Over the last few years, Bitcoin established a key narrative for itself as an inflation hedge. The narrative became especially strong during the Covid-19 pandemic, which saw M2 money supply in the United States more than double over a few years.

However, with the orange coin’s prices tumbling over 70% since it’s all-time-high, some have dismissed the its labels as an “inflation hedge” as nothing more than a marketing slogan.

Often termed “digital gold”, Bitcoin seems to have failed in this aspect, despite inflation numbers across the globe coming in at record highs. So why do people still cling on to this seemingly lost narrative of Bitcoin as an inflation hedge when it has seemingly underperformed all expectations?

Also Read: NFTs Are Exploding … On The Bitcoin Network

Understanding Exactly How Scarce Bitcoin is

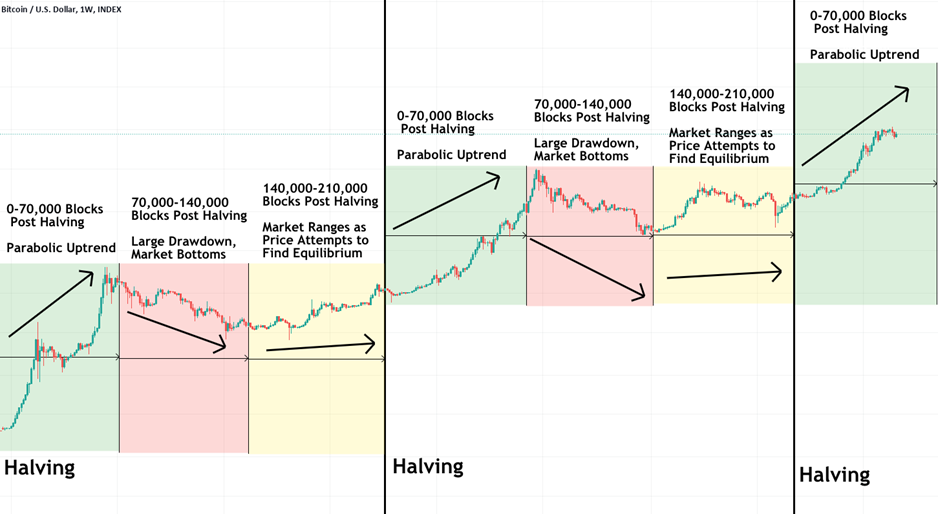

By now, most of us know about the Bitcoin “halving” cycles, which occur approximately once every four years. During halvings, rewards paid out to Bitcoin miners are halved, which decreases the new supply of Bitcoin and has historically led to bull rallies.

However, it is truly difficult to fully contextualize how effective the halvings are.

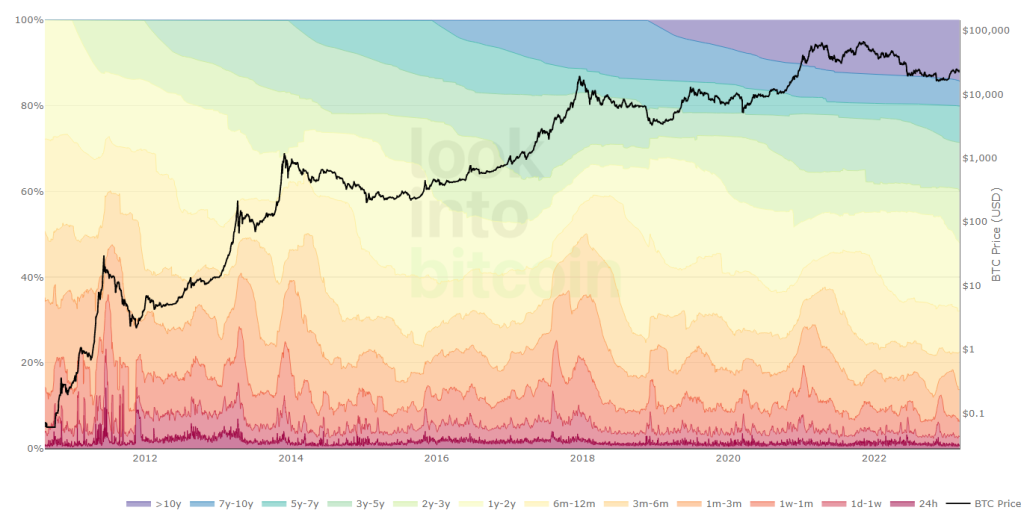

Did you know, for example, that more than 90% of all Bitcoin have already been mined? As stipulated in the Bitcoin whitepaper, only 21 million Bitcoin will ever exist, of which 19.3 million, or 92%, area already in circulating supply.

From the time of writing (6th March 2023) till the next halving approximately 400 days later, there will be 60,438 blocks mined, with a reward of 6.25 Bitcoin per block for a total of ~370,000 Bitcoin.

In terms of dollar value, that translates to ~$8.5 billion, barely a third of the average daily Bitcoin trading volume in the last few months.

By 2048, 99.9% of all Bitcoin would have been mined, with the last 0.1%, or 21000 Bitcoins being mined over the next 100 years. The last Bitcoin itself will be mined over a period of 40 years.

Bitcoin Dormancy Surpasses Available Supply on Exchanges

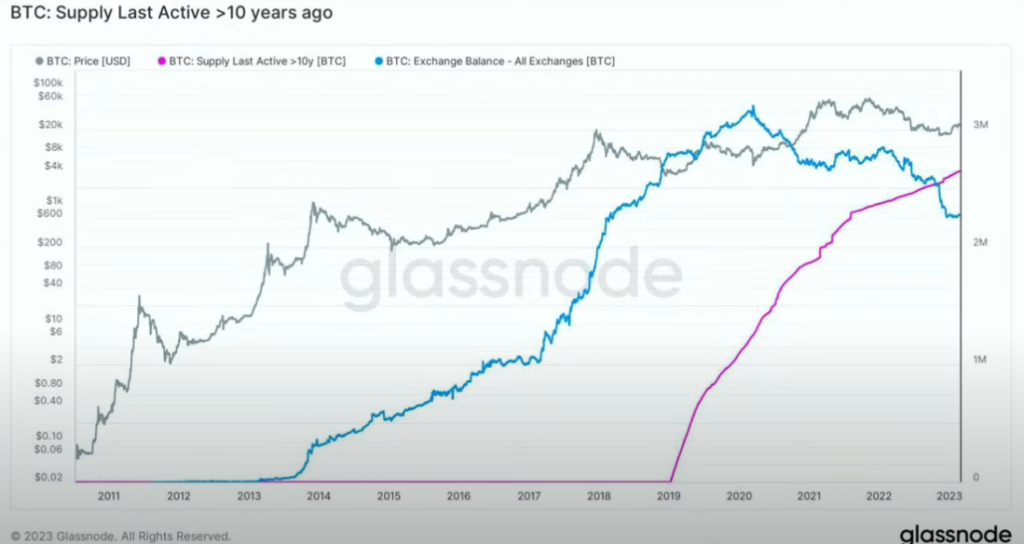

As whales, institutions, and entire countries continue to allocate toward long-term Bitcoin holdings, the available supply for trading continues to dwindle across exchanges.

As Bitcoin continued to crash, whales begun accumulation, especially at the $16,000 to $20,000 range, with more than 60,000 Bitcoin added by smart money in just the last 3 months.

Furthermore, the amount of Bitcoin that has remained dormant for a decade or longer recently passed available Bitcoin on exchanges, at 2.5 million Bitcoin. This includes the original 1 million Bitcoins mined by Satoshi Nakamoto, the pseudonymous creator of Bitcoin, that since remained untouched in over a decade.

At the time of writing, the approximately 2.5 million Bitcoin translates to 13.2% of supply, which some analysts suggest could never be reactivated again. This could be due to multiple factors, such as the loss of private keys, passing on of the owner, or incorrect tranasctions.

It looks like that with the deaths of Mircea Popescu and John McAfee a significant amount of $BTC might be lost forever.

— Alexander Mardar (@amardar1) June 28, 2021

RIP https://t.co/8KGPows3Kh

High-profile cases such as known Bitcoin billionaire Mircea Popescu’s passing and TV personality Alex Jones losing 10,000 Bitcoins are just some of the many instances where Bitcoin is permanently taken out of the circulation.

Interestingly, approximately 6 million Bitcoin, or ~30% of circulating supply, has not moved in the last 5 years or more. While we cannot expect all 6 million of these coins to remain dormant forever, it is likely that a significant amount of Bitcoin will continue to be taken out of the circulating supply every year due to various reasons.

Can Bitcoin Hold The Narrative as an Inflation Hedge?

This article speaks mostly to the scarcity of Bitcoin and the theoretical reduction of circulating supply over time. Equally as important (or even more so), is of course the demand for Bitcoin.

The leading cryptocurrency has increasingly fallen out of favour from both retail and institutional investors due to it’s lack of smart contract support, which prevents key aspects of Web3 such as smart contracts and DeFi to function on the blockchain.

However, advances in technology regarding Bitcoin are being made in strides, and the recent hype around Bitcoin-native NFTs, named ordinals, have landed them a valuation of $4.5 Billion by 2025.

Furthermore, the inflation hedge narrative does not necessarily have to be the only driving force for Bitcoin’s demand. The leading cryptocurrency still remains the de-facto method for many institutions and companies to gain exposure to Web3, due to how straightforward and simple it is.

SEC Chairman Gary Gensler: Everything other than #Bitcoin…[is a security].

— James Lavish (@jameslavish) February 26, 2023

Additionally, the SEC, chaired by Gary Gensler, seems to be taking regulatory action against every cryptocurrency under the sun, except for Bitcoin. This could be a major driver for institutional investors to allocate toward Bitcoin instead of other cryptocurrencies to remain compliant with U.S regulations.

Also Read: We Asked 5 Industry Leaders For Their 2023 Market Outlook

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief