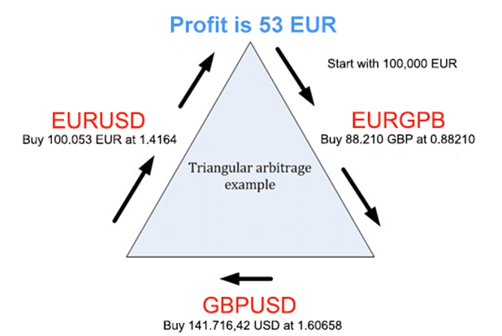

The textbook definition of arbitrage is the practice of simultaneously buying and selling securities, currency, or commodities in different markets to take advantage of differing prices for the same asset.

A classic example of arbitrage can be seen in the forex markets and looks something like this:

While traditional arbitrage requires a ton of technical expertise and deep pockets to make meaningful profits, the type of arbitrage that we are going to talk about today is slightly different. The type that we will cover is accessible to almost anyone and is simple to employ.

Also Read: How You Can Protect The Peg Of UST While Earning Yield In The Terra Ecosystem With White Whale

On the Terra ecosystem, you would have heard about multiple Luna derivatives that have sprung up recently. With the appearance of such derivatives, there is a need to ensure that the price of one Luna is equal to — or at least similar — the price of one Luna derivative.

One way to ensure that the peg is maintained is through constant arbitraging. Thus, this presents a unique opportunity to investors in the Terra ecosystem.

The idea is simple: when a LUNA derivative is trading at a discount to LUNA, you swap your LUNA to that derivative. You can then proceed to burn it on the respective protocol to receive LUNA at a 1:1 ratio. This process normally takes between 21 to 24 days. This two-step process is deathly easy but is pretty underrated in my opinion.

Some of the more common derivatives include bLUNA which is the derivative of Anchor protocol, LunaX of Stader Labs, and cLUNA of Prism protocol.

In all three cases, you are able to swap LUNA for the respective derivatives on the protocol itself or a DEX and burn them to receive LUNA at a 1:1 ratio.

How does it work?

Let’s take bLUNA as an example. Based on the chart, you can see that 1 bLUNA is almost never equal to 1 LUNA. In fact, it trades at a discount to LUNA most of the time, sometimes up to 3-4%.

bLUNA

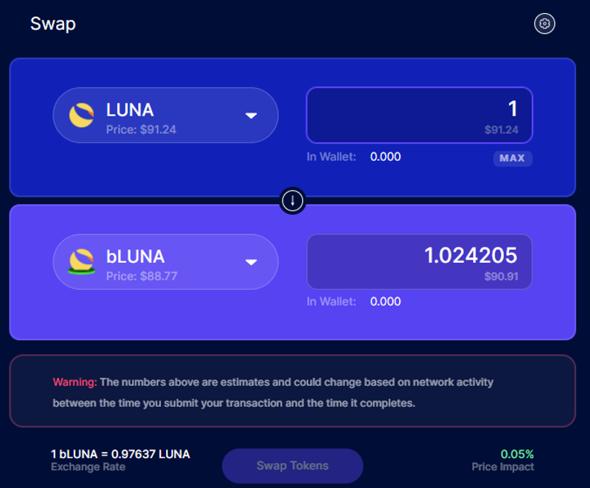

To start the process, you can simply go to Astroport to swap your LUNA for bLUNA when you deem the discount to be high enough.

You can use other DEXes as well but based on my experience, Astroport will give you the best deal. In my opinion, anything above 2.5% (ie. Below 0.975) is satisfactory.

You might think that this is quite a minuscule amount. However, when done consistently, it adds up and can be rather profitable as we will see later.

Based on the time of my screenshot, you will get 1.024 bLUNA for every 1 LUNA swapped. Because liquidity in the pool is deep, you should be able to swap huge amounts with relatively low slippage.

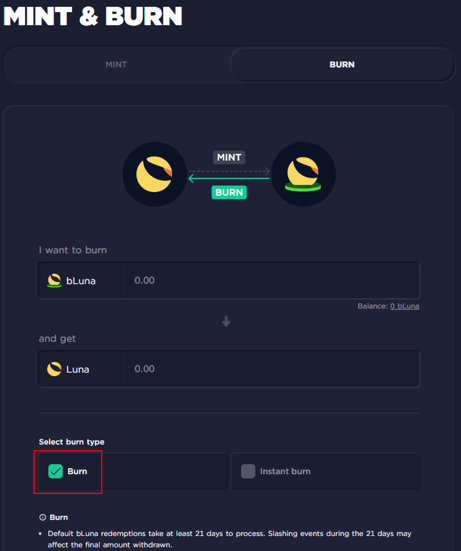

The next step will be to burn your bLUNA. This process takes 21-24 days, depending on when it is initiated.

This round-trip process should net you around 2.4% in profits. Be careful to choose the ‘Burn’ option and not ‘Instant burn’ as that is no different from swapping on a DEX.

I personally tried this at the end of January and managed to get a 4%+ profit! My only regret is not using more LUNA at that time.

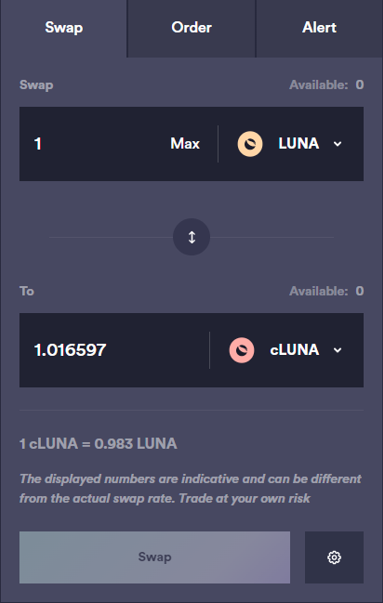

We can do something similar for both cLUNA and lunaX as well. However, do note that the liquidity for cLUNA is not as deep yet, so slippage will be an issue.

Arbitraging large amounts of LUNA at once (in the hundreds), on Prism, will not be profitable. The same goes for lunaX. In fact, I think this is the hardest derivative to arbitrage. But anyway, I’ll just leave the steps below for both.

cLUNA

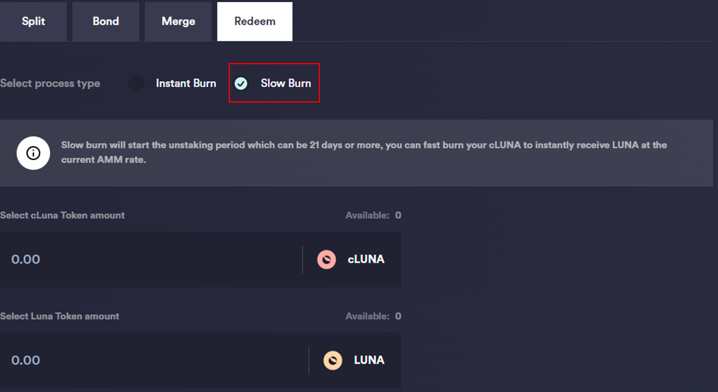

To arbitrage cLUNA, you can go to prismprotocol.app/swap to swap LUNA for cLUNA.

Afterward, you can proceed to prismprotocol.app/refract to burn it. Again, remember to choose the Slow Burn option so you will receive LUNA at a 1:1 ratio.

LunaX

Lastly, for LunaX you can proceed to terra.staderlabs.com/lt-pools to swap for LunaX and you can then unstake it for LUNA at a 1:1 ratio

Do note that you can swap your LUNA for other LUNA derivatives on DEXes such as Astroport, TerraSwap, and Loop apart from the protocol itself.

Where you end up swapping depends on which platform provides the best rate. I will include a tip at the end of the article so remember to read on!

Expected annualised returns from arbitraging

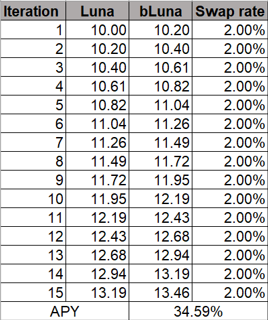

After understanding the process of how we can carry out this arbitrage, let’s study the numbers to see if it is indeed a worthwhile strategy to pursue. For that, we calculate the annual returns from just doing this two-step process.

Using the most conservative estimates, this strategy can yield an APY of almost 35%! If you were to use a swap rate of 2.5% instead, you would get about 45% APY.

While this strategy is rather boring, it is still able to grow your bags at a wonderful rate. Assuming each iteration takes 24 days, we can loop it for a minimum of 15 times a year.

Compared with staking which yields around 7% APR currently and decreases as the price of LUNA increases, I would argue that this is a much better way to grow your LUNA bags.

Of course, the trade-off is missing out on airdrops but I don’t think it matters as much unless you have a large amount of LUNA to stake in the first place.

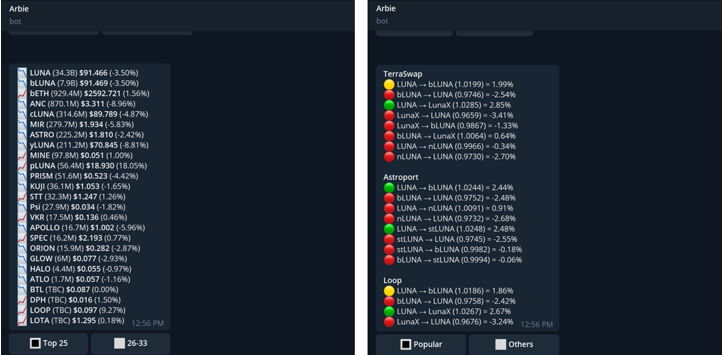

By now you must be wondering how it is possible to constantly keep track of the different discounts. Fortunately, there is a telegram bot that will alert you to such price swings. You can access the bot here.

Apart from price and arbitrage alerts, it even allows you to link your wallet so you can see your borrowing and bid positions! Now this is quite something

Closing thoughts

In closing, I think this is a worthwhile strategy to pursue. It can be used on top of your current staking LP positions to stack more LUNA.

I am aware that Whitewhale has indicated that they will introduce a LUNA vault for such arbing opportunities. However, it is still under development currently with no news on when it will go live. Hence, we should seize this opportunity while it lasts!

Regarding risks, I think it is pretty low unless the protocol itself gets hacked. However, you might want to weigh the fact that your tokens are locked for a period of 21 days using this strategy. But if you are focused on increasing the amount of LUNA and are not concerned with short-term price volatility, then this is the strategy for you!

Featured Image Credit: The VR Soldier

Also Read: Anchor Protocol’s Stablecoin Rates No Longer Fixed At 20% – What Does This Mean For Investors?