In light of the ongoing CeDeFi collapse, many users have pivoted from centralized exchanges to decentralized alternatives for trading. This led to a massive boom in GMX users, leading to a 4x in token prices.

However, this has not been the only lucrative source of revenue for GMX believers. The platform’s liquidity provider token, GLP, has been paying out users in ETH and AVAX for taking the other side of trader’s positions.

Although liquidity providers have had a good run, one trader may be coming for their positions – and his name is Andrew Kang.

Also Read: All You Need To Know About GMX

A Quick Recap on GMX & GLP

Before we dive into the nitty gritty, let’s recap GMX’s revenue model -if you’re already familiar with it, feel free to skip to the next section.

GMX prides itself on not paying inflationary rewards to attract TVL, instead relying on a two-token system, namely $GMX and $GLP.

$GMX is the native governance token of the platform, and can be staked for various rewards such as $esGMX, $AVAX, $ETH, and fee rewards.

However, we will main be focusing on $GLP , the liquidity provider token of the platform.

Instead of ponzi tokens, they use $GLP, which can be minted/redeemed for assets within an index

— Chain Debrief (@ChainDebrief) August 2, 2022

These assets provide liquidity for traders on the platform

4/x pic.twitter.com/7GgxNUfOc9

$GLP consists of a basket of tokens including $BTC and $ETH, and $GLP stakers act as a counterparty to all traders on the platform. Essentially, if a trader on GMX goes long $BTC, all $GLP stakers are now automatically short, in proportion to their stake.

Therefore, if a trader loses money, all $GLP stakers will earn that amount, in proportion to their stake, and vice versa.

To compensate stakers for this risk, they are rewarded in trader’s fees and escrowed $GMX.

With 90% of traders being unprofitable, this has historically been profitable for $GLP stakers, with ~20% APRs in the middle of last year.

Enter Andrew Kang.

Who is Andrew Kang?

Andrew Kang is an angel investors and Co-Founder of DeFi-Focused investment firm Mechanism Capital. To date, he has invested over $30M in various crypto companies, including Nansen and perpetual protocol.

He also just so happens to be the top trader by PnL on GMX, with a profit of over $7.9 million at the time of writing (including fees!).

Implications from the USDC crisis are both negative/positive

— Andrew Kang (@Rewkang) March 11, 2023

Negative

– Stablecoin supply drops as holders diversify risk

– DeFi and CeFi liquidity will be reduced

– Overall net outflows from crypto/sidelined capital reduced

– USDC security risk if balance sheet used

Positive

-… https://t.co/wl8laO7nWX

Downloading data from a public wallet linked to him, 0xe8c19db00287e3536075114b2576c70773e039bd, I found that he traded approximately $26 million in volume over the last 150 days across 47 trades. The median position size of his trades was approximately USD$340,000, or 200 $ETH at the time of writing.

Andrew Kang has nearly $15 million in profit leverage shorting $BTC and $ETH on GMX and Kwentahttps://t.co/gCjkgce1Ec pic.twitter.com/dbt6LYy8sv

— Nansen Portfolio (@nansenportfolio) March 10, 2023

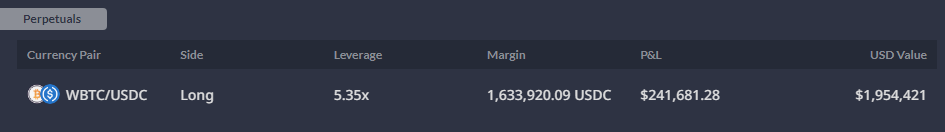

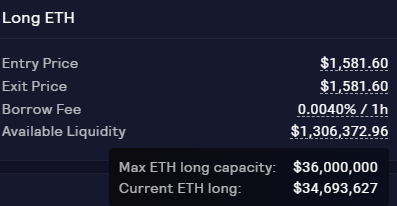

Due to recent market volatility, Kang has also been increasing his position size, taking a $1.6M BTC long on the platform during the recent dip.

How This Affects GLP Stakers

GLP Stakers get a large chunk of their revenue from losing trades. When a trader gets liquidated or goes red in PnL, their losses are directly distributed to GLP stakers in proportion.

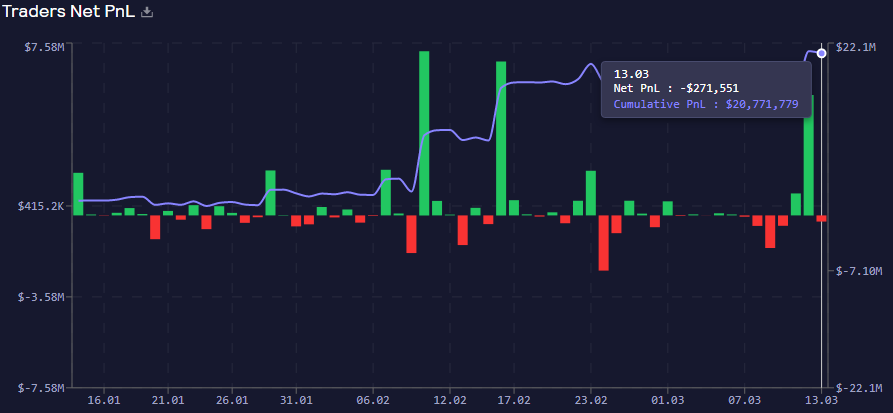

However, since Andrew’s emergence on GMX, culminative trader PnL has been rising substantially, even wiping out the $33M deficit that was present in the middle of last year.

Instead, culminative profit has been on the uptrend, and traders have made a net $20 million from GLP stakers since the inception of GMX.

The Bear Case For GMX

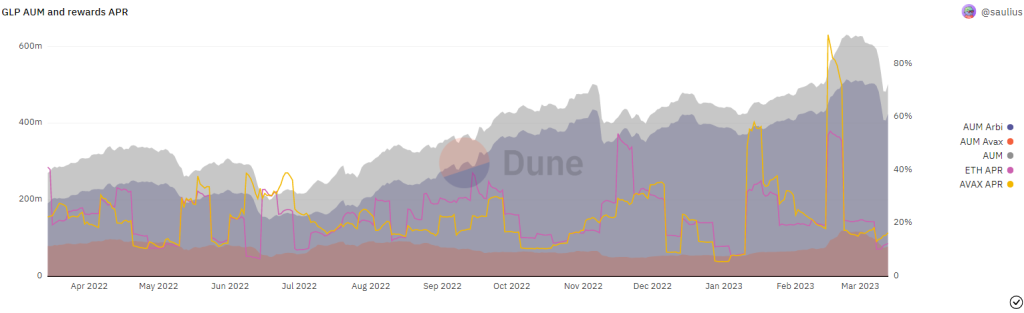

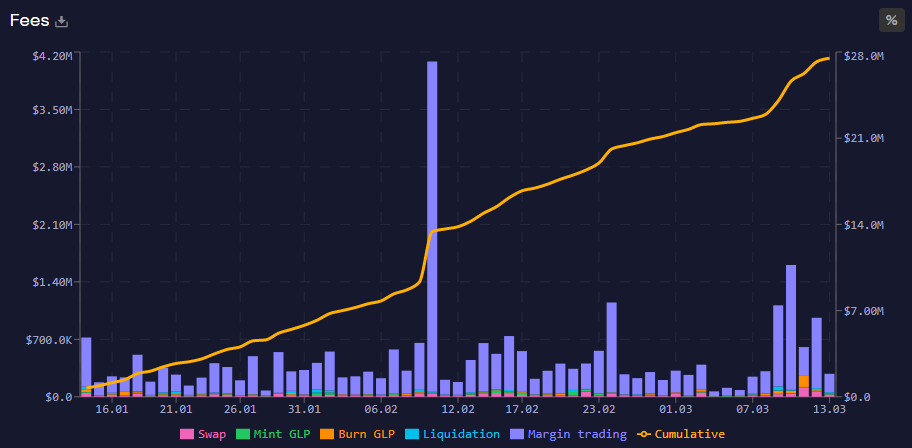

The problem with having extremely profitable traders is that $GLP becomes a much less attractive staking options for liquidity providers. For example, while $GLP APRs were ~25% in the middle of last year, they have fallen to 12% at the time of writing, despite AUM and fees going up in tandem.

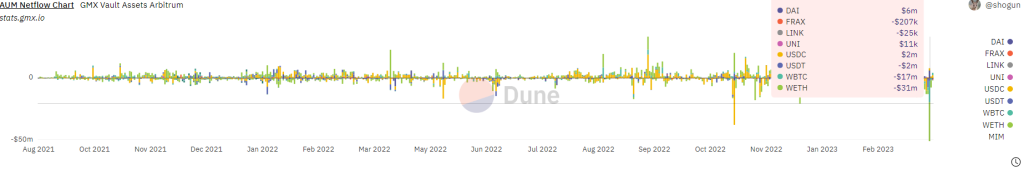

Furthermore, traders like Andrew Kang who profit heavily on the platform, often transfer their winnings to other platforms or hold them privately instead of reinvesting on GMX. Of course, they are in every right to do so, but this removes liquidity from the ecosystem, something essential for traders.

Recently, GMX has been experiencing more net outflow from $GLP stakers. Compounded with the current fear surrounding $USDC’s depeg, we saw the largest net outflow of Assets Under Management (AUM) from GMX at $42 million in one day.

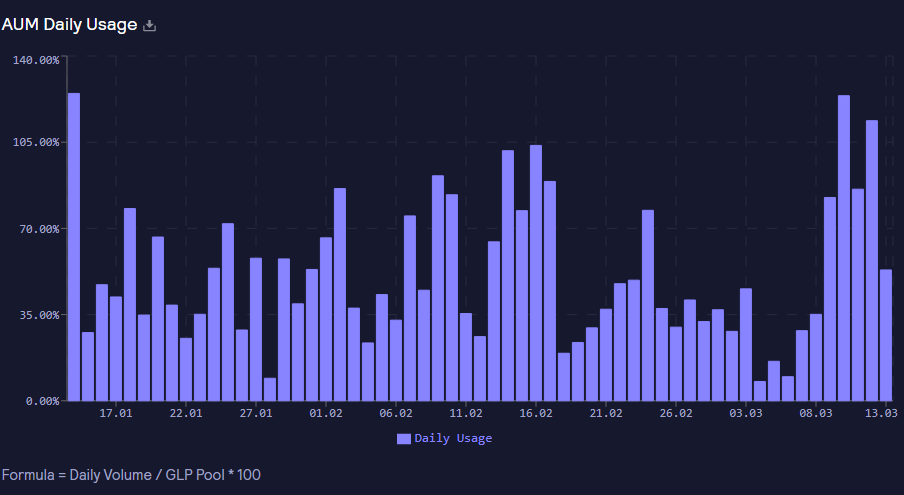

While this is of no concern now, GMX often faces situations where little liquidity is available to go long or short, especially during volatility events. Just this week, $GLP daily usage spiked above 100% twice.

Why does this matter?

Remember that trade fees make up a large portion of $GLP’s rewards. Should traders continue to be profitable, the following negative feedback loop could therefore occur:

- Traders on GMX are profitable, reducing $GLP AUM

- Trading conditions less liquid, less traders choose GMX

- $GLP APR falls, causing unstaking from holders

- Trading conditions less liquid, less traders choose GMX

- Repeat steps 3-4

Should this cycle occur ad infinitum, $GLP would essentially undergo a bank run, leading to the collapse of GMX.

Will it Happen?

While the negative repercussions of the above mentioned bankrun could theoretically occur, it’s unlikely.

Once again, fees are the imperative factor when considering whether $GLP stakers would withdraw their liquidity provided to the site. Considering that Andrew Kang paid approximately $2.6 million just to open his trades, that’s a lot of revenue they would be losing out on should they unstake.

GMX charges a trading fee of 0.1% of the position size on opening a trade, and another 0.1% to close a trade. That’s not including borrowing, liquidation, minting, and swap fees.

Altogether, GMX has made ~$140 million in fees since inception, at a volume of $90 billion traded on the site. Furthermore, it’s only at 226,881 total users, far below the number of users many centralized exchanges boast.

For context, Uniswap, the largest on-chain decentralized exchange, averages 41,000 daily users, in comparison to GMX’s 2,000.

While $GLP stakers have lost $20 million to traders on GMX, they have been compensated with $140 million in fees, or 7 times that amount, in the same period. Although APRs are lower, $GLP stakers receive real yield via $ETH or $AVAX, which is important given the inflationary yield many other platforms provide

Closing Thoughts

Andrew Kang, along with other users at the top of the PnL charts are a testament to just how profitable trading can be given the right conditions. However, they are the exception here – most traders on GMX are still unprofitable, or reach breakeven at best.

While they have accumulated a hefty profit at the expense of $GLP stakers, the majority of traders on GMX are still going to lose money, albeit probably at a much smaller size.

As GMX continues to expand and achieves a wider user base, it will undoubtedly onboard more (technically unprofitable) traders, which would help $GLP stakers receive higher APR, and trigger a positive economic flywheel, instead of the aforementioned negative one.

However, these unlikely liquidity events have come true in the past – FTX, Luna, and now SVB. Although GMX remains one of the most bullish dAPPs out there, considering the worst case scenario is important for any investor, especially in Web3.

Also Read: How Cap Finance Brings Real Yield to DeFi

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chaindebrief