For a long time, Opensea was the go-to NFT marketplace that NFT traders, collectors and creators naturally gravitate towards. However, there has recently been a massive shift in the NFT ecosystem with the introduction of BLUR, giving Opensea a run for its money.

You might have heard of Genie, X2Y2 and LooksRare as competing NFT marketplace platforms, but none of them really bothered Opensea. Some even explored venturing into NFT-Fi products to value-add holders but saw little traction. Click on the image below to find out more.

However, none gave Opensea a run for its money like BLUR did. BLUR surpassed Opensea to become the largest NFT marketplace, mainly field with an incentivized flywheel to create massive network effects.

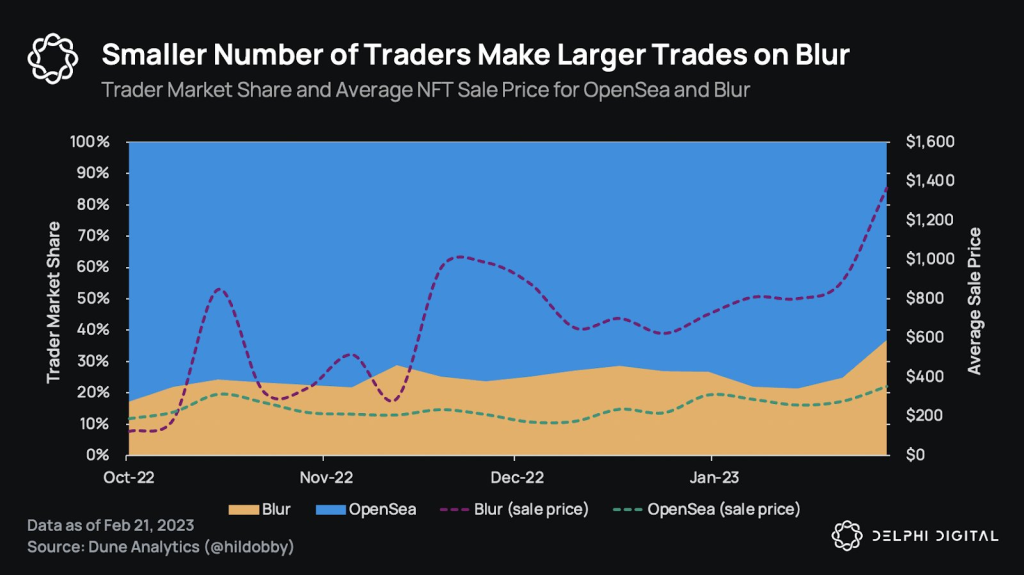

According to Delphi Digital, BLUR has achieved a 53% market share within a few months of launch, a number quite unfathomable if I told you one year ago during the peak of the NFT season.

.@blur_io has surpassed OpenSea to become the largest NFT marketplace.

— Delphi Digital (@Delphi_Digital) February 21, 2023

Its airdrop has fueled an incentive flywheel to create real network effects.

Blur has achieved 53% market share within a few months of launch, here's how they did it: 🧵⬇️ pic.twitter.com/GlQiaXpopR

Think of BLUR as a hybridised platform which combines a marketplace and an aggregator. Furthermore, BLUR offers zero marketplace fees and an option to skip or reduce royalty payments; it also is the faster NFT sweep/swipes out there.

But the game-changer was the massive $BLUR airdrop. This was the biggest reason for the surge in market dominance, despite the low fees and fancy tools.

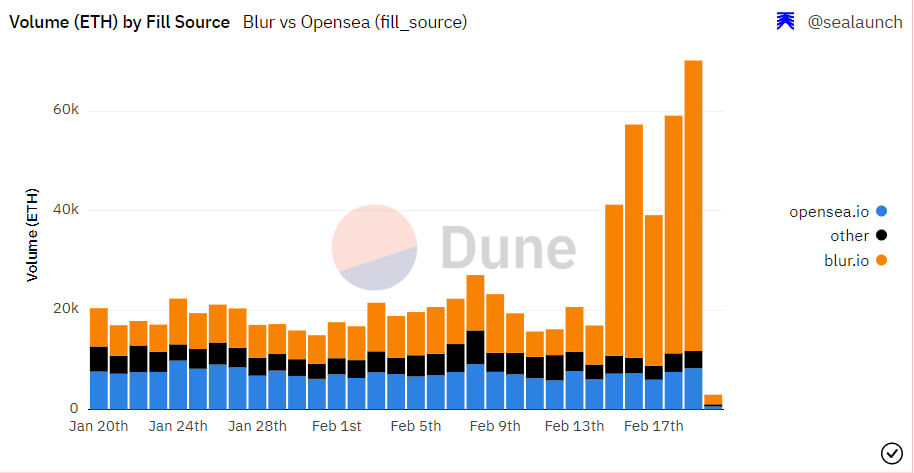

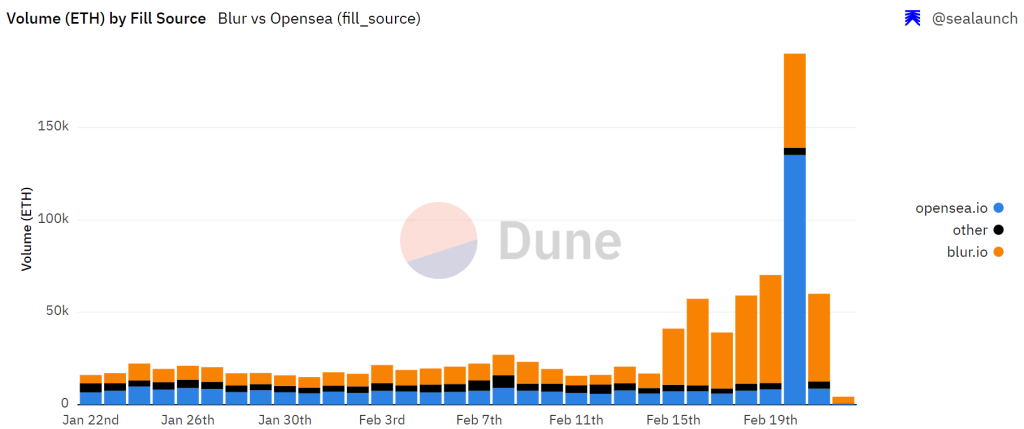

As seen with the volume, there has been a clear winner over the past few days. $BLUR’s execution was commendable because who doesn’t love airdrops? But as the throne was about to be handed to BLUR, Opensea had some tricks up its sleeves.

I block you, you block me

BLUR’s response was to cut off all ties with Opensea by recommending users block Opensea from accessing their wallets. Additionally, they announced that it would enforce the royalty fee requested by any NFT project creator so long as that creator blocks the trading of their collections on OpenSea.

This was in response to BLUR accusing Opensea of failing to pay royalties to creators of the NFTs sold on its platform. Since the accusation, Opensea has denied the allegations, claiming that it has paid owed royalties to creators of the NFTs sold.

While the battle rages on today, ~80% of the total ecosystem volume does not pay entire creator earnings, and most of the volume has moved to a zero-fee environment.

OpenSea vs Blur, Q1 2023 pic.twitter.com/sSzpYnbsVa

— Loopify 🧙♂️ (@Loopifyyy) February 17, 2023

Opensea strikes back

Openses, being fully aware of its declining dominance, isn’t going to sit back and let BLUR take over the throne. They can only do one thing to recapture market share, which will come with a massive trade-off.

We’re making some big changes today:

— OpenSea (@opensea) February 17, 2023

1) OpenSea fee → 0% for a limited time

2) Moving to optional creator earnings (0.5% min) for all collections without on-chain enforcement (old & new)

3) Marketplaces with the same policies will not be blocked by the operator filter

To stay competitive, Opensea had to make big chances of its own. This resulted in reduced fees to 0% (previously 2.5%). The battle will be on “equal grounds” now but still handicapped. Opensea still lacks the flexibility for traders/collectors to pay royalties while falling short in having “sniping” NFT tools.

However, with massive decisions comes massive change. After the initial change, Opensea volume spiked, the highest recorded since 14 June 2022. But that initial pump fell short the following day, while BLUR continues dominating a larger volume.

BLUR executed many high-value trades with an average NFT sale price of $1,365 vs OpenSea’s $351. According to Delphi Digital, OpenSea retains many of its traders even when fewer traders on BLUR are making larger trades.

Is this worth it? HUGE RAMIFICATIONS

If you are an NFT flipper, you don’t mind those extra monies. But at what costs? Behind every NFT is a creator, and revenue streams are disrupted when the royalties are being cut for them. Reducing to 0% fees saw a significant increase in the overall NFT volumes, but that comes at the expense of creators.

If this continues, it does feel like no marketplaces care about founders and creators. They only care about where the ETH goes. Understandably, business decisions had to be made, but sucking dry creators will be unsustainable.

Smaller projects will be suffocated

As mentioned earlier, the smaller projects will like fade away. Imagine getting a pay cut because your company wants to compete with rivals. Not the best analogy, but it will undoubtedly spark anger because livelihood is at stake.

Royalties are the only thing keeping many NFTs alive. When marketplaces shift towards a 0% fee model, NFTs with the biggest backing from VCs will be eventual winners.

On the topic of VCs, we discovered that Opensea and BLUR had something in common. Their lead investor is Paradigm Capital. How awkward can this get?

The emergence of project-owned marketplaces

Imagine the situation so bad, it will not be surprising when the big players look to create their marketplaces to trade their NFT assets. Not only will this give projects closer touch points with their holders, but they will also derive all royalties and fees to their projects. With more revenue comes sustainability, which could differentiate between a decent project and an amazing one.

The other trade-off we have to consider is the barrier of entry. Making NFTs exclusive on project-owned marketplaces will make buying difficult and fragment the entire NFT space. We see popular projects such as CryptoPunks already having their own NFT marketplace, and it will likely follow with other big projects.

A new business model for NFTs

Netflix, Spotify, Microsoft, crypto alpha groups and Twitter’s verified mark have something in common: their subscription model. Imagine a world where you will be charged a monthly subscription fee for holding a particular NFT. Would you do it? Yes, if it provides more value than the abovementioned services, but no, it will just be my profile picture.

I am unsure how to feel with this model in place, but when projects are sucked dry, this is the only way to guarantee a constant revenue stream. Utilizing this approach, we can hold projects accountable for executing their roadmap.

But this hinges on the fact holders will be willing to pay that subscription fee. Else, the entire business model for NFTs will unlikely succeed.

Is BLUR’s performance purely driven by hype?

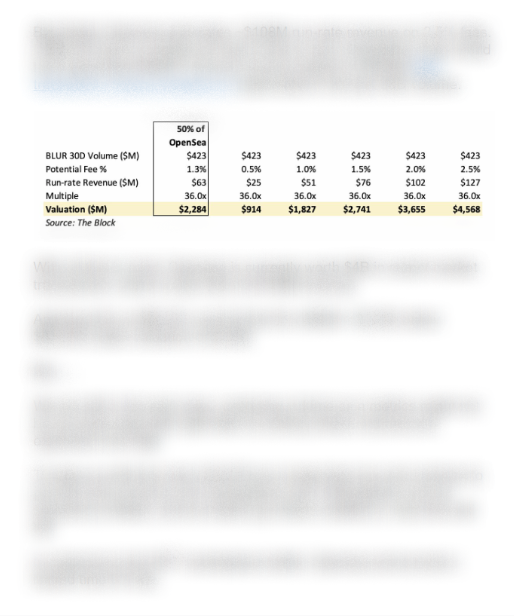

$BLUR token is valued at $2.8B, fully diluted at the time of writing. We wore a TradFi lens to find out more about the fundamentals.

When we value NFTs, the only cash flow is usually when you sell them, making fundamental valuation difficult. With an exchange like Binance and GTX, you have recurring cash flow from trading fees.

The $BLUR team decides they do not want revenue that way. Instead, they are banging big on governance. This also means its valuation hinges on token holders enabling potential monetisation streams in the future.

Alternatively, you can look into this thread below on $BLUR’s valuation.

Brick is back with a bänger babyyy@blur_io started trading 7 days ago and the price action has been quite interesting

— Brrr (@0x___Brick) February 21, 2023

Some thoughts on NFT marketplaces and $BLUR's valuation 👇🏼 pic.twitter.com/s6nyiIXt78

Closing thoughts

How do you think this will hurt creators? While Opensea took measures to stay competitive in the heated NFT marketplace wars, their decision will hurt creators in the long run.

And honestly, we cannot really blame them either, they are a business which needed to make necessary business decisions. But the longer this drags, the more 0% fees will become a norm, likely creating negative sentiments amongst NFT creators.

The markets follow liquidity, but liquidity will also follow good projects. There are many considerations to be taken as an NFT founder/creator, and I’ll keep a close eye on this, especially how the NFT market, as a whole, moves forwards.

However, Opensea could still have one more card up its sleeve, the Opensea token.

Also Read: What Are The Biggest Crypto VCs Betting On In 2023?

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: ChainDebrief