For cryptocurrency holders, one of the ways to earn passive income on your idle cryptocurrency is to supply them into liquidity pools and earn yields from these liquidity pools.

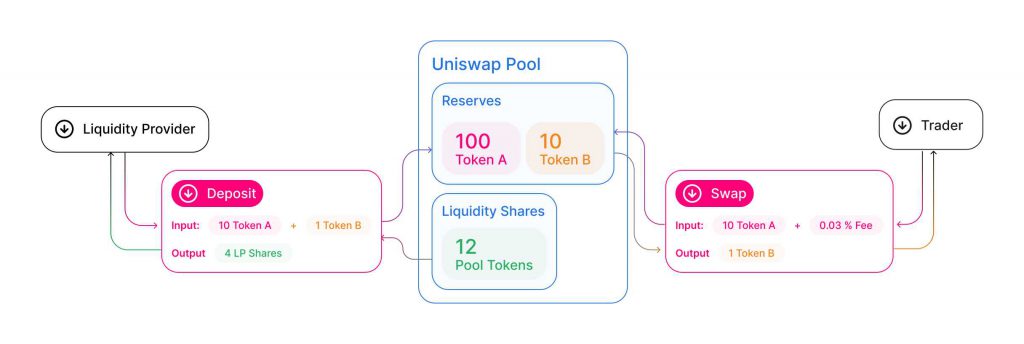

Here’s a simple illustration from Uniswap on how liquidity pool works:

As a liquidity pool provider, you will earn interest originating from the transaction fee generated whenever a trader or borrower executes a cryptocurrency trade.

For Polygon (previously known as Matic), here are a list of liquidity pool provider or yield farms where you can supply your cryptocurrency into in order to generate a return on your digital asset.

| Pool Provider | Reward Tokens | Website |

|---|---|---|

| Quickswap | QUICK | https://quickswap.exchange/#/quick |

| Cometh | MUST | https://swap.cometh.io/#/stake |

| Dark | DB | https://www.dark.build |

| Smartdex | NIOX | https://swap.smartdex.app |

| Elk | ELK | https://app.elk.finance |

| Polywhale | KRILL | https://polywhale.finance |

| Aave | MATIC | https://aave.com |

| Polyfox | FOX | https://polyfox.finance |

| Hawkdex | HAWK | https://hawkdex.com |

| Polycat | FISH | https://polycat.finance |

| BoughtThe.top | BTT | https://farm.BoughtThe.top |

| PolyStarter | STARTER | https://www.polystarter.fi |

| Polyvolve | SPEAR | https://polyvolve.finance |

| Polygaj | GAJ | https://polygaj.finance |

| Galaxy | Various | https://galaxyfarm.routerprotocol.com |

| Zenko | ZENKO | https://app.zenko.finance |

| GameSwap | STONK | https://gameswapfinance.com |

| Blackswap | AURORA | https://www.blackswap.finance |

| Polycake | PCAKE | https://www.polycake.finance |

| Polyrangers | RNG | https://polyrangers.finance |

| Sushi | SUSHI | https://app.sushi.com |

| Mai | Qi | https://www.mai.finance |

| Polyshark | SHARK | https://www.polyshark.finance |

| Polyfi | PolyFi | https://polyfi.io |

| Polyape | Ape | https://www.polyape.online |

| Polyzap | PZAP | https://farm.polyzap.finance |

| Polypanda | BAMBOO | https://polypanda.finance |

| Dfyn | DFYN | https://exchange.dfyn.network/ |

As there are new yield farms being created everyday, please do your own research on the team’s background before committing large amount of cryptocurrency to a new farm.

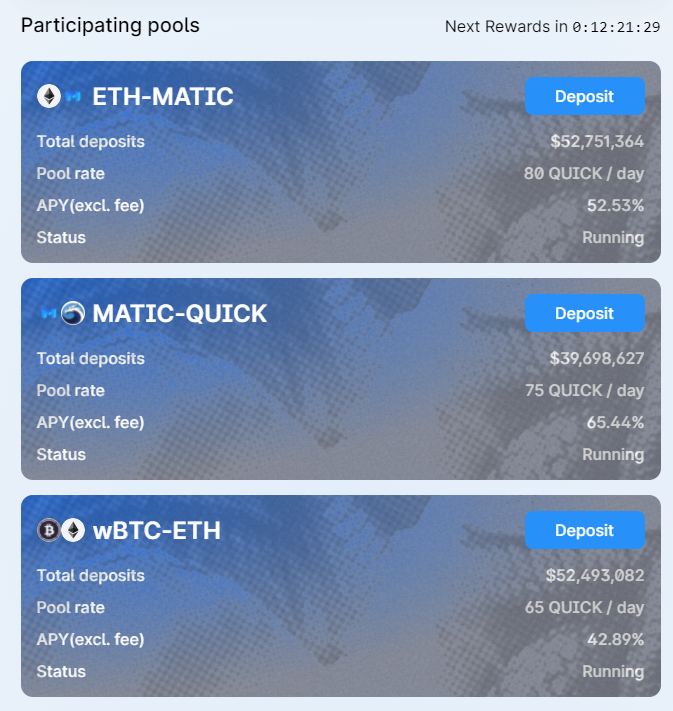

As a rule of thumb, signs of a good liquidity pool include:

- The longer the liquidity pool is around, the safer it is.

- The more total value locked in the farm, the safer it is.

- The more cryptocurrency pair available for staking, the safer it is.

- High APYs (4 – 7 digit APYs) generally means the liquidity pool is relative new and less stakers to split the pool rewards.

- The more users staking their cryptocurrency (total value locked), the safer it is.

- The more protocols built on top of the liquidity pool, the safer it is.

Personally, we have tried out Quickswap and so far the experience has been smooth with the yield farm, with decent currency swap time.

Also Read: The Ultimate 2021 Guide On Crypto Yield Farming And How To Get Started