On March 6, 2025, President Donald Trump signed an executive order to establish a Strategic Bitcoin Reserve and a Digital Asset Stockpile. This new approach contrasts with the past, where the U.S. government sold seized Bitcoin early, missing out on significant profits.

JUST NOW!

— Margo Martin (@MargoMartin47) March 7, 2025

President Trump signs an Executive Order establishing the Strategic Bitcoin Reserve and U.S. Digital Asset Stockpile 🇺🇸 pic.twitter.com/N9p2sQknVS

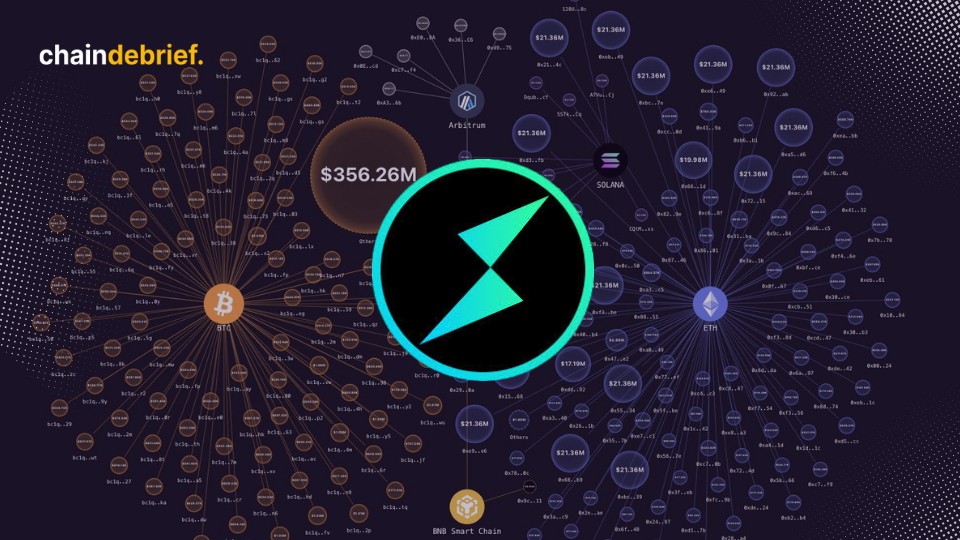

The reserve will hold around 200,000 Bitcoin obtained through federal asset forfeiture, with the goal of preserving them as a long-term store of value rather than selling them prematurely.

In addition to Bitcoin, the order sets up a U.S. Digital Asset Stockpile that will hold other cryptocurrencies seized in criminal or civil cases.

Market Reaction and Concerns

Despite initial excitement, the announcement led to disappointment among some market participants. The government’s decision not to acquire additional Bitcoin for the reserve immediately dampened investor enthusiasm.

Bitcoin’s price fell more than 5%, briefly dropping to $85,000. The absence of a clear strategy for acquiring more Bitcoin raised concerns about the reserve’s ability to fully leverage Bitcoin’s long-term growth potential.

Critics argue that not actively expanding the reserve could expose it to market volatility, limiting its effectiveness. On the other hand, supporters maintain that holding the Bitcoin without selling it could prevent the mistakes of past sales, allowing the government to avoid missing out on future gains.

You can also read this Trump to Host Historic White House Crypto Summit on March 7

Long-Term Implications for the U.S. and Global Crypto Markets

The creation of the Strategic Bitcoin Reserve signals a shift in the U.S. government’s approach to managing digital assets. By holding Bitcoin as a national reserve, the U.S. could set a global precedent for other countries looking to integrate digital assets into their financial strategies.

This move is part of Trump’s broader vision to support digital asset growth and establish the U.S. as the global leader in cryptocurrency innovation.

The long-term impact of this decision could influence how digital assets are integrated into national economies and shape the future of digital finance worldwide.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

You can also read this ThorChain, A Tool for Laundering Stolen Assets