The bear market is a difficult landscape for new projects to launch and navigate in. Two renowned investors, Wangarian (Darryl Wang) and Jason Choi from prominent crypto firms have decided to launch Tangent, which is a collective of successful founders and operators in crypto.

So what exactly is Tangent and who is involved? Let’s find out.

Different from the rest

What really differentiates Tangent from other Web 3.0 funds in the space?

As an angel collective, Tangent provides the following structure:

(An angel investor also known as a private investor, seed investor or angel funder is a high-net-worth individual who provides financial backing for small startups or entrepreneurs, typically in exchange for ownership equity in the company.)

- Does not take VC funds or outside capital

- Will only take a maximum of 3% of token supply and/or equity

- Only funds and advises 5 protocols per quarter

- Hands-on help and advice from founders and builders with good experience

The founders and builders in the angel collective have quite a polished background. Let’s take a look.

Who Is In Tangent?

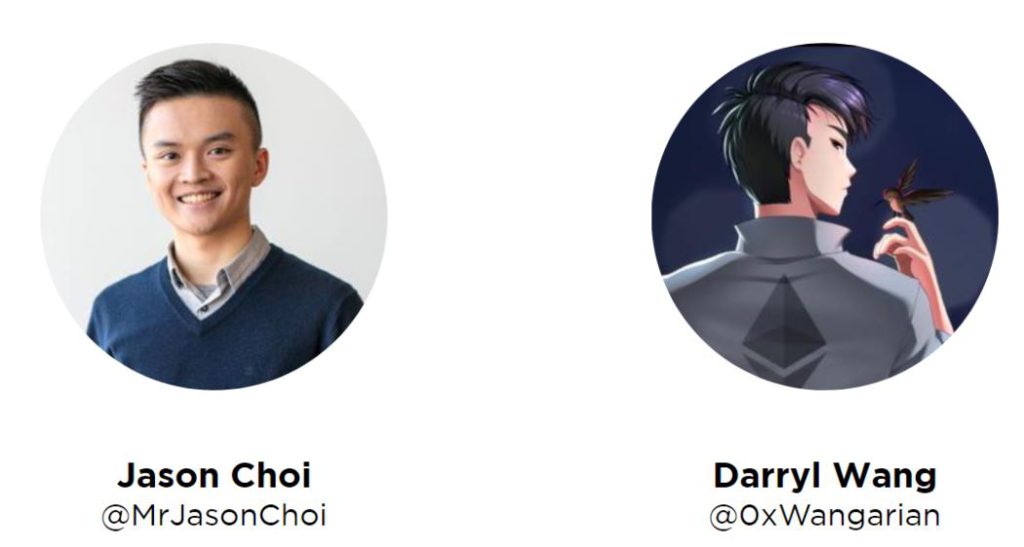

The two founders of Tangent are Darryl Wang (commonly known as Wangarian), ex-Defiance Capital, and Jason Choi, former GP of Spartan Capital.

Wangarian was also featured in our Twitter Spaces in May to discuss his thoughts on the LUNA and UST depeg collapse, alongside Darius Sit from QCP Capital and Tascha Che from Tascha Labs.

Also Read: “UST Is A Done Deal,” — Key Insights From Luna Crash Debrief With Insiders

Jason Choi, who has been a crypto investor in 2018, also runs a podcast, Blockcrunch, which features some of the biggest names and projects in the crypto space.

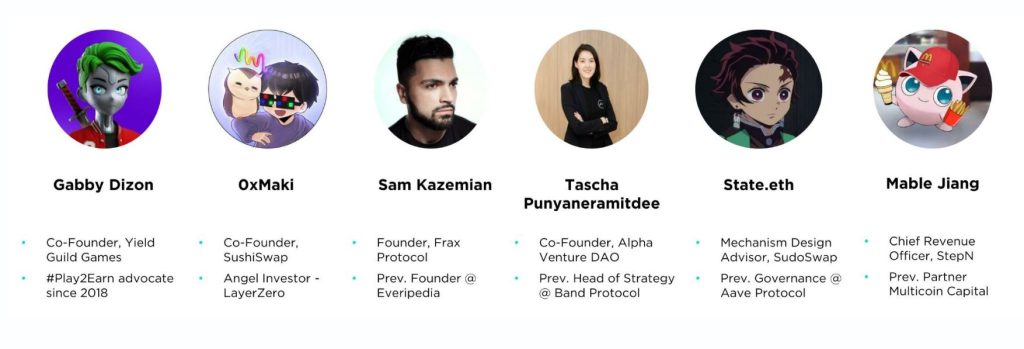

The Advisor board in Tangent is stacked with ex-founders with great credentials in building the space as well. They feature the following:

Some of the big projects the Tangent advisory was involved in include Aave, the largest DeFi lending platform in crypto, StepN, the viral Walk-2-Earn hit, Yield Guild Games, a gaming guild for GameFi, as well as LayerZero, an Omni-chain interoperability protocol.

This might not matter much to retail investors in the short term, but it is certainly a breath of fresh air for projects that are looking for advisors to scale and build their projects sustainably and successfully.

Also Read: Is Crypto Here For The Long Run? 5 Takeaways From Billion Dollar VC Firm a16z

Building a better future with Tangent

One of the key goals of Tangent is to be the most “value-add investor per dollar”. Offering friendly token vesting terms to new projects, as well as a strong advisory team are some of the more unique things that Tangent is focused on.

Building projects in the Web 3.0 space is a different beast compared to traditional industries.

Furthermore, in a bear market, it is very difficult for teams to continue building and scaling as sentiment, funding, and general on-chain activity starts to slow down. Needless to say, many might be put off launching a new project in these conditions as well.

However, if nobody dares to build or dream in the bear market, how can the industry move on? Wangarian and Jason’s new vision may play a part here.

It is no surprise that this new angel collective is stringent in its requirements and is only looking for high-conviction bets every quarter. Those that make the cut might just receive some of the best service, advice, and funding that Web 3.0 veterans have to offer.

Will the Tangent collective be successful in seeding the Web 3.0 industry? Which projects will make their cut? In the depths of the bear market, it seems that the angels have slowly started to speak.

Also Read: Is DeFi A Dead Wasteland? What Is Needed For A Revival

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]