Overview of Defi, Terra and UST

DeFi, or decentralized finance, is loosely described as a mechanism where people can become their own banks to lend and borrow money peer-to-peer, instead of going through traditional banking system. This alternative finance ecosystem leads to two main benefits:

- Lenders can achieve much higher interest rates on their deposits than through traditional methods like banks

- Borrowers do not have to go through a long verification process as their loans are often over-collateralized (They deposit more money than they borrow and in the case of a payment default, the system simply uses their deposit to cover the amount owed.)

Terra capitalizes on the DeFi system through its Anchor Protocol by allowing users to lend and borrow UST (TerraUSD).

A great opportunity for people to earn interest on their stablecoins, lenders benefit regardless of whether the market moves up, down or even sideways. A common alternative to earn through interest rates is providing liquidity, which carries the risk factor of impermanent loss (simply put — losing value from your initial investment due to the price of one cryptocurrency moving much faster than the other).

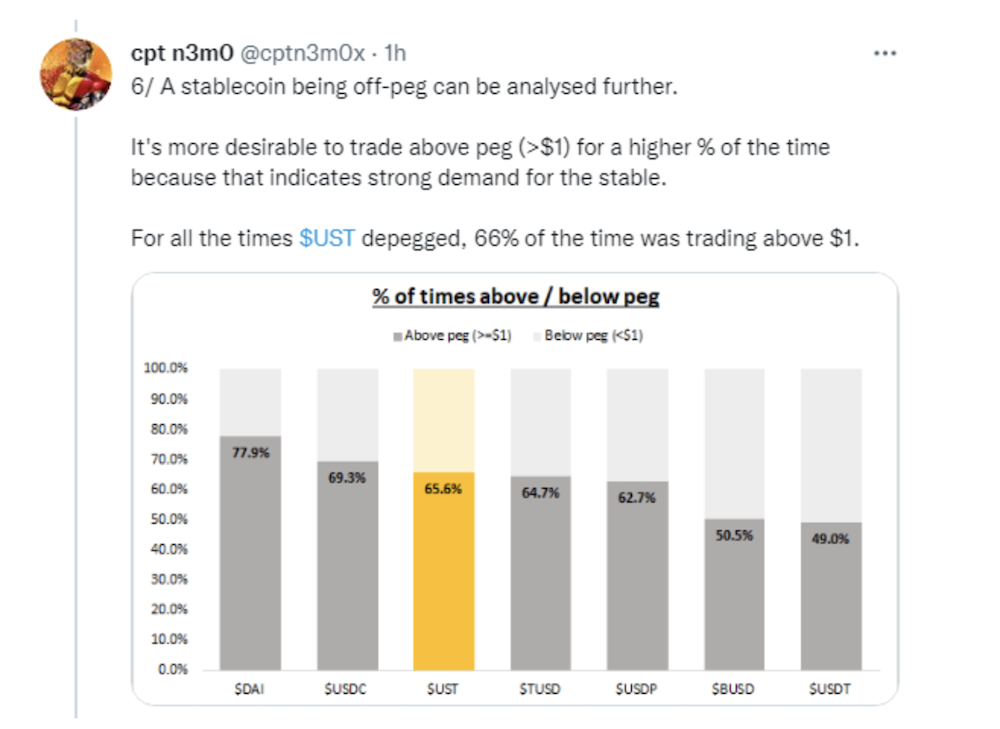

Terra’s seigniorage mechanism and large amount of use cases for its stablecoin ensures that UST remains pegged to the US Dollar, avoiding a situation similar to the recent iron-finance run, which left many investors holding the bag.

To find out more about Terra’s dual-token system and how they are running ahead of competitors, you can check the link here.

Why Terra

Most participants in DeFi are here to achieve the largest return on investment while also ensuring its safety.

As we convert our fiat to stablecoins, we look to earn money from that and not the LUNA token increasing in price — therefore we look at the APY (Annual Percentage Yield) on investment.

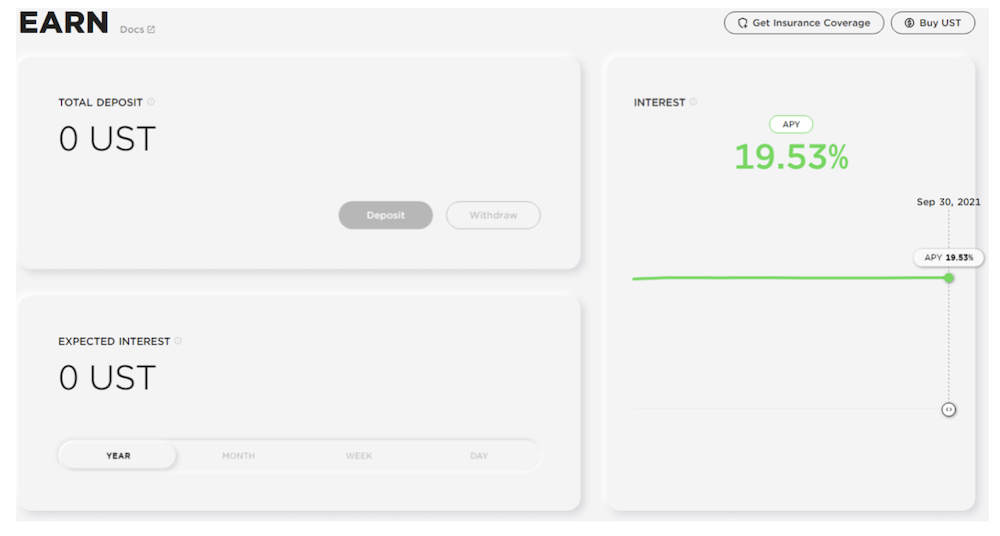

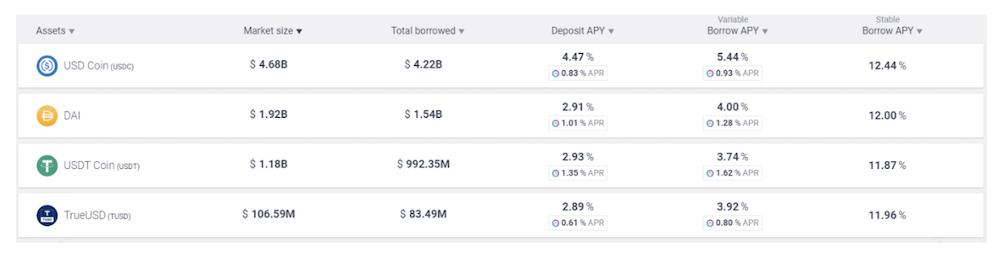

On top of its easy-to-use interface, Terra’s system currently boasts a 19.53% APY, much higher than alternatives such as Dai (2.91% APY) and USDC (4.63% APY) on Aave at the time of writing.

Of course, all these are leaps ahead of traditional bank interest rates, which rarely go above 0.050% PA for most local banks. Terra keeps their deposit APY high through staking derivatives such as forfeiting the borrower’s over-collateralized proof-of-stake rewards, which go towards the lender.

Furthermore, the Anchor protocol manages to retain an attractive 12.14% net Borrow APR (Annual Percentage Rate), which means you actually get paid to borrow UST using bLUNA (Bound LUNA), which you can deposit and earn interest on once again to exceed 20% APY! Either way you’re using the protocol, you’ll most likely be earning money.

How to generate APY by lending on the Anchor Protocol.

For this tutorial, you’ll need an Ethereum address and have to be holding some Ethereum for GAS fees, usually both done through the MetaMask wallet. Check this page out if you haven’t set one up yet.

1. Obtain a Terra Station wallet

Much like MetaMask, the Terra Station wallet is a web extension that allows you access the Anchor protocol and Decentralized Applications on the Terra blockchain. There are also ledger-supporting options available.

Once you have the extension installed, simply set it up the same way you would with a MetaMask wallet (Remember to copy down your seed phrase somewhere!)

2. Funding your account with UST

Though the Terra interface is relatively simple to use, getting UST is not the simplest of tasks, due to it being built on the Terra Blockchain while most wallets are built on Ethereum, and therefore requires some form of bridging. Though this may take awhile and incur some costs, earning about 20% APY is almost always definitely worth the time and money invested.

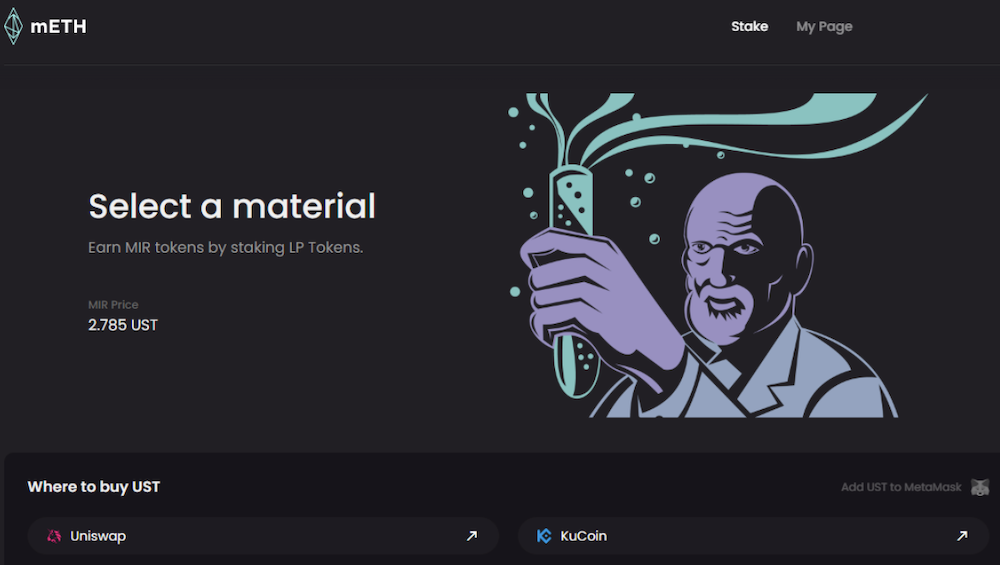

To start, head over to this page and connect your MetaMask wallet. After which, select the stake tab which will bring you to this screen.

You can choose to purchase UST from either the UniSwap page or the KuCoin exchange, depending on which you are more comfortable with. This UST will then show up on your “My Page” tab.

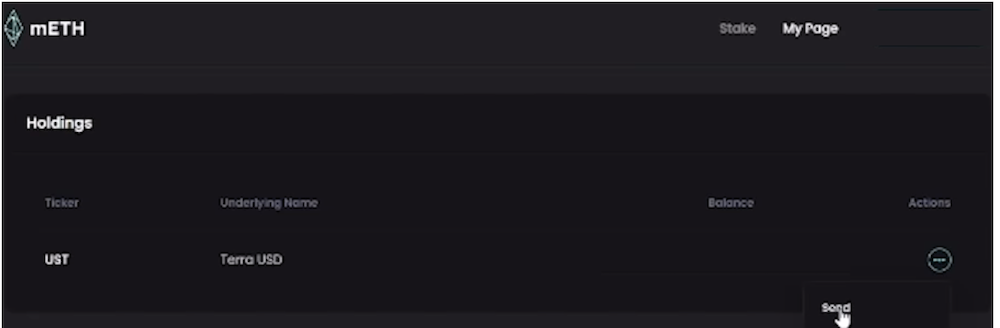

Under the actions column, select the three dots and press “send”, promoting you to send your UST into an Ethereum or Terra address. In this case, we will be sending it into our Terra wallet we set up earlier, by copying the address (which should start with terra1) at the top of our Terra Station browser extension when we open it.

Once you input the address and amount, press send and it should take your to the MetaMask extension for you to approve the transaction. Make sure you have some Ethereum for the gas fee!

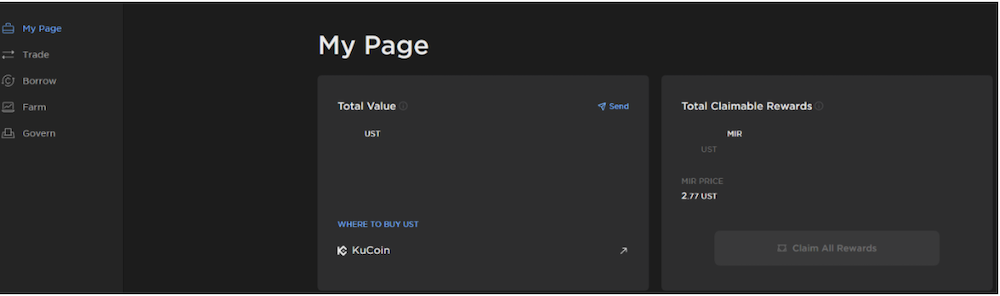

Now that we are done with the Ethereum side, head to this link and connect your Terra Station wallet. Head over to the “My Page” side to double check that you have the appropriate amount of UST deposited.

3. Start earning interest

Once done, head over to the Anchor Protocol App and connect your Terra Station wallet at the top right-hand corner.

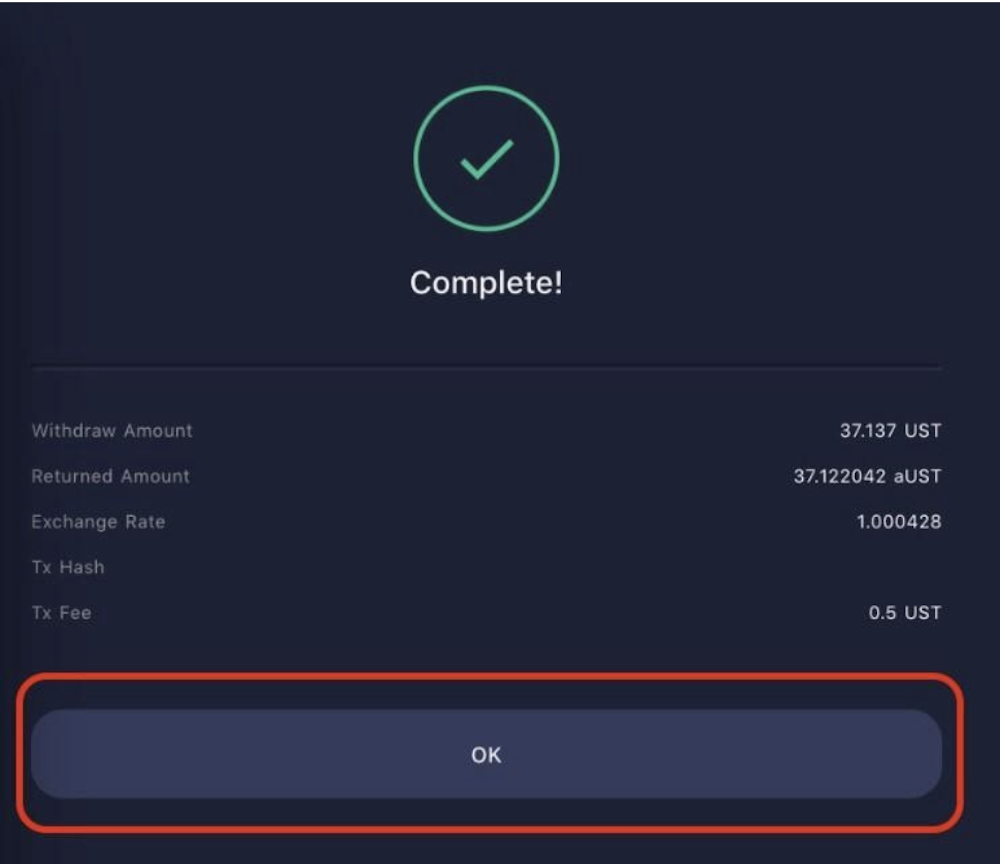

Making sure you’re on the earn tab, click deposit, and enter in the amount of UST you would like to lend out and press proceed, once again confirming the transaction on the Terra Station Wallet and you should see this screen once everything is complete.

Take note that your tokens will be deposited as aUST instead of UST, which is a wrapped version of UST, and therefore you will not be depositing exactly the same amount of UST. aUST is a special token that is created to calculate interest and carries essentially the same value as UST.

I’m Done! Now what?

That’s the good part about Defi protocols, especially a secure one like Terra. Whether the market goes up, down or sideways, you will be earning roughly 20% APY on your stablecoins and will not have to worry about it.

Just wait around and collect your profits whenever you see fit from the withdraw button. If anything, you can take the time to explore the borrow options on the Anchor Protocol and see if you can earn additional profits from there. Happy lending!

Featured Image Credit: CoinMarketCap

Also Read: An Introduction To Terra (LUNA): Is It The Next Big Crypto Ecosystem?