Binance, one of the world’s largest cryptocurrency exchanges, announced last week that users in Singapore would no longer be allowed buy and trade cryptocurrencies on its main platform, to comply with local regulations.

From October 26, Binance users in Singapore will no longer be able to deposit fiat currencies, or buy or spot-trade cryptocurrencies on the platform, Monday’s statement said. Users have been given one month to withdraw their fiat assets and redeem their tokens.

As a person who optimizes my digital assets as much as I can, I took the opportunity to research and find out where should I migrate my cryptocurrencies to.

Before that, here’s a look at the cryptocurrencies I hold again as previously shared:

| Crypto | Allocation | Where are they currently held |

| Ethereum | 30% | Hodlnaut |

| Arweave | 15% | Binance |

| Terra | 15% | Terra Station |

| Algorand | 10% | Binance |

| Avalanche | 5% | Binance |

| FTT | 5% | Binance |

| Cosmos | 5% | Binance |

| Lukso | 5% | MetaMask |

| SAND | 3% | Binance |

| One | 3% | Dex |

The easiest way to migrate your digital assets is to move it from Binance to another centralized exchange. Some of the popular centralized exchange choices include Kucoin, FTX and Huobi.

Here is a comparison between Binance and the 3 exchanges mentioned:

| Exchanges | Trading Pairs | Fees | Others |

| Binance | 386 | 0.1% | No spot trading for Singaporean |

| Kucoin | 465 | 0.1% | Many trading pairs Somewhat bad reputation |

| FTX | 261 | 0.06% | Low fees but lower trading pairs. |

| Huobi | 356 | 0.2% | Higher trading fees Has office in Singapore |

While it should be relatively straightforward to migrate all your assets from Binance to let’s say FTX to enjoy the lowered fees, there are certain nuances if you hold multiple cryptocurrencies as the exchange you choose may not be able to hold your cryptocurrencies.

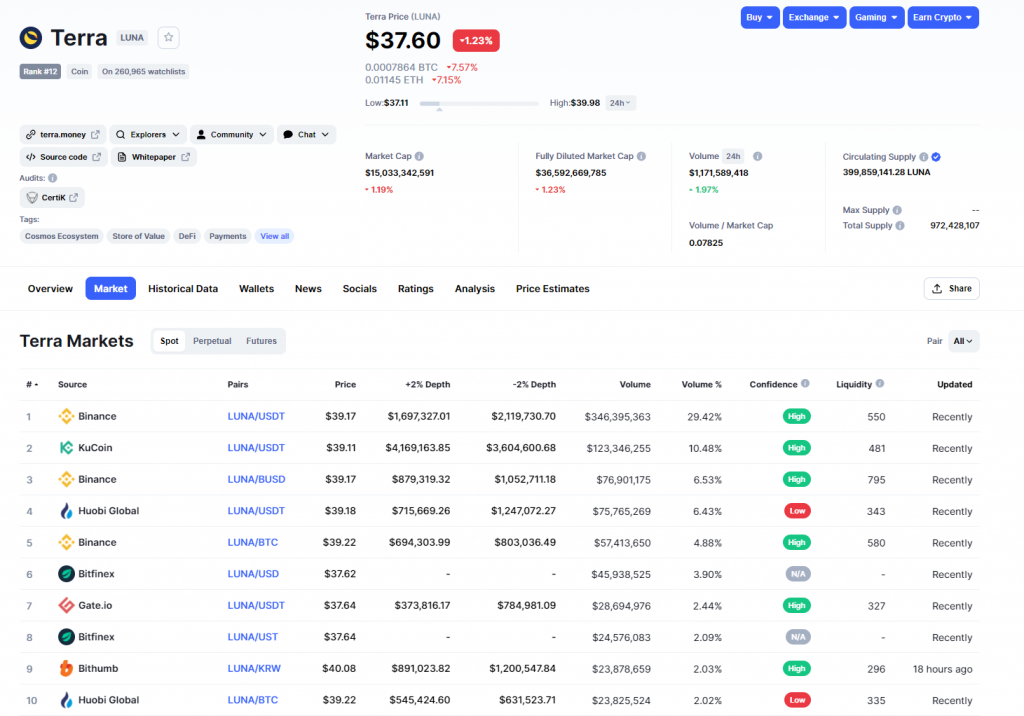

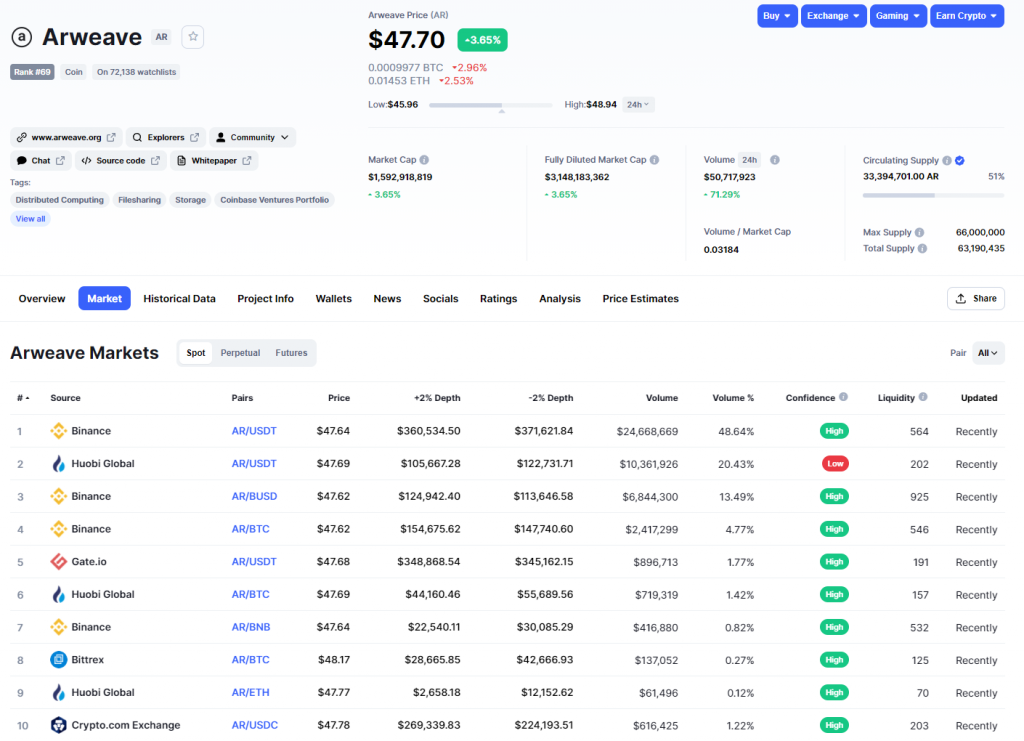

For example, FTX does not provide wallets to hold Luna or Arweave. You can check which exchange can hold your cryptocurrencies by checking on Coinmarketcap or Coingecko on where the coins are traded on.

Here’s the various exchanges that Luna and Arweave are available on:

Beyond just migrating your cryptocurrency from one exchange to another, there are also options for you to migrate your cryptocurrencies into your own digital wallet or to migrate it into the native blockchain’s wallet, which typically allows you to stake them for a decent yield.

Different ways of holding your cryptocurrencies

Here are the pros and cons of the different ways of holding your cryptocurrencies:

| Pros | Cons | |

| Holding crypto in centralized exchanges like Binance | Easy to manage all cryptos in one platform. You can trade your crypto anytime with other trading pairs. | Crypto may be idling there and not generating returns for you. |

| Holding crypto in your own digital wallet like MetaMask | You can earn higher yields by providing liquidity in liquidity pools. Some liquidity pool provides up to hundreds of APY. | You need to diligently manage your assets if you are involved in liquidity mining. |

| Holding crypto in the native blockchain wallet like Terra station for Luna | Delegating your tokens to the network delegator earns you decent yield and you may be eligible for airdrops | Delegated tokens are locked and when you undelegate it, it takes days for you to receive your tokens back. |

Migrating my cryptocurrencies

Based on the various pointers above, here’s how and where I moved my cryptocurrencies to:

| Crypto | Where are they currently held | Where I moved them to |

| Ethereum | Hodlnaut | Hodlnaut (earning 7.2% APY) |

| Arweave | Binance | Huobi earning 1% APY |

| Luna | Terra Station | Terra Station earning 6-7% APY (w airdrops) |

| Algorand | Binance | My Algo Wallet earning 9% APY (potential airdrop) |

| Avalanche | Binance | Avax Wallet earning 9% APY (potential airdrop) |

| FTT | Binance | FTX staked for airdrop |

| Cosmos | Binance | Rotated to Luna, moved to Terra Station |

| Lukso | MetaMask | MetaMask idling |

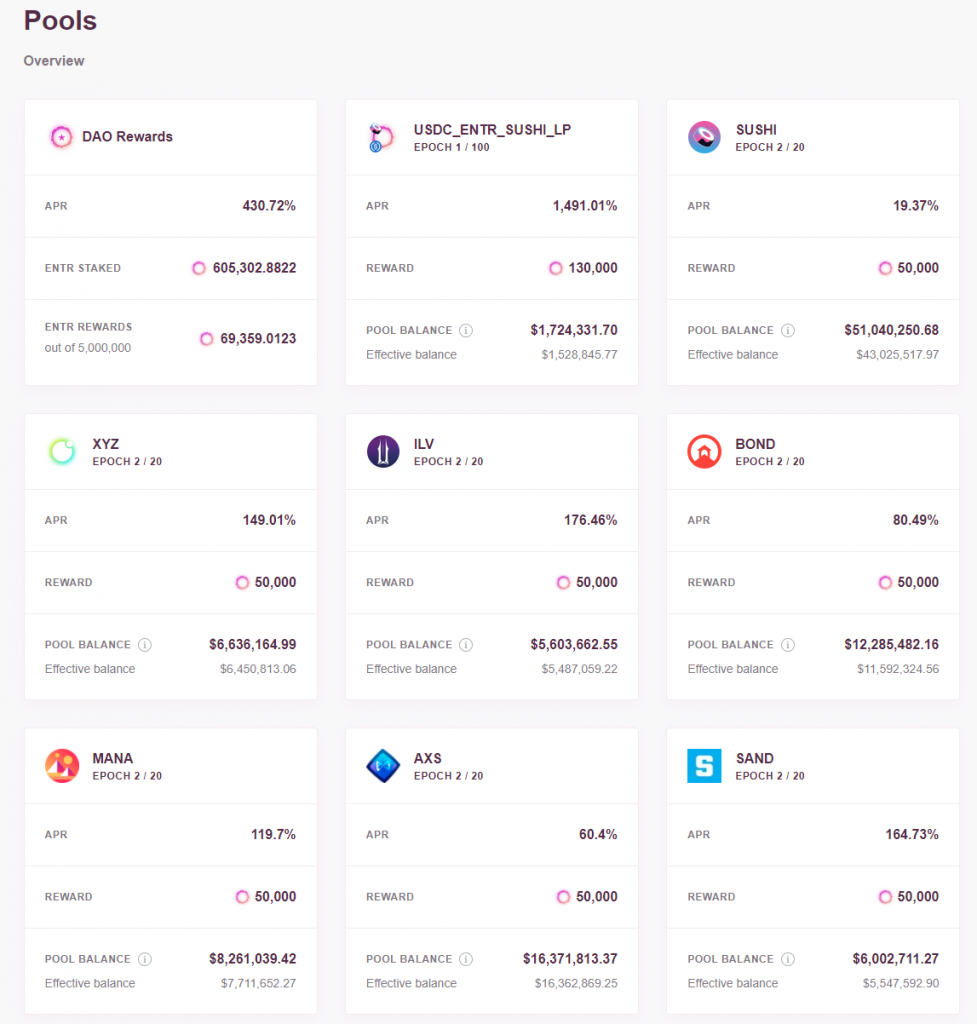

| SAND | Binance | MetaMask Enter Dao earning 200%+ APY |

| One | Dex | Dex (Mochiswap) earning 16%+ APY |

I have decided to move my cryptocurrencies to their native blockchain as much as possible, while staking them with delegators in order to be eligible for potential airdrops.

For example, I have shifted my Luna to the Terra Station and Avalanche to AVAX Wallet. In the wallet, you are able to delegate your tokens to validators of the network, and in exchange, you get a % fee and will be eligible for future airdrops.

For SAND, I have decided to participate in a liquidity pool which rewards me up to 160+% APY for providing liquidity to the pool.

Providing liquidity is quite simple — after you move your asset to your MetaMask wallet, connect the wallet with the website and enable the staking.

Here’s a guide for you if you are looking to explore liquidity provision: What Is Crypto Yield Farming And How To Get Started

From Binance to multiple wallets

The migration of my cryptocurrency was quite an exercise for me but it really reinforces the concept of financial self-sovereignty and control – you are free to move your assets around to any decentralized applications and you yourself are truly in charge and be responsible for your financial assets.

Instead of having just 1 Binance account, I now have 4 more “wallets” that I need to keep track and manage – one on FTX, one on Huobi, one on AVAX, and one on EnterDao via MetaMask.

You can simply register a MetaMask digital wallet in 1 click, move your cryptocurrency to that digital wallet, and start earning interest from a wide range of decentralized applications, all in just a few clicks without any lengthy sign up process or limitation.

While this may seem like a tedious task, you may also choose to move your digital asset to other exchanges, which offers similar yield earning services on your cryptocurrencies.

Join our telegram community group to discuss all things crypto.

Featured Image Credit: Fox Business

Also Read: Here’s How You Can Transfer Or Withdraw Your Crypto From Binance To MetaMask