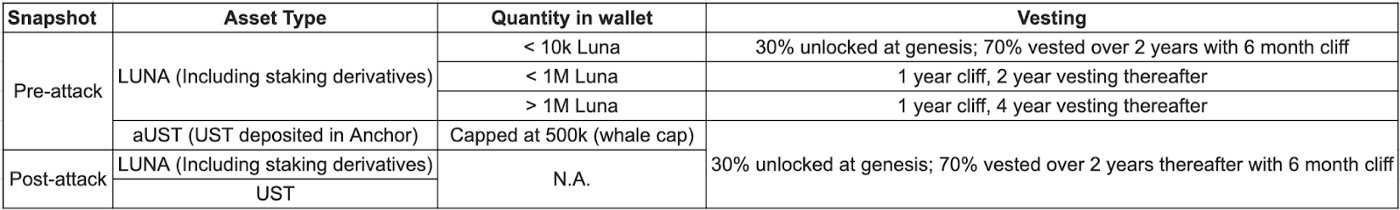

Supported tokens, exchanges, and chains

You may find the table above for a more comprehensive overview of the LUNA 2.0 airdrop.

There is a snapshot on 26 May on various CEX (Binance, Huobi, Bybit, Bitrue, Bitfinex, Kraken, FTX, Gate.io, OKX, and Bitget) where LUNA holder investors will be airdropped.

Will Terra succeed on its second try?

In my opinion, one of the main drivers in the success LUNA was its value proposition with the former algorithmic stablecoin, $UST. Without that aspect, what’s the value proposition of LUNA 2.0 now?

Considering it’s foundation being a Layer 1, they fall behind their competitors right now who has been focusing on developing infrastructure like Avalanche’s Subnets or IBC of Cosmos.

The need for something huge in their value proposition for LUNA 2.0 is necessary for their reversal.

I would also like to know how developers on the Terra ecosystem are feeling right now. It is highly plausible that their conviction on Terra is being stretched and tested in current times.

Could we also see an outflow of developers in the Terra ecosystem? If so, which blockchain will they move to?

“It’s a cycle of life, you begin from nothing and go back to nothing”. This did not age well though it may have been taken out of context.

We also have to talk about LUNA 2.0 being a fresh chapter for Terraform Labs. I am all in for projects to fail before its succession and Luna took the bait for the entire crypto industry at the expense of its investors.

However, in the past year, Terra was able to build a strong ecosystem and community. An ecosystem with various components of DeFi, AMMs, DEXs and lending and borrowing applications and the a strong support from the community which could be the main driver in tiding the project through this very big storm.

Also, they are one of the few layer 1s which network has not experience a shortage, their robust infrastructure is essential for the future of Luna 2.0.

Airdrops might not be enough but sufficient in the short term, I would want to see how LUNA 2.0 plays out with their offering as a project to investors before making any investment decision.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief

Also Read: “Terra Is More Than UST”: Will Do Kwon’s Revival Plan Save The Terra Chain?